Answered step by step

Verified Expert Solution

Question

1 Approved Answer

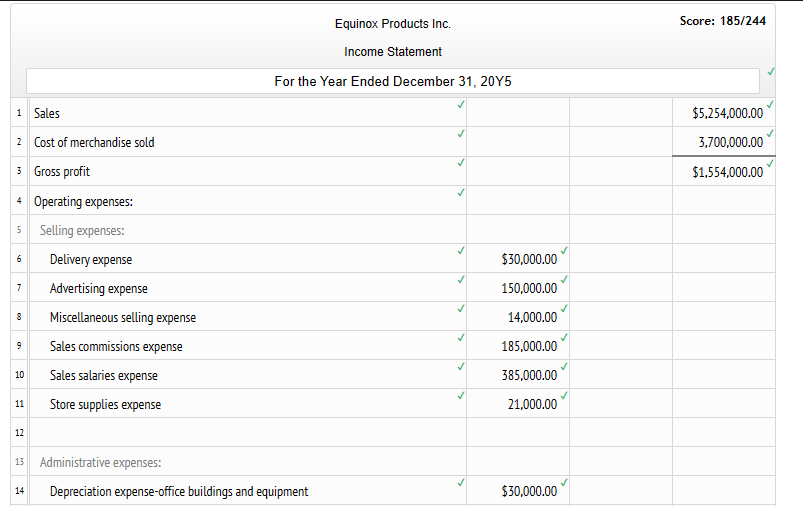

Income Statement data: Advertising expense $ 1 5 0 , 0 0 0 Cost of merchandise sold 3 , 7 0 0 , 0 0

Income Statement data:

Advertising expense $

Cost of merchandise sold

Delivery expense

Depreciation expenseoffice buildings and equipment

Depreciation expensestore buildings and equipment

Gain on sale of investments

Income from Pinkberry Co investment

Income tax expense

Interest expense

Interest revenue

Miscellaneous administrative expense

Miscellaneous selling expense

Office rent expense

Office salaries expense

Office supplies expense

Sales

Sales commissions expense

Sales salaries expense

Store supplies expense

Retained earnings and balance sheet data:

Accounts payable $

Accounts receivable

Accumulated depreciationoffice buildings and equipment

Accumulated depreciationstore buildings and equipment

Allowance for doubtful accounts

Availableforsale investments at cost

Bonds payable, due in years

Cash

Common stock, $ par

shares authorized; shares issued, outstanding

Dividends:

Cash dividends for common stock

Cash dividends for preferred stock

Goodwill

Income tax payable

Interest receivable

Investment in Pinkberry Co stock equity method

Investment in Dream Inc. bonds long term

Merchandise inventory December Y

at lower of cost FIFO or market

Office buildings and equipment

Paidin capital from sale of treasury stock

Excess of issue price over parcommon stock

Excess of issue price over parpreferred stock

Preferred $ stock, $ par

shares authorized; shares issued

Premium on bonds payable

Prepaid expenses

Retained earnings, January Y

Store buildings and equipment

Treasury stock

shares of common stock at cost of $ per share

Unrealized gain loss on availableforsale investments

Valuation allowance for availableforsale investments

CONTINUED

Labels

Current assets

Current liabilities

December Y

Dividends

For the Year Ended December Y

Intangible assets

Investments

Longterm liabilities

Operating expenses

Other revenue and expenses

Paidin capital

Property, plant, and equipment

Amount Descriptions

Availableforsale investments

Bonds payable

Common stock

Decrease in retained earnings

From sale of treasury stock

Gross profit

Investment in Pinkberry Co stock

Investment in Dream Inc. bonds

Income before income tax

Income from operations

Increase in retained earnings

Merchandise inventory, at lower of cost FIFO or market

Net income

Net loss

Preferred stock

Paidin capital in excess of parpreferred stock

Paidin capital in excess of parcommon stock

Retained earnings

Retained earnings, January Y

Retained earnings, December Y

Treasury common stock

Total administrative expenses

Total

Total assets

Total current assets

Total current liabilities

Total liabilities

Total liabilities and stockholders equity

Total longterm liabilities

Total investments

Total operating expenses

Total paidin capital

Total property, plant, and equipment

Total selling expenses

Total stockholders equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started