In your action plan, you must refer to at least these concepts:

-

Briefly explain to LB what caused her firm to get into financial difficulty. o Give a maximum of 3 reasons.

-

Complete a Cs of credit analysis for this loan.

-

Identify the key parties to this decision, other than the bank, and how and why their interests must be accommodated.

-

Provide your decision to LB's requests (Y or N).

-

Provide supporting rationale for your decision along with the maximum amount of the LOC, if

you say yes to it.

-

Provide terms and conditions for any part of her requests you say yes to.

-

Keep options/loan terms and conditions short/focussed. Be specific about what you are doing:

Assume you are Brad MacDougall of the Canadian Commercial Bank (CCB). You will be meeting with Ms. Bodie (LB) tomorrow afternoon to deal with her requests for a $200,000 loan to cover an expansion of the BIS warehouse and her need for a line of credit (LOC).

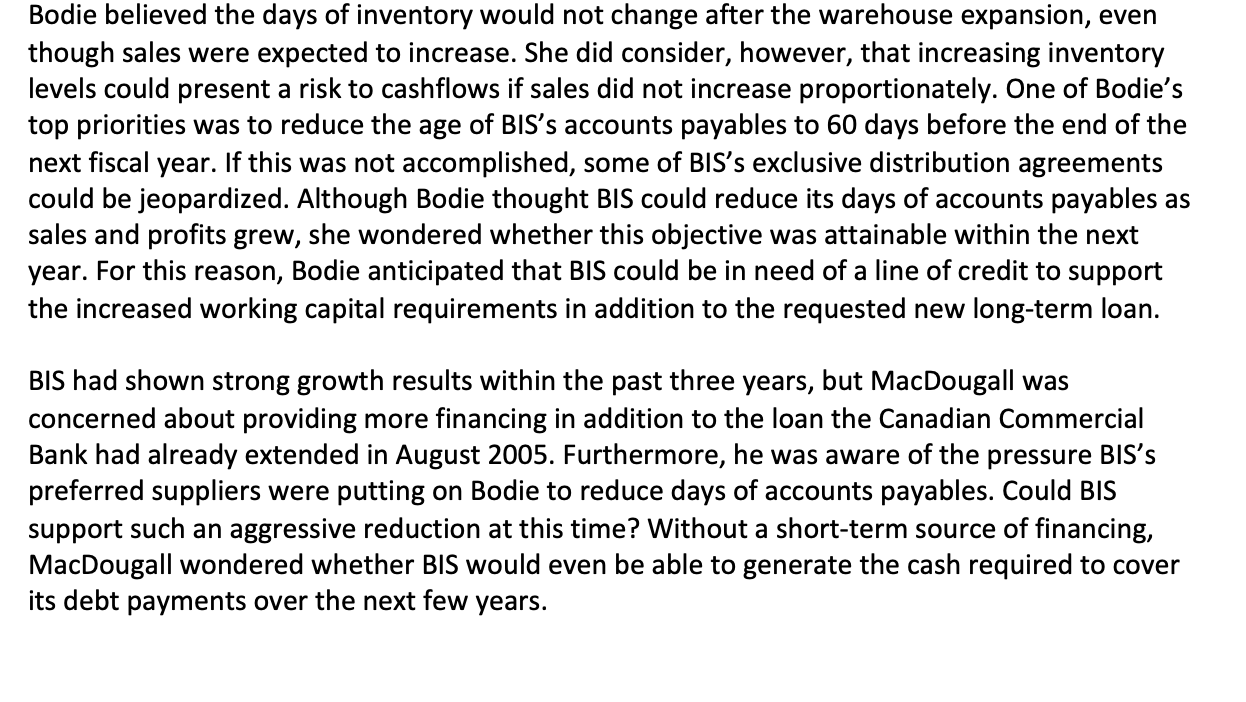

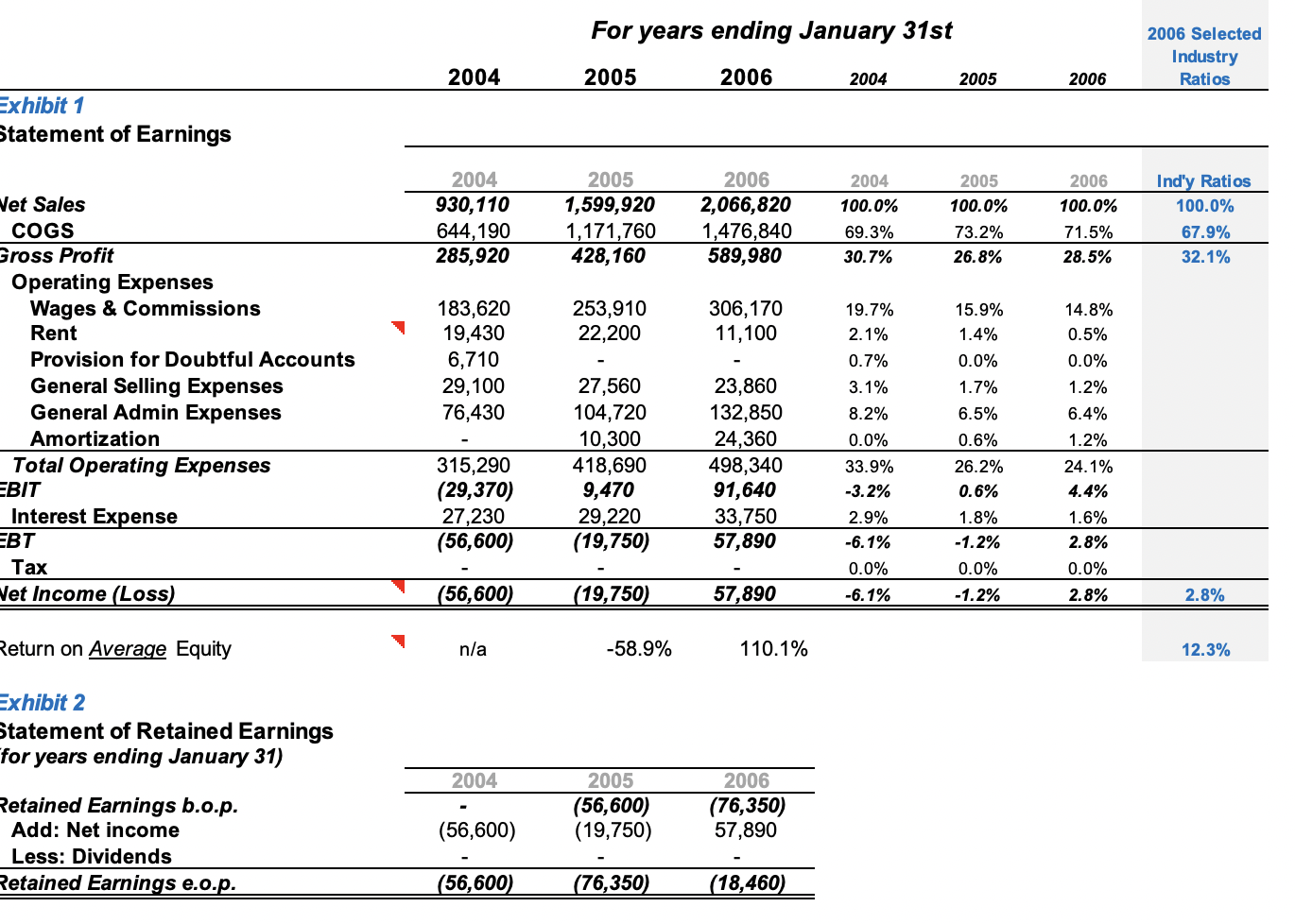

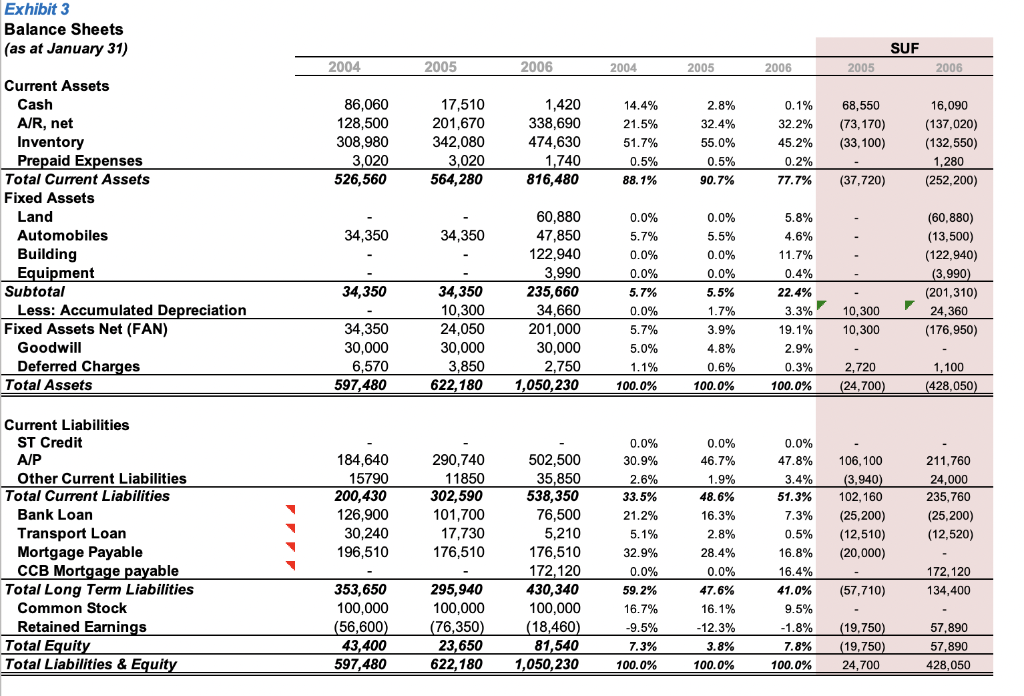

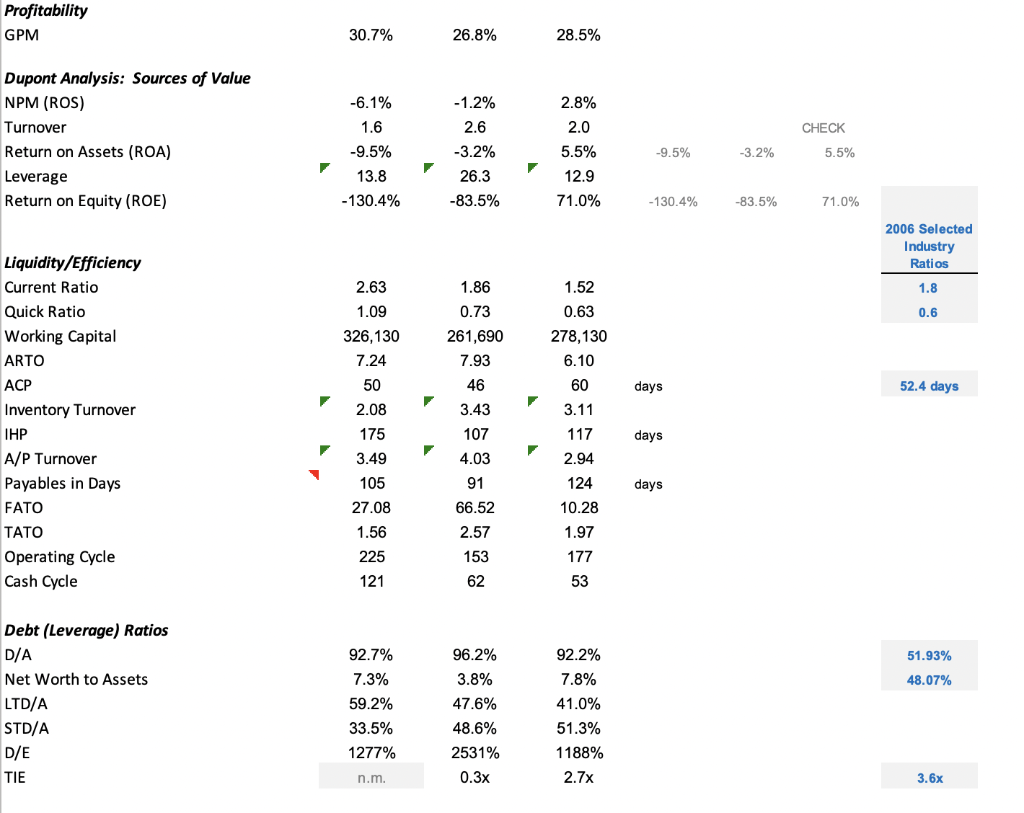

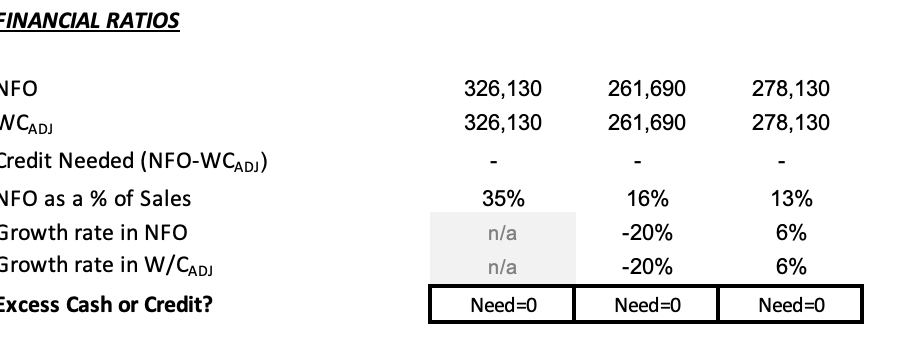

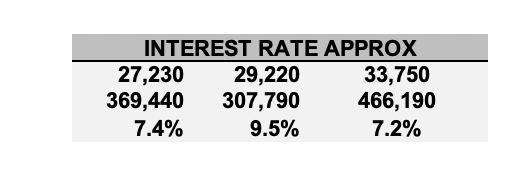

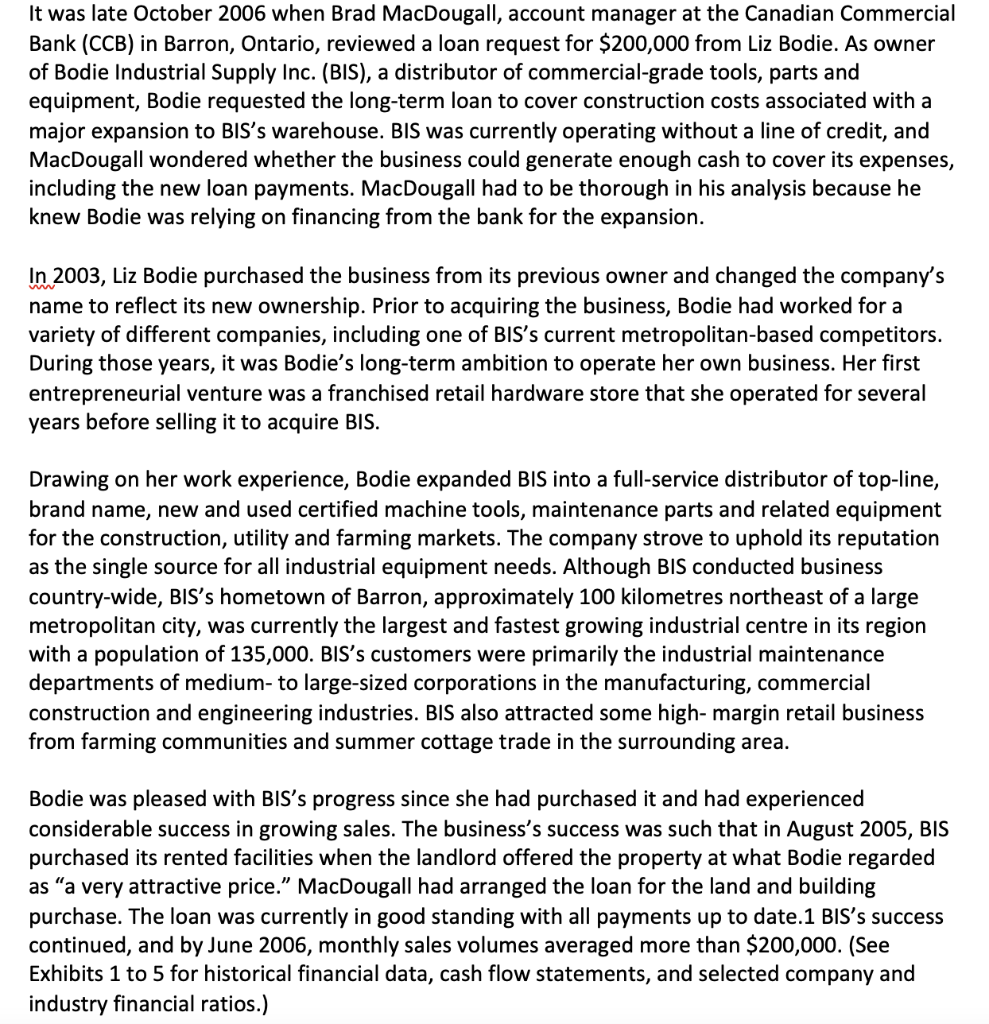

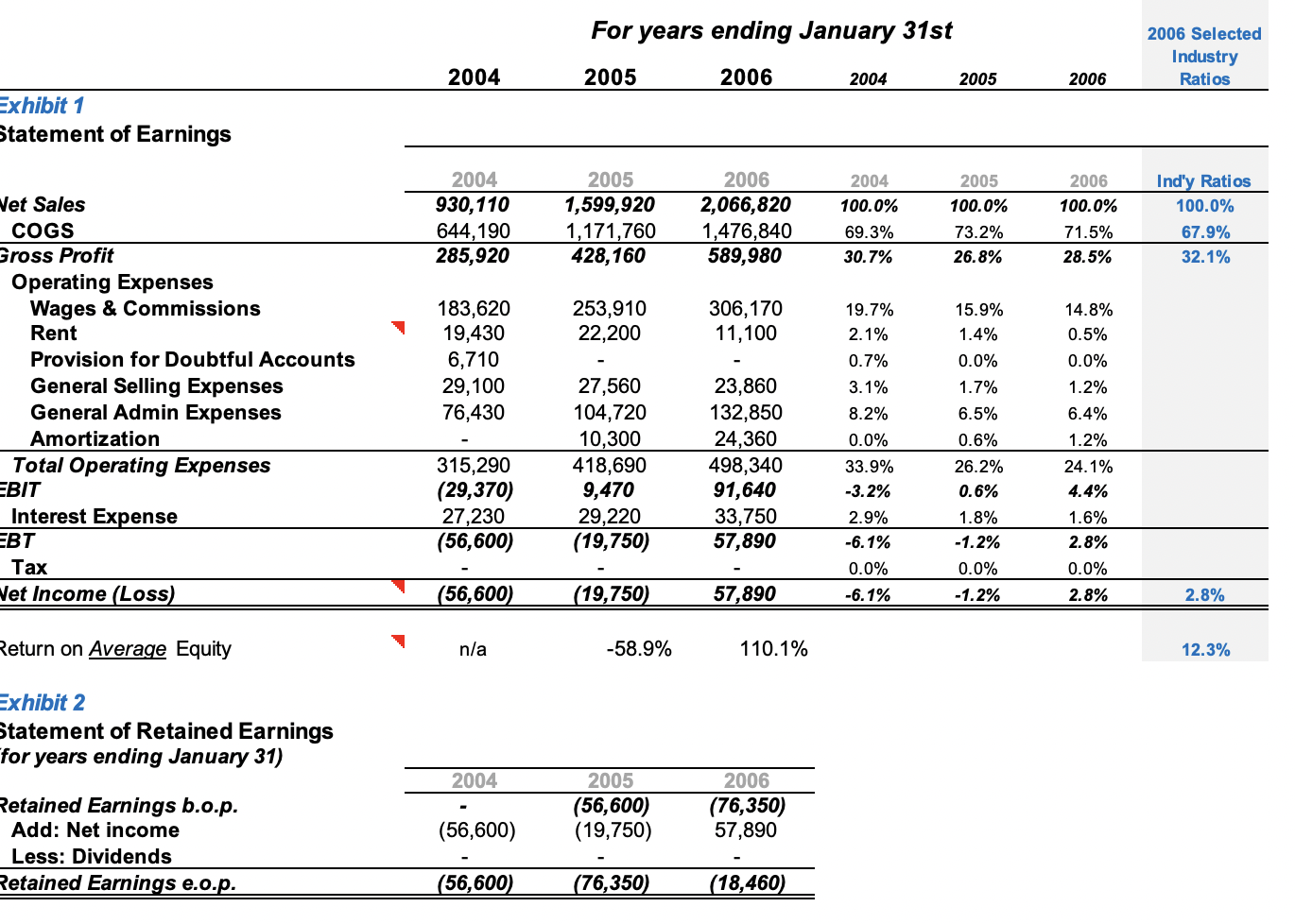

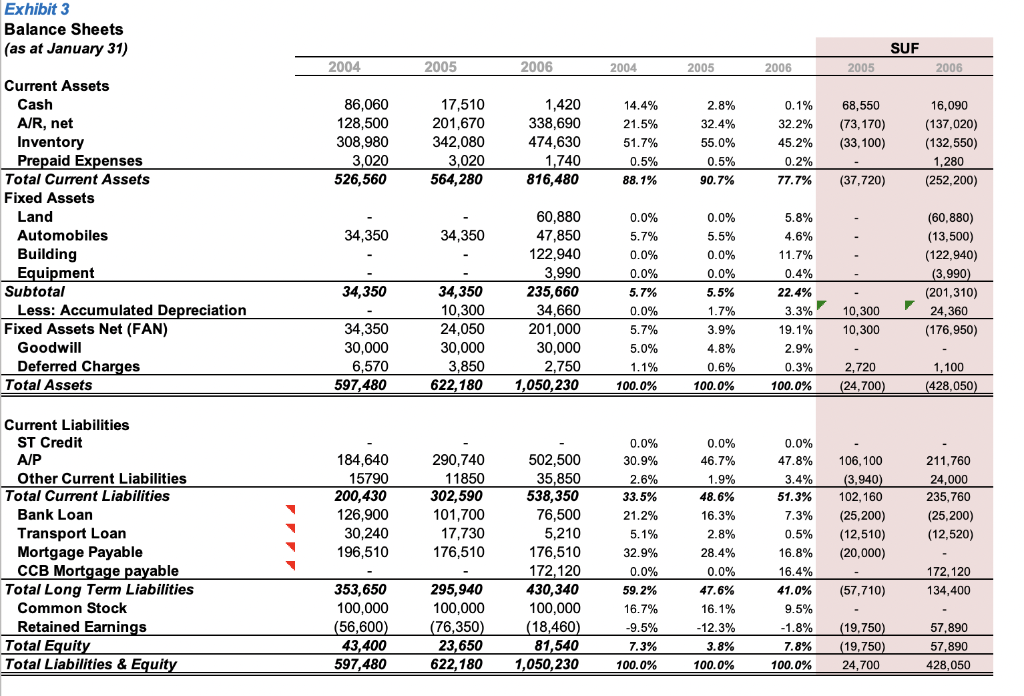

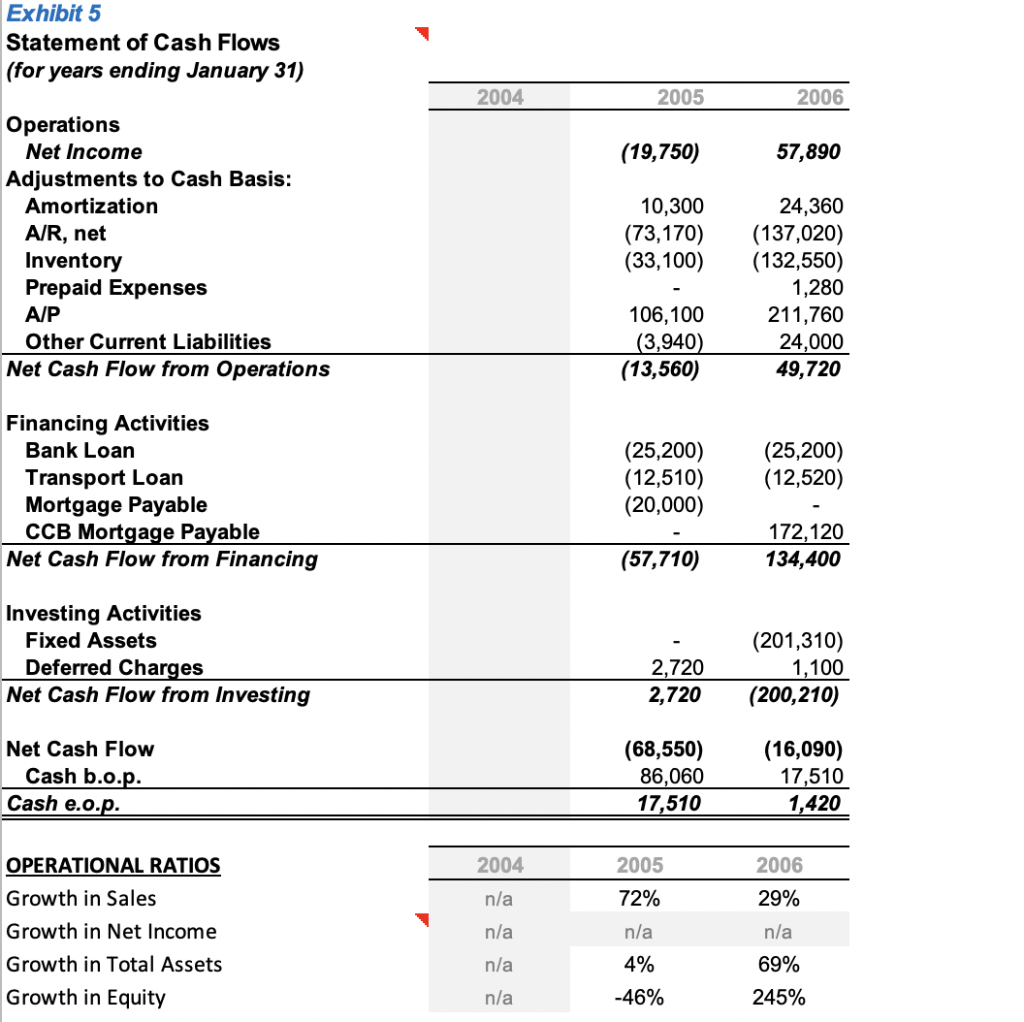

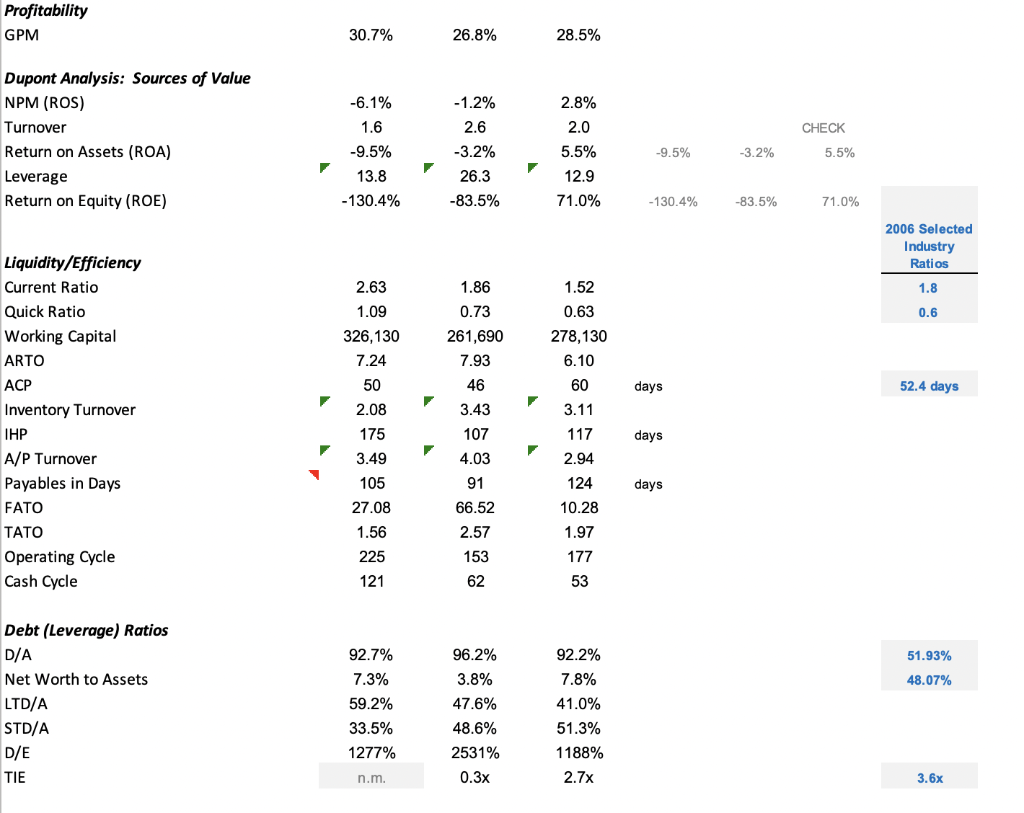

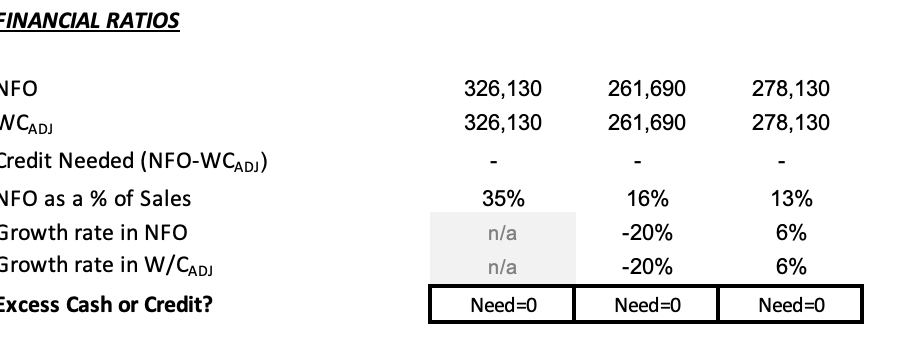

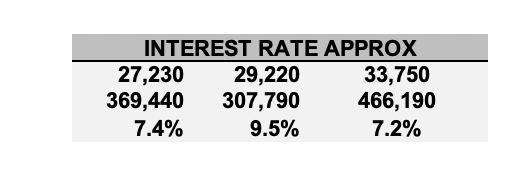

It was late October 2006 when Brad MacDougall, account manager at the Canadian Commercial Bank (CCB) in Barron, Ontario, reviewed a loan request for $200,000 from Liz Bodie. As owner of Bodie Industrial Supply Inc. (BIS), a distributor of commercial-grade tools, parts and equipment, Bodie requested the long-term loan to cover construction costs associated with a major expansion to BIS's warehouse. BIS was currently operating without a line of credit, and MacDougall wondered whether the business could generate enough cash to cover its expenses, including the new loan payments. MacDougall had to be thorough in his analysis because he knew Bodie was relying on financing from the bank for the expansion. In 2003, Liz Bodie purchased the business from its previous owner and changed the company's name to reflect its new ownership. Prior to acquiring the business, Bodie had worked for a variety of different companies, including one of BIS's current metropolitan-based competitors. During those years, it was Bodie's long-term ambition to operate her own business. Her first entrepreneurial venture was a franchised retail hardware store that she operated for several years before selling it to acquire BIS. Drawing on her work experience, Bodie expanded BIS into a full-service distributor of top-line, brand name, new and used certified machine tools, maintenance parts and related equipment for the construction, utility and farming markets. The company strove to uphold its reputation as the single source for all industrial equipment needs. Although BIS conducted business country-wide, BIS's hometown of Barron, approximately 100 kilometres northeast of a large metropolitan city, was currently the largest and fastest growing industrial centre in its region with a population of 135,000. BIS's customers were primarily the industrial maintenance departments of medium- to large-sized corporations in the manufacturing, commercial construction and engineering industries. BIS also attracted some high-margin retail business from farming communities and summer cottage trade in the surrounding area. Bodie was pleased with BIS's progress since she had purchased it and had experienced considerable success in growing sales. The business's success was such that in August 2005, BIS purchased its rented facilities when the landlord offered the property at what Bodie regarded as a very attractive price. MacDougall had arranged the loan for the land and building purchase. The loan was currently in good standing with all payments up to date.1 BIS's success continued, and by June 2006, monthly sales volumes averaged more than $200,000. (See Exhibits 1 to 5 for historical financial data, cash flow statements, and selected company and industry financial ratios.) Bodie was also proud of the company's reputation for dependability and integrity. She believed her success was due largely to the personalized service and engineering advice she offered BIS's customers. Bodie also noted that an important factor in attracting new customers and building lasting relationships was BIS's success in obtaining exclusive rights to offer the products of some top-line brand-name manufacturers. She also believed that maintaining good supplier relations with those manufacturers who granted BIS exclusivity was a key element to future success. Until late 2005, BIS had been the only distributor of machine tools, parts and equipment in Barron. Minimal competition had come from salespeople operating from out-of-town warehouses, but in the fall of 2005, a new distributor opened in downtown Barron. Bodie believed that the new competitor would compete directly with only a small portion of her business because of BIS's exclusive brand distribution rights and complete line of specialized products. Additionally, this new distributor had not yet earned a reputation comparable to that of BIS for dependable service. Although not necessarily considered a direct threat, the entrance of big-box retailers did increase competition among Canadian wholesalers and retailers alike. Big-box retailers competing within the home improvement, construction and building maintenance industries, such as Home Depot, RONA and Lowes, opened stores from 3,500 square metres to 15,000 square metres in size. Not only did these retailers offer lower prices, but they also provided a wide variety of products for retail and commercial consumers. At present, there were three major retailers in Barron with a fourth scheduled to open in the coming months. Although these retailers did not carry specialized, large and commercial-grade industrial equipment, they did offer a wide selection of construction supplies typically used by many of BIS's smaller, higher margin accounts. Bodie was still uncertain how and to what extent mass retailers and wholesalers could influence the business. Bodie believed a more eminent threat was the rapid growth of Internet-based selling. Many of BIS's competitors now had websites with online ordering and e-commerce capabilities that provided added convenience and quicker service to customers looking to order general use supplies. Online selling also reduced the need for customers to do business with a local supplier, potentially vastly increasing BIS's pool of competition. Although BIS did currently have a company website, it was purely informational. Although market information was limited, Bodie thought that BIS had about 35 per cent of the machine tool and equipment market in Barron and the surrounding region. Given the existing market potential, she believed sales could not increase beyond $4 million without expanding BIS's geographical market. For the next two years, she projected sales at $2.8 million for the year ending January 31, 2007, and $3.2 million for the year ending January 31, 2008.1 Appears as CCB mortgage payable on the balance sheet; secured by land and building. Bodie's major concern was the cramped space in BIS's warehouse. She believed the business could not handle any significant increases in inventory, given its present facilities. In order to maintain BIS's standard of service and delivery, Bodie wanted to add a warehouse extension, estimated at a cost of $200,000, by the beginning of November. If the loan was approved, principal payments would be $40,000 each year, beginning February 1, 2007, and annual interest payments would be approximately $13,000 for the first two years. In addition to these new loan payments, the combined principal payment on the total amount of all existing long-term debt for fiscal 2007 and 2008 would be $36,528 and $71,924 respectively. The associated annual interest payments on these outstanding liabilities would be $20,914 for 2007 and $35,528 for 2008. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2006. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before the end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before the end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. BIS had shown strong growth results within the past three years, but MacDougall was concerned about providing more financing in addition to the loan the Canadian Commercial Bank had already extended in August 2005. Furthermore, he was aware of the pressure BIS's preferred suppliers were putting on Bodie to reduce days of accounts payables. Could BIS support such an aggressive reduction at this time? Without a short-term source of financing, MacDougall wondered whether BIS would even be able to generate the cash required to cover its debt payments over the next few years. For years ending January 31st 2005 2006 2006 Selected Industry Ratios 2004 2004 2005 2006 Exhibit 1 Statement of Earnings 2004 930,110 644,190 285,920 2005 1,599,920 1,171,760 428,160 2006 2,066,820 1,476,840 589,980 2004 100.0% 69.3% 30.7% 2005 100.0% 73.2% 26.8% 2006 100.0% 71.5% 28.5% Indy Ratios 100.0% 67.9% 32.1% 253,910 22,200 306,170 11,100 Net Sales COGS Gross Profit Operating Expenses Wages & Commissions Rent Provision for Doubtful Accounts General Selling Expenses General Admin Expenses Amortization Total Operating Expenses EBIT Interest Expense EBT Tax Net Income (Loss) 183,620 19,430 6,710 29,100 76,430 14.8% 0.5% 0.0% 19.7% 2.1% 0.7% 3.1% 8.2% 0.0% 1.2% 6.4% 1.2% 27,560 104,720 10,300 418,690 9,470 29,220 (19,750) 15.9% 1.4% 0.0% 1.7% 6.5% 0.6% 26.2% 0.6% 1.8% -1.2% 0.0% -1.2% 23,860 132,850 24,360 498,340 91,640 33,750 57,890 315,290 (29,370) 27,230 (56,600) 24.1% 4.4% 33.9% -3.2% 2.9% -6.1% 0.0% 1.6% 2.8% 0.0% 2.8% (56,600) (19,750) 57,890 -6.1% 2.8% Return on Average Equity n/a -58.9% 110.1% 12.3% Exhibit 2 Statement of Retained Earnings for years ending January 31) 2004 2005 (56,600) (19,750) 2006 (76,350) 57,890 (56,600) Retained Earnings b.o.p. Add: Net income Less: Dividends Retained Earnings e.o.p. (56,600) (76,350) (18,460) Exhibit 3 Balance Sheets (as at January 31) SUF 2004 2005 2006 2004 2005 2006 2005 2006 14.4% 0.1% 86,060 128,500 308,980 3,020 526,560 17,510 201,670 342,080 3,020 564,280 1,420 338,690 474,630 1.740 816,480 2.8% 32.4% 55.0% 0.5% 90.7% 32.2% 45.2% 68,550 (73,170) (33, 100) 21.5% 51.7% 0.5% 88.1% 16,090 (137,020) (132,550) 1,280 (252, 200) 0.2% 77.7% (37,720) 0.0% Current Assets Cash A/R, net Inventory Prepaid Expenses Total Current Assets Fixed Assets Land Automobiles Building Equipment Subtotal Less: Accumulated Depreciation Fixed Assets Net (FAN) Goodwill Deferred Charges Total Assets 34,350 34,350 34,350 60,880 47,850 122,940 3,990 235,660 34,660 201,000 30,000 2,750 1,050,230 0.0% 5.7% 0.0% 0.0% 5.7% 0.0% 5.7% 5.0% 1.1% 100.0% (60,880) (13,500) (122,940) (3,990) (201,310) 24,360 (176,950) 5.5% 0.0% 0.0% 5.5% 1.7% 3.9% 4.8% 0.6% 100.0% 34,350 10,300 24,050 30,000 3,850 622,180 5.8% 4.6% 11.7% 0.4% 22.4% 3.3% 19.1% 2.9% 0.3% 100.0% 10,300 10,300 34,350 30,000 6,570 597,480 2,720 (24,700 1,100 (428,050) 184,640 15790 200,430 126,900 30,240 196,510 290,740 11850 302,590 101,700 211,760 24,000 235,760 (25,200) (12,520) Current Liabilities ST Credit A/P Other Current Liabilities Total Current Liabilities Bank Loan Transport Loan Mortgage Payable CCB Mortgage payable Total Long Term Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Equity 1 17,730 106, 100 (3,940) 102,160 (25,200) (12,510) (20,000) 176,510 0.0% 30.9% 2.6% 33.5% 21.2% 5.1% 32.9% 0.0% 59.2% 16.7% -9.5% 7.3% 100.0% 502,500 35,850 538,350 76,500 5,210 176,510 172,120 430,340 100,000 (18,460) 81,540 1,050,230 0.0% 46.7% 1.9% 48.6% 16.3% 2.8% 28.4% 0.0% 47.6% 16.1% -12.3% 3.8% 100.0% 0.0% 47.8% 3.4% 51.3% 7.3% 0.5% 16.8% 16.4% 41.0% 9.5% -1.8% 7.8% 100.0% 172, 120 134,400 (57,710) - 353,650 100,000 (56,600) 43,400 597,480 295,940 100,000 (76,350) 23,650 622, 180 (19,750) (19,750) 24,700 57,890 57,890 428,050 Exhibit 5 Statement of Cash Flows (for years ending January 31) 2004 2005 2006 (19,750) 57,890 Operations Net Income Adjustments to Cash Basis: Amortization A/R, net Inventory Prepaid Expenses A/P Other Current Liabilities Net Cash Flow from Operations 10,300 (73,170) (33,100) 24,360 (137,020) (132,550) 1,280 211,760 24,000 49,720 106,100 (3,940) (13,560) Financing Activities Bank Loan Transport Loan Mortgage Payable CCB Mortgage Payable Net Cash Flow from Financing (25,200) (12,510) (20,000) (25,200) (12,520) 172,120 134,400 (57,710) Investing Activities Fixed Assets Deferred Charges Net Cash Flow from Investing 2,720 2,720 (201,310) 1,100 (200,210) Net Cash Flow Cash b.o.p. Cash e.o.p. (68,550) 86,060 17,510 (16,090) 17,510 1,420 2004 2006 2005 72% n/a 29% OPERATIONAL RATIOS Growth in Sales Growth in Net Income Growth in Total Assets Growth in Equity n/a n/a n/a 69% n/a 4% -46% n/a 245% Profitability GPM 30.7% 26.8% 28.5% CHECK Dupont Analysis: Sources of Value NPM (ROS) Turnover Return on Assets (ROA) Leverage Return on Equity (ROE) -6.1% 1.6 -9.5% 13.8 -130.4% - 1.2% 2.6 -3.2% 26.3 -83.5% 2.8% 2.0 5.5% 12.9 71.0% -9.5% -3.2% 5.5% -130.4% -83.5% 71.0% 2006 Selected Industry Ratios 1.8 0.6 2.63 1.09 326,130 7.24 50 2.08 1.86 0.73 261,690 7.93 46 3.43 1.52 0.63 278,130 6.10 60 3.11 days 52.4 days Liquidity/Efficiency Current Ratio Quick Ratio Working Capital ARTO ACP Inventory Turnover IHP A/P Turnover Payables in Days FATO TATO Operating Cycle Cash Cycle 107 days 175 3.49 105 27.08 1.56 225 121 117 2.94 124 10.28 days 4.03 91 66.52 2.57 153 62 1.97 177 53 51.93% 92.7% 7.3% 48.07% Debt (Leverage) Ratios D/A Net Worth to Assets LTD/A STD/A D/E TIE 96.2% 3.8% 47.6% 48.6% 2531% 0.3x 92.2% 7.8% 41.0% 51.3% 59.2% 33.5% 1277% 1188% 2.7x n.m. 3.6x FINANCIAL RATIOS 326,130 326,130 261,690 261,690 278,130 278,130 FO NCADI Credit Needed (NFO-WCAD) VFO as a % of Sales Growth rate in NFO Growth rate in W/CADJ Excess Cash or Credit? 16% 13% 35% n/a -20% -20% 6% 6% n/a Need=0 Need=0 Need=0 INTEREST RATE APPROX 27,230 29,220 33,750 369,440 307,790 466,190 7.4% 9.5% 7.2% It was late October 2006 when Brad MacDougall, account manager at the Canadian Commercial Bank (CCB) in Barron, Ontario, reviewed a loan request for $200,000 from Liz Bodie. As owner of Bodie Industrial Supply Inc. (BIS), a distributor of commercial-grade tools, parts and equipment, Bodie requested the long-term loan to cover construction costs associated with a major expansion to BIS's warehouse. BIS was currently operating without a line of credit, and MacDougall wondered whether the business could generate enough cash to cover its expenses, including the new loan payments. MacDougall had to be thorough in his analysis because he knew Bodie was relying on financing from the bank for the expansion. In 2003, Liz Bodie purchased the business from its previous owner and changed the company's name to reflect its new ownership. Prior to acquiring the business, Bodie had worked for a variety of different companies, including one of BIS's current metropolitan-based competitors. During those years, it was Bodie's long-term ambition to operate her own business. Her first entrepreneurial venture was a franchised retail hardware store that she operated for several years before selling it to acquire BIS. Drawing on her work experience, Bodie expanded BIS into a full-service distributor of top-line, brand name, new and used certified machine tools, maintenance parts and related equipment for the construction, utility and farming markets. The company strove to uphold its reputation as the single source for all industrial equipment needs. Although BIS conducted business country-wide, BIS's hometown of Barron, approximately 100 kilometres northeast of a large metropolitan city, was currently the largest and fastest growing industrial centre in its region with a population of 135,000. BIS's customers were primarily the industrial maintenance departments of medium- to large-sized corporations in the manufacturing, commercial construction and engineering industries. BIS also attracted some high-margin retail business from farming communities and summer cottage trade in the surrounding area. Bodie was pleased with BIS's progress since she had purchased it and had experienced considerable success in growing sales. The business's success was such that in August 2005, BIS purchased its rented facilities when the landlord offered the property at what Bodie regarded as a very attractive price. MacDougall had arranged the loan for the land and building purchase. The loan was currently in good standing with all payments up to date.1 BIS's success continued, and by June 2006, monthly sales volumes averaged more than $200,000. (See Exhibits 1 to 5 for historical financial data, cash flow statements, and selected company and industry financial ratios.) Bodie was also proud of the company's reputation for dependability and integrity. She believed her success was due largely to the personalized service and engineering advice she offered BIS's customers. Bodie also noted that an important factor in attracting new customers and building lasting relationships was BIS's success in obtaining exclusive rights to offer the products of some top-line brand-name manufacturers. She also believed that maintaining good supplier relations with those manufacturers who granted BIS exclusivity was a key element to future success. Until late 2005, BIS had been the only distributor of machine tools, parts and equipment in Barron. Minimal competition had come from salespeople operating from out-of-town warehouses, but in the fall of 2005, a new distributor opened in downtown Barron. Bodie believed that the new competitor would compete directly with only a small portion of her business because of BIS's exclusive brand distribution rights and complete line of specialized products. Additionally, this new distributor had not yet earned a reputation comparable to that of BIS for dependable service. Although not necessarily considered a direct threat, the entrance of big-box retailers did increase competition among Canadian wholesalers and retailers alike. Big-box retailers competing within the home improvement, construction and building maintenance industries, such as Home Depot, RONA and Lowes, opened stores from 3,500 square metres to 15,000 square metres in size. Not only did these retailers offer lower prices, but they also provided a wide variety of products for retail and commercial consumers. At present, there were three major retailers in Barron with a fourth scheduled to open in the coming months. Although these retailers did not carry specialized, large and commercial-grade industrial equipment, they did offer a wide selection of construction supplies typically used by many of BIS's smaller, higher margin accounts. Bodie was still uncertain how and to what extent mass retailers and wholesalers could influence the business. Bodie believed a more eminent threat was the rapid growth of Internet-based selling. Many of BIS's competitors now had websites with online ordering and e-commerce capabilities that provided added convenience and quicker service to customers looking to order general use supplies. Online selling also reduced the need for customers to do business with a local supplier, potentially vastly increasing BIS's pool of competition. Although BIS did currently have a company website, it was purely informational. Although market information was limited, Bodie thought that BIS had about 35 per cent of the machine tool and equipment market in Barron and the surrounding region. Given the existing market potential, she believed sales could not increase beyond $4 million without expanding BIS's geographical market. For the next two years, she projected sales at $2.8 million for the year ending January 31, 2007, and $3.2 million for the year ending January 31, 2008.1 Appears as CCB mortgage payable on the balance sheet; secured by land and building. Bodie's major concern was the cramped space in BIS's warehouse. She believed the business could not handle any significant increases in inventory, given its present facilities. In order to maintain BIS's standard of service and delivery, Bodie wanted to add a warehouse extension, estimated at a cost of $200,000, by the beginning of November. If the loan was approved, principal payments would be $40,000 each year, beginning February 1, 2007, and annual interest payments would be approximately $13,000 for the first two years. In addition to these new loan payments, the combined principal payment on the total amount of all existing long-term debt for fiscal 2007 and 2008 would be $36,528 and $71,924 respectively. The associated annual interest payments on these outstanding liabilities would be $20,914 for 2007 and $35,528 for 2008. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2006. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before the end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. Bodie believed the days of inventory would not change after the warehouse expansion, even though sales were expected to increase. She did consider, however, that increasing inventory levels could present a risk to cashflows if sales did not increase proportionately. One of Bodie's top priorities was to reduce the age of BIS's accounts payables to 60 days before the end of the next fiscal year. If this was not accomplished, some of BIS's exclusive distribution agreements could be jeopardized. Although Bodie thought BIS could reduce its days of accounts payables as sales and profits grew, she wondered whether this objective was attainable within the next year. For this reason, Bodie anticipated that BIS could be in need of a line of credit to support the increased working capital requirements in addition to the requested new long-term loan. BIS had shown strong growth results within the past three years, but MacDougall was concerned about providing more financing in addition to the loan the Canadian Commercial Bank had already extended in August 2005. Furthermore, he was aware of the pressure BIS's preferred suppliers were putting on Bodie to reduce days of accounts payables. Could BIS support such an aggressive reduction at this time? Without a short-term source of financing, MacDougall wondered whether BIS would even be able to generate the cash required to cover its debt payments over the next few years. For years ending January 31st 2005 2006 2006 Selected Industry Ratios 2004 2004 2005 2006 Exhibit 1 Statement of Earnings 2004 930,110 644,190 285,920 2005 1,599,920 1,171,760 428,160 2006 2,066,820 1,476,840 589,980 2004 100.0% 69.3% 30.7% 2005 100.0% 73.2% 26.8% 2006 100.0% 71.5% 28.5% Indy Ratios 100.0% 67.9% 32.1% 253,910 22,200 306,170 11,100 Net Sales COGS Gross Profit Operating Expenses Wages & Commissions Rent Provision for Doubtful Accounts General Selling Expenses General Admin Expenses Amortization Total Operating Expenses EBIT Interest Expense EBT Tax Net Income (Loss) 183,620 19,430 6,710 29,100 76,430 14.8% 0.5% 0.0% 19.7% 2.1% 0.7% 3.1% 8.2% 0.0% 1.2% 6.4% 1.2% 27,560 104,720 10,300 418,690 9,470 29,220 (19,750) 15.9% 1.4% 0.0% 1.7% 6.5% 0.6% 26.2% 0.6% 1.8% -1.2% 0.0% -1.2% 23,860 132,850 24,360 498,340 91,640 33,750 57,890 315,290 (29,370) 27,230 (56,600) 24.1% 4.4% 33.9% -3.2% 2.9% -6.1% 0.0% 1.6% 2.8% 0.0% 2.8% (56,600) (19,750) 57,890 -6.1% 2.8% Return on Average Equity n/a -58.9% 110.1% 12.3% Exhibit 2 Statement of Retained Earnings for years ending January 31) 2004 2005 (56,600) (19,750) 2006 (76,350) 57,890 (56,600) Retained Earnings b.o.p. Add: Net income Less: Dividends Retained Earnings e.o.p. (56,600) (76,350) (18,460) Exhibit 3 Balance Sheets (as at January 31) SUF 2004 2005 2006 2004 2005 2006 2005 2006 14.4% 0.1% 86,060 128,500 308,980 3,020 526,560 17,510 201,670 342,080 3,020 564,280 1,420 338,690 474,630 1.740 816,480 2.8% 32.4% 55.0% 0.5% 90.7% 32.2% 45.2% 68,550 (73,170) (33, 100) 21.5% 51.7% 0.5% 88.1% 16,090 (137,020) (132,550) 1,280 (252, 200) 0.2% 77.7% (37,720) 0.0% Current Assets Cash A/R, net Inventory Prepaid Expenses Total Current Assets Fixed Assets Land Automobiles Building Equipment Subtotal Less: Accumulated Depreciation Fixed Assets Net (FAN) Goodwill Deferred Charges Total Assets 34,350 34,350 34,350 60,880 47,850 122,940 3,990 235,660 34,660 201,000 30,000 2,750 1,050,230 0.0% 5.7% 0.0% 0.0% 5.7% 0.0% 5.7% 5.0% 1.1% 100.0% (60,880) (13,500) (122,940) (3,990) (201,310) 24,360 (176,950) 5.5% 0.0% 0.0% 5.5% 1.7% 3.9% 4.8% 0.6% 100.0% 34,350 10,300 24,050 30,000 3,850 622,180 5.8% 4.6% 11.7% 0.4% 22.4% 3.3% 19.1% 2.9% 0.3% 100.0% 10,300 10,300 34,350 30,000 6,570 597,480 2,720 (24,700 1,100 (428,050) 184,640 15790 200,430 126,900 30,240 196,510 290,740 11850 302,590 101,700 211,760 24,000 235,760 (25,200) (12,520) Current Liabilities ST Credit A/P Other Current Liabilities Total Current Liabilities Bank Loan Transport Loan Mortgage Payable CCB Mortgage payable Total Long Term Liabilities Common Stock Retained Earnings Total Equity Total Liabilities & Equity 1 17,730 106, 100 (3,940) 102,160 (25,200) (12,510) (20,000) 176,510 0.0% 30.9% 2.6% 33.5% 21.2% 5.1% 32.9% 0.0% 59.2% 16.7% -9.5% 7.3% 100.0% 502,500 35,850 538,350 76,500 5,210 176,510 172,120 430,340 100,000 (18,460) 81,540 1,050,230 0.0% 46.7% 1.9% 48.6% 16.3% 2.8% 28.4% 0.0% 47.6% 16.1% -12.3% 3.8% 100.0% 0.0% 47.8% 3.4% 51.3% 7.3% 0.5% 16.8% 16.4% 41.0% 9.5% -1.8% 7.8% 100.0% 172, 120 134,400 (57,710) - 353,650 100,000 (56,600) 43,400 597,480 295,940 100,000 (76,350) 23,650 622, 180 (19,750) (19,750) 24,700 57,890 57,890 428,050 Exhibit 5 Statement of Cash Flows (for years ending January 31) 2004 2005 2006 (19,750) 57,890 Operations Net Income Adjustments to Cash Basis: Amortization A/R, net Inventory Prepaid Expenses A/P Other Current Liabilities Net Cash Flow from Operations 10,300 (73,170) (33,100) 24,360 (137,020) (132,550) 1,280 211,760 24,000 49,720 106,100 (3,940) (13,560) Financing Activities Bank Loan Transport Loan Mortgage Payable CCB Mortgage Payable Net Cash Flow from Financing (25,200) (12,510) (20,000) (25,200) (12,520) 172,120 134,400 (57,710) Investing Activities Fixed Assets Deferred Charges Net Cash Flow from Investing 2,720 2,720 (201,310) 1,100 (200,210) Net Cash Flow Cash b.o.p. Cash e.o.p. (68,550) 86,060 17,510 (16,090) 17,510 1,420 2004 2006 2005 72% n/a 29% OPERATIONAL RATIOS Growth in Sales Growth in Net Income Growth in Total Assets Growth in Equity n/a n/a n/a 69% n/a 4% -46% n/a 245% Profitability GPM 30.7% 26.8% 28.5% CHECK Dupont Analysis: Sources of Value NPM (ROS) Turnover Return on Assets (ROA) Leverage Return on Equity (ROE) -6.1% 1.6 -9.5% 13.8 -130.4% - 1.2% 2.6 -3.2% 26.3 -83.5% 2.8% 2.0 5.5% 12.9 71.0% -9.5% -3.2% 5.5% -130.4% -83.5% 71.0% 2006 Selected Industry Ratios 1.8 0.6 2.63 1.09 326,130 7.24 50 2.08 1.86 0.73 261,690 7.93 46 3.43 1.52 0.63 278,130 6.10 60 3.11 days 52.4 days Liquidity/Efficiency Current Ratio Quick Ratio Working Capital ARTO ACP Inventory Turnover IHP A/P Turnover Payables in Days FATO TATO Operating Cycle Cash Cycle 107 days 175 3.49 105 27.08 1.56 225 121 117 2.94 124 10.28 days 4.03 91 66.52 2.57 153 62 1.97 177 53 51.93% 92.7% 7.3% 48.07% Debt (Leverage) Ratios D/A Net Worth to Assets LTD/A STD/A D/E TIE 96.2% 3.8% 47.6% 48.6% 2531% 0.3x 92.2% 7.8% 41.0% 51.3% 59.2% 33.5% 1277% 1188% 2.7x n.m. 3.6x FINANCIAL RATIOS 326,130 326,130 261,690 261,690 278,130 278,130 FO NCADI Credit Needed (NFO-WCAD) VFO as a % of Sales Growth rate in NFO Growth rate in W/CADJ Excess Cash or Credit? 16% 13% 35% n/a -20% -20% 6% 6% n/a Need=0 Need=0 Need=0 INTEREST RATE APPROX 27,230 29,220 33,750 369,440 307,790 466,190 7.4% 9.5% 7.2%