In your view, based on the statements and ratio analysis, briefly describe Mary strengths and weaknesses in financial position

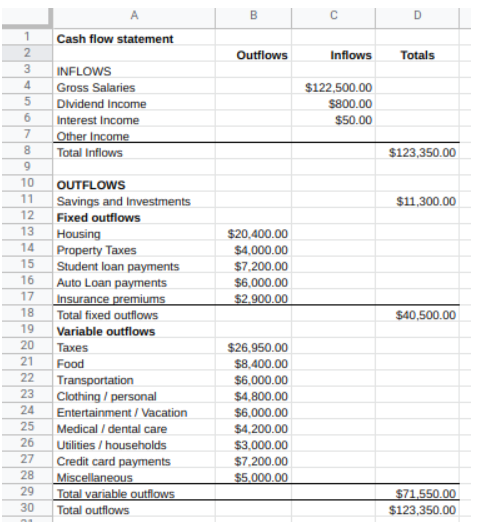

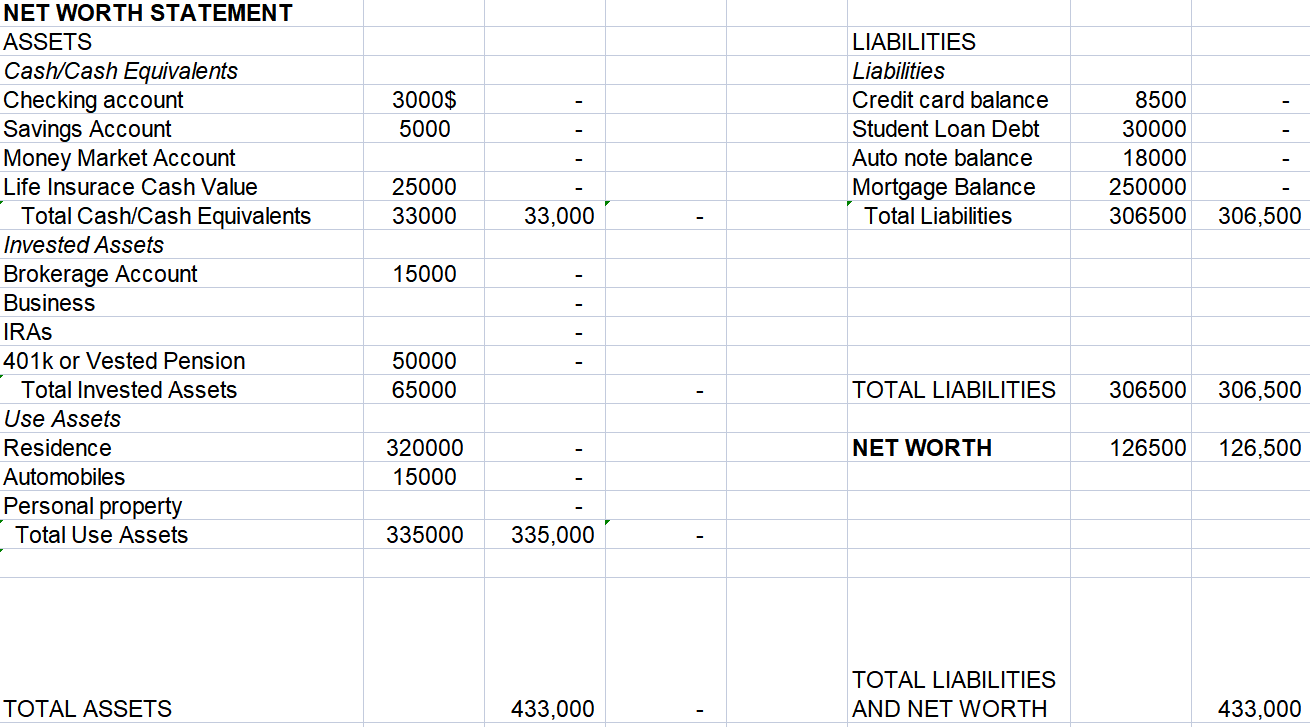

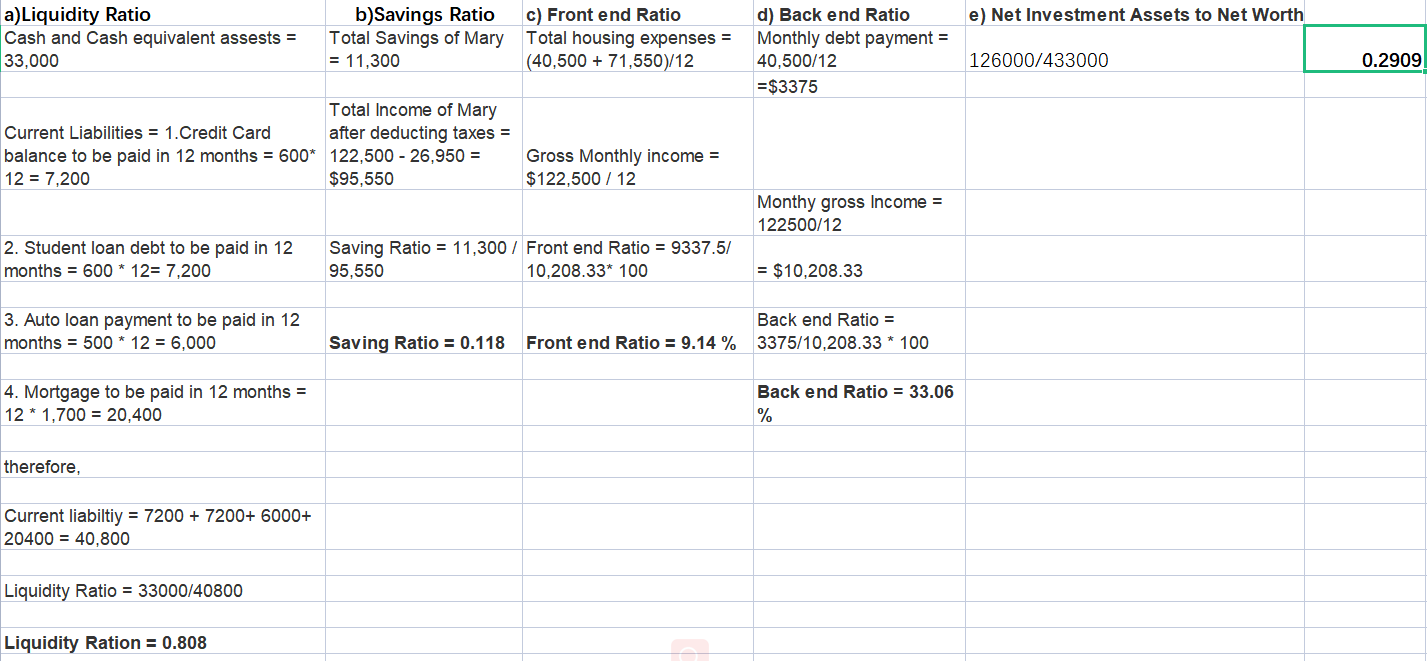

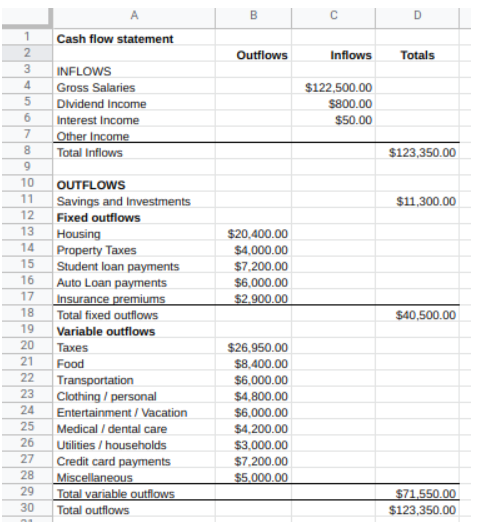

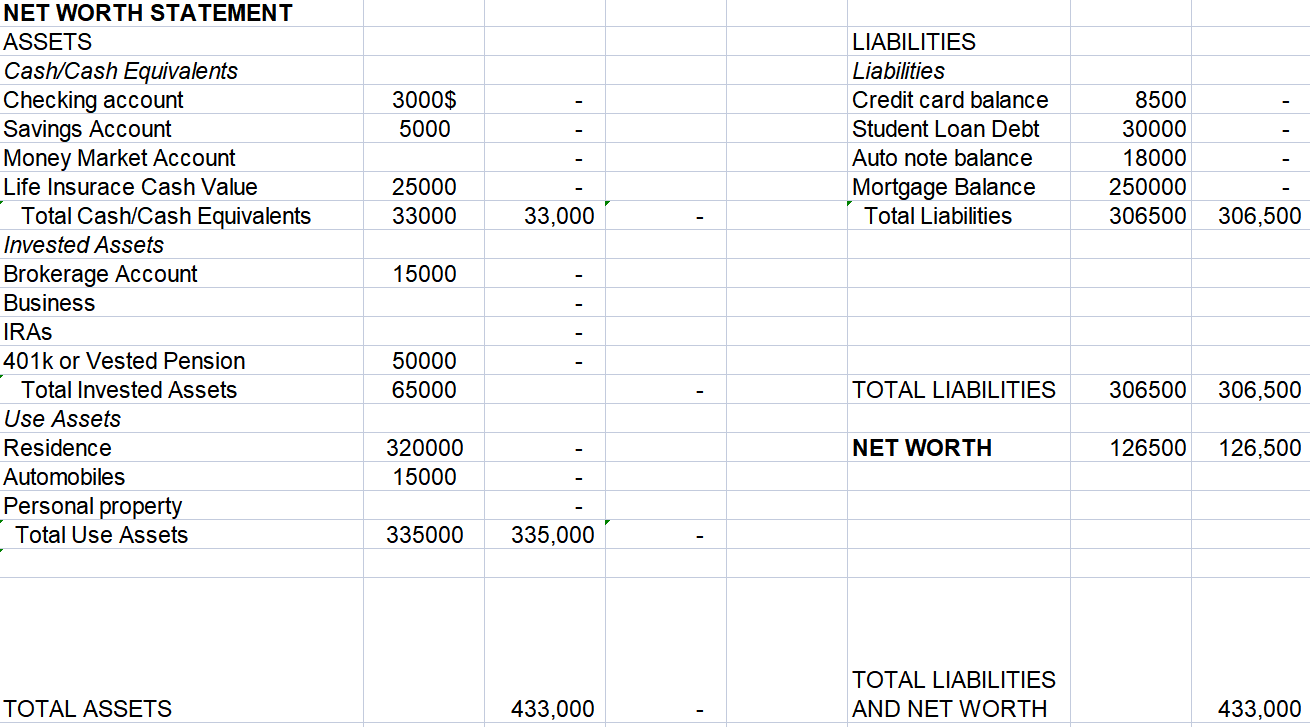

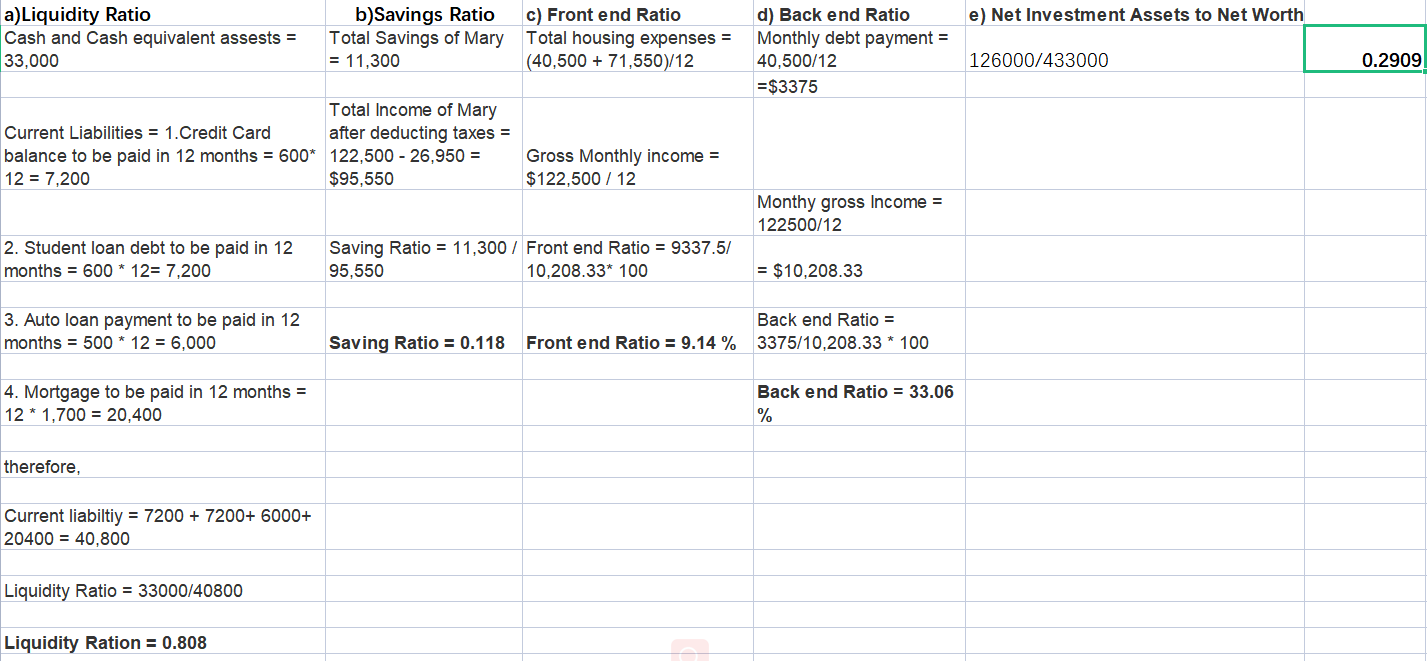

00 B D Cash flow statement Outflows Inflows Totals INFLOWS Gross Salaries Dividend Income Interest Income Other Income Total Inflows $122,500.00 $800.00 $50.00 $123,350.00 $11,300.00 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 $20.400.00 $4,000.00 $7,200.00 $6,000.00 $2.900.00 $40,500.00 OUTFLOWS Savings and Investments Fixed outflows Housing Property Taxes Student loan payments Auto Loan payments Insurance premiums Total fixed outflows Variable outflows Taxes Food Transportation Clothing/ personal Entertainment / Vacation Medical / dental care Utilities / households Credit card payments Miscellaneous Total variable outflows Total outflows 24 $26.950.00 $8,400.00 $6,000.00 $4,800.00 $6,000.00 $4,200.00 $3,000.00 $7,200.00 $5.000.00 25 26 27 28 29 30 $71.550.00 $123,350.00 3000$ 5000 LIABILITIES Liabilities Credit card balance Student Loan Debt Auto note balance Mortgage Balance Total Liabilities 8500 30000 18000 250000 306500 25000 33000 33,000 306,500 NET WORTH STATEMENT ASSETS Cash/Cash Equivalents Checking account Savings Account Money Market Account Life Insurace Cash Value Total Cash/Cash Equivalents Invested Assets Brokerage Account Business IRAS 401k or Vested Pension Total Invested Assets Use Assets Residence Automobiles Personal property Total Use Assets 15000 50000 65000 - TOTAL LIABILITIES 306500 306,500 I NET WORTH 126500 126,500 320000 15000 335000 335,000 TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS 433,000 433,000 e) Net Investment Assets to Net Worth a)Liquidity Ratio Cash and Cash equivalent assests = 33,000 b)Savings Ratio Total Savings of Mary = 11,300 c) Front end Ratio Total housing expenses = (40,500 + 71,550/12 d) Back end Ratio Monthly debt payment = 40,500/12 = $3375 126000/433000 0.2909 Total Income of Mary Current Liabilities = 1.Credit Card after deducting taxes = balance to be paid in 12 months = 600* 122,500 - 26,950 = 12 = 7,200 $95,550 Gross Monthly income = $122,500 / 12 Monthy gross Income = 122500/12 2. Student loan debt to be paid in 12 months = 600 * 12= 7,200 Saving Ratio = 11,300 / Front end Ratio = 9337.5/ 95.550 10.208.33* 100 = $10,208.33 3. Auto loan payment to be paid in 12 months = 500 * 12 = 6,000 Back end Ratio = Front end Ratio = 9.14 % 3375/10,208.33 * 100 Saving Ratio = 0.118 4. Mortgage to be paid in 12 months = 12* 1,700 = 20,400 Back end Ratio = 33.06 % therefore, Current liabiltiy = 7200 + 7200+ 6000+ 20400 = 40,800 Liquidity Ratio = 33000/40800 Liquidity Ration = 0.808 00 B D Cash flow statement Outflows Inflows Totals INFLOWS Gross Salaries Dividend Income Interest Income Other Income Total Inflows $122,500.00 $800.00 $50.00 $123,350.00 $11,300.00 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 $20.400.00 $4,000.00 $7,200.00 $6,000.00 $2.900.00 $40,500.00 OUTFLOWS Savings and Investments Fixed outflows Housing Property Taxes Student loan payments Auto Loan payments Insurance premiums Total fixed outflows Variable outflows Taxes Food Transportation Clothing/ personal Entertainment / Vacation Medical / dental care Utilities / households Credit card payments Miscellaneous Total variable outflows Total outflows 24 $26.950.00 $8,400.00 $6,000.00 $4,800.00 $6,000.00 $4,200.00 $3,000.00 $7,200.00 $5.000.00 25 26 27 28 29 30 $71.550.00 $123,350.00 3000$ 5000 LIABILITIES Liabilities Credit card balance Student Loan Debt Auto note balance Mortgage Balance Total Liabilities 8500 30000 18000 250000 306500 25000 33000 33,000 306,500 NET WORTH STATEMENT ASSETS Cash/Cash Equivalents Checking account Savings Account Money Market Account Life Insurace Cash Value Total Cash/Cash Equivalents Invested Assets Brokerage Account Business IRAS 401k or Vested Pension Total Invested Assets Use Assets Residence Automobiles Personal property Total Use Assets 15000 50000 65000 - TOTAL LIABILITIES 306500 306,500 I NET WORTH 126500 126,500 320000 15000 335000 335,000 TOTAL LIABILITIES AND NET WORTH TOTAL ASSETS 433,000 433,000 e) Net Investment Assets to Net Worth a)Liquidity Ratio Cash and Cash equivalent assests = 33,000 b)Savings Ratio Total Savings of Mary = 11,300 c) Front end Ratio Total housing expenses = (40,500 + 71,550/12 d) Back end Ratio Monthly debt payment = 40,500/12 = $3375 126000/433000 0.2909 Total Income of Mary Current Liabilities = 1.Credit Card after deducting taxes = balance to be paid in 12 months = 600* 122,500 - 26,950 = 12 = 7,200 $95,550 Gross Monthly income = $122,500 / 12 Monthy gross Income = 122500/12 2. Student loan debt to be paid in 12 months = 600 * 12= 7,200 Saving Ratio = 11,300 / Front end Ratio = 9337.5/ 95.550 10.208.33* 100 = $10,208.33 3. Auto loan payment to be paid in 12 months = 500 * 12 = 6,000 Back end Ratio = Front end Ratio = 9.14 % 3375/10,208.33 * 100 Saving Ratio = 0.118 4. Mortgage to be paid in 12 months = 12* 1,700 = 20,400 Back end Ratio = 33.06 % therefore, Current liabiltiy = 7200 + 7200+ 6000+ 20400 = 40,800 Liquidity Ratio = 33000/40800 Liquidity Ration = 0.808