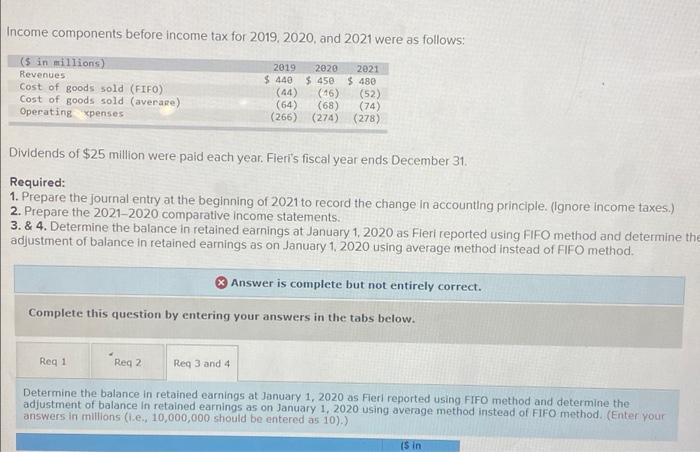

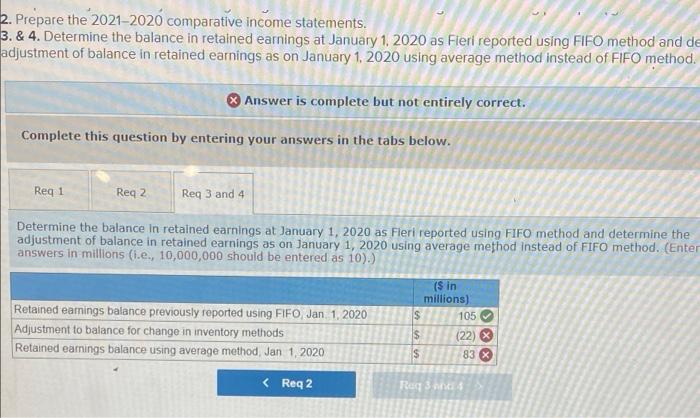

Income components before income tax for 2019, 2020, and 2021 were as follows: (5 in millions) Revenues Cost of goods sold (FIFO) Cost of goods sold (averare) Operating xpenses 2019 2020 2021 $ 440 $ 450 $ 480 (44) (16) (52) (64) (68) (74) (266) (274) (278) Dividends of $25 million were paid each year. Fieri's fiscal year ends December 31 Required: 1. Prepare the journal entry at the beginning of 2021 to record the change in accounting principle. (Ignore Income taxes.) 2. Prepare the 2021-2020 comparative Income statements. 3. & 4. Determine the balance in retained earnings at January 1, 2020 as Fler reported using FIFO method and determine the adjustment of balance in retained earnings as on January 1, 2020 using average method instead of FIFO method. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 "Reg 2 Req 3 and 4 Determine the balance in retained earnings at January 1, 2020 as Fler reported using FIFO method and determine the adjustment of balance in retained earnings as on January 1, 2020 using average method instead of FIFO method. (Enter your answers in millions (1.e., 10,000,000 should be entered as 10).) is in 2. Prepare the 2021-2020 comparative income statements. 3. & 4. Determine the balance in retained earnings at January 1, 2020 as Fleri reported using FIFO method and de adjustment of balance in retained earnings as on January 1, 2020 using average method instead of FIFO method. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Reg 1 Req 2 Req 3 and 4 Determine the balance in retained earnings at January 1, 2020 as Fleri reported using FIFO method and determine the adjustment of balance in retained earnings as on January 1, 2020 using average method instead of FIFO method. (Enter answers in millions (i.e., 10,000,000 should be entered as 10).) (s in millions) Retained earnings balance previously reported using FIFO Jan 1, 2020 s 105 Adjustment to balance for change in inventory methods $ (22) Retained earnings balance using average method, Jan 1, 2020 $ 83 %