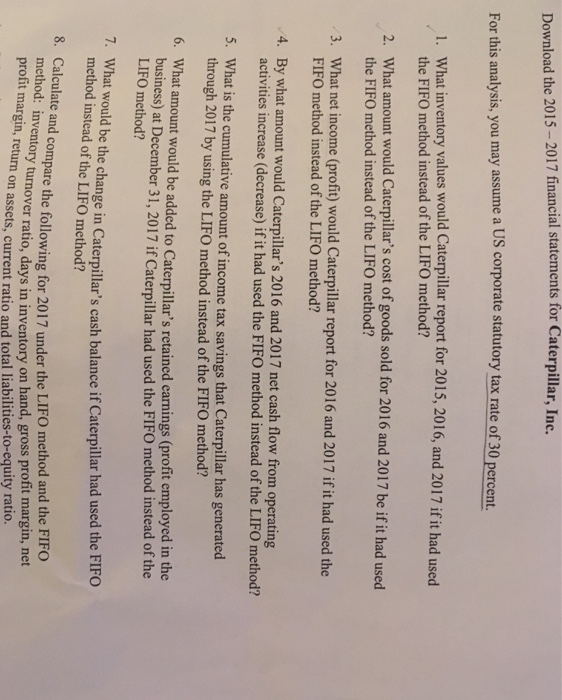

, Inc. Download the 2015-2017 financial statements for Caterpillar For this analysis, you may assume a US corporate statutory tax rate of 30 percent. 1. What inventory values would Caterpillar report for 2015, 2016, and 2017 if it had used the FIFO method instead of the LIFO method? 2. What amount would Caterpillar's cost of goods sold for 2016 and 2017 be if it had used 3. What net income (profit) would Caterpillar report for 2016 and 2017 if it had used the 4. By what amount would Caterpillar's 2016 and 2017 net cash flow from operating the FIFO method instead of the LIFO method? FIFO method instead of the LIFO method? activities increase (decrease) if it had used the FIFO method instead of the LIFO method? What is the cumulative amount of income tax savings that Caterpillar has generated through 2017 by using the LIFO method instead of the FIFO method? 5. 6. What amount would be added to Caterpillar's retained earnings (profit employed in the siness) at December 31, 2017 if Caterpillar had used the FIFO method instead of the LIFO method? 7. What would be the change in Caterpilla's cash balance if Caterpillar had used the FI method instead of the LIFO method? Calculate and compare the following for method: inventory profit margin, return 8. 2017 under the LIFO method and the FIFO turnover ratio, days in inventory on hand, gross profit margin, net on assets, current ratio and total liabilities-to-equity ratio , Inc. Download the 2015-2017 financial statements for Caterpillar For this analysis, you may assume a US corporate statutory tax rate of 30 percent. 1. What inventory values would Caterpillar report for 2015, 2016, and 2017 if it had used the FIFO method instead of the LIFO method? 2. What amount would Caterpillar's cost of goods sold for 2016 and 2017 be if it had used 3. What net income (profit) would Caterpillar report for 2016 and 2017 if it had used the 4. By what amount would Caterpillar's 2016 and 2017 net cash flow from operating the FIFO method instead of the LIFO method? FIFO method instead of the LIFO method? activities increase (decrease) if it had used the FIFO method instead of the LIFO method? What is the cumulative amount of income tax savings that Caterpillar has generated through 2017 by using the LIFO method instead of the FIFO method? 5. 6. What amount would be added to Caterpillar's retained earnings (profit employed in the siness) at December 31, 2017 if Caterpillar had used the FIFO method instead of the LIFO method? 7. What would be the change in Caterpilla's cash balance if Caterpillar had used the FI method instead of the LIFO method? Calculate and compare the following for method: inventory profit margin, return 8. 2017 under the LIFO method and the FIFO turnover ratio, days in inventory on hand, gross profit margin, net on assets, current ratio and total liabilities-to-equity ratio