Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income from operations: Nonoperating income (if any): Income taxes: Discontinued operations (if any): Net income: Sooner Company sells ou souvenirs and sports apparel. Sooner had

Income from operations:

Nonoperating income (if any):

Income taxes:

Discontinued operations (if any):

Net income:

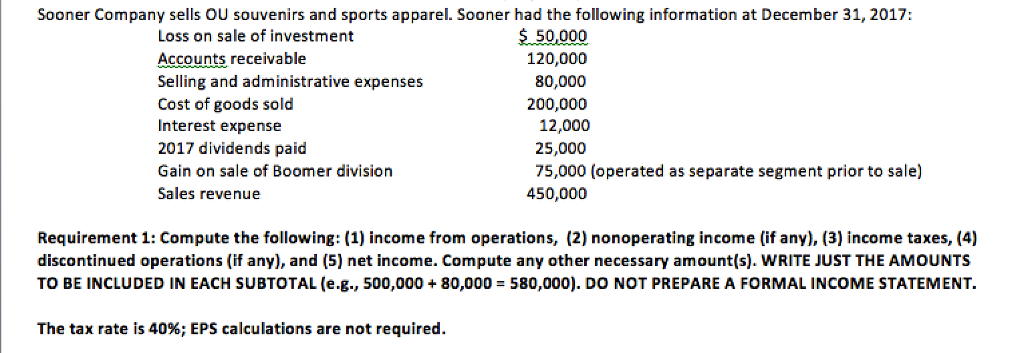

Sooner Company sells ou souvenirs and sports apparel. Sooner had the following information at December 31, 2017: Loss on sale of investment 50,000 120,000 Accounts receivable 80,000 Selling and administrative expenses Cost of goods sold 200,000 12,000 Interest expense 2017 dividends paid 25,000 75,000 (operated as separate segment prior to sale) Gain on sale of Boomer division 450,000 Sales revenue Requirement 1: Compute the following: (1) income from operations, (2) nonoperating income (if any), (3) income taxes, (4) discontinued operations (if any), and (5) net income. Compute any other necessary amount (s). WRITE JUST THE AMOUNTS TO BE INCLUDED IN EACH SUBTOTAL (e.g., 500,000 80,000 3580,000). DO NOT PREPARE A FORMAL INCOME STATEMENT. The tax rate is 40%; EPS calculations are not requiredStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started