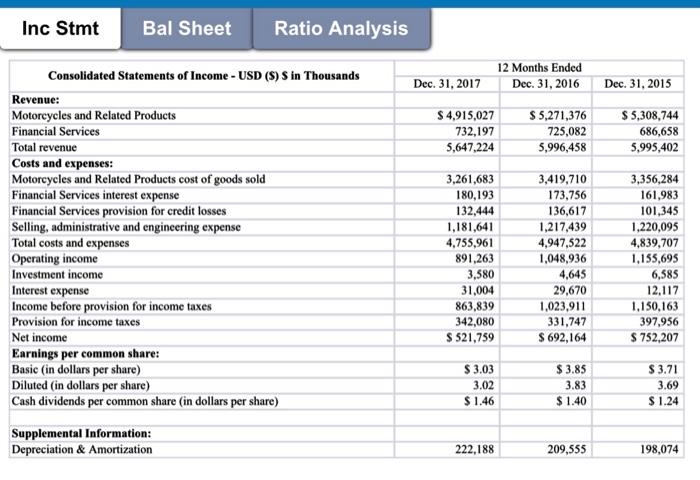

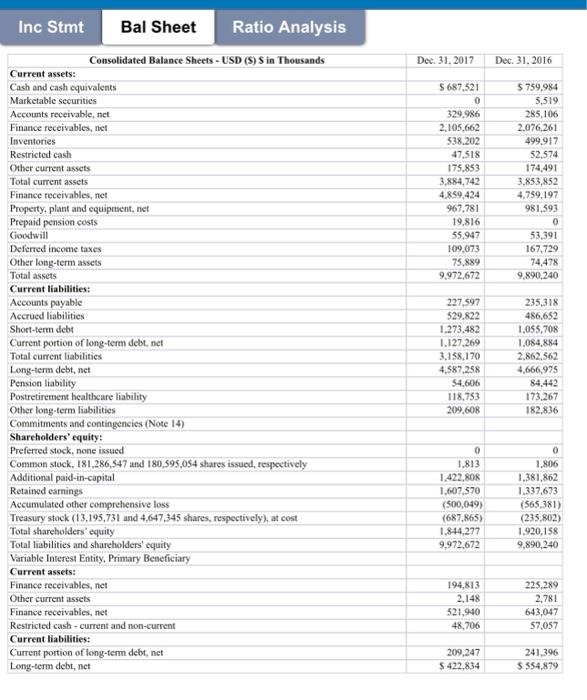

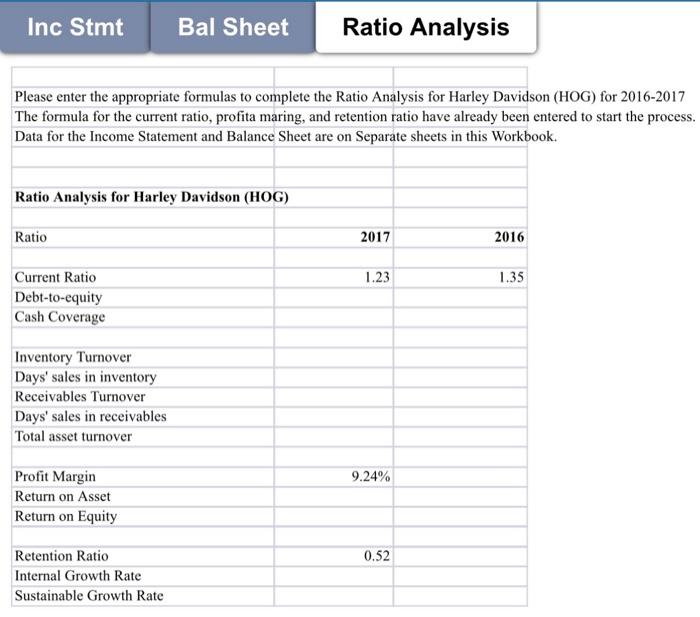

Inc Stmt Bal Sheet Ratio Analysis \begin{tabular}{|c|c|c|} \hline Consolidated Balance Sheets - USD (S) S in Thousands & Dec. 31.2017 & Dec. 31.2016 \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $687,521 & $759,984 \\ \hline Marketable securities & 0 & 5,519 \\ \hline Accounts receivable, net & 329,986 & 285,106 \\ \hline Finance receivables, net & 2,105,662 & 2,076,261 \\ \hline Inventories & 538.202 & 499.917 \\ \hline Restricted cash & 47,518 & 52,574 \\ \hline Other current assets & 175,853 & 174,491 \\ \hline Total current assets & 3,884,742 & 3,853,852 \\ \hline Finance receivables, net & 4,859,424 & 4,759,197 \\ \hline Property, plant and equipment, net & 967,781 & 981,593 \\ \hline Prepaid pension costs & 19,816 & 0 \\ \hline Goodwill & 55,947 & 53,391 \\ \hline Deferred income taxes & 109,073 & 167,729 \\ \hline Other long-term assets & 75,889 & 74,478 \\ \hline Total assets & 9,972,672 & 9,890,240 \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Accounts payable & 227,597 & 235,318 \\ \hline Accrued liabilities & 529.822 & 486,652 \\ \hline Short-term debt & 1.273 .482 & 1,055,708 \\ \hline Current portion of long-term debt, net & 1.127,269 & 1,084,884 \\ \hline Total current liabilities & 3,158,170 & 2,862,562 \\ \hline Long-term debt, net & 4,587,258 & 4,666,975 \\ \hline Pension liability & 54,606 & 84,442 \\ \hline Postretirement healtheare liability & 118,753 & 173.267 \\ \hline Other long-term liabilities & 209,608 & 182,836 \\ \hline \multicolumn{3}{|l|}{ Commitments and contingencies (Note 14) } \\ \hline \multicolumn{3}{|l|}{ Sharcholders' equity: } \\ \hline Preferred stock, none issued & 0 & 0 \\ \hline Common stock, 181,286,547 and 180,595,054 shares issued, respectively & 1,813 & 1,806 \\ \hline Additional paid-in-capital & 1.422,808 & 1,381,862 \\ \hline Retained earnings & 1,607,570 & 1,337,673 \\ \hline Accumulated other comprehensive loss & (500,049) & (565,381) \\ \hline Treasury stock (13,195,731 and 4,647,345 shares, respectively), at cost & (687,865) & (235,802) \\ \hline Total shareholders' equity & 1,844,277 & 1,920,158 \\ \hline Total liabilities and shareholders' equity & 9,972,672 & 9,890,240 \\ \hline \multicolumn{3}{|l|}{ Variable Interest Entity, Primary Beneficiary } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline Finance receivables, net & 194,813 & 225,289 \\ \hline Other current assets & 2,148 & 2,781 \\ \hline Finance receivables, net & 521,940 & 643,047 \\ \hline Restricted cash - current and non-current & 48,706 & 57,057 \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline Current portion of long-term debt, net & 209,247 & 241,396 \\ \hline Long-term debt, net & $422,834 & $554,879 \\ \hline \end{tabular} ion (HOG) for 2016-2017 entered to start the process. ook. Inc Stmt Bal Sheet Ratio Analysis \begin{tabular}{|c|c|c|c|} \hline \multirow{2}{*}{ Consolidated Statements of Income - USD (\$) S in Thousands } & \multicolumn{3}{|c|}{12 Months Ended } \\ \hline & Dec. 31,2017 & Dec. 31,2016 & Dec. 31,2015 \\ \hline \multicolumn{4}{|l|}{ Revenue: } \\ \hline Motorcycles and Related Products & $4,915,027 & $5,271,376 & $5,308,744 \\ \hline Financial Services & 732,197 & 725,082 & 686,658 \\ \hline Total revenue & 5,647,224 & 5,996,458 & 5,995,402 \\ \hline \multicolumn{4}{|l|}{ Costs and expenses: } \\ \hline Motorcycles and Related Products cost of goods sold & 3,261,683 & 3,419,710 & 3,356,284 \\ \hline Financial Services interest expense & 180,193 & 173,756 & 161,983 \\ \hline Financial Services provision for credit losses & 132,444 & 136,617 & 101,345 \\ \hline Selling, administrative and engineering expense & 1,181,641 & 1,217,439 & 1,220,095 \\ \hline Total costs and expenses & 4,755,961 & 4,947,522 & 4,839,707 \\ \hline Operating income & 891,263 & 1,048,936 & 1,155,695 \\ \hline Investment income & 3,580 & 4,645 & 6,585 \\ \hline Interest expense & 31,004 & 29,670 & 12,117 \\ \hline Income before provision for income taxes & 863,839 & 1,023,911 & 1,150,163 \\ \hline Provision for income taxes & 342,080 & 331,747 & 397,956 \\ \hline Net income & $521,759 & $692,164 & $752,207 \\ \hline \multicolumn{4}{|l|}{ Earnings per common share: } \\ \hline Basic (in dollars per share) & $3.03 & $3.85 & $3.71 \\ \hline Diluted (in dollars per share) & 3.02 & 3.83 & 3.69 \\ \hline Cash dividends per common share (in dollars per share) & $1.46 & $1.40 & $1.24 \\ \hline \multicolumn{4}{|l|}{ Supplemental Information: } \\ \hline Depreciation \& Amortization & 222,188 & 209,555 & 198,074 \\ \hline \end{tabular}