Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Include procedure include procedure 5. Maria Teresa and Danilo are brother and sister, Maria Teresa sold stock to Danilo for $5.000, its fair market value.

Include procedure

include procedure

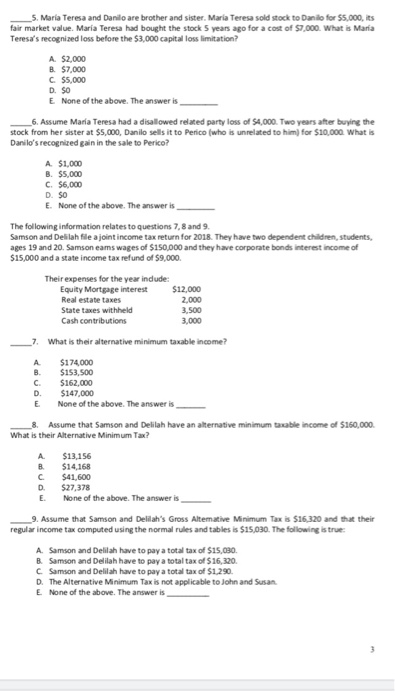

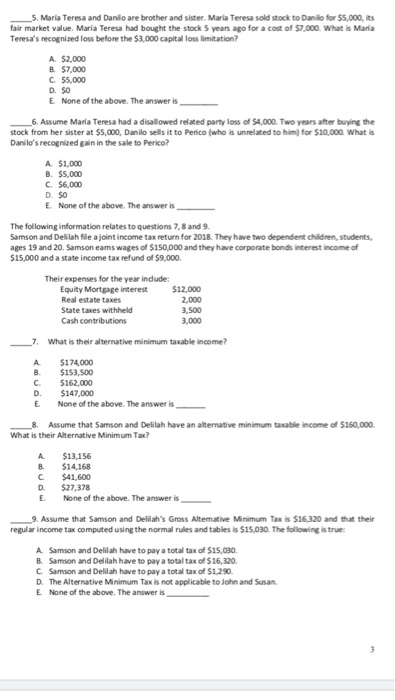

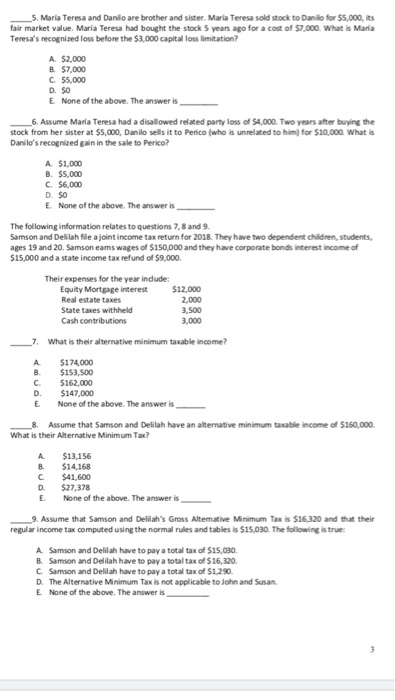

5. Maria Teresa and Danilo are brother and sister, Maria Teresa sold stock to Danilo for $5.000, its fair market value. Maria Teresa had bought the stock 5 years ago for a cost of $7,000. What is Maria Teresa's recognized loss before the $3,000 capital loss limitation? A $2.000 B $7.000 C $5,000 D. $0 E None of the above. The answer is 6. Assume Maria Teresa had a disallowed related party loss of $4,000. Two years after buying the stock from her sister at $5,000, Danilo sells it to Perico (who is unrelated to him) for $10,000 What is Danilo's recognized gain in the sale to Perico? A $1,000 B. $5.000 C. $6,000 D. SO E. None of the above. The answer is The following information relates to questions 7,8 and 9. Samson and Delilah file a joint income tax return for 2018. They have two dependent children, students. ages 19 and 20. Samson eams wages of $150,000 and they have corporate bonds interest income of $15,000 and a state income tax refund of $9,000 $12,000 Their expenses for the year indude Equity Mortgage interest Real estate taxes State taxes withheld Cash contributions 2.000 3,500 3.000 What is their alternative minimum taxable income? B. $174,000 $153,500 $162.000 $147.000 None of the above. The answer is D E 8. Assume that Samson and Delilah have an alternative minimum table income of $150.000 What is their Alternative Minimum Tax? A $13.156 $14,168 $41,600 $27,378 None of the above. The answer is D. 9. Assume that Samson and Delilah's Gross Alterative Minimum Taxis $16.320 and that their regular income tax computed using the normal rules and tables is $15,030. The following is true A. Samson and Delilah have to pay a total tax of $15,030 B Samson and Delilah have to pay a total tax of $16,320 C Samson and Delilah have to pay a total tax of $1.290. D. The Alternative Minimum Tax is not applicable to john and Susan E None of the above. The answer is 5. Maria Teresa and Danilo are brother and sister, Maria Teresa sold stock to Danilo for $5.000, its fair market value. Maria Teresa had bought the stock 5 years ago for a cost of $7,000. What is Maria Teresa's recognized loss before the $3,000 capital loss limitation? A $2.000 B $7.000 C $5,000 D. $0 E None of the above. The answer is 6. Assume Maria Teresa had a disallowed related party loss of $4,000. Two years after buying the stock from her sister at $5,000, Danilo sells it to Perico (who is unrelated to him) for $10,000 What is Danilo's recognized gain in the sale to Perico? A $1,000 B. $5.000 C. $6,000 D. SO E. None of the above. The answer is The following information relates to questions 7,8 and 9. Samson and Delilah file a joint income tax return for 2018. They have two dependent children, students. ages 19 and 20. Samson eams wages of $150,000 and they have corporate bonds interest income of $15,000 and a state income tax refund of $9,000 $12,000 Their expenses for the year indude Equity Mortgage interest Real estate taxes State taxes withheld Cash contributions 2.000 3,500 3.000 What is their alternative minimum taxable income? B. $174,000 $153,500 $162.000 $147.000 None of the above. The answer is D E 8. Assume that Samson and Delilah have an alternative minimum table income of $150.000 What is their Alternative Minimum Tax? A $13.156 $14,168 $41,600 $27,378 None of the above. The answer is D. 9. Assume that Samson and Delilah's Gross Alterative Minimum Taxis $16.320 and that their regular income tax computed using the normal rules and tables is $15,030. The following is true A. Samson and Delilah have to pay a total tax of $15,030 B Samson and Delilah have to pay a total tax of $16,320 C Samson and Delilah have to pay a total tax of $1.290. D. The Alternative Minimum Tax is not applicable to john and Susan E None of the above. The answer is 5. Maria Teresa and Danilo are brother and sister, Maria Teresa sold stock to Danilo for $5.000, its fair market value. Maria Teresa had bought the stock 5 years ago for a cost of $7,000. What is Maria Teresa's recognized loss before the $3,000 capital loss limitation? A $2.000 B $7.000 C $5,000 D. $0 E None of the above. The answer is 6. Assume Maria Teresa had a disallowed related party loss of $4,000. Two years after buying the stock from her sister at $5,000, Danilo sells it to Perico (who is unrelated to him) for $10,000 What is Danilo's recognized gain in the sale to Perico? A $1,000 B. $5.000 C. $6,000 D. SO E. None of the above. The answer is The following information relates to questions 7,8 and 9. Samson and Delilah file a joint income tax return for 2018. They have two dependent children, students. ages 19 and 20. Samson eams wages of $150,000 and they have corporate bonds interest income of $15,000 and a state income tax refund of $9,000 $12,000 Their expenses for the year indude Equity Mortgage interest Real estate taxes State taxes withheld Cash contributions 2.000 3,500 3.000 What is their alternative minimum taxable income? B. $174,000 $153,500 $162.000 $147.000 None of the above. The answer is D E 8. Assume that Samson and Delilah have an alternative minimum table income of $150.000 What is their Alternative Minimum Tax? A $13.156 $14,168 $41,600 $27,378 None of the above. The answer is D. 9. Assume that Samson and Delilah's Gross Alterative Minimum Taxis $16.320 and that their regular income tax computed using the normal rules and tables is $15,030. The following is true A. Samson and Delilah have to pay a total tax of $15,030 B Samson and Delilah have to pay a total tax of $16,320 C Samson and Delilah have to pay a total tax of $1.290. D. The Alternative Minimum Tax is not applicable to john and Susan E None of the above. The answer is 5. Maria Teresa and Danilo are brother and sister, Maria Teresa sold stock to Danilo for $5.000, its fair market value. Maria Teresa had bought the stock 5 years ago for a cost of $7,000. What is Maria Teresa's recognized loss before the $3,000 capital loss limitation? A $2.000 B $7.000 C $5,000 D. $0 E None of the above. The answer is 6. Assume Maria Teresa had a disallowed related party loss of $4,000. Two years after buying the stock from her sister at $5,000, Danilo sells it to Perico (who is unrelated to him) for $10,000 What is Danilo's recognized gain in the sale to Perico? A $1,000 B. $5.000 C. $6,000 D. SO E. None of the above. The answer is The following information relates to questions 7,8 and 9. Samson and Delilah file a joint income tax return for 2018. They have two dependent children, students. ages 19 and 20. Samson eams wages of $150,000 and they have corporate bonds interest income of $15,000 and a state income tax refund of $9,000 $12,000 Their expenses for the year indude Equity Mortgage interest Real estate taxes State taxes withheld Cash contributions 2.000 3,500 3.000 What is their alternative minimum taxable income? B. $174,000 $153,500 $162.000 $147.000 None of the above. The answer is D E 8. Assume that Samson and Delilah have an alternative minimum table income of $150.000 What is their Alternative Minimum Tax? A $13.156 $14,168 $41,600 $27,378 None of the above. The answer is D. 9. Assume that Samson and Delilah's Gross Alterative Minimum Taxis $16.320 and that their regular income tax computed using the normal rules and tables is $15,030. The following is true A. Samson and Delilah have to pay a total tax of $15,030 B Samson and Delilah have to pay a total tax of $16,320 C Samson and Delilah have to pay a total tax of $1.290. D. The Alternative Minimum Tax is not applicable to john and Susan E None of the above. The answer is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started