Answered step by step

Verified Expert Solution

Question

1 Approved Answer

in your short answers, please cite the applicable code section, regulation case or other authority in support of the analysis. please note if the answer

in your short answers, please cite the applicable code section, regulation case or other authority in support of the analysis. please note if the answer is not yes or no, and could be "it depends" then please state what the issue would be for you to answer.

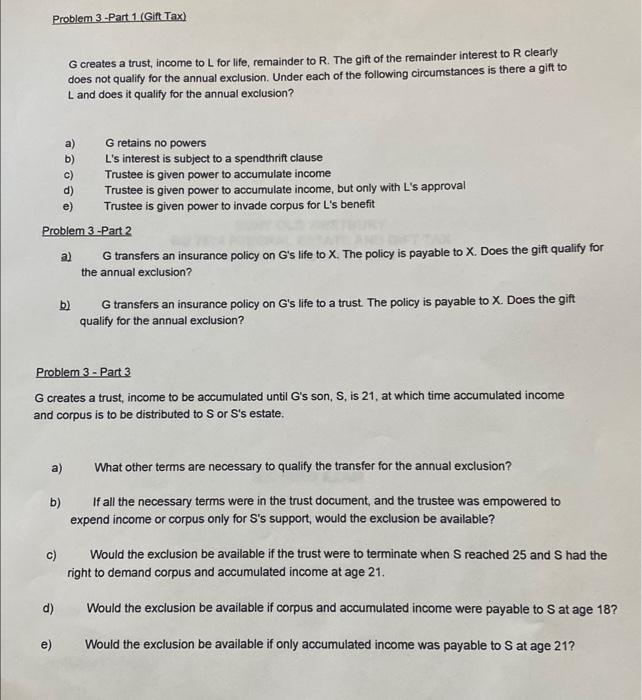

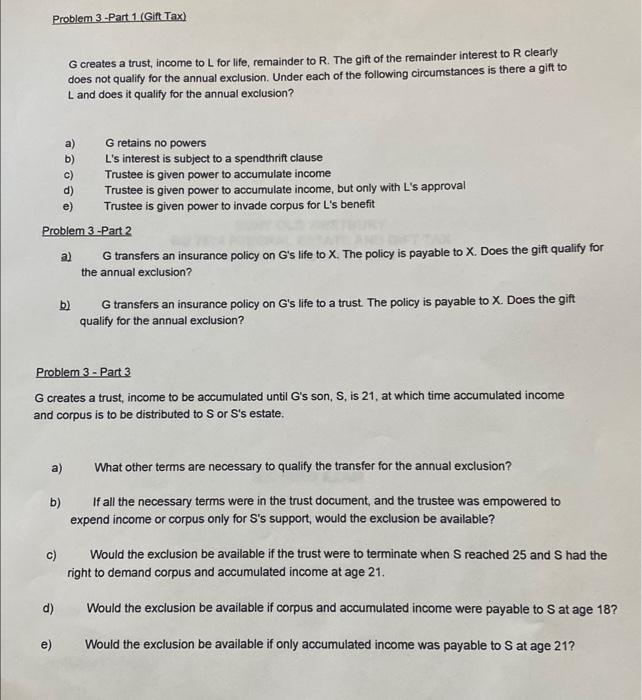

G creates a trust, income to L for life, remainder to R. The gift of the remainder interest to R clearly does not qualify for the annual exclusion. Under each of the following circumstances is there a gift to L and does it qualify for the annual exclusion? a) G retains no powers b) L's interest is subject to a spendthrift clause c) Trustee is given power to accumulate income d) Trustee is given power to accumulate income, but only with L's approval e) Trustee is given power to invade corpus for L's benefit Problem 3 -Part 2 a) G transfers an insurance policy on G's life to X. The policy is payable to X. Does the gift qualify for the annual exclusion? b) G transfers an insurance policy on G's life to a trust. The policy is payable to X. Does the gift qualify for the annual exclusion? Problem 3 - Part 3 G creates a trust, income to be accumulated until G's son, S, is 21, at which time accumulated income and corpus is to be distributed to S or S's estate. a) What other terms are necessary to qualify the transfer for the annual exclusion? b) If all the necessary terms were in the trust document, and the trustee was empowered to expend income or corpus only for S's support, would the exclusion be available? c) Would the exclusion be available if the trust were to terminate when S reached 25 and S had the right to demand corpus and accumulated income at age 21. d) Would the exclusion be available if corpus and accumulated income were payable to S at age 18 e) Would the exclusion be available if only accumulated income was payable to S at age 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started