Answered step by step

Verified Expert Solution

Question

1 Approved Answer

INCOME STATEMENT BALANCE SHEET Find: Current Ratio, Quick Ratio, Inventory Turnover, Accounts Receivable turnover, Average collection period, Total assets to total debt, Debt equity, Gross

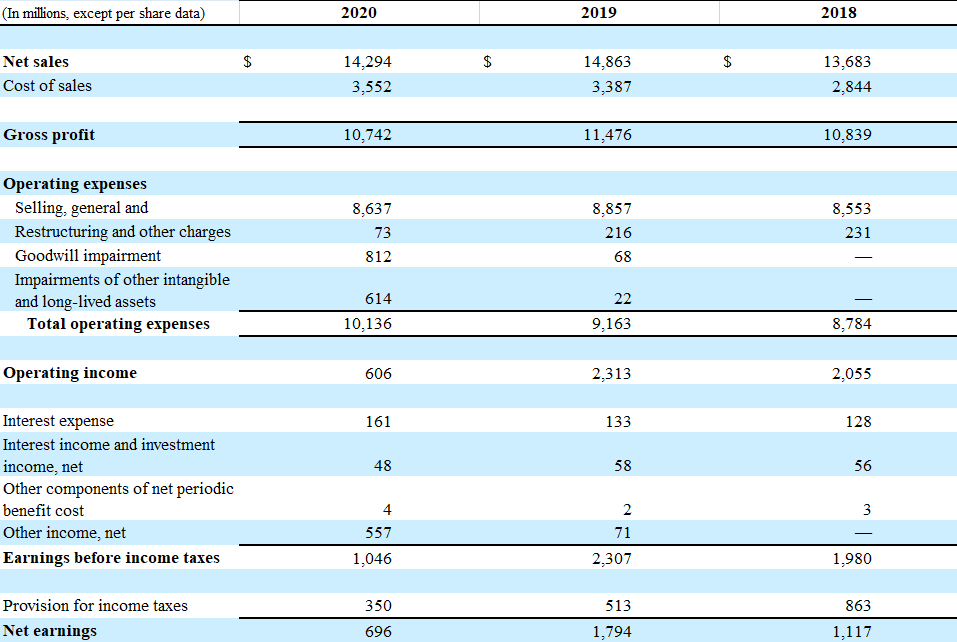

INCOME STATEMENT

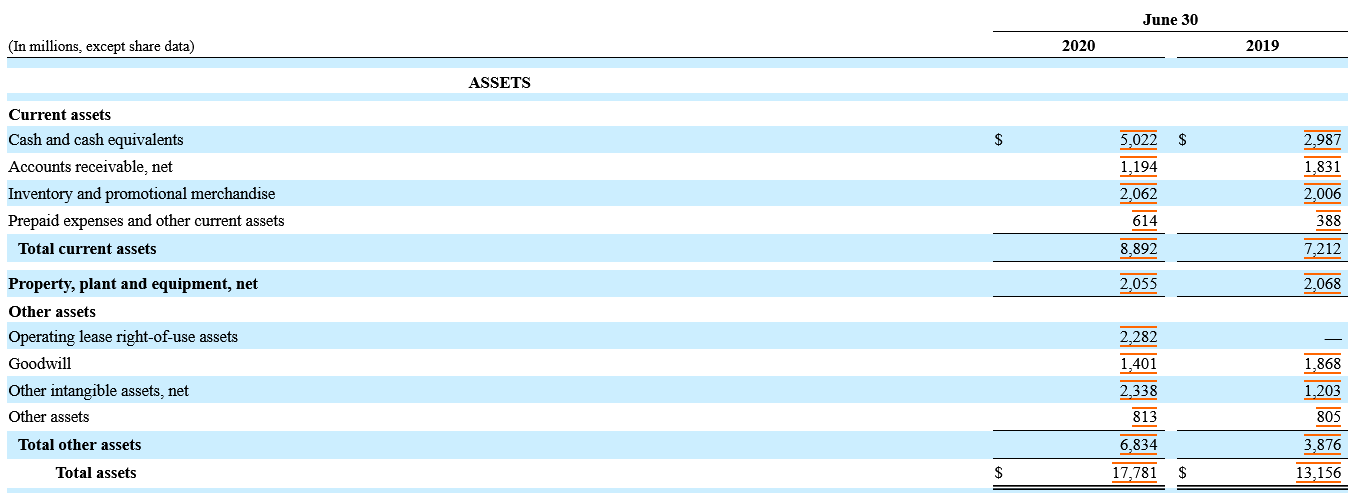

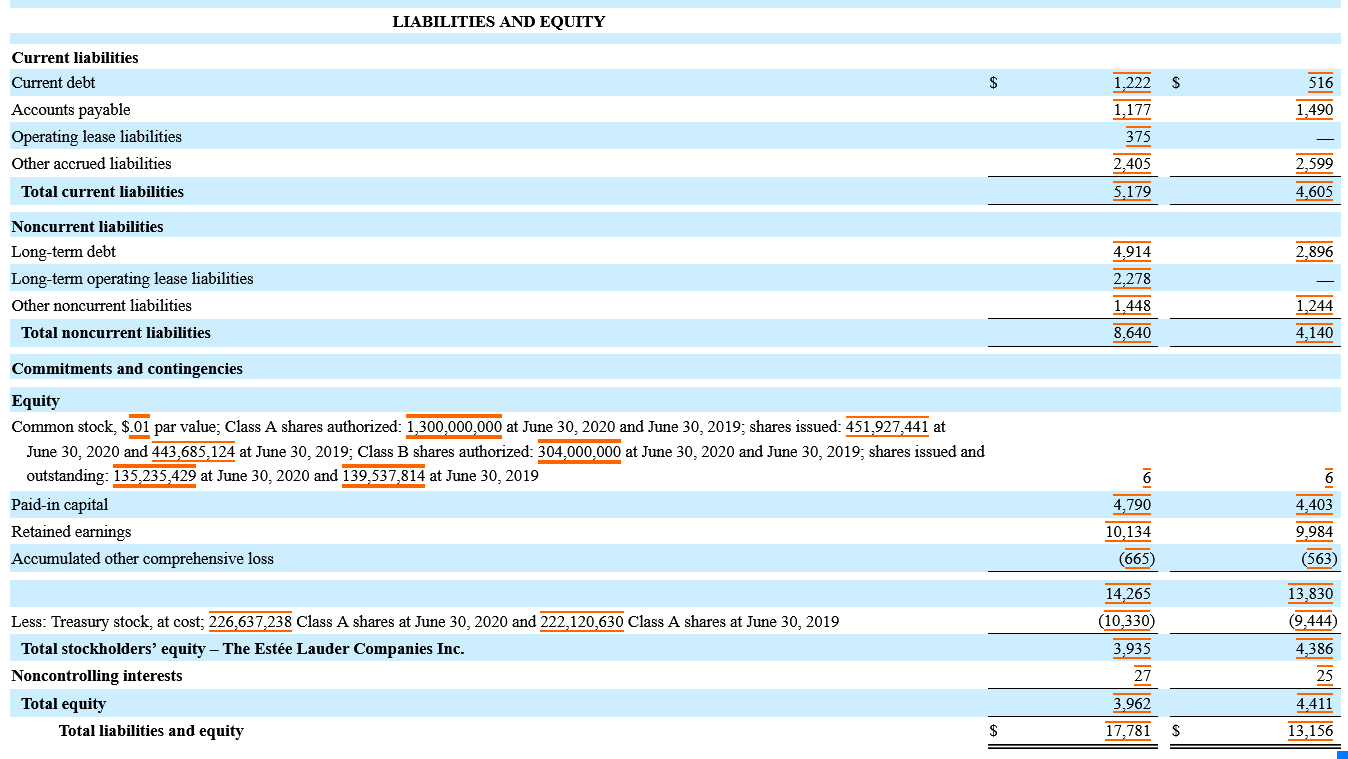

BALANCE SHEET

Find: Current Ratio, Quick Ratio, Inventory Turnover, Accounts Receivable turnover, Average collection period, Total assets to total debt, Debt equity, Gross profit margin, net profit margin, Return on total asset, Return on equity.

(In millions, except per share data) 2020 2019 2018 $ $ $ Net sales Cost of sales 14,294 3,552 14,863 3,387 13,683 2,844 Gross profit 10,742 11,476 10,839 Operating expenses Selling, general and Restructuring and other charges Goodwill impairment Impairments of other intangible and long-lived assets Total operating expenses 8,637 73 812 8,857 216 68 8,553 231 614 10,136 22 9,163 8,784 Operating income 606 2,313 2,055 161 133 128 48 58 56 Interest expense Interest income and investment income, net Other components of net periodic benefit cost Other income, net Earnings before income taxes 2 3 4 557 1,046 71 2,307 1,980 513 863 Provision for income taxes Net earnings 350 696 1,794 1,117 June 30 (In millions, except share data) 2020 2019 ASSETS $ $ Current assets Cash and cash equivalents Accounts receivable, net Inventory and promotional merchandise Prepaid expenses and other current assets Total current assets 5,022 1,194 2,062 2,987 1,831 2,006 614 388 8,892 7,212 2,055 2,068 Property, plant and equipment, net Other assets Operating lease right-of-use assets Goodwill Other intangible assets, net Other assets 2.282 1,401 2.338 813 1,868 1,203 805 Total other assets 6,834 3,876 13,156 Total assets $ 17,781 $ LIABILITIES AND EQUITY $ 1.222 $ 516 1,177 1,490 Current liabilities Current debt Accounts payable Operating lease liabilities Other accrued liabilities Total current liabilities 375 2,405 2.599 5.179 4,605 2,896 Noncurrent liabilities Long-term debt Long-term operating lease liabilities Other noncurrent liabilities Total noncurrent liabilities 4,914 2,278 1.448 8,640 1.244 4,140 Commitments and contingencies Equity Common stock, $.01 par value; Class A shares authorized: 1,300,000,000 at June 30, 2020 and June 30, 2019; shares issued: 451,927,441 at June 30, 2020 and 443,685,124 at June 30, 2019; Class B shares authorized: 304,000,000 at June 30, 2020 and June 30, 2019, shares issued and outstanding: 135,235,429 at June 30, 2020 and 139,537,814 at June 30, 2019 Paid-in capital Retained earnings Accumulated other comprehensive loss 4,790 10,134 (665) 6 4,403 9,984 (563) 13,830 9,444) Less: Treasury stock, at cost; 226,637,238 Class A shares at June 30, 2020 and 222,120,630 Class A shares at June 30, 2019 Total stockholders' equity The Este Lauder Companies Inc. Noncontrolling interests Total equity Total liabilities and equity 14,265 (10,330) 3,935 27 4,386 25 4.411 3,962 17,781 $ $ 13,156Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started