Answered step by step

Verified Expert Solution

Question

1 Approved Answer

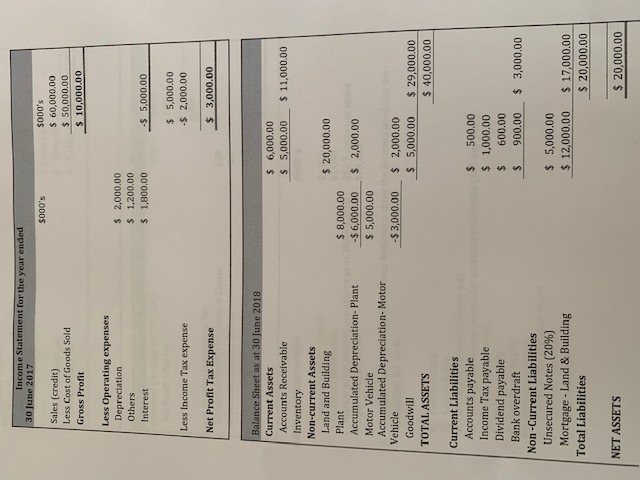

Income Statement for the year ended 30 June 2017 $000's $000's $ 60,000.00 $ 50,000.00 $ 10,000.00 Sales (credit) Less Cost of Goods Sold

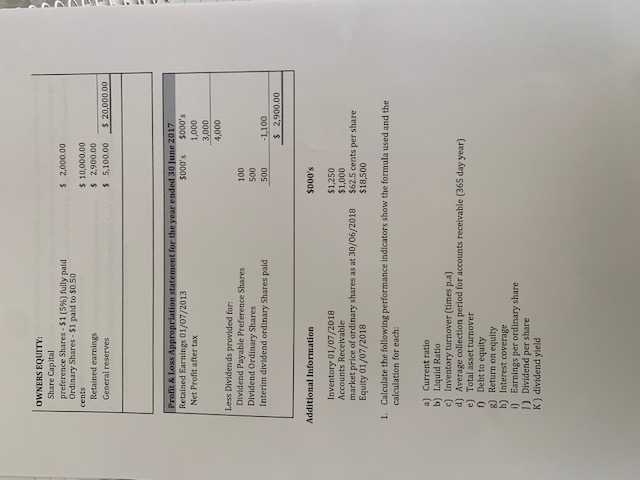

Income Statement for the year ended 30 June 2017 $000's $000's $ 60,000.00 $ 50,000.00 $ 10,000.00 Sales (credit) Less Cost of Goods Sold Gross Profit Less Operating expenses $ 2,000.00 Depreciation Others $ 1,200.00 Interest $ 1,800.00 Less Income Tax expense Net Profit Tax Expense Balance Sheet as at 30 June 2018 Current Assets Accounts Receivable Inventory Non-current Assets Land and Building Plant Accumulated Depreciation- Plant Motor Vehicle Accumulated Depreciation- Motor Vehicle Goodwill TOTAL ASSETS Current Liabilities Accounts payable -$ 5,000.00 $ 5,000.00 -$ 2,000.00 $ 6,000.00 $ 3,000.00 $ 5,000.00 $ 11,000.00 $ 20,000.00 $ 8,000.00 -$6,000.00 $ 2,000.00 $ 5,000.00 -$3,000.00 $ 2,000.00 $ 5,000.00 $ 29,000.00 $ 500.00 $ 40,000.00 Income Tax payable Dividend payable Bank overdraft Non-Current Liabilities $ 1,000.00 $ 600.00 $ 900.00 $ 3,000.00 Unsecured Notes (20%) $ 5,000.00 Mortgage Land & Building $ 12,000.00 $ 17,000.00 Total Liabilities $ 20,000.00 NET ASSETS $ 20,000.00 OWNERS EQUITY: Share Capital preference Shares-$1 (5%) fully paid Ordinary Shares- $1 paid to $0.50 cents Retained earnings General reserves $ 2,000.00 $ 10,000.00 $ 2,900.00 $ 5,100.00 $ 20,000.00 Profit & Loss Appropriation statement for the year ended 30 June 2017 Retained Earnings 01/07/2013 $000's Net Profit after tax Less Dividends provided for: Dividend Payable Preference Shares Dividend Ordinary Shares Interim dividend ordinary Shares paid $000's 1,000 3,000 4,000 100 500 500 -1,100 $ 2,900.00 Additional Information Inventory 01/07/2018 Accounts Receivable market price of ordinary shares as at 30/06/2018 Equity 01/07/2018 $000's $1,250 $1,000 $62.5 cents per share $18,500 1. Calculate the following performance indicators show the formula used and the calculation for each: a) Current ratio b) Liquid Ratio c) Inventory turnover (times p.a) d) Average collection period for accounts receivable (365 day year) e) Total asset turnover f) Debt to equity g) Return on equity h) Interest coverage i) Earnings per ordinary share 1) Dividend per share K) dividend yield 2. Complete the Client Information Form provided with this assessment for the case study 3. Provide suggestions for the client about their business performance by providing an overview of the business performance and options for continuance of the business for short and long term loan options 4. Assessment of the relevant significant taxation issues 5. Provide details of sources of all advice that you have used, including the relevant authorities and where was sourced from.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started