Question

Income Statement for 2018 Sales $455,150,000 Less : Expenses excluding depreciation and amortization (Sales - EBITDA) $386,877,500 (455,150,000 - 68,272,500) EBITDA (15% of Sales) $68,272,500

Income Statement for 2018

| Sales | $455,150,000 |

| Less : Expenses excluding depreciation and amortization (Sales - EBITDA) | $386,877,500 (455,150,000 - 68,272,500) |

| EBITDA (15% of Sales) | $68,272,500 (455,150,000 * 15%) |

| Less: Depreciation and amortization (11% of net fixed assets) | $7,388,150 ($67,165,000 * 11%) |

| EBIT | $60,884,350 |

| Less : Interest Expense | $8,575,000 |

| EBT | $52,309,350 |

| Taxes at 40% | $20,923,740 |

| Net Income | $31,385,610 |

| Less: Common Dividends (40% of Net Income) | $12,554,244 |

| Addition to Retained Earnings | $18,831,366 |

Calculate 2017 and 2018 net operating working capital (NOWC) and 2018 free cash flow (FCF). Assume the firm has no excess cash. PLEASE SHOW WORK!!

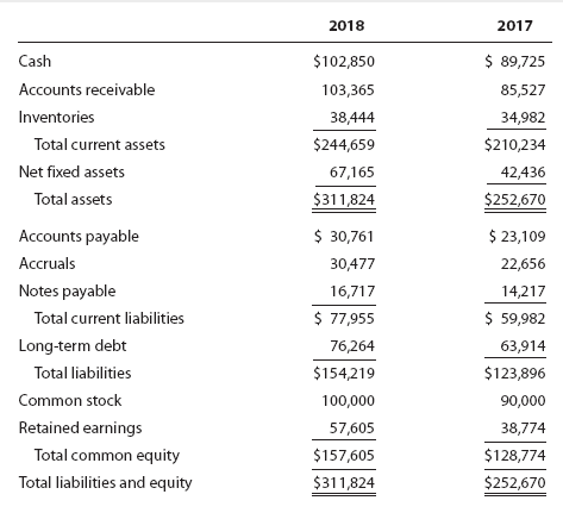

2018 2017 Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets $102,850 103,365 38,444 $244,659 67,165 $311,824 $ 89,725 85,527 34,982 $210,234 42,436 $252,670 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities and equity $ 30,761 30,477 16,717 $ 77,955 76,264 $154,219 100,000 57,605 $157,605 $311,824 $ 23,109 22,656 14,217 $ 59,982 63,914 $123,896 90,000 38,774 $128,774 $252,670Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started