Answered step by step

Verified Expert Solution

Question

1 Approved Answer

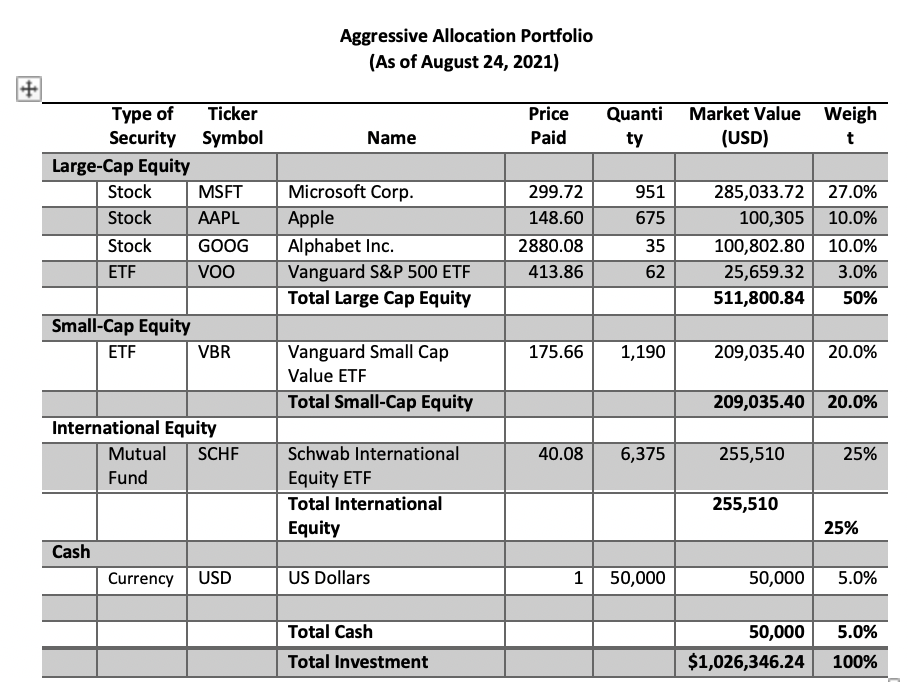

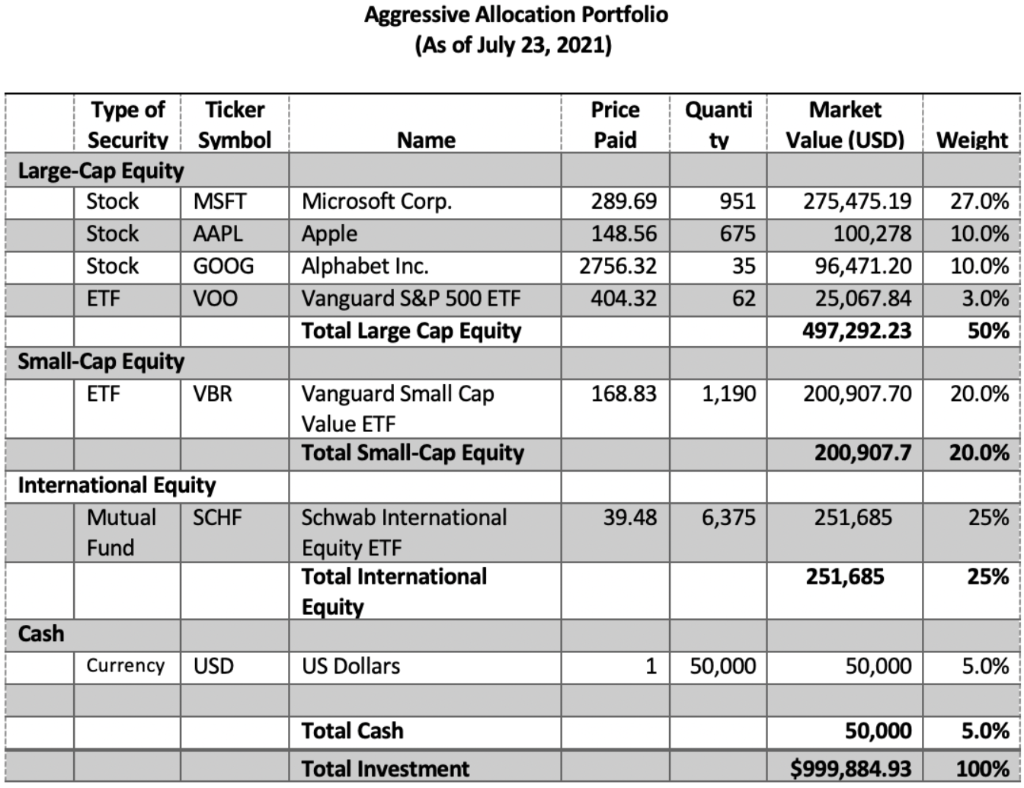

Include the gain or losses of each individual securities (from july to august ), total holding-period return and the effective annual rate (EAR). Aggressive Allocation

Include the gain or losses of each individual securities (from july to august ), total holding-period return and the effective annual rate (EAR).

Aggressive Allocation Portfolio (As of August 24, 2021) + Price Paid Quanti Market Value Weigh ty (USD) t Name Type of Ticker Security Symbol Large-Cap Equity Stock MSFT Stock AAPL Stock GOOG ETE VOO Microsoft Corp. Apple Alphabet Inc. Vanguard S&P 500 ETF Total Large Cap Equity 299.72 148.60 2880.08 413.86 951 675 35 62 285,033.72 27.0% 100,305 10.0% 100,802.80 10.0% 25,659.32 3.0% 511,800.84 50% Small-Cap Equity ETF VBR 175.66 1,190 209,035.40 20.0% Vanguard Small Cap Value ETF Total Small-Cap Equity 209,035.40 20.0% International Equity Mutual SCHE Fund 40.08 6,375 255,510 25% Schwab International Equity ETF Total International Equity 255,510 25% Cash Currency USD US Dollars 1 50,000 50,000 5.0% Total Cash Total Investment 50,000 $1,026,346.24 5.0% 100% Aggressive Allocation Portfolio (As of July 23, 2021) Quanti Price Paid Market Value (USD) Name ty Weight Type of Ticker Security Symbol Large-Cap Equity Stock MSFT Stock AAPL Stock GOOG ETF VOO Microsoft Corp. Apple Alphabet Inc. Vanguard S&P 500 ETF Total Large Cap Equity 289.69 148.56 2756.32 404.32 951 675 35 62 275,475.19 100,278 96,471.20 25,067.84 497,292.23 27.0% 10.0% 10.0% 3.0% 50% Small-Cap Equity ETF VBR 168.83 1,190 200,907.70 20.0% Vanguard Small Cap Value ETF Total Small-Cap Equity 200,907.7 20.0% International Equity Mutual SCHE Fund 39.48 6,375 251,685 25% Schwab International Equity ETF Total International Equity 251,685 25% Cash Currency USD US Dollars 1 50,000 50,000 5.0% Total Cash 5.0% 50,000 $999,884.93 Total Investment 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started