Answered step by step

Verified Expert Solution

Question

1 Approved Answer

One hundred percent of the outstanding membership of Foxtrot Company, LLC (the Company), which was formed on January 1, 2022, is owned by Haywood Dawson.

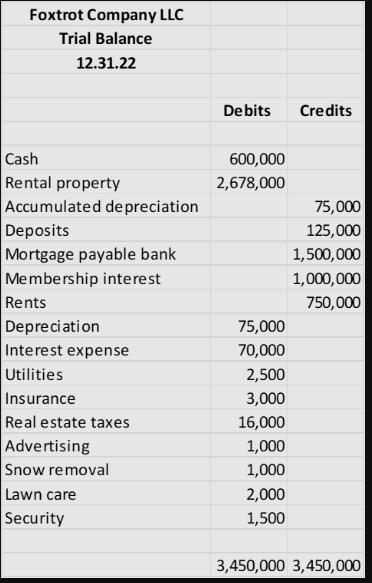

One hundred percent of the outstanding membership of Foxtrot Company, LLC (the Company), which was formed on January 1, 2022, is owned by Haywood Dawson. The Company owns and rents commercial real estate to unrelated parties. In connection with your completion of Mr. Dawson's tax returns for 2022, he brings you the following 2022 trial balance for the Company.

Prepare the necessary tax form for presentation of this information to the IRS. Ignore any other taxable income or deductions that Mr. Dawson may have.

Foxtrot Company LLC Trial Balance 12.31.22 Cash Rental property Accumulated depreciation Deposits Mortgage payable bank Membership interest Rents Depreciation Interest expense Utilities Insurance Real estate taxes Advertising Snow removal Lawn care Security De bits 600,000 2,678,000 75,000 70,000 2,500 3,000 16,000 1,000 1,000 2,000 1,500 Credits 75,000 125,000 1,500,000 1,000,000 750,000 3,450,000 3,450,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started