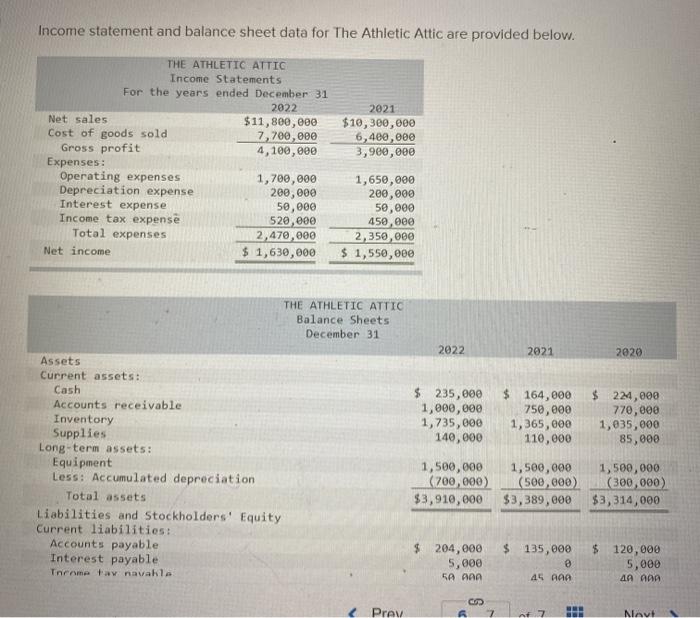

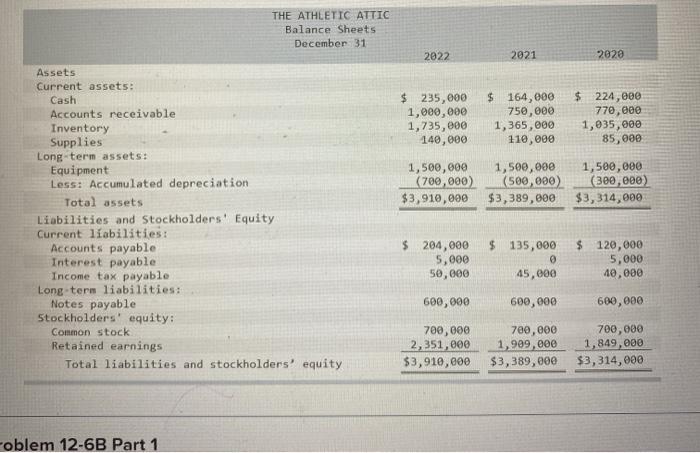

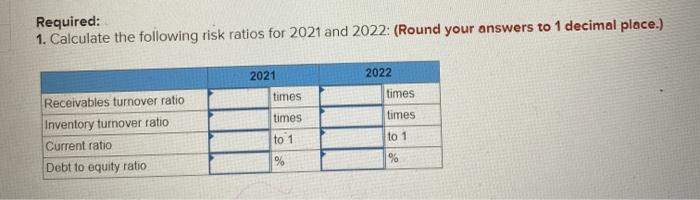

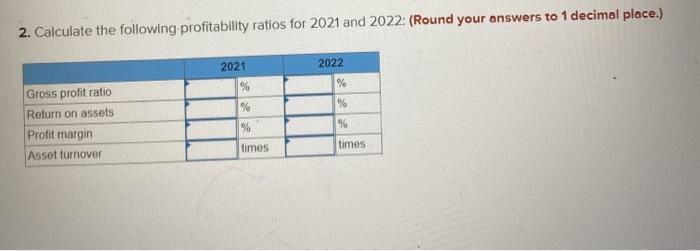

Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 Net sales $11,800,000 Cost of goods sold 7,700,000 Gross profit 4,100,000 Expenses: Operating expenses 1,700,000 Depreciation expense 2 , Interest expense 50,000 Income tax expense 520,000 Total expenses 2,470,000 Net income $ 1,630,000 2021 $10,300,000 6,400,000 3,980,000 1,650,000 200,000 50,000 450,000 2,350,000 $ 1,550,000 THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 235,000 1,000,000 1,735,000 140,000 $ 164,000 750,000 1,365,000 110,000 $ 224,000 770,000 1,035,000 85,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Throme ay navalla 1,500,000 (700,000) $3,910,000 1,500,000 (500,000) $3,389,000 1,500,000 (300,000) $3,314,000 $ 135,000 204,000 5,000 5A AAA $ 120,000 5,000 AA AAA 45 AAA Prav Naut THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 235,000 1,000,000 1,735,000 140,000 $164,000 750,000 1,365,000 110,000 $ 224,000 77 , 1,035,000 85,000 1,500,000 (700,000) $3,910,000 1,500,000 (500,000) $3,389,000 1,500,000 (300,000) $3,314,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ 204,000 5,000 50,000 $ 135,000 0 45,000 $ 120,000 5,000 40,000 600,000 600,000 600,000 700,000 2,351,000 $3,910,000 7 700,000 1,909,000 $3,389,000 700,000 1,849,000 $3,314,000 oblem 12-6B Part 1 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2022 2021 times times times Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio times to 1 % to 1 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 % % % Gross profit ratio Return on assets Profit margin Asset turnover % % % times times