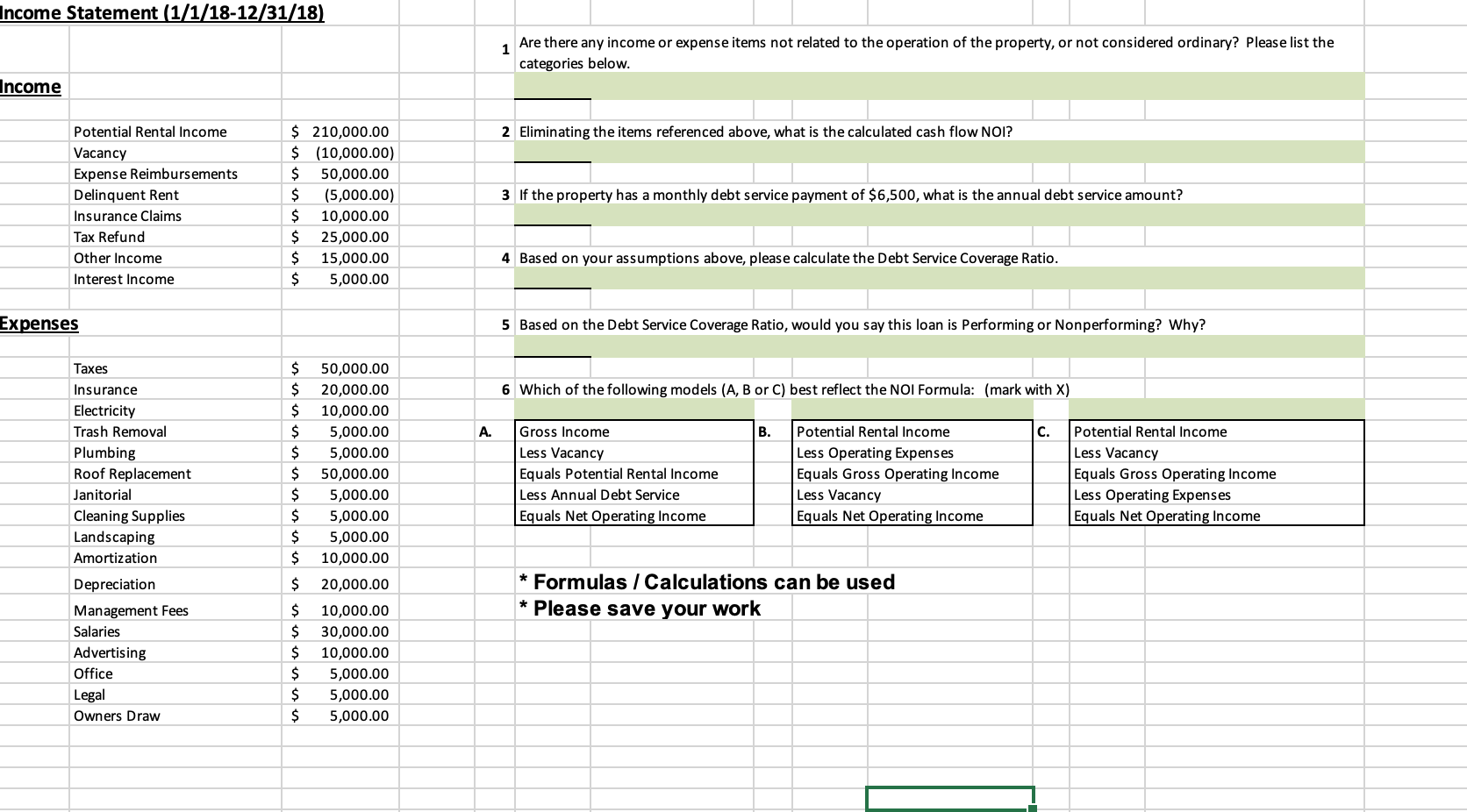

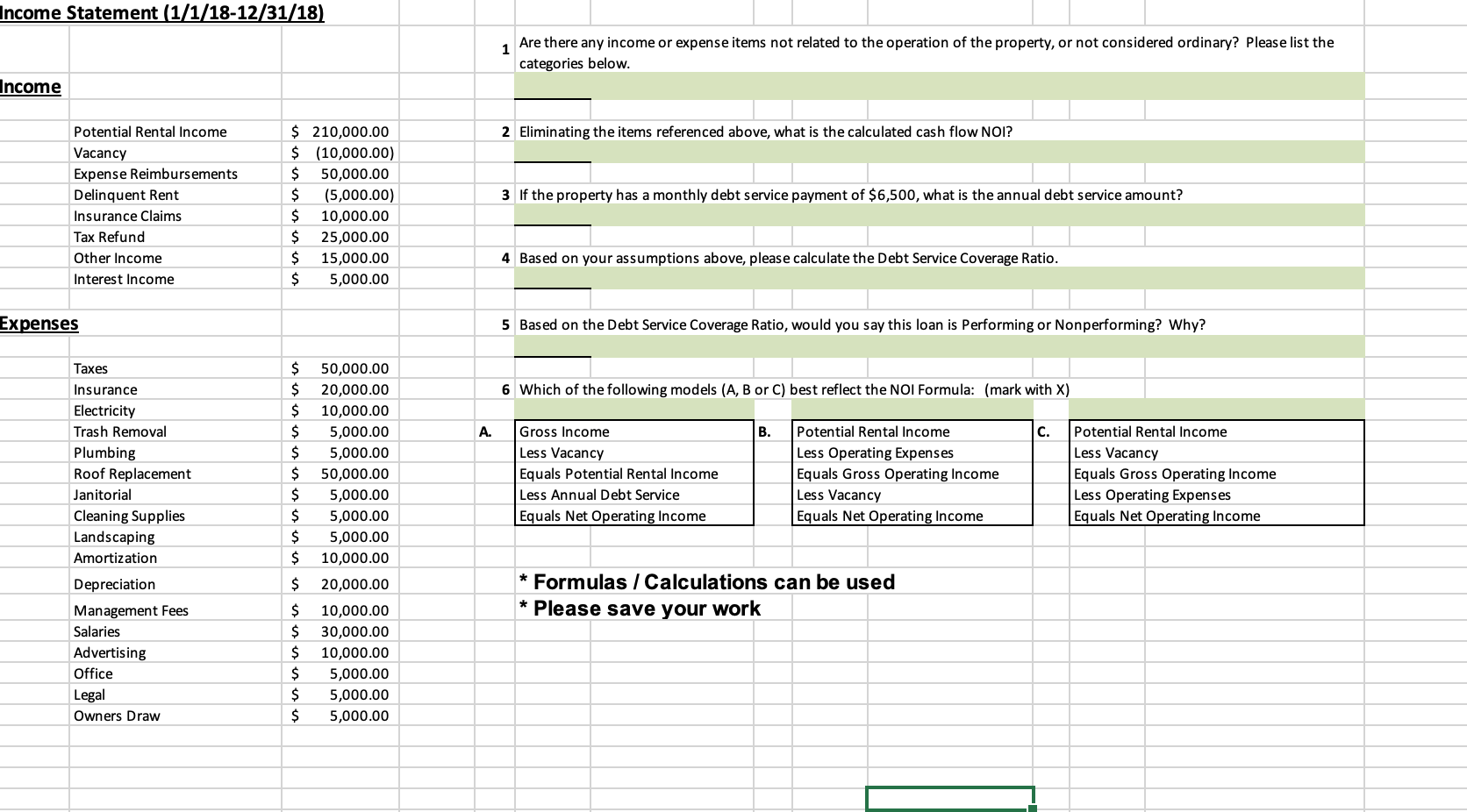

Income Statement (1/1/18-12/31/18) 1 Are there any income or expense items not related to the operation of the property, or not considered ordinary? Please list the categories below. Income 2 Eliminating the items referenced above, what is the calculated cash flow NOI? 3. If the property has a monthly debt service payment of $6,500, what is the annual debt service amount? Potential Rental Income Vacancy Expense Reimbursements Delinquent Rent Insurance Claims Tax Refund Other Income Interest Income $ 210,000.00 $ (10,000.00) $ 50,000.00 $ (5,000.00) $ 10,000.00 $ 25,000.00 $ 15,000.00 $ 5,000.00 4 Based on your assumptions above, please calculate the Debt Service Coverage Ratio. Expenses 5 Based on the Debt Service Coverage Ratio, would you say this loan is Performing or Nonperforming? Why? 6 Which of the following models (A, B or C) best reflect the NOI Formula: (mark with X) A. B. c. $ $ $ $ $ $ $ $ $ $ 50,000.00 20,000.00 10,000.00 5,000.00 5,000.00 50,000.00 5,000.00 5,000.00 5,000.00 10,000.00 20,000.00 Gross Income Less Vacancy Equals Potential Rental Income Less Annual Debt Service Equals Net Operating Income Taxes Insurance Electricity Trash Removal Plumbing Roof Replacement Janitorial Cleaning Supplies Landscaping Amortization Depreciation Management Fees Salaries Advertising Office Legal Owners Draw Potential Rental Income Less Operating Expenses Equals Gross Operating Income Less Vacancy Equals Net Operating Income Potential Rental Income Less Vacancy Equals Gross Operating Income Less Operating Expenses Equals Net Operating Income $ Formulas / Calculations can be used * Please save your work $ $ $ $ $ $ 10,000.00 30,000.00 10,000.00 5,000.00 5,000.00 5,000.00 Income Statement (1/1/18-12/31/18) 1 Are there any income or expense items not related to the operation of the property, or not considered ordinary? Please list the categories below. Income 2 Eliminating the items referenced above, what is the calculated cash flow NOI? 3. If the property has a monthly debt service payment of $6,500, what is the annual debt service amount? Potential Rental Income Vacancy Expense Reimbursements Delinquent Rent Insurance Claims Tax Refund Other Income Interest Income $ 210,000.00 $ (10,000.00) $ 50,000.00 $ (5,000.00) $ 10,000.00 $ 25,000.00 $ 15,000.00 $ 5,000.00 4 Based on your assumptions above, please calculate the Debt Service Coverage Ratio. Expenses 5 Based on the Debt Service Coverage Ratio, would you say this loan is Performing or Nonperforming? Why? 6 Which of the following models (A, B or C) best reflect the NOI Formula: (mark with X) A. B. c. $ $ $ $ $ $ $ $ $ $ 50,000.00 20,000.00 10,000.00 5,000.00 5,000.00 50,000.00 5,000.00 5,000.00 5,000.00 10,000.00 20,000.00 Gross Income Less Vacancy Equals Potential Rental Income Less Annual Debt Service Equals Net Operating Income Taxes Insurance Electricity Trash Removal Plumbing Roof Replacement Janitorial Cleaning Supplies Landscaping Amortization Depreciation Management Fees Salaries Advertising Office Legal Owners Draw Potential Rental Income Less Operating Expenses Equals Gross Operating Income Less Vacancy Equals Net Operating Income Potential Rental Income Less Vacancy Equals Gross Operating Income Less Operating Expenses Equals Net Operating Income $ Formulas / Calculations can be used * Please save your work $ $ $ $ $ $ 10,000.00 30,000.00 10,000.00 5,000.00 5,000.00 5,000.00