Answered step by step

Verified Expert Solution

Question

1 Approved Answer

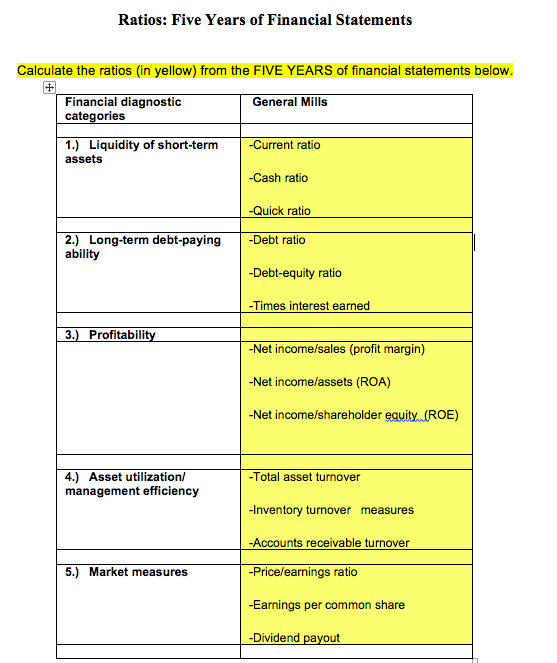

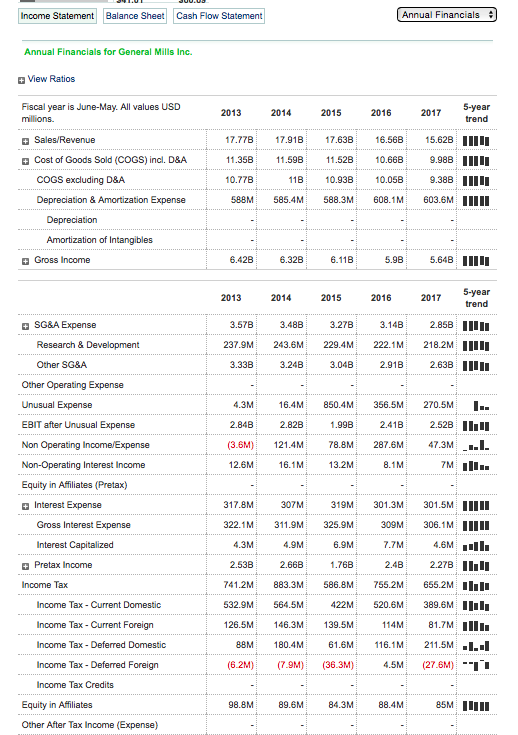

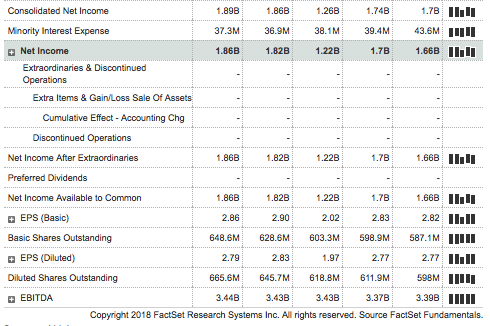

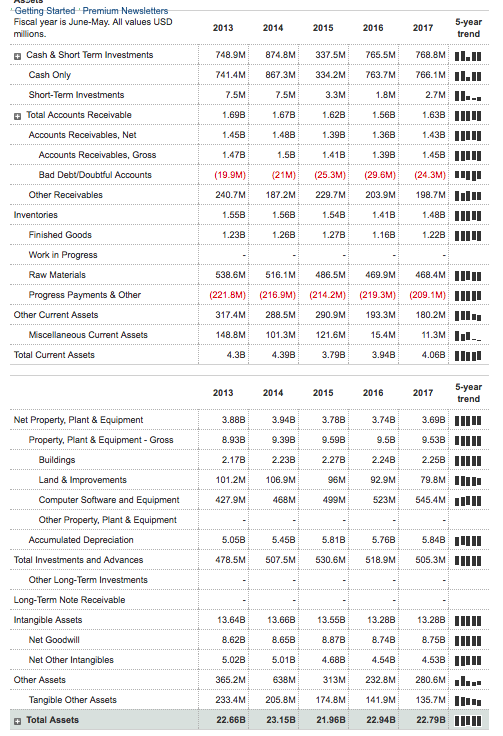

Income Statement Balance Sheet Statement of Cash Flow Dividend 1.94 $59.04 market price ($25.127 billion aggregated market value) Ratios: Five Years of Financial Statements Calculate

Income Statement

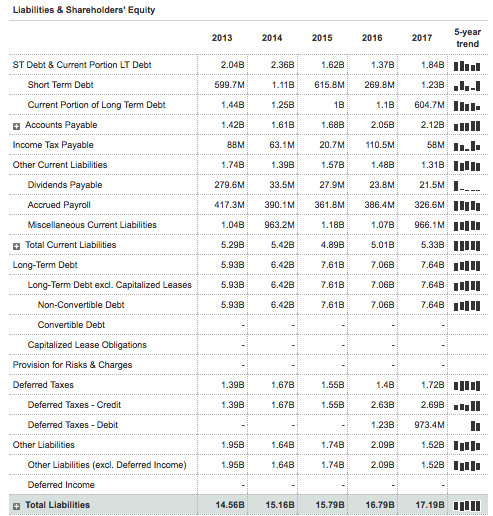

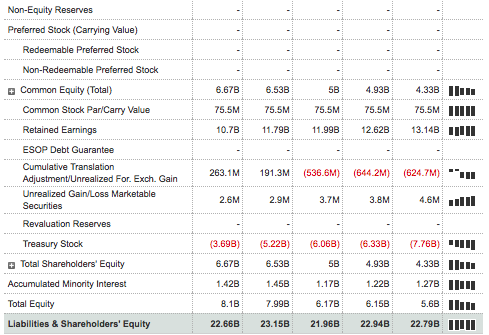

Balance Sheet

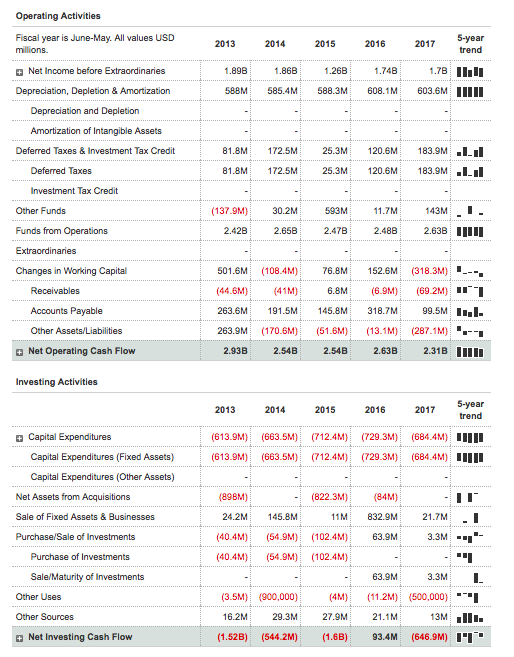

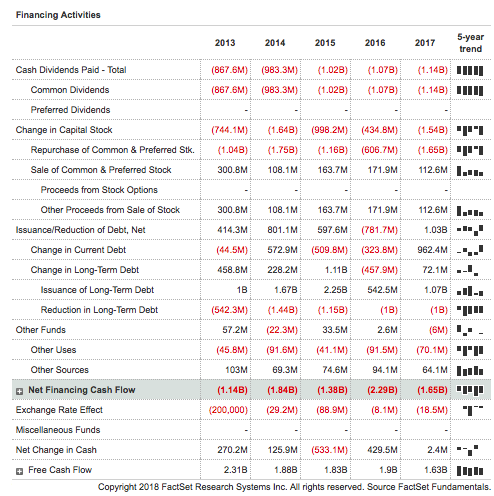

Statement of Cash Flow

Dividend 1.94

$59.04 market price ($25.127 billion aggregated market value)

Ratios: Five Years of Financial Statements Calculate the ratios (in yellow) from the FIVE YEARS of financial statements below. General Mills Financial diagnostic categories 1.) Liquidity of short-term Current ratio assets -Cash ratio -Quick ratio 2.) Long-term debt-paying Debt ratio ability -Debt-equity ratio Times interest earned 3.) Profitabil -Net income/sales (profit margin) -Net income/assets (ROA) -Net income/shareholder equity(ROE) 4.) Asset utilizationl management efficiency Total asset turnover -Inventory turnover measures -Accounts receivable turnover -Price/earnings ratio -Earnings per common share -Dividend 5.) Market measures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started