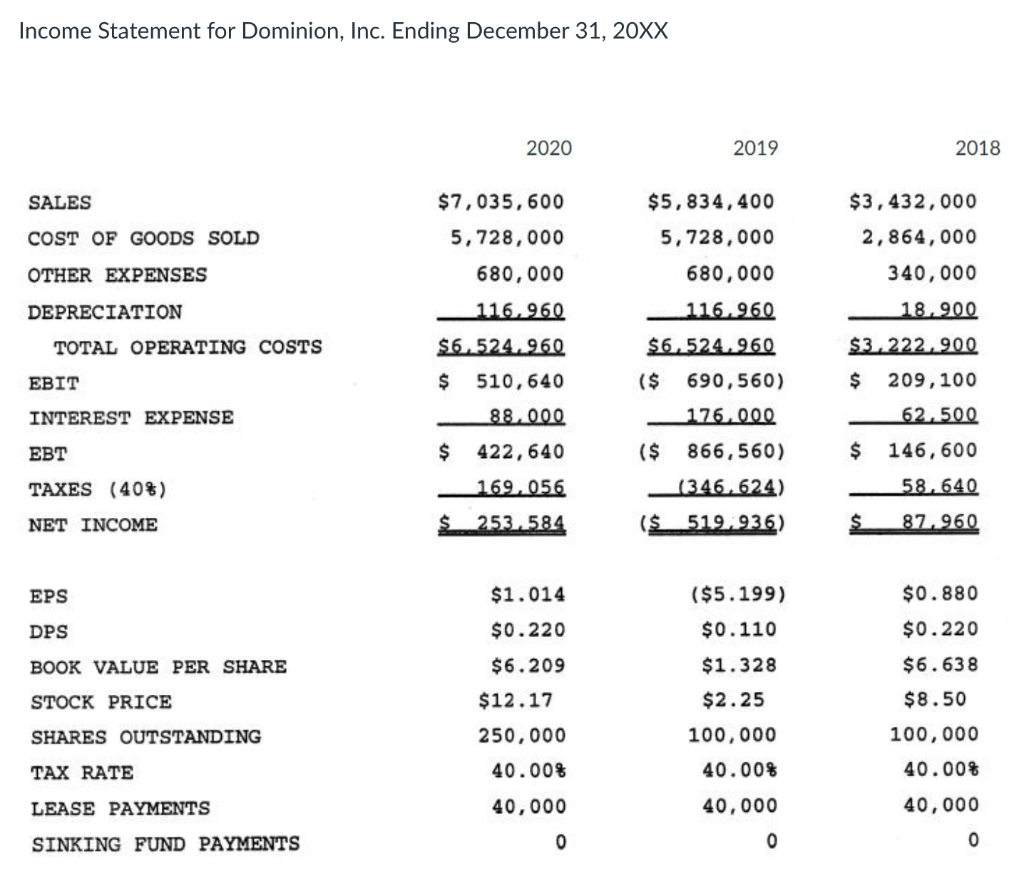

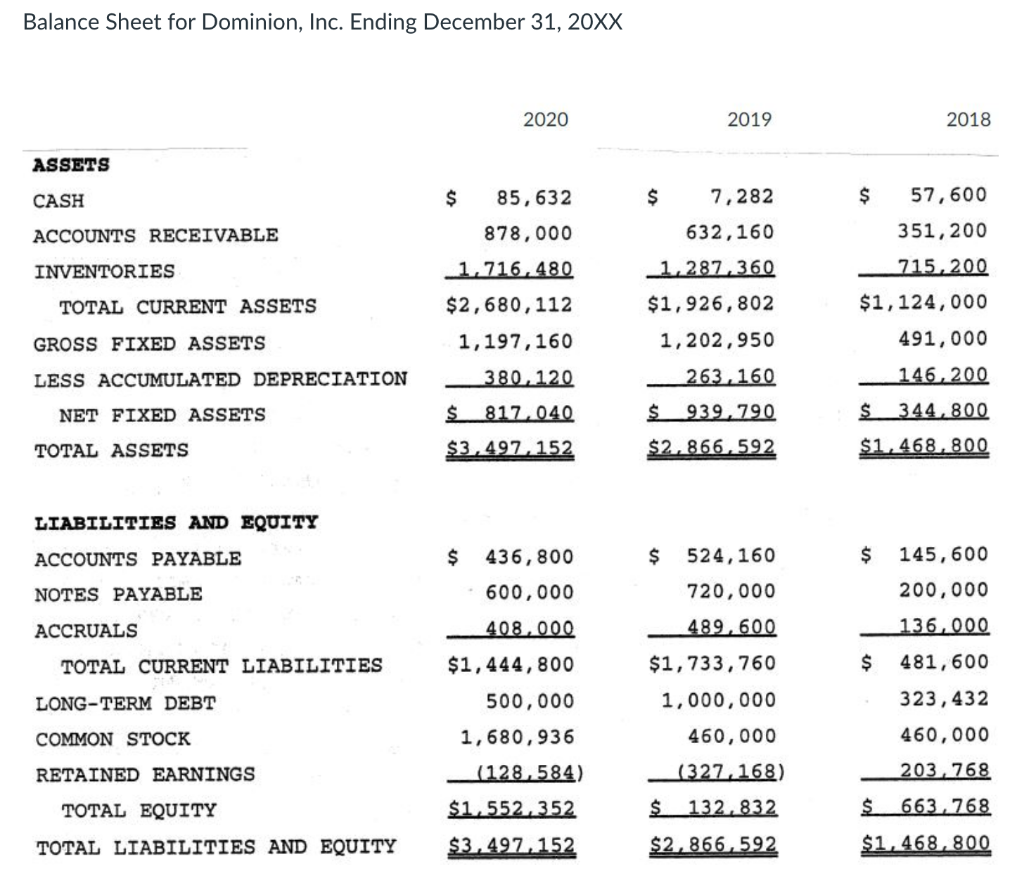

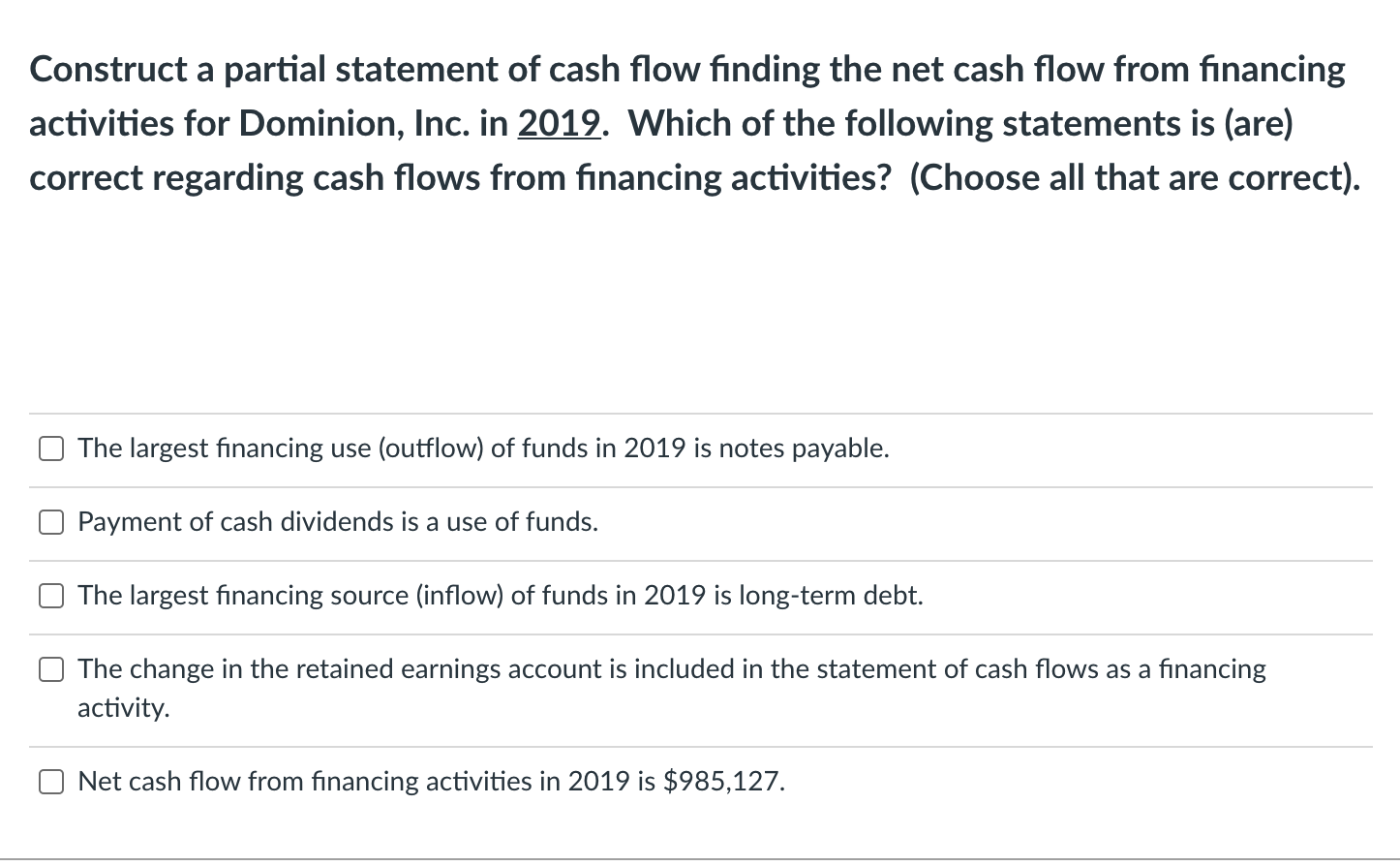

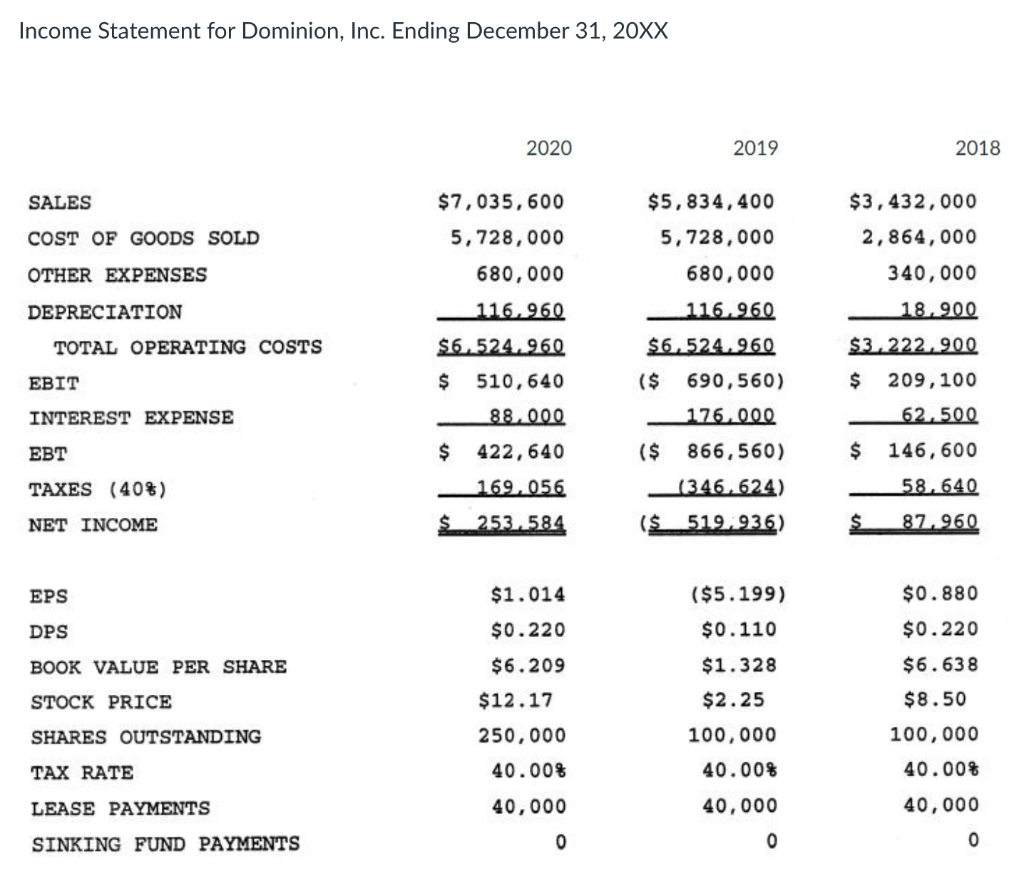

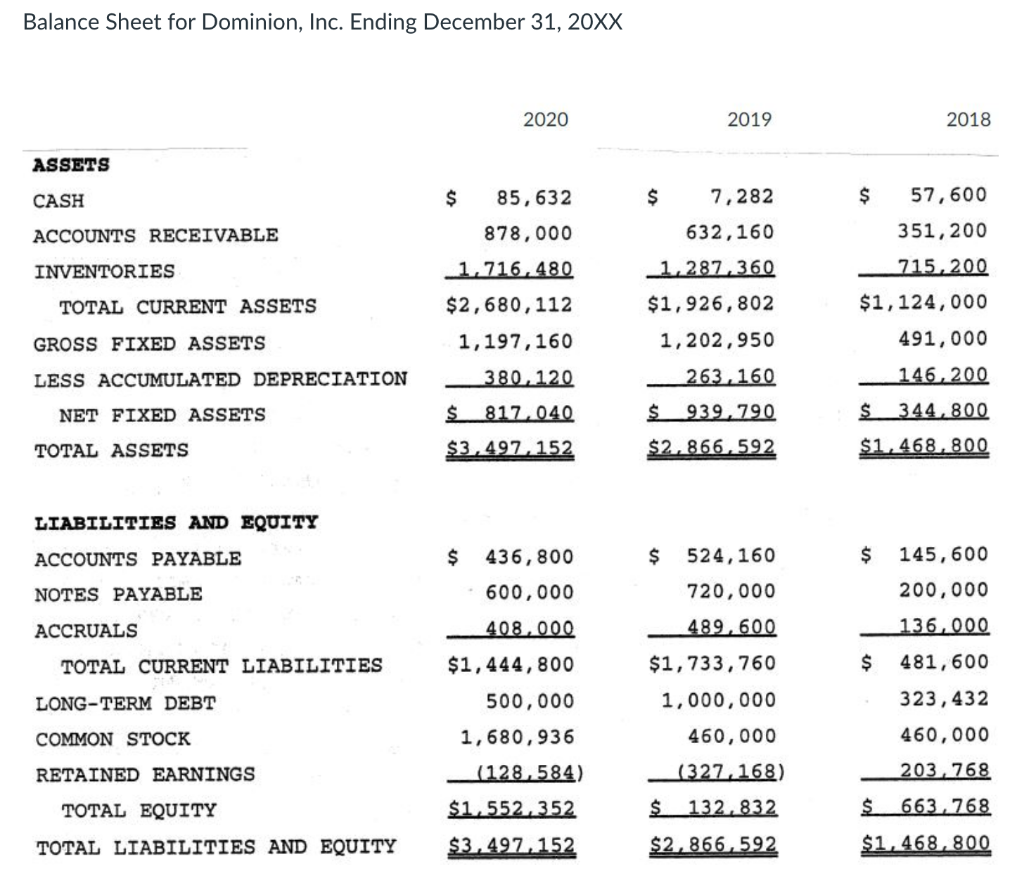

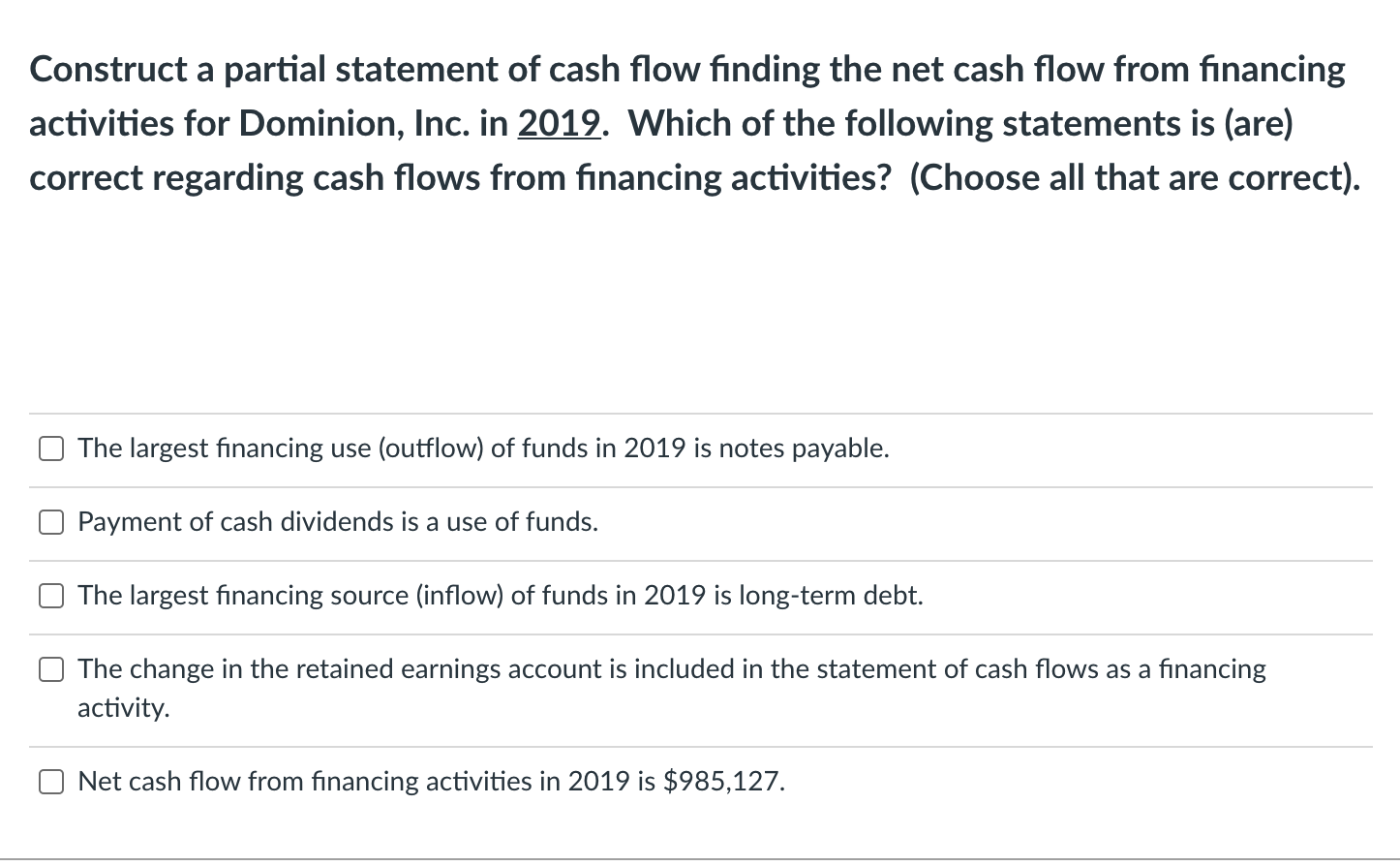

Income Statement for Dominion, Inc. Ending December 31, 20XX 2020 2019 2018 SALES $5,834,400 COST OF GOODS SOLD $7,035,600 5,728,000 680,000 $3,432,000 2,864,000 340,000 OTHER EXPENSES 5,728,000 680,000 116.960 $6.524,960 DEPRECIATION 116.960 18.900 $3,222, 900 TOTAL OPERATING COSTS EBIT $6.524,960 $ 510,640 88.000 $ 209, 100 INTEREST EXPENSE 62.500 EBT $ ($ 690,560) 176.000 ($ 866,560) (346.624) ($ 519,936) $ 422,640 169,056 146,600 TAXES (40%) 58.640 NET INCOME $ 253,584 $ 87.960 EPS $1.014 ($5.199) $0.880 DPS $0.220 $0.110 $0.220 BOOK VALUE PER SHARE $1.328 $6.638 STOCK PRICE $6.209 $12.17 250,000 $2.25 SHARES OUTSTANDING 100,000 40.00% $8.50 100,000 40.00% TAX RATE 40.00% LEASE PAYMENTS 40,000 40,000 40,000 SINKING FUND PAYMENTS 0 0 0 Balance Sheet for Dominion, Inc. Ending December 31, 20XX 2020 2019 2018 ASSETS CASH $ 7,282 $ 57,600 ACCOUNTS RECEIVABLE 351,200 INVENTORIES $ 85,632 878,000 1,716,480 $2,680,112 1,197,160 632,160 1,287,360 $1,926, 802 715,200 TOTAL CURRENT ASSETS $1,124,000 491,000 GROSS FIXED ASSETS 1,202,950 263,160 LESS ACCUMULATED DEPRECIATION 380, 120 146,200 NET FIXED ASSETS $ 817.040 $ 939,790 $ 344,800 TOTAL ASSETS $3,497,152 $2.866.592 $1,468.800 LIABILITIES AND EQUITY ACCOUNTS PAYABLE $ $ $ 145,600 NOTES PAYABLE 436,800 600,000 408.000 524,160 720,000 489,600 200,000 ACCRUALS 136.000 TOTAL CURRENT LIABILITIES $ 481,600 LONG-TERM DEBT 323, 432 COMMON STOCK $1,444,800 500,000 1,680,936 (128,584) $1,552, 352 460,000 $1,733, 760 1,000,000 460,000 (327,168) $ 132,832 $2,866,592 RETAINED EARNINGS 203, 768 TOTAL EQUITY $ 663,768 $1, 468,800 TOTAL LIABILITIES AND EQUITY $3,497,152 Construct a partial statement of cash flow finding the net cash flow from financing activities for Dominion, Inc. in 2019. Which of the following statements is (are) correct regarding cash flows from financing activities? (Choose all that are correct). The largest financing use (outflow) of funds in 2019 is otes payable. Payment of cash dividends is a use of funds. The largest financing source (inflow) of funds in 2019 is long-term debt. The change in the retained earnings account is included in the statement of cash flows as a financing activity. Net cash flow from financing activities in 2019 is $985,127