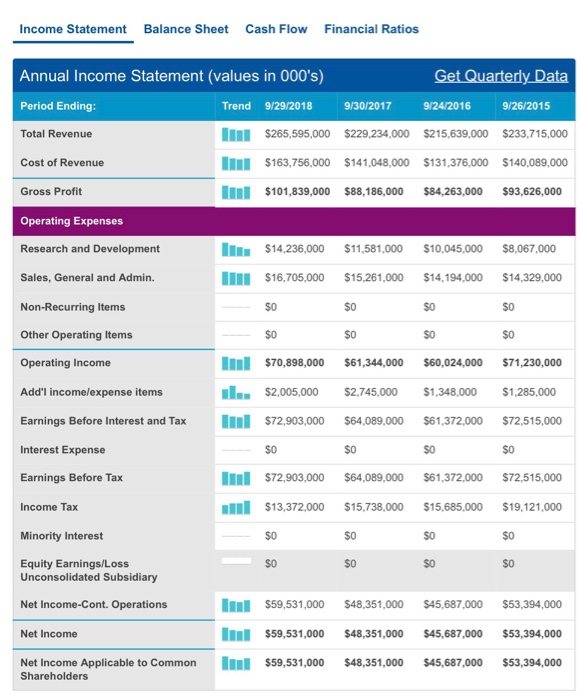

Income Statement Balance Sheet Cash Flow Financial Ratios Annual Income Statement (values in 000's) Period Ending Total Revenue Trend 9/29/2018 9/30/2017 9/24/2016 9/26/2015 $265,595,000 $229234,000 $215,639,000 $233,715,000 $163,756,000 $141,048,000 $131,376,000 $140,089,000 $101,839,000 $88,186,000 $84,263,000 $93,626,000 Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Other Operating Items Operating Income Add'l incomelexpense items Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Earnings/Loss $14,236,000 $11,581,000 $10,045,000 $8,067,000 $16,705,000 $15,261,000 $14,194,000 $14,329,000 SO $70,898,000 $61,344,000 60,024,000 $71,230,000 $2,005,000 $2,745,000 $1.348,000 $1,285,000 SO $72,903,000 $64,089,000 $61,372.000 $72,515,000 SO $72,903,000 $64,089,000 $61,372.000 $72,515,000 $13,372,000 $15,738,000 $15,685,000 $19,121,000 S0 SO SO SO SO SO SO Unconsolidated Subsidiary $59,531,000 $48,351,000 $45,687,000 $53,394,000 $59,531,000 $48,351,000 $45,687,000 $53,394,000 Net Income Applicable to Common $59,531,000 $48,351,000 $45,687,000 $53,394,000 Net Income-Cont. Operations Net Income Shareholders Income Statement Balance Sheet Cash Flow Financial Ratios Annual Income Statement (values in 000's) Period Ending Total Revenue Trend 9/29/2018 9/30/2017 9/24/2016 9/26/2015 $265,595,000 $229234,000 $215,639,000 $233,715,000 $163,756,000 $141,048,000 $131,376,000 $140,089,000 $101,839,000 $88,186,000 $84,263,000 $93,626,000 Cost of Revenue Gross Profit Operating Expenses Research and Development Sales, General and Admin. Non-Recurring Items Other Operating Items Operating Income Add'l incomelexpense items Earnings Before Interest and Tax Interest Expense Earnings Before Tax Income Tax Minority Interest Equity Earnings/Loss $14,236,000 $11,581,000 $10,045,000 $8,067,000 $16,705,000 $15,261,000 $14,194,000 $14,329,000 SO $70,898,000 $61,344,000 60,024,000 $71,230,000 $2,005,000 $2,745,000 $1.348,000 $1,285,000 SO $72,903,000 $64,089,000 $61,372.000 $72,515,000 SO $72,903,000 $64,089,000 $61,372.000 $72,515,000 $13,372,000 $15,738,000 $15,685,000 $19,121,000 S0 SO SO SO SO SO SO Unconsolidated Subsidiary $59,531,000 $48,351,000 $45,687,000 $53,394,000 $59,531,000 $48,351,000 $45,687,000 $53,394,000 Net Income Applicable to Common $59,531,000 $48,351,000 $45,687,000 $53,394,000 Net Income-Cont. Operations Net Income Shareholders