Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In your own words summarize what you understand from the above chapter summary. SUMMARY In this chapter we have used our newfound knowledge of present

In your own words summarize what you understand from the above chapter summary.

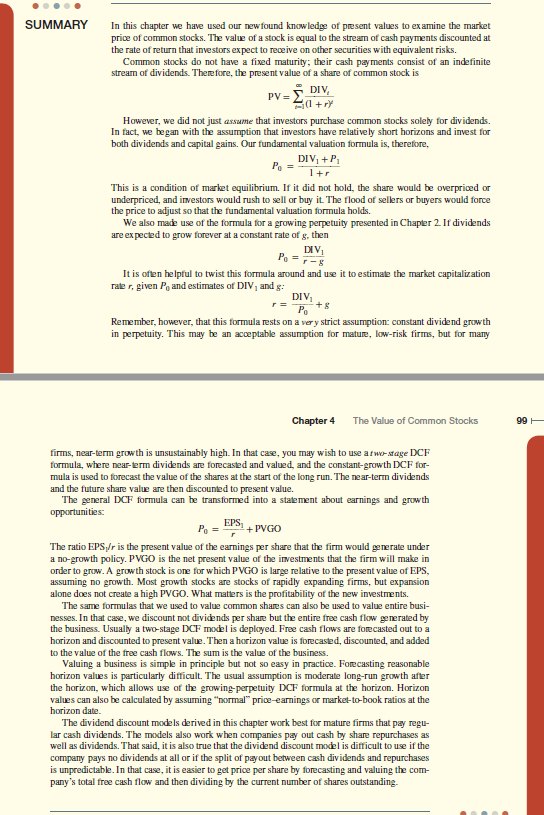

SUMMARY In this chapter we have used our newfound knowledge of present values to ex amine the market price of common stocks. The value of a stock is equal to the stream of cash payments discounted at the rate of return that investors expect to receive on other securities with equivalent risks. Common stocks do not have a fixed maturity; their cash payments consist of an indefinite stream of dividends. There fore, the present value of a share of common stock is +r However, we did not just assume that investors purchase common stocks solely for dividends. In fact, we began with the assurmption that investors have relatively short horizons and invest for both dividends and capital gains. Our fundamental valuation formula is, therefore, DIV +P This is a condition of market equilibrium. If it did not hold, the share would be overpriced or underpriced, and investors would rush to sell or buy it. The flood of selers or buyers would force the price to adjust so that the fundamental valuation formula holds. We also made use of the formula for a growing perpetuity presented in Chaper 2. If dividends are expected to grow forever at a constant rate of g, then DIV It is often he lpful to twist this formula around and use it to estimate the market capitalization rate r, given Po and estimates of DIV, and g: t 8 Remember, however, that this formula rests on a very strict assumption: constant dividend growth in perpetuity. This may be an acceptable assumption for mature, low-risk firms, but for many Chapter 4 The Value of Common Stocks 99H firms, near-term growth is unsustainably high. In that case, you may wish to use atwostage DCF formula, where near-erm dividends are forecasted and valued, and the constant-growth DCF for- mula is used to forecast the value of the shares at the start of the long run. The near-termn dividends and the future share value are then discounted to present value. The general DCF formula can be transformed into a statement about earnings and growth opportunities EPS The ratio EPSr is the present value of the earnings per share that the firm would generate under a no-growth policy. PVGO is the net present value of the investments that the firm will make in order to grow. A growth stock is one for which PVGO is large relative to the present value of EPS, assuming no growth. Most growth stocks are stocks of rapidly expanding firms, but expansion alone does not create a high PVGO. What matters is the profitability of the new investments. The same formulas that we used to value common shares can also be used to value entire busi- nesses. In that case, we discount not divide nds per share but the entire free cash flow generated by the business. Usually a two-stage DCF model is deplayed. Free cash flows are forecasted out to a horizon and discounted to present value. Then a horizon value is forecasted, discounted, and added to the value of the free cash flows. The sum is the value of the business. Valuing a business is simple in principle but not so easy in practice. Forecasting reasonable horizon values is particularly difficult. The usual assumption is moderate long-run growth after the horizon, which allows use of the growing-perpetuity DCF formula at the horizon. Horizon values can also be calculated by assuming "normal" price-earnings or market-to-book ratios at the horizon date. The dividend discount mode ls derived in this chapter work best for mature firms that pay regu- lar cash dividends. The models also work when companies pay out cash by share repurchases as well as dividends. That said, it is also true that the dividend discount model is difficult to use if the company pays no dividends at all or if the split of payout between cash dividends and repurchases is unpredictable. In that case, it is easier to get price per share by forecasting and valuing the com- pany's total free cash flow and then dividing by the current number of shares outstanding. SUMMARY In this chapter we have used our newfound knowledge of present values to ex amine the market price of common stocks. The value of a stock is equal to the stream of cash payments discounted at the rate of return that investors expect to receive on other securities with equivalent risks. Common stocks do not have a fixed maturity; their cash payments consist of an indefinite stream of dividends. There fore, the present value of a share of common stock is +r However, we did not just assume that investors purchase common stocks solely for dividends. In fact, we began with the assurmption that investors have relatively short horizons and invest for both dividends and capital gains. Our fundamental valuation formula is, therefore, DIV +P This is a condition of market equilibrium. If it did not hold, the share would be overpriced or underpriced, and investors would rush to sell or buy it. The flood of selers or buyers would force the price to adjust so that the fundamental valuation formula holds. We also made use of the formula for a growing perpetuity presented in Chaper 2. If dividends are expected to grow forever at a constant rate of g, then DIV It is often he lpful to twist this formula around and use it to estimate the market capitalization rate r, given Po and estimates of DIV, and g: t 8 Remember, however, that this formula rests on a very strict assumption: constant dividend growth in perpetuity. This may be an acceptable assumption for mature, low-risk firms, but for many Chapter 4 The Value of Common Stocks 99H firms, near-term growth is unsustainably high. In that case, you may wish to use atwostage DCF formula, where near-erm dividends are forecasted and valued, and the constant-growth DCF for- mula is used to forecast the value of the shares at the start of the long run. The near-termn dividends and the future share value are then discounted to present value. The general DCF formula can be transformed into a statement about earnings and growth opportunities EPS The ratio EPSr is the present value of the earnings per share that the firm would generate under a no-growth policy. PVGO is the net present value of the investments that the firm will make in order to grow. A growth stock is one for which PVGO is large relative to the present value of EPS, assuming no growth. Most growth stocks are stocks of rapidly expanding firms, but expansion alone does not create a high PVGO. What matters is the profitability of the new investments. The same formulas that we used to value common shares can also be used to value entire busi- nesses. In that case, we discount not divide nds per share but the entire free cash flow generated by the business. Usually a two-stage DCF model is deplayed. Free cash flows are forecasted out to a horizon and discounted to present value. Then a horizon value is forecasted, discounted, and added to the value of the free cash flows. The sum is the value of the business. Valuing a business is simple in principle but not so easy in practice. Forecasting reasonable horizon values is particularly difficult. The usual assumption is moderate long-run growth after the horizon, which allows use of the growing-perpetuity DCF formula at the horizon. Horizon values can also be calculated by assuming "normal" price-earnings or market-to-book ratios at the horizon date. The dividend discount mode ls derived in this chapter work best for mature firms that pay regu- lar cash dividends. The models also work when companies pay out cash by share repurchases as well as dividends. That said, it is also true that the dividend discount model is difficult to use if the company pays no dividends at all or if the split of payout between cash dividends and repurchases is unpredictable. In that case, it is easier to get price per share by forecasting and valuing the com- pany's total free cash flow and then dividing by the current number of shares outstandingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started