Answered step by step

Verified Expert Solution

Question

1 Approved Answer

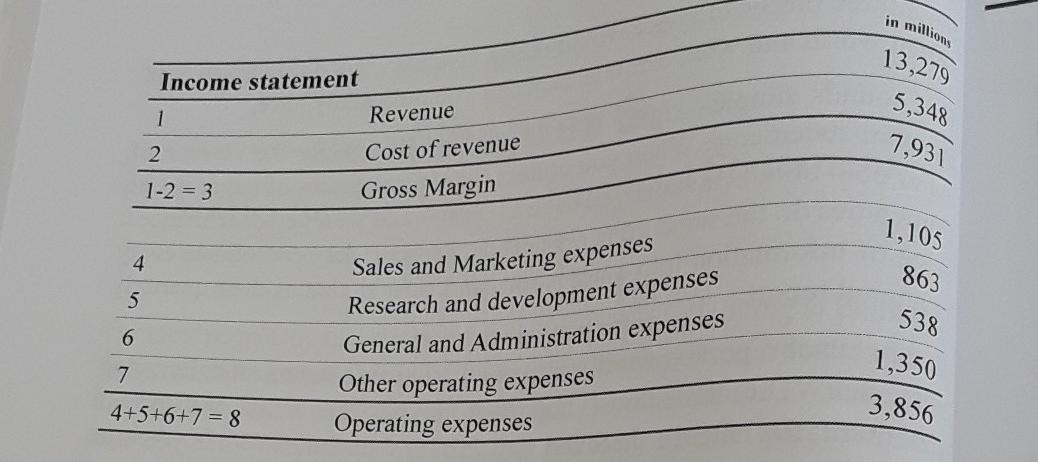

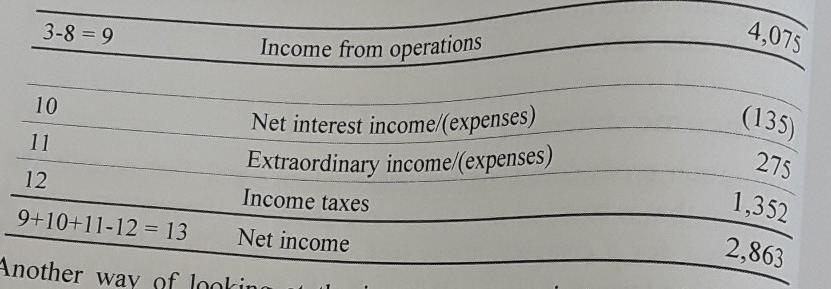

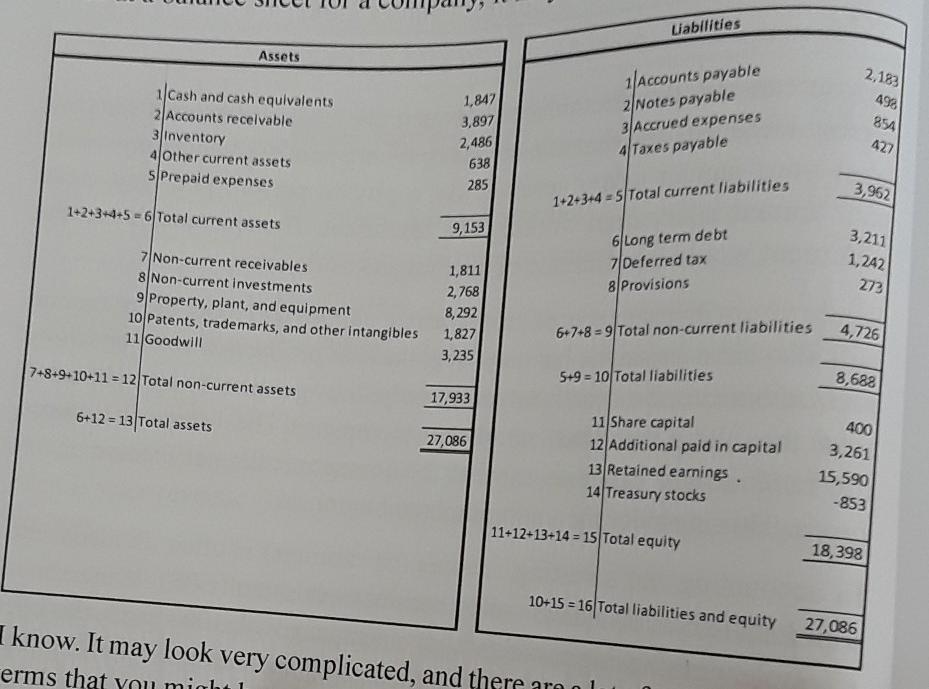

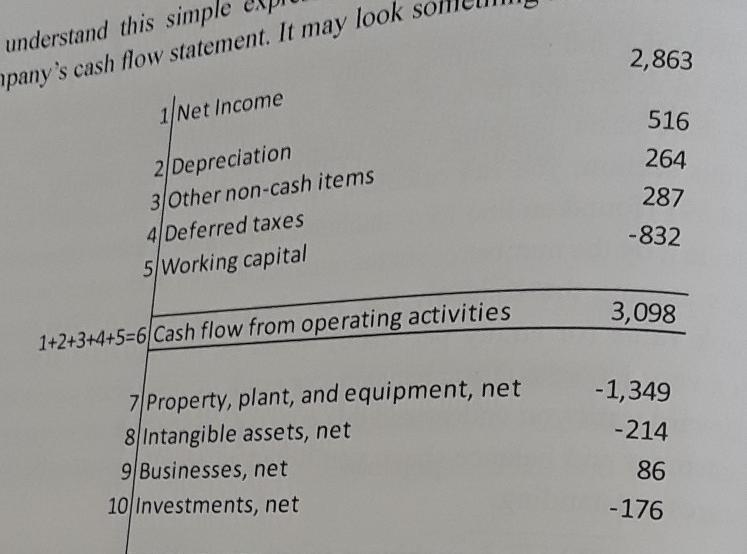

income statement balance sheet Question: What can you tell from the numbers in the financial statements? Please elaborate and be specific. in millions 13,279 5,348

income statement

balance sheet

Question: What can you tell from the numbers in the financial statements? Please elaborate and be specific.

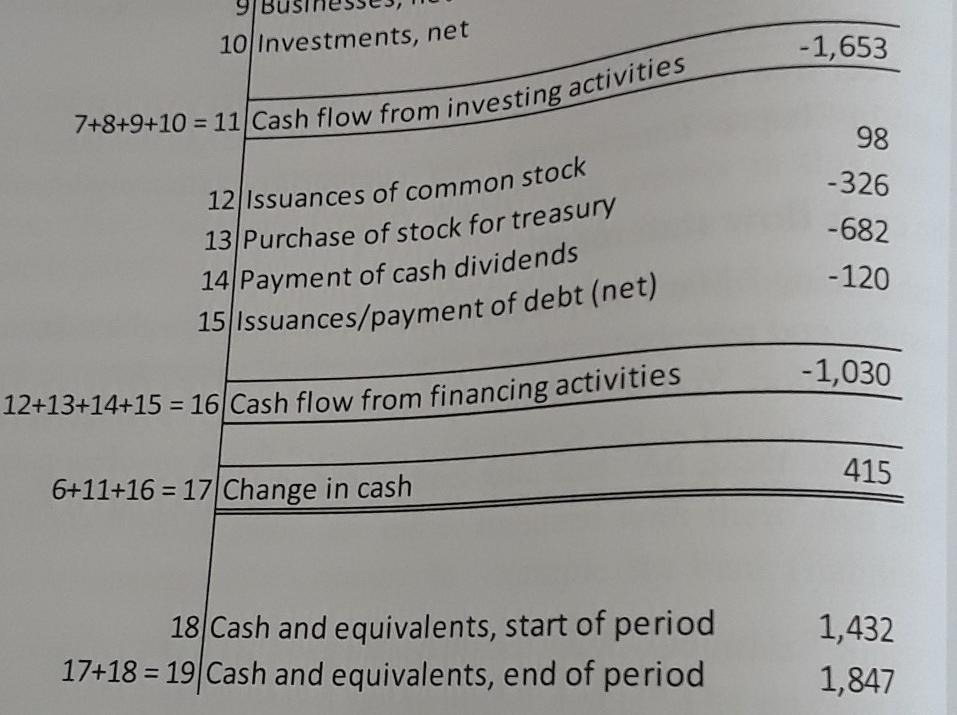

in millions 13,279 5,348 Income statement 1 Revenue Cost of revenue 7,931 2 1-2 = 3 Gross Margin 1,105 4 863 5 Sales and Marketing expenses Research and development expenses General and Administration expenses 538 6 7 1,350 3,856 Other operating expenses Operating expenses 4+5+6+7 = 8 3-8 = 9 4,075 Income from operations 10 (135) 11 Net interest income/expenses) Extraordinary income/expenses) 275 12 Income taxes 1,352 9+10+11-12 = 13 Net income 2,863 Another way of looking Liabilities Assets 2,183 498 Cash and cash equivalents 2 Accounts receivable 3 Inventory 4 other current assets S Prepaid expenses 1,847 3,897 2,486 638 285 Accounts payable 2 Notes payable 3 Accrued expenses 4 Taxes payable 854 427 3,962 1+2+3+4 = 5 Total current liabilities 1+2+3+4+5 -6 Total current assets 9,153 6 Long term debt 7 Deferred tax 8 Provisions 3,211 1,242 273 7 Non-current receivables 8 Non-current investments 9 Property, plant, and equipment 10 Patents, trademarks, and other intangibles 11 Goodwill 1,811 2,768 8,292 1,827 3,235 6+7+8 = 9 Total non-current liabilities 4,726 7+8+9+10+11 = 12 Total non-current assets 5+9 = 10 Total liabilities 8,688 17,933 6+12 = 13 Total assets 400 27,086 11 Share capital 12 Additional paid in capital 13 Retained earnings 14 Treasury stocks 3,261 15,590 -853 11+12+13+14 - 15 Total equity 18,398 10+15 = 16 Total liabilities and equity 27,086 I know. It may look very complicated, and there arnal erms that you might 1 understand this simple pany's cash flow statement. It may look so 2,863 1/Net Income 516 264 287 2 Depreciation 3 Other non-cash items 4 Deferred taxes 5 Working capital -832 3,098 1+2+3+4+5=6 Cash flow from operating activities -1,349 -214 7 Property, plant, and equipment, net 8 Intangible assets, net 9 Businesses, net 10 Investments, net 86 -176 10 Investments, net -1,653 7+8+9+10 = 11 Cash flow from investing activities 12 Issuances of common stock 98 -326 -682 -120 13 Purchase of stock for treasury 14 Payment of cash dividends 15 Issuances/payment of debt (net) - 1,030 12+13+14+15 = 16 Cash flow from financing activities 415 6+11+16 = 17 Change in cash 18 Cash and equivalents, start of period 17+18 = 19 Cash and equivalents, end of period 1,432 1,847Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started