Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In year T the company Romex is unlevered and plans to readjust its leverage policy. The company has already distributed its free cash flows

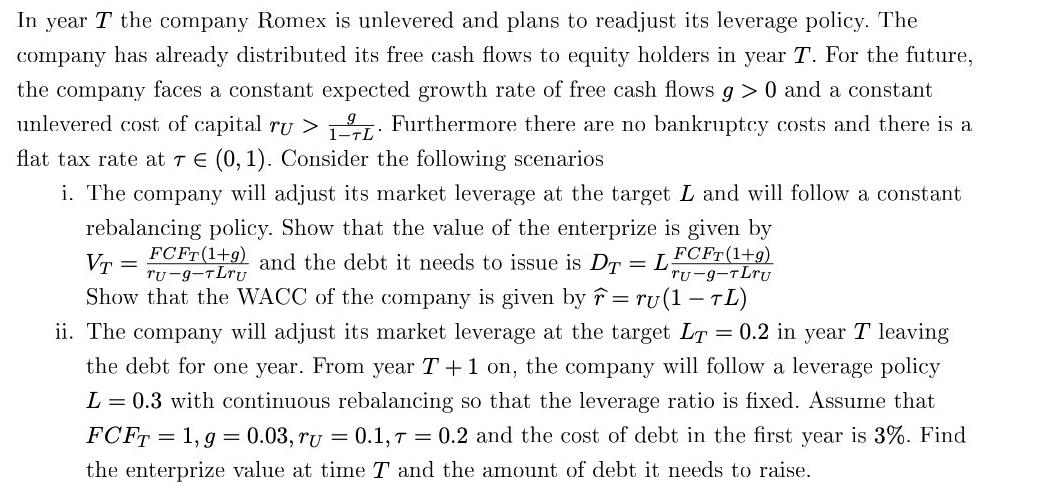

In year T the company Romex is unlevered and plans to readjust its leverage policy. The company has already distributed its free cash flows to equity holders in year T. For the future, the company faces a constant expected growth rate of free cash flows g> 0 and a constant unlevered cost of capital ru > 1L. Furthermore there are no bankruptcy costs and there is a flat tax rate at 7 (0, 1). Consider the following scenarios i. The company will adjust its market leverage at the target L and will follow a constant rebalancing policy. Show that the value of the enterprize is given by VT = FCFT(1+9) and the debt it needs to issue is DT = L FCFT(1+g) TU-9-TLTU Tu-9-TLTU Show that the WACC of the company is given by = ru(1-TL) ii. The company will adjust its market leverage at the target LT = 0.2 in year T leaving the debt for one year. From year T+1 on, the company will follow a leverage policy L = 0.3 with continuous rebalancing so that the leverage ratio is fixed. Assume that FCFT = 1,9 = 0.03, ru = 0.1, T = 0.2 and the cost of debt in the first year is 3%. Find the enterprize value at time T and the amount of debt it needs to raise.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

i To show that the value of the enterprise is given by V FCFT1grug and the debt it needs to iss...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started