Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Inc. made a $15,000 sale on account with the following terms: 3/10, n/30. Ifthe the net method to record sales made on credit, what is/are

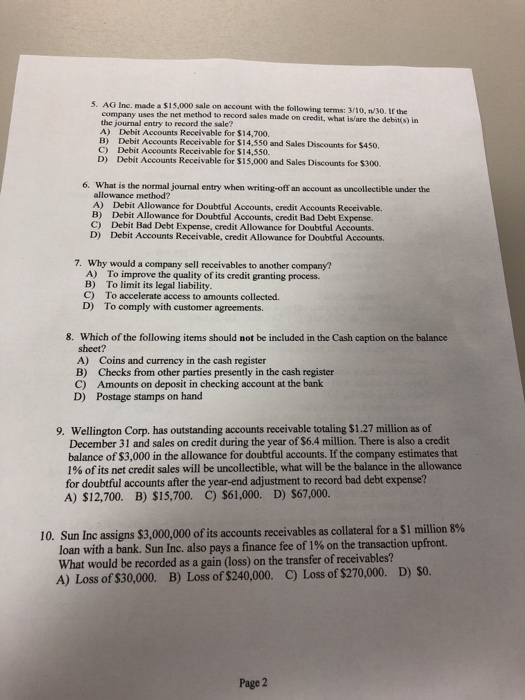

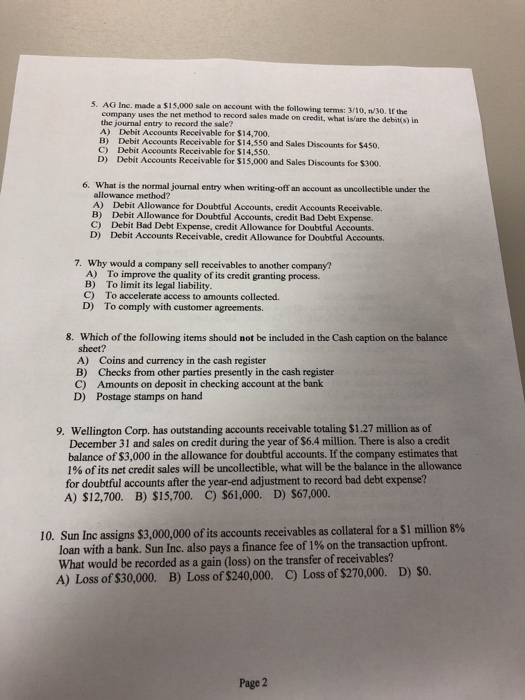

Inc. made a $15,000 sale on account with the following terms: 3/10, n/30. Ifthe the net method to record sales made on credit, what is/are the debit(s) in company the journal entry to record the sale? A) Debit Accounts Receivable for $14,700. B) Debit Accounts Receivable for $14,550 and Sales Discounts for $450. C) Debit Accounts Receivable for $14,550. D) Debit Accounts Receivable for $15,000 and Sales Discounts for $300. 6. What is the normal joumal entry when writing-off an account as uncollectible under the allowance method? A) B) C) D) Debit Allowance for Doubtful Accounts, credit Accounts Receivable. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 7. Why would a company sell receivables to another company To improve the quality of its credit granting process. To limit its legal liability To accelerate access to amounts collected. To comply with customer agreements. A) B) C) D) 8. Which of the following items should not be included in the Cash caption on the balance sheet? A) B) C) Coins and currency in the cash register Checks from other parties presently in the cash register Amounts on deposit in checking account at the bank D) Postage stamps on hand Wellington Corp, has outstanding accounts receivable totaling $1.27 million as of December 31 and sales on credit during the year of $6.4 million. There is also a credit balance of $3,000 in the allowance for doubtful accounts. If the company estimates that 1% of its net credit sales will be uncollectible, what will be the balance in the allowance for doubtful accounts after the year-end adjustment to record bad debt expense? A) $12,700. B) $15,700. C) $61,000. D) $67,000. 9. 10, Sun Inc assigns $3,000,000 of its accounts receivables as collateral for a $1 million 8% loan with a bank. Sun Inc. also pays a finance fee of 1% on the transaction upfront. What would be recorded as a gain (loss) on the transfer of receivables? A) Loss of $30,000. B) Loss of $240,000. C) Loss of $270,000. D) S0. Page 2

Inc. made a $15,000 sale on account with the following terms: 3/10, n/30. Ifthe the net method to record sales made on credit, what is/are the debit(s) in company the journal entry to record the sale? A) Debit Accounts Receivable for $14,700. B) Debit Accounts Receivable for $14,550 and Sales Discounts for $450. C) Debit Accounts Receivable for $14,550. D) Debit Accounts Receivable for $15,000 and Sales Discounts for $300. 6. What is the normal joumal entry when writing-off an account as uncollectible under the allowance method? A) B) C) D) Debit Allowance for Doubtful Accounts, credit Accounts Receivable. Debit Allowance for Doubtful Accounts, credit Bad Debt Expense. Debit Bad Debt Expense, credit Allowance for Doubtful Accounts. Debit Accounts Receivable, credit Allowance for Doubtful Accounts. 7. Why would a company sell receivables to another company To improve the quality of its credit granting process. To limit its legal liability To accelerate access to amounts collected. To comply with customer agreements. A) B) C) D) 8. Which of the following items should not be included in the Cash caption on the balance sheet? A) B) C) Coins and currency in the cash register Checks from other parties presently in the cash register Amounts on deposit in checking account at the bank D) Postage stamps on hand Wellington Corp, has outstanding accounts receivable totaling $1.27 million as of December 31 and sales on credit during the year of $6.4 million. There is also a credit balance of $3,000 in the allowance for doubtful accounts. If the company estimates that 1% of its net credit sales will be uncollectible, what will be the balance in the allowance for doubtful accounts after the year-end adjustment to record bad debt expense? A) $12,700. B) $15,700. C) $61,000. D) $67,000. 9. 10, Sun Inc assigns $3,000,000 of its accounts receivables as collateral for a $1 million 8% loan with a bank. Sun Inc. also pays a finance fee of 1% on the transaction upfront. What would be recorded as a gain (loss) on the transfer of receivables? A) Loss of $30,000. B) Loss of $240,000. C) Loss of $270,000. D) S0. Page 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started