--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

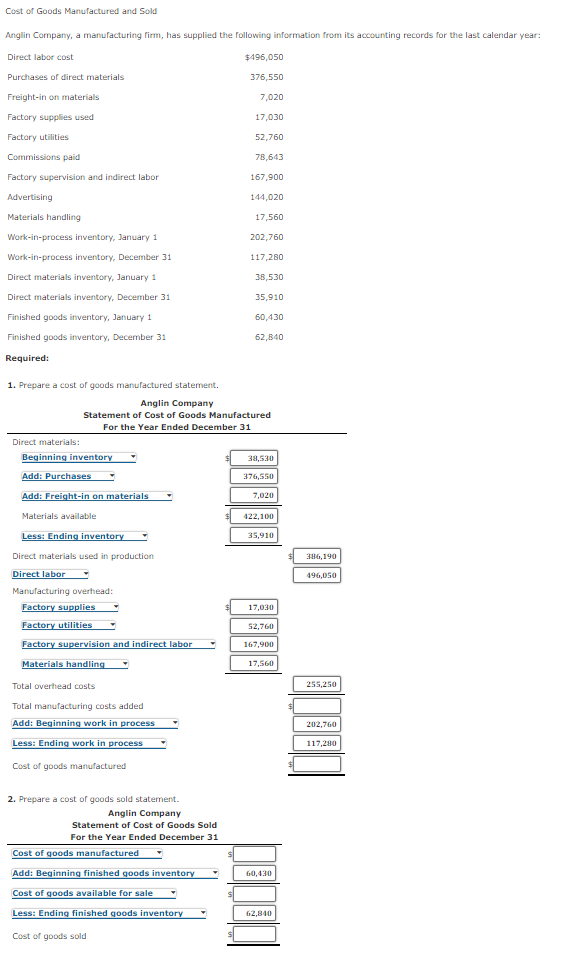

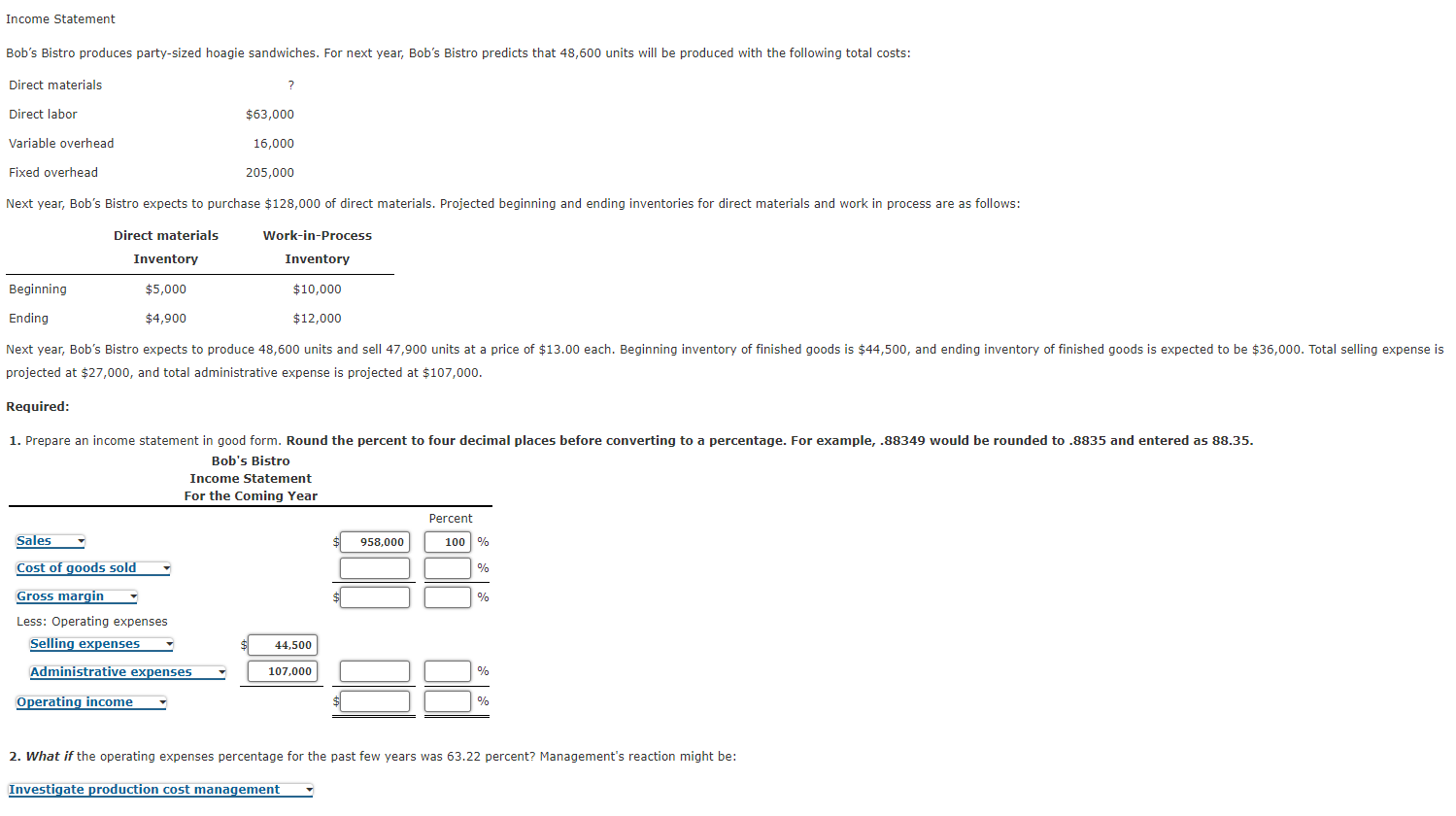

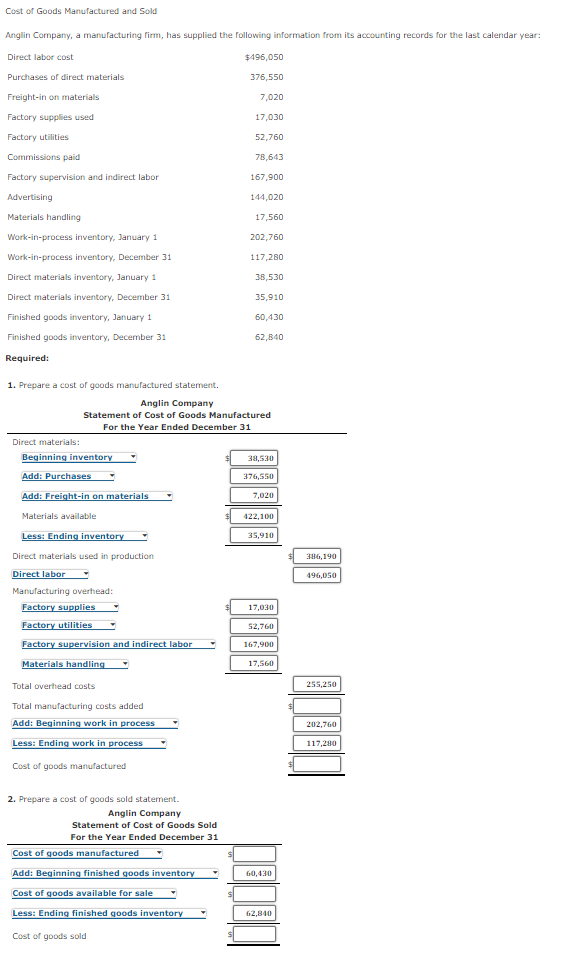

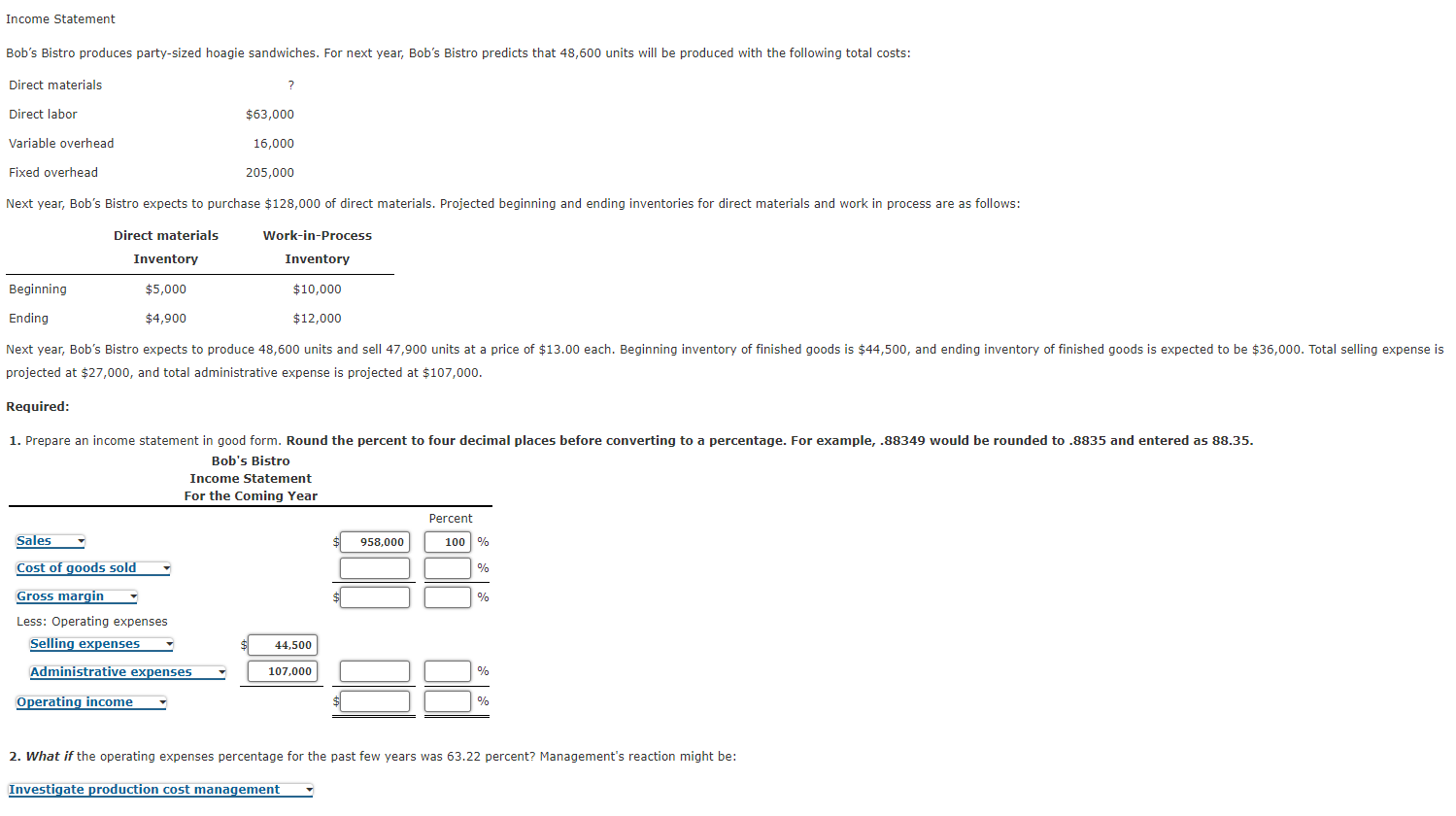

Income Statement Bob's Bistro produces party-sized hoagie sandwiches. For next year, Bob's Bistro predicts that 48,600 units will be produced with the following total costs: Direct materials 2 Direct labor $63,000 Variable overhead 16,000 Fixed overhead 205,000 Next year, Bob's Bistro expects to purchase $128,000 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows: Direct materials Work-in-Process Inventory Inventory Beginning $5,000 $10,000 Ending $4,900 $12,000 Next year, Bob's Bistro expects to produce 48,600 units and sell 47,900 units at a price of $13.00 each. Beginning inventory of finished goods is $44,500, and ending inventory of finished goods is expected to be $36,000. Total selling expense is projected at $27,000, and total administrative expense is projected at $107,000. Required: 1. Prepare an income statement in good form. Round the percent to four decimal places before converting to a percentage. For example, .88349 would be rounded to .8835 and entered as 88.35. Bob's Bistro Income Statement For the Coming Year Percent Sales 958,000 100 % Cost of goods sold Gross margin et ili Less: Operating expenses Selling expenses 44,500 Administrative expenses 107,000 Operating income 2. What if the operating expenses percentage for the past few years was 63.22 percent? Management's reaction might be: Investigate production cost management Cost of Goods Manufactured and Sold Anglin Company, a manufacturing firm, has supplied the following information from its accounting records for the last calendar year: Direct labor cost $496,050 Purchases of direct materials 376,550 Freight-in on materials 7,020 Factory supplies used 17.030 Factory utilities 52,760 Commissions paid 78,643 Factory supervision and indirect labor 167,900 Advertising 144,020 Materials handling 17,560 202,760 117,280 Work-in-process inventory, January 1 Work-in-process inventory, December 31 Direct materials inventory, January 1 Direct materials inventory, December 31 Finished goods inventory, January 1 38,530 35,910 60,430 62,840 Finished goods inventory, December 31 Required: 1. Prepare a cost of goods manufactured statement. Anglin Company Statement of Cost of Goods Manufactured For the Year Ended December 31 Direct materials: Beginning inventory 38,530 Add: Purchases 376,550 Add: Freight-in on materials 7,020 Materials available 422,100 Less: Ending inventory 35,910 Direct materials used in production Direct labor Manufacturing overhead: Factory supplies 17.030 Factory utilities 52,760 Factory supervision and indirect labor 167,900 Materials handling 17,560 286,190 496,050 255,250 Total overhead costs Total manufacturing costs added Add: Beginning work in process Less: Ending work in process Cost of goods manufactured 202,760 117,280 2. Prepare a cost of goods sold statement. Anglin Company Statement of Cost of Goods Sold For the Year Ended December 31 Cost of goods manufactured 60, 430 Add: Beginning finished goods inventory Cost of goods available for sale Less: Ending finished goods inventory 62,840 Cost of goods sold

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------