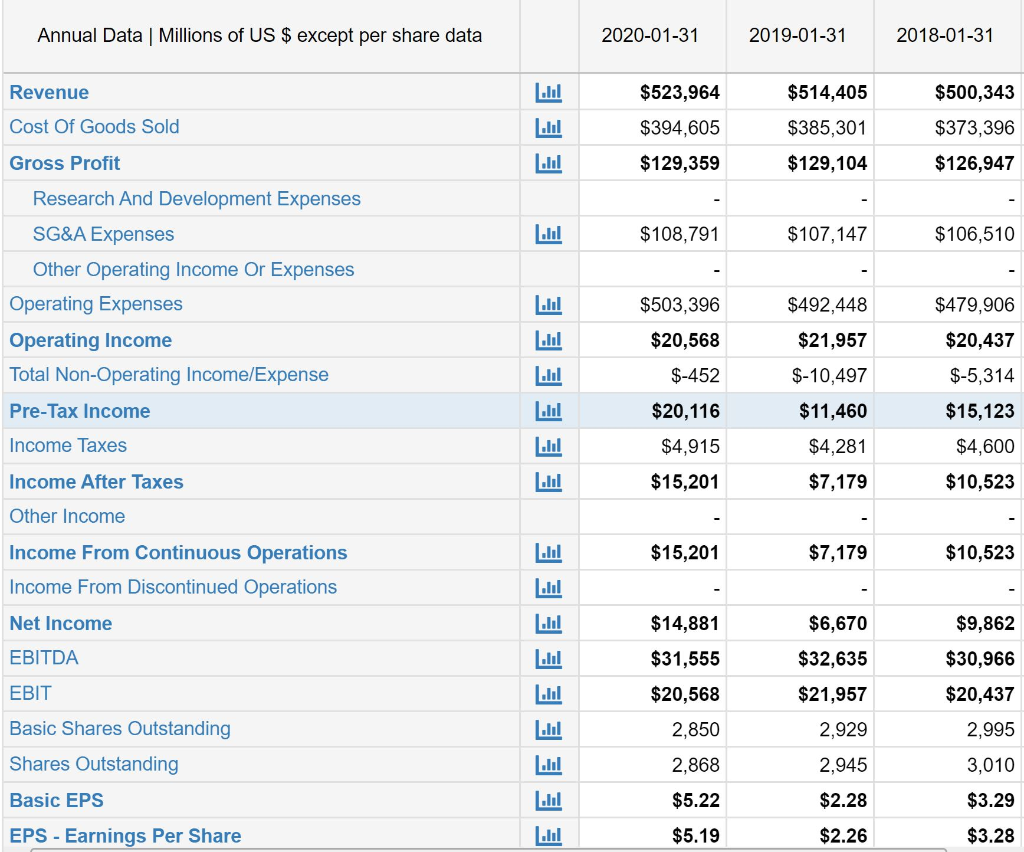

Income Statement

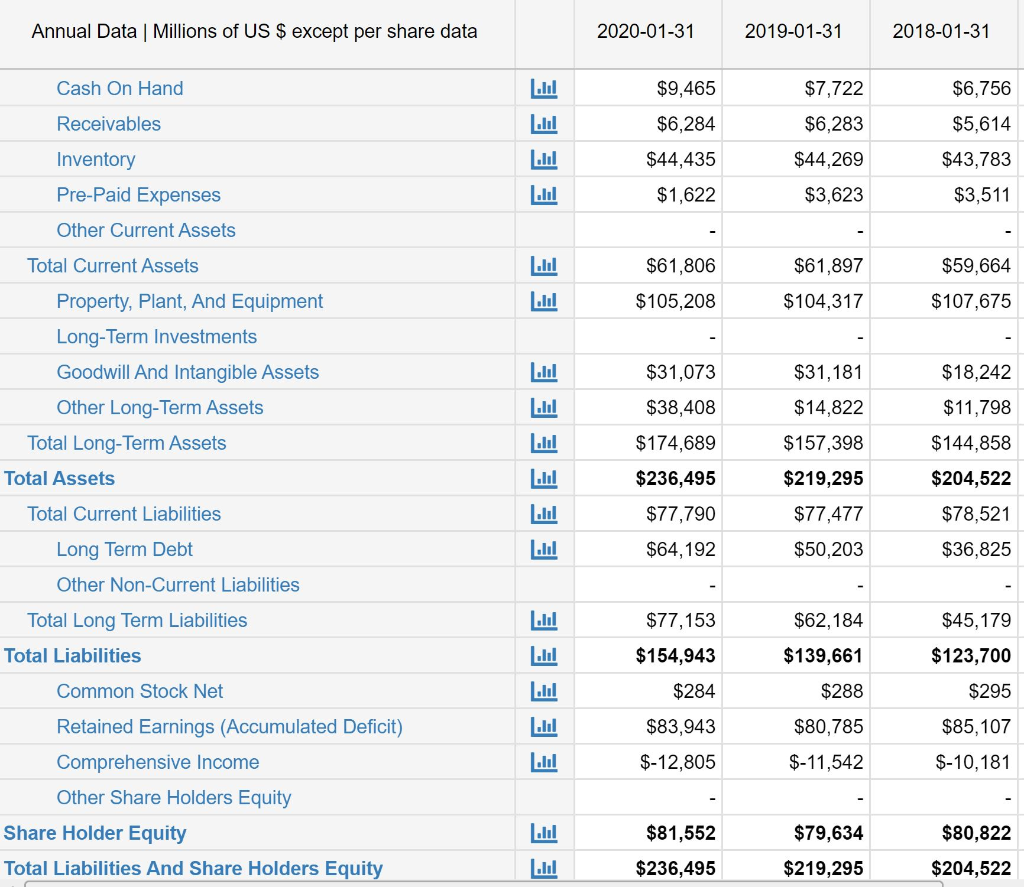

Balance Sheet Statement

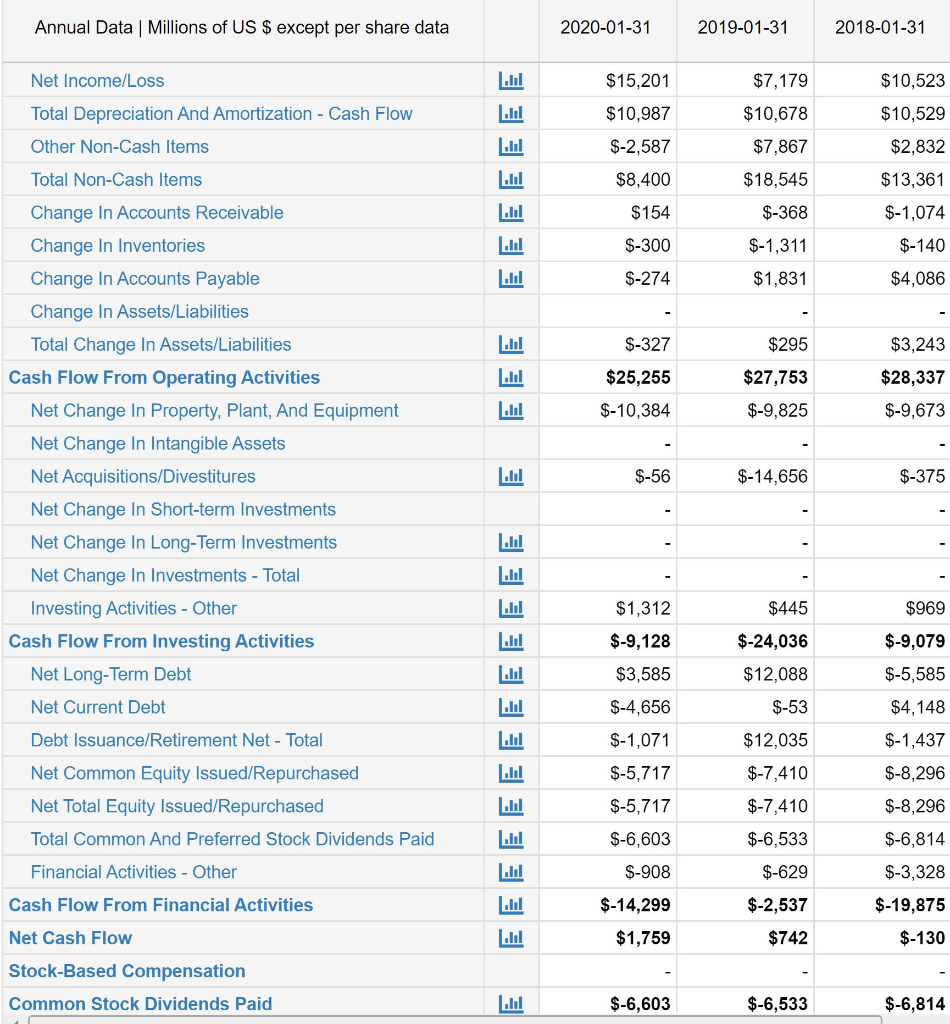

Cash Flow Statement

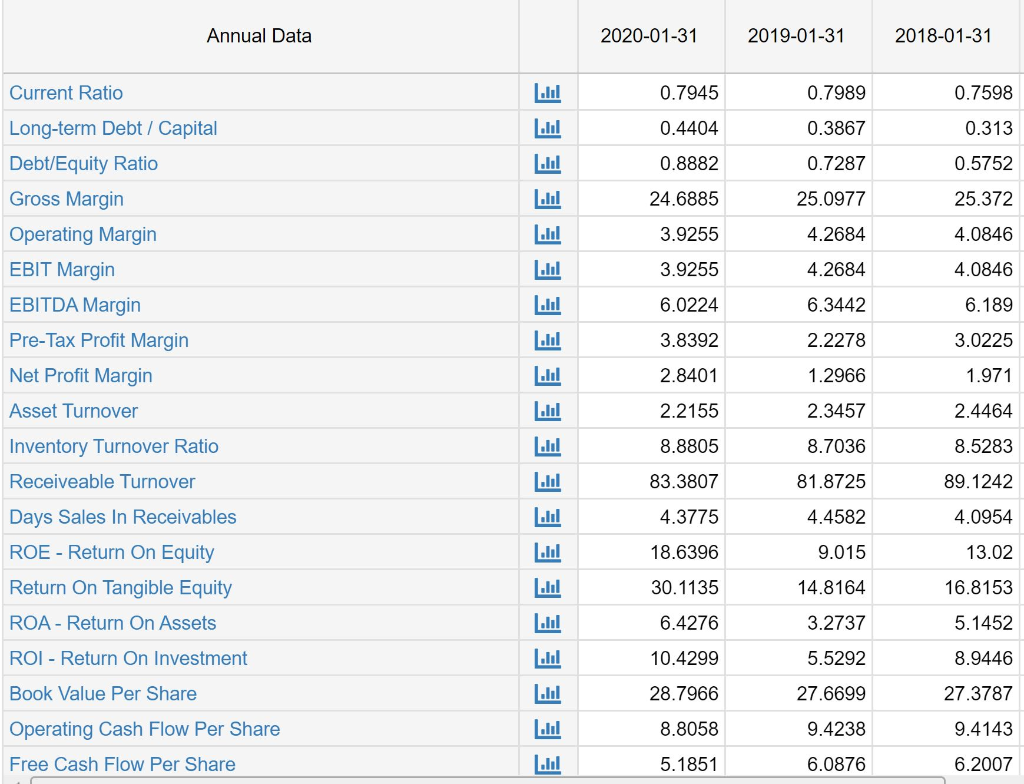

Financial Ratios

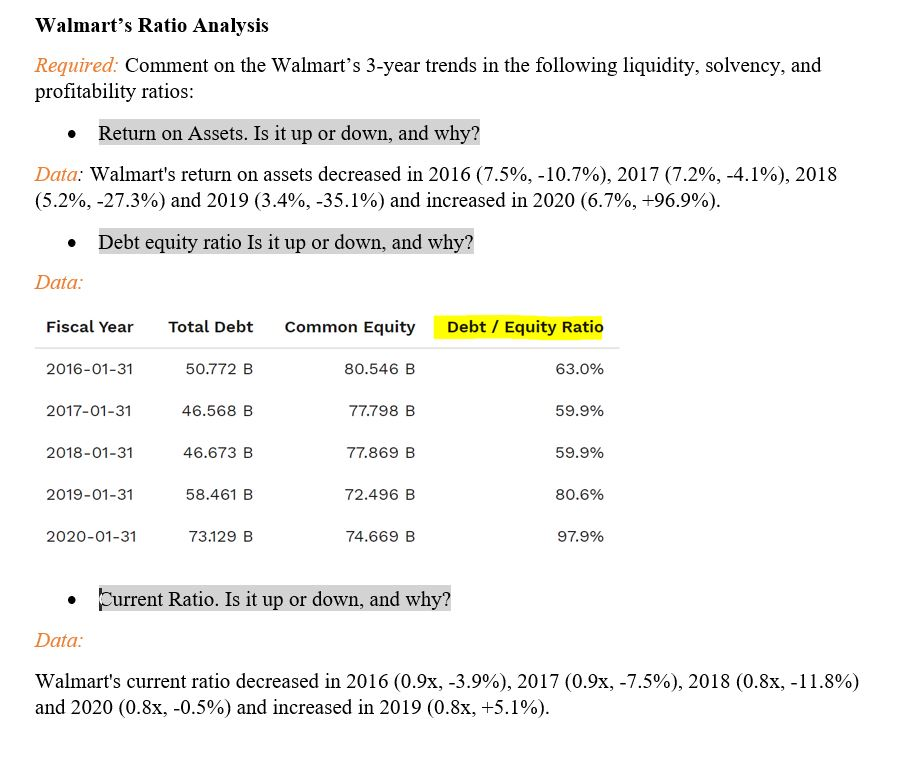

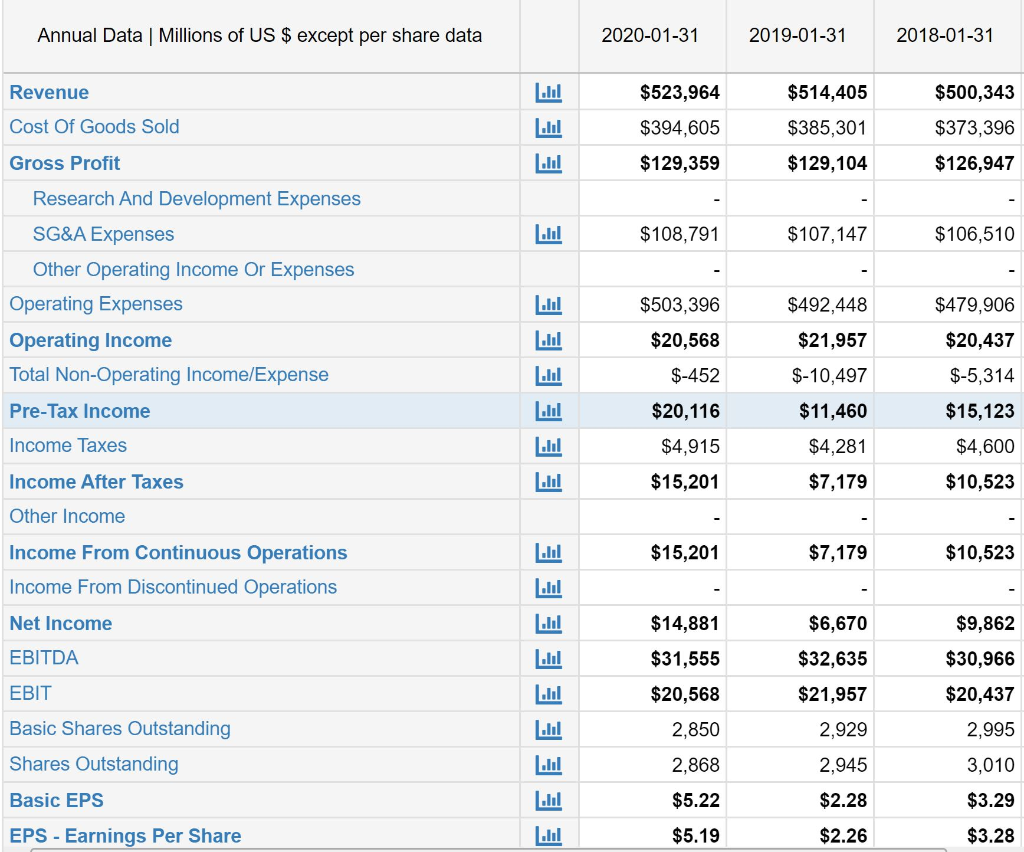

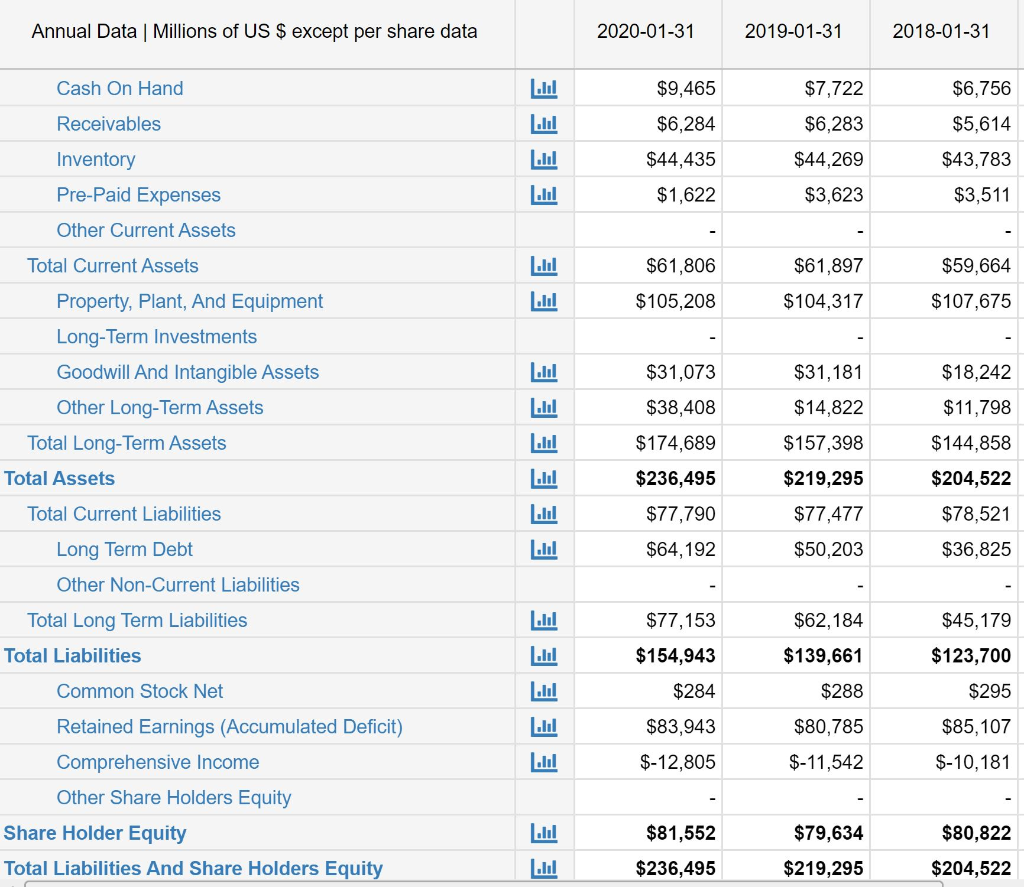

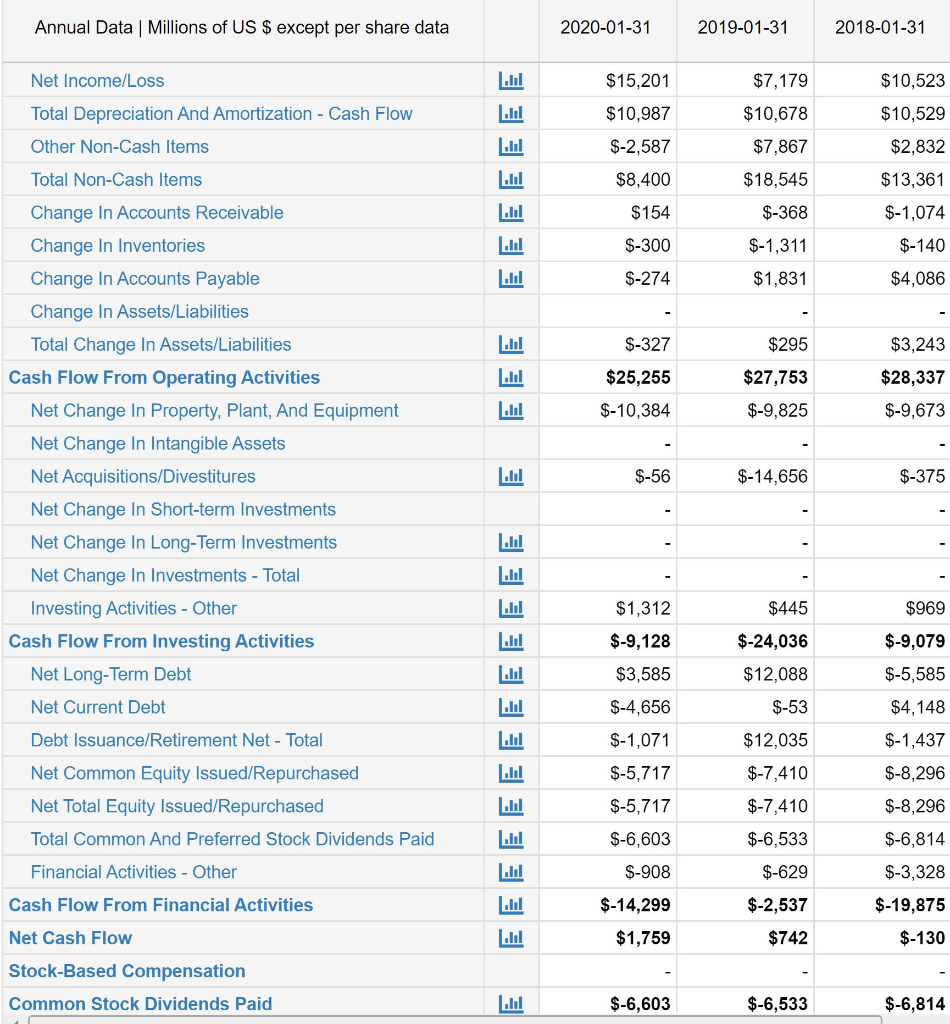

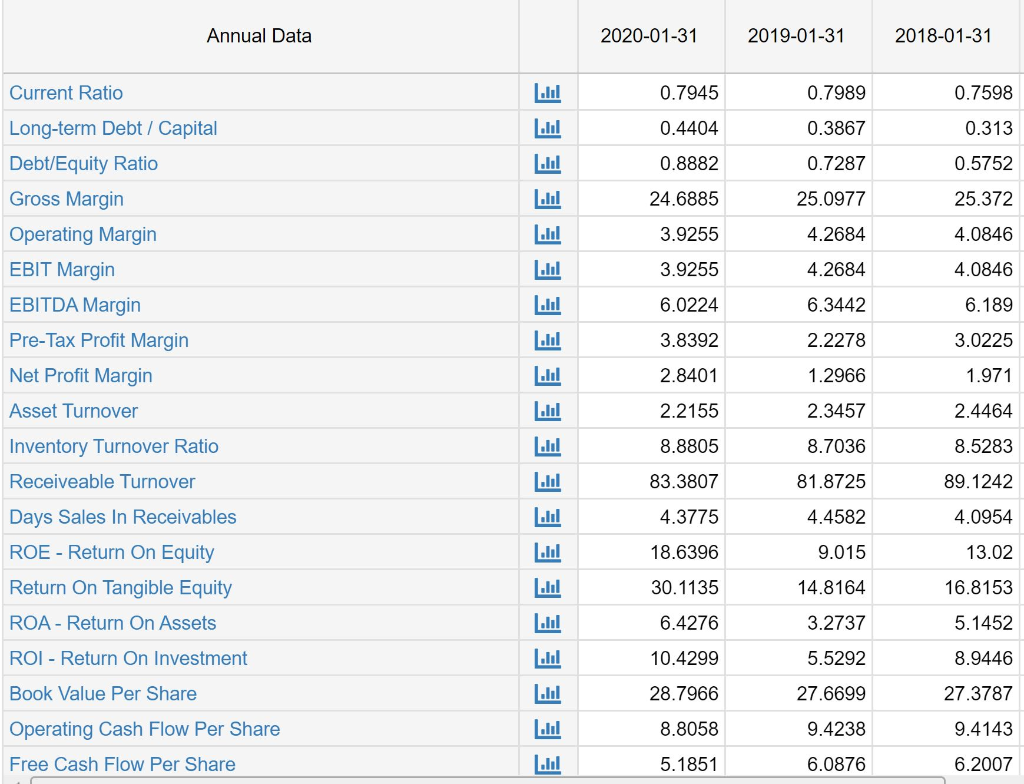

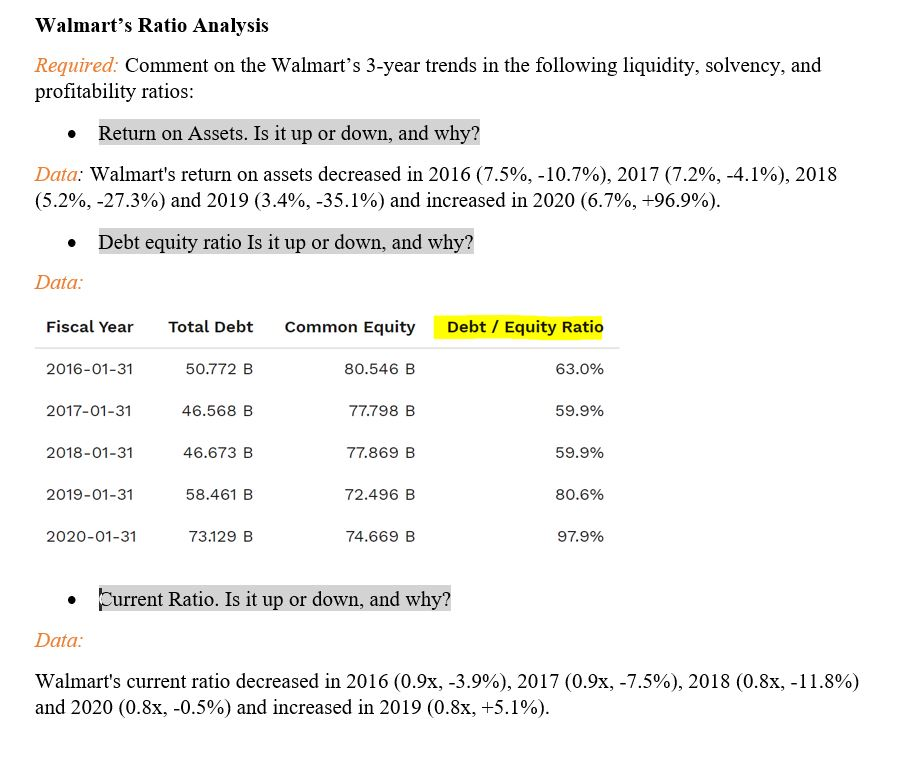

Walmart's Ratio Analysis Required: Comment on the Walmart's 3-year trends in the following liquidity, solvency, and profitability ratios: Return on Assets. Is it up or down, and why? Data: Walmart's return on assets decreased in 2016 (7.5%, -10.7%), 2017 (7.2%, -4.1%), 2018 (5.2%, -27.3%) and 2019 (3.4%, -35.1%) and increased in 2020 (6.7%, +96.9%). Debt equity ratio Is it up or down, and why? Data: Fiscal Year Total Debt Common Equity Debt / Equity Ratio 2016-01-31 50.772 B 80.546 B 63.0% 2017-01-31 46.568 B 77.798 B 59.9% 2018-01-31 46.673 B 77.869 B 59.9% 2019-01-31 58.461 B 72.496 B 80.6% 2020-01-31 73.129 B 74.669 B 97.9% Current Ratio. Is it up or down, and why? Data: Walmart's current ratio decreased in 2016 (0.9x, -3.9%), 2017 (0.9x, -7.5%), 2018 (0.8x, -11.8%) and 2020 (0.8x, -0.5%) and increased in 2019 (0.8x, +5.1%). Annual Data Millions of US $ except per share data 2020-01-31 2019-01-31 2018-01-31 Revenue III $523,964 $514,405 $500,343 Cost Of Goods Sold ... $394,605 $385,301 $129,104 $373,396 $126,947 $129,359 Lil $108,791 $107,147 $106,510 Gross Profit Research And Development Expenses SG&A Expenses Other Operating Income Or Expenses Operating Expenses Operating Income Total Non-Operating Income/Expense Pre-Tax Income Lil $492,448 $479,906 $503,396 $20,568 $20,437 Ill $-452 $21,957 $-10,497 $11,460 $4,281 $-5,314 $15,123 $20,116 Income Taxes I.LT $4,915 $4,600 Income After Taxes Lil $15,201 $7,179 $10,523 Other Income $15,201 $7,179 $10,523 Income From Continuous Operations Income From Discontinued Operations Net Income $14,881 $9,862 $6,670 $32,635 EBITDA $31,555 $30,966 EBIT E E E E E E E E E $20,568 $21,957 $20,437 2,850 2,929 2,995 Basic Shares Outstanding Shares Outstanding 2,868 2,945 3,010 Basic EPS $5.22 $2.28 $3.29 EPS - Earnings Per Share $5.19 $2.26 $3.28 Annual Data | Millions of US $ except per share data 2020-01-31 2019-01-31 2018-01-31 Cash On Hand $9,465 $7,722 $6,756 $5,614 Receivables $6,284 $6,283 $44,435 $44,269 $43,783 Inventory Pre-Paid Expenses Ill $1,622 $3,623 $3,511 Other Current Assets Total Current Assets $61,897 $61,806 $105,208 $59,664 $107,675 $104,317 $31,073 $31,181 Property, Plant, And Equipment Long-Term Investments Goodwill And Intangible Assets Other Long-Term Assets Total Long-Term Assets Total Assets LUI $38,408 $14,822 $18,242 $11,798 $144,858 $174,689 $157,398 $219,295 Total Current Liabilities Ill $236,495 $77,790 $64,192 $77,477 $204,522 $78,521 $36,825 Long Term Debt LUI $50,203 Other Non-Current Liabilities Total Long Term Liabilities Ill $77,153 $62,184 $45,179 Total Liabilities Ul $154,943 $139,661 $123,700 $295 Common Stock Net Ill $284 $288 $83,943 $80,785 $85,107 $-12,805 $-11,542 $-10,181 Retained Earnings (Accumulated Deficit) Comprehensive Income Other Share Holders Equity Share Holder Equity Total Liabilities And Share Holders Equity Ill $81,552 $80,822 $79,634 $219,295 $236,495 $204,522 Annual Data Millions of US $ except per share data 2020-01-31 2019-01-31 2018-01-31 Net Income/Loss $7,179 $10,523 $15,201 $10,987 ..lol $10,678 $10,529 $-2,587 $7,867 $2,832 I. $8,400 $18,545 $13,361 $154 $-368 $-1,074 Ill $-300 $-1,311 $-140 Ill $-274 $1,831 $4,086 $-327 $295 $3,243 $28,337 LUI $27,753 $25,255 $-10,384 $-9,825 $-9,673 Total Depreciation And Amortization - Cash Flow Other Non-Cash Items Total Non-Cash Items Change in Accounts Receivable Change In Inventories Change in Accounts Payable Change In Assets/Liabilities Total Change In Assets/Liabilities Cash Flow From Operating Activities Net Change In Property, Plant, And Equipment Net Change In Intangible Assets Net Acquisitions/Divestitures Net Change In Short-term Investments Net Change In Long-Term Investments Net Change In Investments - Total Investing Activities - Other Cash Flow From Investing Activities Net Long-Term Debt Net Current Debt Debt Issuance/Retirement Net - Total Net Common Equity Issued/Repurchased Net Total Equity Issued/Repurchased E $-56 $-14,656 $-375 LUI LUI $1,312 $445 $969 LUI $-24,036 $-9,079 $-9,128 $3,585 $12,088 $-53 $-5,585 $4,148 $-1,437 $-8,296 $-4,656 $-1,071 $-5,717 $-5,717 LUI $12,035 $-7,410 $-7,410 $-8,296 Total Common And Preferred Stock Dividends Paid $-6,603 $-6,533 $-6,814 $-908 $-629 Financial Activities - Other Cash Flow From Financial Activities $-3,328 $-19,875 $-14,299 $-2,537 Net Cash Flow $1,759 $742 $-130 Stock-Based Compensation Common Stock Dividends Paid $-6,603 $-6,533 $-6,814 Annual Data 2020-01-31 2019-01-31 2018-01-31 Current Ratio 0.7945 0.7989 0.7598 0.4404 0.3867 0.313 ...1 0.8882 0.7287 0.5752 24.6885 25.0977 25.372 1.il 3.9255 4.2684 4.0846 Long-term Debt / Capital Debt/Equity Ratio Gross Margin Operating Margin EBIT Margin EBITDA Margin Pre-Tax Profit Margin Net Profit Margin Asset Turnover lil 3.9255 4.2684 4.0846 6.0224 6.3442 6.189 3.8392 2.2278 3.0225 IIII 2.8401 1.2966 1.971 2.2155 2.3457 2.4464 Inventory Turnover Ratio |-lil 8.8805 8.7036 8.5283 Receiveable Turnover IIII 83.3807 81.8725 89.1242 Days Sales In Receivables ... 4.3775 4.4582 4.0954 III 18.6396 9.015 13.02 ROE - Return On Equity Return On Tangible Equity 30.1135 14.8164 16.8153 Lil Ill ROA - Return On Assets 6.4276 3.2737 5.1452 ROI - Return On Investment 10.4299 5.5292 8.9446 Book Value Per Share Ill 28.7966 27.6699 27.3787 Operating Cash Flow Per Share Ill 8.8058 9.4238 9.4143 Free Cash Flow Per Share 5.1851 6.0876 6.2007