Overall Recommendation 5. Based on both the financial and non-financial factors together, which alternative would you recommend - electric vans or diesel vans? Briefly

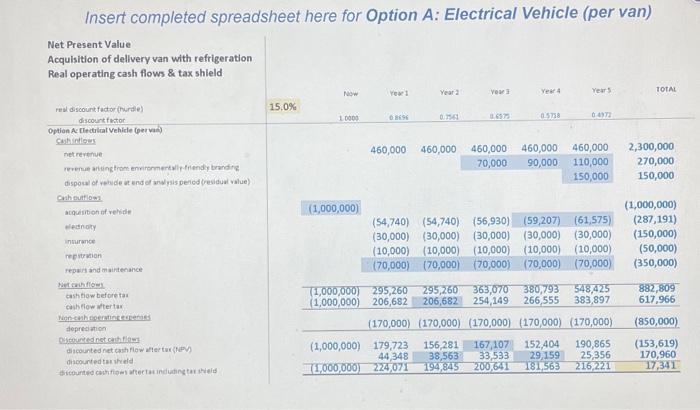

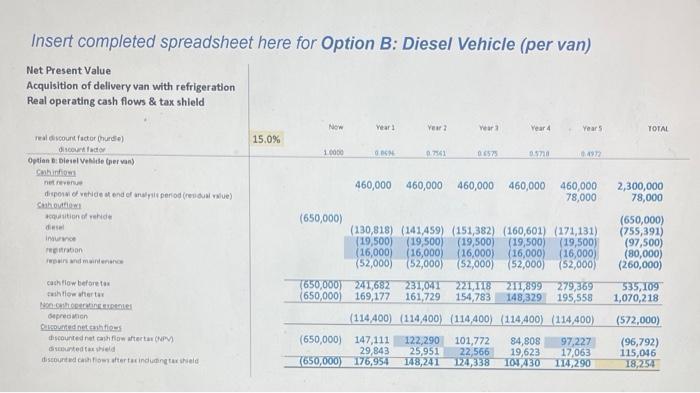

Overall Recommendation 5. Based on both the financial and non-financial factors together, which alternative would you recommend - electric vans or diesel vans? Briefly explain why. [3 marks] Insert completed spreadsheet here for Option A: Electrical Vehicle (per van) Net Present Value Acquisition of delivery van with refrigeration Real operating cash flows & tax shield real discount factor (hurdle) discount factor Option A: Electrical Vehicle (pervan) Cash inflows net revenue revenue arising from environmentally-friendly branding disposal of vehicle at end of analysis period (residual value) Cash outflows acquisition of vehide electroty insurance repstration repairs and maintenance Net cash flows cash flow before tax cash flow after tax Non-cash operating expenses depreciation Discounted net cash flows discounted net cash flow after tax (NPV) discounted tax shield discounted cash flows aftertas induding tax shield 15.0% Now 10000 (1,000,000) Year 1 Year 2 Year 3 460,000 460,000 460,000 70,000 (1,000,000) 295,260 (1,000,000) 206,682 Year 4 05738 Year 5 0.4972 460,000 460,000 90,000 110,000 150,000 295,260 363,070 380,793 548,425 206,682 254,149 266,555 383,897 (170,000) (170,000) (170,000) (170,000) (170,000) TOTAL (54,740) (54,740) (56,930) (59,207) (61,575) (30,000) (30,000) (30,000) (30,000) (30,000) (50,000) (10,000) (10,000) (10,000) (10,000) (10,000) (70,000) (70,000) (70,000) (70,000) (70,000) (350,000) (1,000,000) 179,723 156,281 167,107 152,404 190,865 44,348 38,563 33,533 29,159 25,356 (1,000,000) 224,071 194,845 200,641 181,563 216,221 2,300,000 270,000 150,000 (1,000,000) (287,191) (150,000) 882,809 617,966 (850,000) (153,619) 170,960 17,341 Insert completed spreadsheet here for Option B: Diesel Vehicle (per van) Net Present Value Acquisition of delivery van with refrigeration Real operating cash flows & tax shield real discount factor (hurdle) discount factor Option B: Diesel Vehicle (per van) Cashinfioms net revenue disposal of vehide at end of analysis period (residual value) Cash outflows acquisition of vehide diesel Insurance registration repairs and maintenance cash flow before tax cash flow after tax Non-stoperating deprecation Discounted net cash flows discounted net cash flow aftertas (NPV) discounted tax shield discounted cash flows after tax induding tax shield 15.0% Now 1.0000 (650,000) Year 1 ON Year 2 0.7541 460,000 460,000 Year 3 06575 Year 4 05718 Year 5 104972 460,000 460,000 460,000 78,000 (130,818) (141,459) (151,382) (16 601) (171,131) (19,500) (19,500) (19,500) (19,500) (19,500) (16,000) (16,000) (16,000) (16,000) (16,000) (52,000) (52,000) (52,000) (52,000) (52,000) (650,000) 241,682 231,041 221,118 211,899 279,369 (650,000) 169,177 161,729 154,783 148,329 195,558 (114,400) (114,400) (114,400) (114400) (114,400) (650,000) 147,111 122,290 101,772 84,808 97,227 29,843 25,951 22,566 19,623 17,063 (650,000) 176,954 148,241 124,338 104,430 114,290 TOTAL 2,300,000 78,000 (650,000) (755,391) (97,500) (80,000) (260,000) 535,109 1,070,218 (572,000) (96,792) 115,046 18,254

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Based on both the financial and nonfinancial factors together which alternative would you recommend electric vans or diesel vans Briefly explain why 3 marks After reviewing both the financial and nonf...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started