Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income statement CASE #1 - FAST SUPPLIES. INC. Your fiend sought your help in coming up with the financial statements of her business, formed in

Income statement

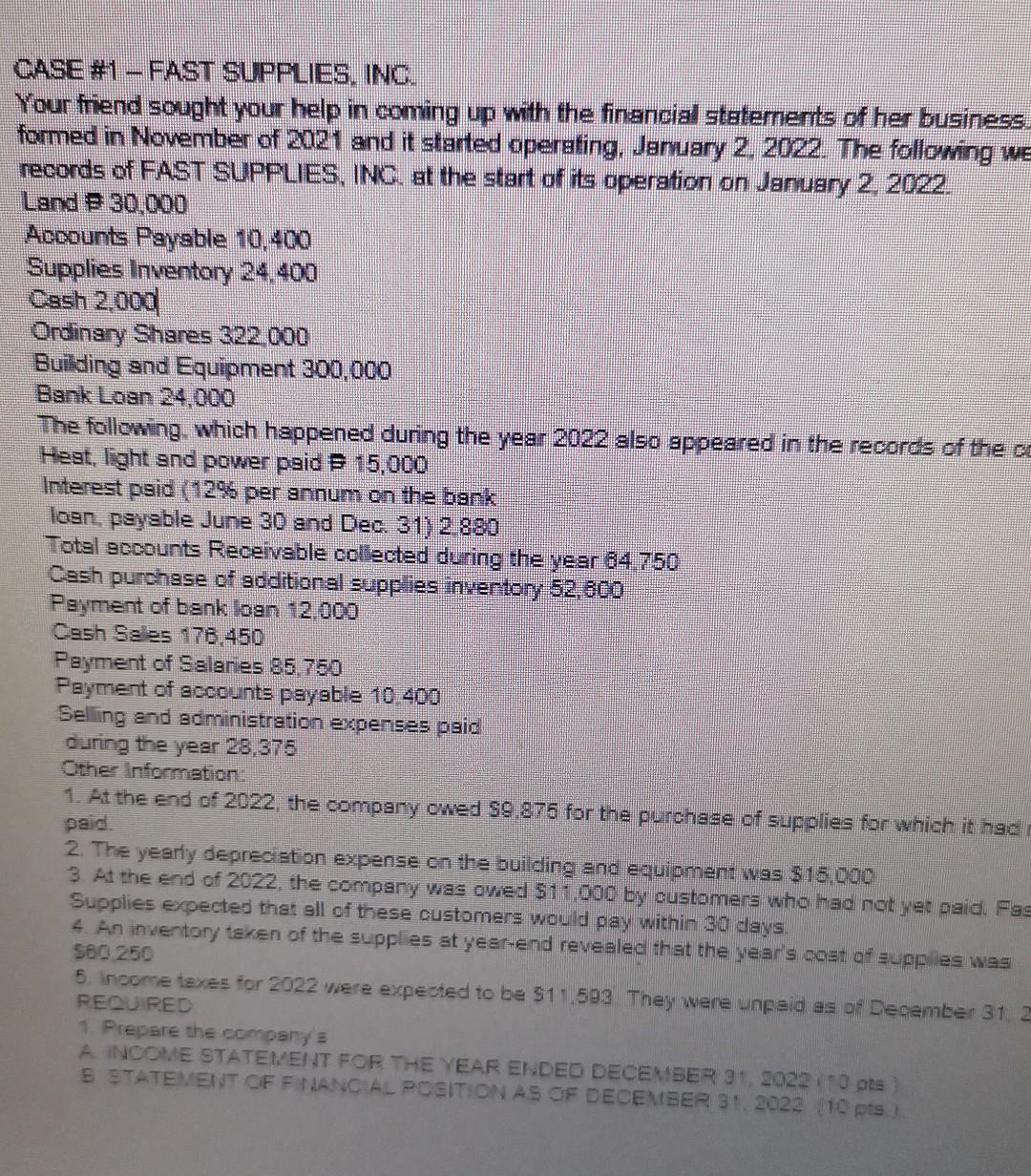

CASE #1 - FAST SUPPLIES. INC. Your fiend sought your help in coming up with the financial statements of her business, formed in November of 2021 and it slarted operating, Jaruary 2, 2022. The following w reoonds of FAST SUPPLIES, INC. at the start of its operation on January 2,2022 . Land $30.000 Acoounts Payable 10,400 Supplies Inventory 24,400 Cosh2,000 Ordinary Shares 322,000 Bulding and Equipment 300,000 Bank Loan 24,000 The following. which happened during the year 2022 also appeared in the records of the c Heat, light and power paid 15,000 Interest paid (12% per annum on the bank loan, payable June 30 and Dec. 31) 2880 Totsl gcoounts Receivable collected during the year 64.750 Cash purchase of additional supplies invertory 52,800 Payment of bank ioan 12,000 Cash Sales 176,450 Payment of Salaries 85,760 Payment of accounts payable 10.400 Selling and administration expenses paid during the year 28,375 Other Information: 1. At the end of 2022, the compary owed $9.875 for the purchsse of supplies for which it hac paid. 2. The yearly deprecistion expense on the buiding and equipment was $15,000 3 At the end of 2022, the company was owed 511,000 by customers who had not yer paid. Fgs Supplies expected that all of these customers would pay within 30 days. 4. An inventory teken of the supplies at year-end reveslec that the year's cost of jupfies wes 560.250 5. Inoome texes for 2022 were expected to be $11.593 They were unfaid as of December 31 . REQUIRED 1. Prepare the company A INOOWE STATEWENT FOR THE YEAR ENDED DECEMBER 31,2022,10gts B \$TATEMENT OF FI HNCAL PCEITIONAS OF DECEMEER 31,2022 10 pts ? CASE #1 - FAST SUPPLIES. INC. Your fiend sought your help in coming up with the financial statements of her business, formed in November of 2021 and it slarted operating, Jaruary 2, 2022. The following w reoonds of FAST SUPPLIES, INC. at the start of its operation on January 2,2022 . Land $30.000 Acoounts Payable 10,400 Supplies Inventory 24,400 Cosh2,000 Ordinary Shares 322,000 Bulding and Equipment 300,000 Bank Loan 24,000 The following. which happened during the year 2022 also appeared in the records of the c Heat, light and power paid 15,000 Interest paid (12% per annum on the bank loan, payable June 30 and Dec. 31) 2880 Totsl gcoounts Receivable collected during the year 64.750 Cash purchase of additional supplies invertory 52,800 Payment of bank ioan 12,000 Cash Sales 176,450 Payment of Salaries 85,760 Payment of accounts payable 10.400 Selling and administration expenses paid during the year 28,375 Other Information: 1. At the end of 2022, the compary owed $9.875 for the purchsse of supplies for which it hac paid. 2. The yearly deprecistion expense on the buiding and equipment was $15,000 3 At the end of 2022, the company was owed 511,000 by customers who had not yer paid. Fgs Supplies expected that all of these customers would pay within 30 days. 4. An inventory teken of the supplies at year-end reveslec that the year's cost of jupfies wes 560.250 5. Inoome texes for 2022 were expected to be $11.593 They were unfaid as of December 31 . REQUIRED 1. Prepare the company A INOOWE STATEWENT FOR THE YEAR ENDED DECEMBER 31,2022,10gts B \$TATEMENT OF FI HNCAL PCEITIONAS OF DECEMEER 31,2022 10 ptsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started