Answered step by step

Verified Expert Solution

Question

1 Approved Answer

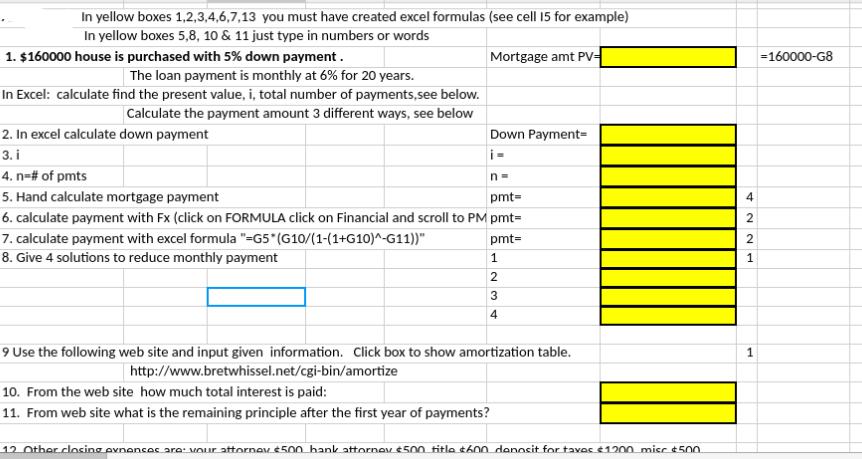

In yellow boxes 1,2,3,4,6,7,13 you must have created excel formulas (see cell 15 for example) In yellow boxes 5,8, 10 & 11 just type

In yellow boxes 1,2,3,4,6,7,13 you must have created excel formulas (see cell 15 for example) In yellow boxes 5,8, 10 & 11 just type in numbers or words 1. $160000 house is purchased with 5% down payment. The loan payment is monthly at 6% for 20 years. In Excel: calculate find the present value, i, total number of payments,see below. Calculate the payment amount 3 different ways, see below 2. In excel calculate down payment 3.i Mortgage amt PV- Down Payment= i= 4. n=# of pmts 5. Hand calculate mortgage payment pmt= 6. calculate payment with Fx (click on FORMULA click on Financial and scroll to PM pmt= 7. calculate payment with excel formula "-G5" (G10/(1-(1+G10)^-G11))" pmt= 422 8. Give 4 solutions to reduce monthly payment 1 1 2 3 4 9 Use the following web site and input given information. Click box to show amortization table. http://www.bretwhissel.net/cgi-bin/amortize 10. From the web site how much total interest is paid: 11. From web site what is the remaining principle after the first year of payments? 12 Other closing evnences are your attorney $500 bank attorney $500 title $600 donosit for taxes $1200 misc $500 1 =160000-G8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 To calculate the present value PV in Excel you can use the formula PV 160000 G8 2 The down ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642bb849daf0_975169.pdf

180 KBs PDF File

6642bb849daf0_975169.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started