Answered step by step

Verified Expert Solution

Question

1 Approved Answer

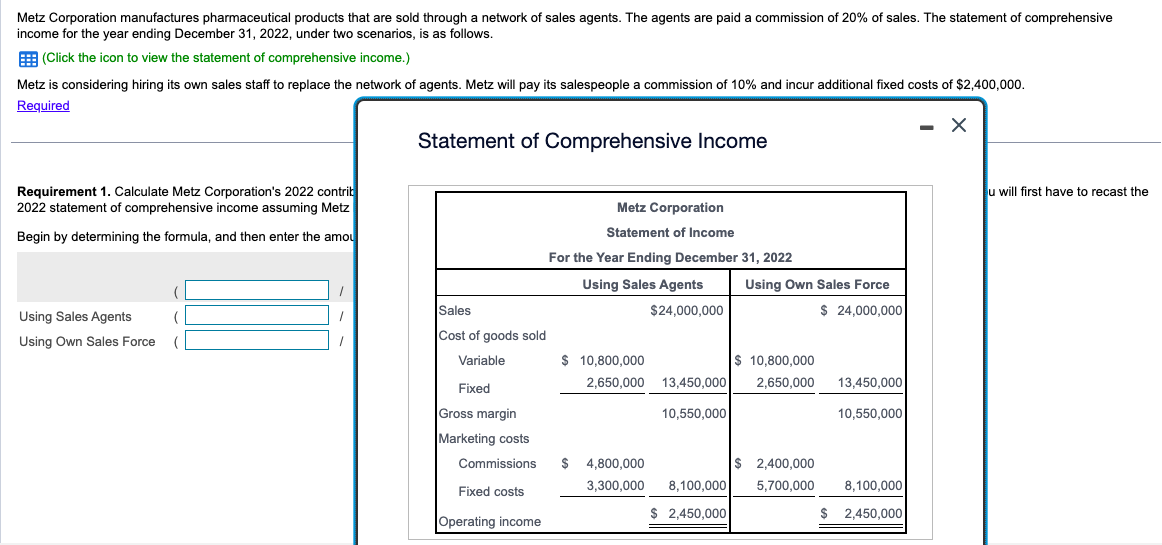

income for the year ending December 31, 2022, under two scenarios, is as follows. (Click the icon to view the statement of comprehensive income.) Statement

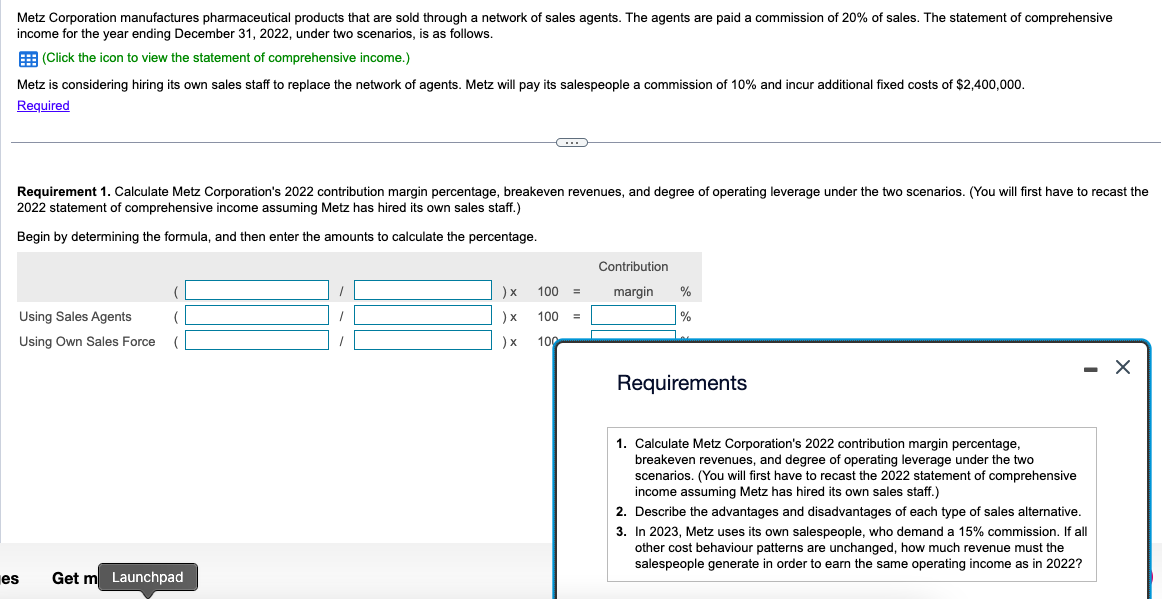

income for the year ending December 31, 2022, under two scenarios, is as follows. (Click the icon to view the statement of comprehensive income.) Statement of Comprehensive Income Requirement 1. Calculate Metz Corporation's 2022 contrit 2022 statement of comprehensive income assuming Metz Begin by determining the formula, and then enter the amol income for the year ending December 31, 2022, under two scenarios, is as follows. (Click the icon to view the statement of comprehensive income.) Required 2022 statement of comprehensive income assuming Metz has hired its own sales staff.) Begin by determining the formula, and then enter the amounts to calculate the percentage. Requirements 1. Calculate Metz Corporation's 2022 contribution margin percentage, breakeven revenues, and degree of operating leverage under the two scenarios. (You will first have to recast the 2022 statement of comprehensive income assuming Metz has hired its own sales staff.) 2. Describe the advantages and disadvantages of each type of sales alternative. 3. In 2023 , Metz uses its own salespeople, who demand a 15% commission. If all other cost behaviour patterns are unchanged, how much revenue must the salespeople generate in order to earn the same operating income as in 2022 ? Get r

income for the year ending December 31, 2022, under two scenarios, is as follows. (Click the icon to view the statement of comprehensive income.) Statement of Comprehensive Income Requirement 1. Calculate Metz Corporation's 2022 contrit 2022 statement of comprehensive income assuming Metz Begin by determining the formula, and then enter the amol income for the year ending December 31, 2022, under two scenarios, is as follows. (Click the icon to view the statement of comprehensive income.) Required 2022 statement of comprehensive income assuming Metz has hired its own sales staff.) Begin by determining the formula, and then enter the amounts to calculate the percentage. Requirements 1. Calculate Metz Corporation's 2022 contribution margin percentage, breakeven revenues, and degree of operating leverage under the two scenarios. (You will first have to recast the 2022 statement of comprehensive income assuming Metz has hired its own sales staff.) 2. Describe the advantages and disadvantages of each type of sales alternative. 3. In 2023 , Metz uses its own salespeople, who demand a 15% commission. If all other cost behaviour patterns are unchanged, how much revenue must the salespeople generate in order to earn the same operating income as in 2022 ? Get r Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started