Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In year two, there are no amendments to the plan, but it was a dismal year for investments. However, the actuary informs you that

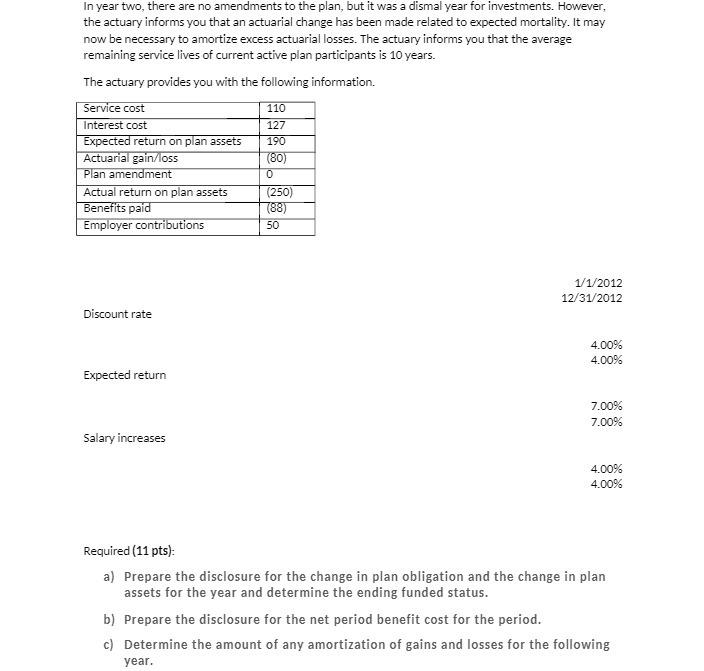

In year two, there are no amendments to the plan, but it was a dismal year for investments. However, the actuary informs you that an actuarial change has been made related to expected mortality. It may now be necessary to amortize excess actuarial losses. The actuary informs you that the average remaining service lives of current active plan participants is 10 years. The actuary provides you with the following information. Service cost Interest cost Expected return on plan assets Actuarial gain/loss Plan amendment Actual return on plan assets Benefits paid Employer contributions Discount rate Expected return Salary increases 110 127 190 (80) 0 (250) (88) 50 1/1/2012 12/31/2012 4.00% 4.00% 7.00% 7.00% 4.00% 4.00% Required (11 pts): a) Prepare the disclosure for the change in plan obligation and the change in plan assets for the year and determine the ending funded status. b) Prepare the disclosure for the net period benefit cost for the period. c) Determine the amount of any amortization of gains and losses for the following year.

Step by Step Solution

★★★★★

3.56 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a Prepare the disclosure for the change in plan obligation and the change in plan assets for the year and determine the ending funded status Change in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started