Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Included in the income of 2024 was an installment sale of property in the amount of $50,000. However, for tax purposes, Vineyard reported the income

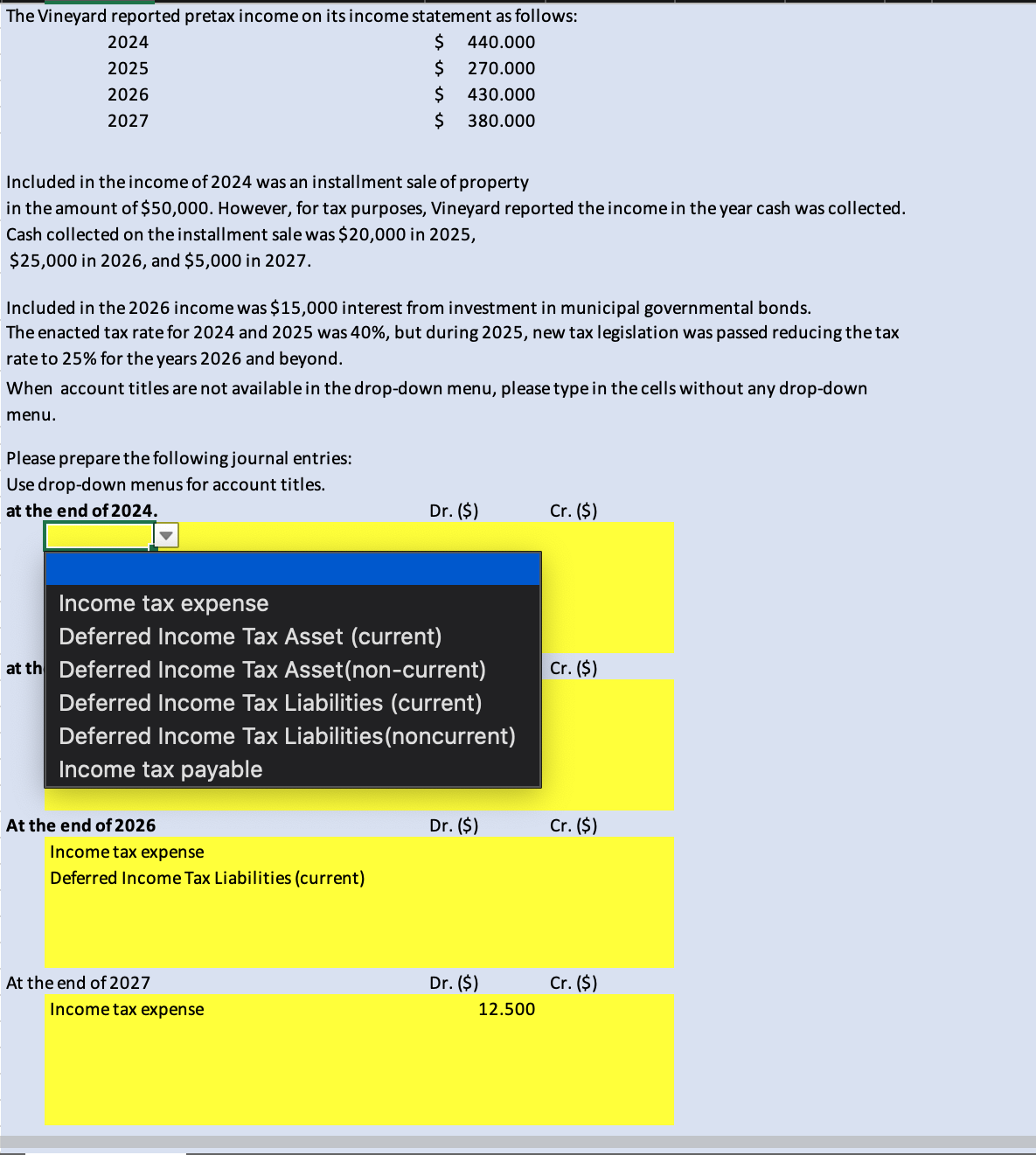

Included in the income of 2024 was an installment sale of property in the amount of $50,000. However, for tax purposes, Vineyard reported the income in the year cash was collected. Cash collected on the installment sale was $20,000 in 2025 , $25,000 in 2026, and \$5,000 in 2027. Included in the 2026 income was $15,000 interest from investment in municipal governmental bonds. The enacted tax rate for 2024 and 2025 was 40%, but during 2025, new tax legislation was passed reducing the tax rate to 25% for the years 2026 and beyond. When account titles are not available in the drop-down menu, please type in the cells without any drop-down menu. Please prepare the following journal entries: Use drop-down menus for account titles. at the end of 2024 . Dr. (\$) Cr. (\$)

Included in the income of 2024 was an installment sale of property in the amount of $50,000. However, for tax purposes, Vineyard reported the income in the year cash was collected. Cash collected on the installment sale was $20,000 in 2025 , $25,000 in 2026, and \$5,000 in 2027. Included in the 2026 income was $15,000 interest from investment in municipal governmental bonds. The enacted tax rate for 2024 and 2025 was 40%, but during 2025, new tax legislation was passed reducing the tax rate to 25% for the years 2026 and beyond. When account titles are not available in the drop-down menu, please type in the cells without any drop-down menu. Please prepare the following journal entries: Use drop-down menus for account titles. at the end of 2024 . Dr. (\$) Cr. (\$) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started