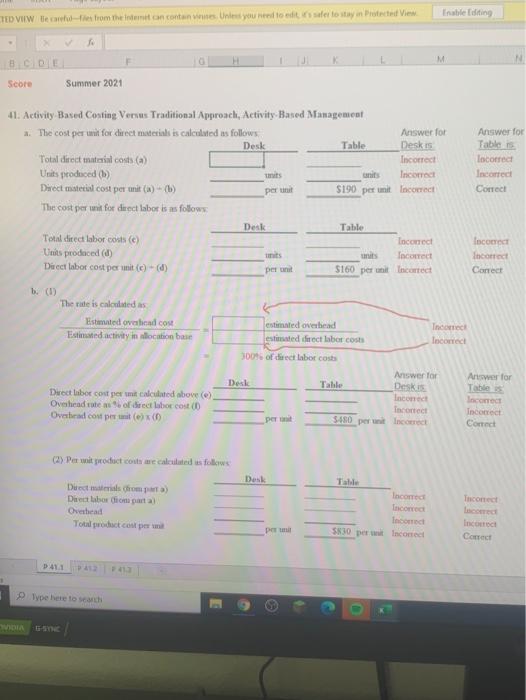

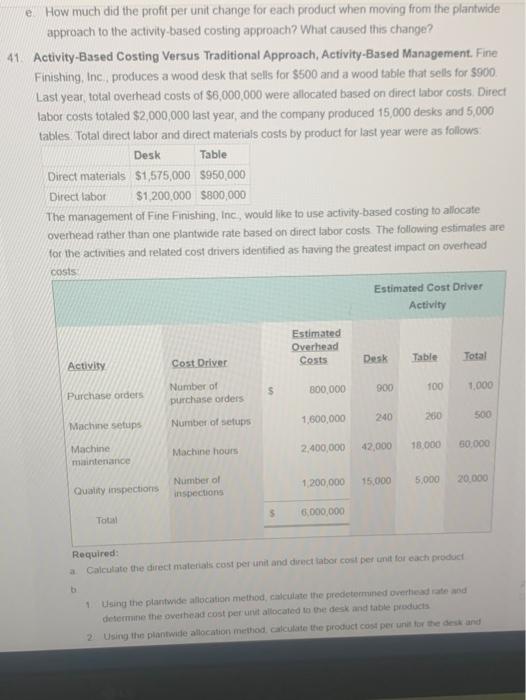

Inable Editing TED VIIW de cards from the intentan contains Unless you need to edit safe to stay in Protected View BCDE H M Score Summer 2021 41. Activity Based Coating Versus Traditional Approach, Activity Based Management a. The cost per unit for direct materials is calculated as follows: Answer for Desk Table Deskis Total direct material costs (a) Incorrect Units produced (s) units Incorrect Direct material cost per unit (a) (b) $190 per unit incorrect The cost per unit for direct labot is as follows: Desk Table Total direct labor cats (C) Incorrect Units produced (d) Incorrect Direct labor cost per unit ()-(d) $160 per unit incorrect Answer for Tables lacorred Income Correct POT locorect Income Correct bi (1) The rate is called as Estimated overhead cost Estimated activity in location base estimated overhead Income estimated direct labor costs Incorrect 300 of direct labor costs Answer for Answer for Desk Table Deskis Inconed conect Incorrect Incorrect nd S480 per unit incorect Correct Direct labor cost permit calculated above) Overhead rate of direct labor cost Overhad cont per tant (ex (2) Pet wat product costs are calculated as follows Desk Thconect Duct materials compa) Direct labor do para Overhead Total product cost per Tat Incomea Incorred incomed 5830 petit incorrect pe Inco Correct D411 41 Type here to search SWASTE e How much did the profit per unit change for each product when moving from the plantwide approach to the activity-based costing approach? What caused this change? 41 Activity-Based Costing Versus Traditional Approach, Activity-Based Management. Fine Finishing, Inc. produces a wood desk that sells for $500 and a wood table that sells for $900, Last year, total overhead costs of $6,000,000 were allocated based on direct labor costs Direct labor costs totaled $2,000,000 last year, and the company produced 15,000 desks and 5,000 tables. Total direct labor and direct materials costs by product for last year were as follows: Desk Table Direct materials $1,575,000 $950,000 Direct labor $1,200,000 $800,000 The management of Fine Finishing, Inc., would like to use activity-based costing to allocate overhead rather than one plantwide rate based on direct labor costs. The following estimates are for the activities and related cost drivers identified as having the greatest impact on overhead costs Estimated Cost Driver Activity Estimated Overhead Costs Desk Table Total Activity Cost Driver 5 800,000 900 100 Number of purchase orders 1.000 Purchase orders 240 200 500 1,600,000 Machine setups Number of setups 2.400,000 42.000 18.000 Machine hours 50.000 Machine maintenance 1.200.000 15.000 5.000 20.000 Number of inspections Quality inspections 5 6.000.000 Total Required: Calculate the direct materials cost per unit and direct labor cost per unit for each product 1 Using the plantwide allocation method calculate the predetermined overheat and determine the overhead cost per un allocated to the desk and table products 2. Using the plantwide allocation method, calculate the product cost per unit to the desk and