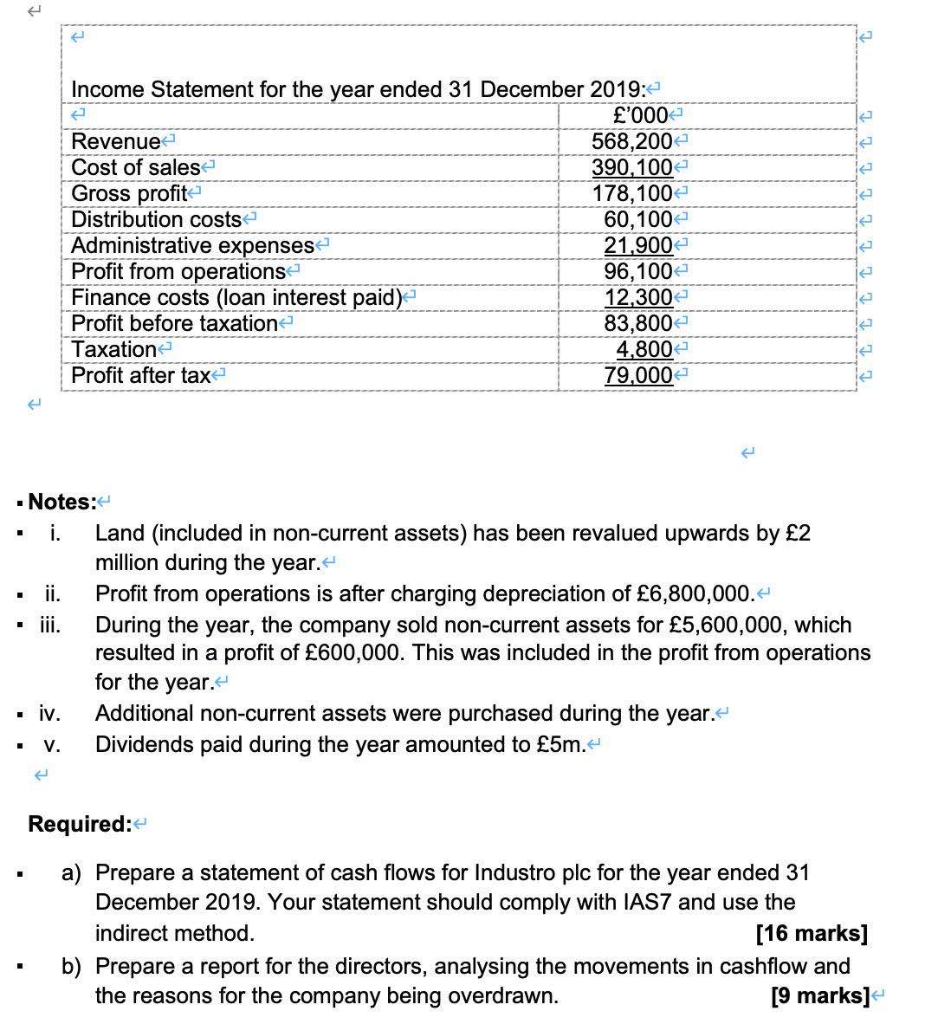

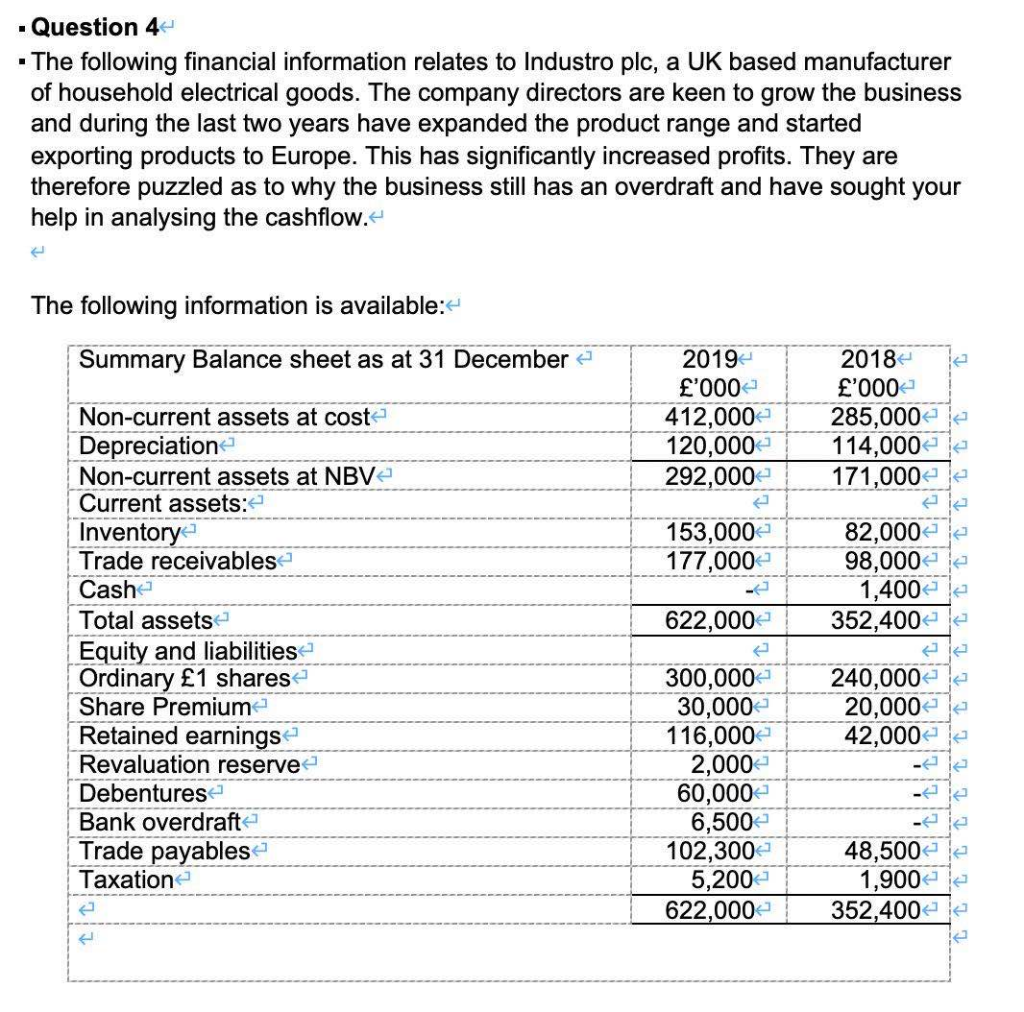

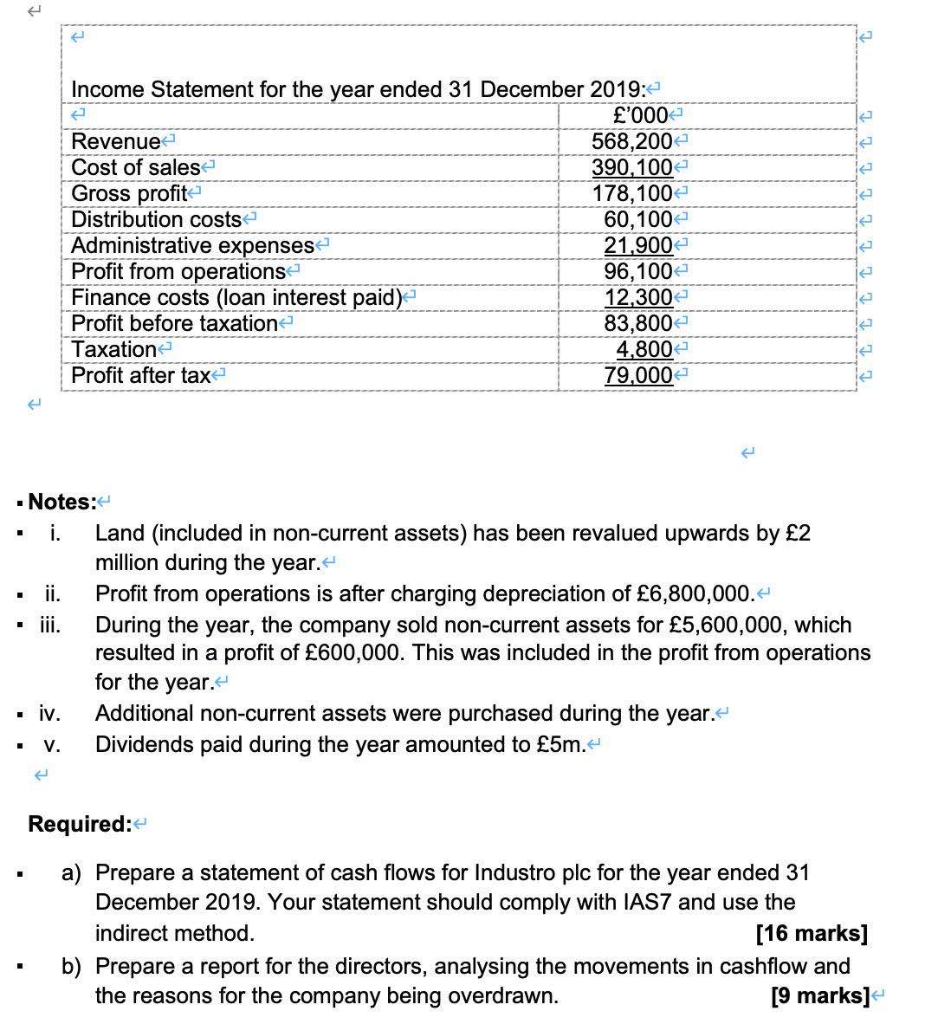

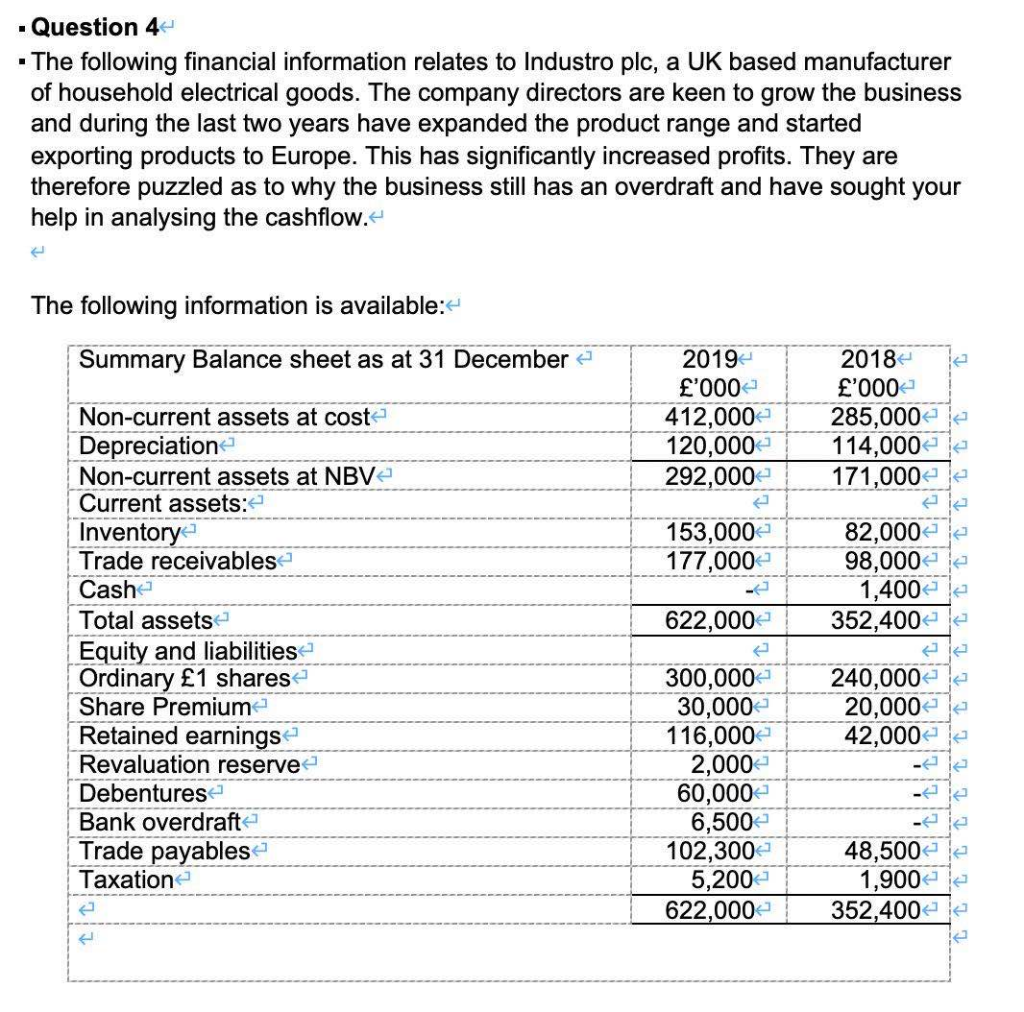

Income Statement for the year ended 31 December 2019: '000 Revenue 568,200 Cost of sales 390,100 Gross profit 178,100 Distribution costs 60,100 Administrative expenses 21,900 Profit from operations 96,100 Finance costs (loan interest paid) 12.300 Profit before taxation 83,800 Taxation 4,800 Profit after tax 79,000 ka ka . Notes: i. Land (included in non-current assets) has been revalued upwards by 2 million during the year.' Profit from operations is after charging depreciation of 6,800,000.- iii. During the year, the company sold non-current assets for 5,600,000, which resulted in a profit of 600,000. This was included in the profit from operations for the year. . iv. Additional non-current assets were purchased during the year. Dividends paid during the year amounted to 5m. V. Required: . a) Prepare a statement of cash flows for Industro plc for the year ended 31 December 2019. Your statement should comply with IAS7 and use the indirect method. [16 marks] b) Prepare a report for the directors, analysing the movements in cashflow and the reasons for the company being overdrawn. [9 marks] . Question 4 The following financial information relates to Industro plc, a UK based manufacturer of household electrical goods. The company directors are keen to grow the business and during the last two years have expanded the product range and started exporting products to Europe. This has significantly increased profits. They are therefore puzzled as to why the business still has an overdraft and have sought your help in analysing the cashflow.' The following information is available:- Summary Balance sheet as at 31 December 2019 '000 412,000 120,000 292,000 2018 '000 285,000 114,000 171,000 ia ie 153,000 177,000 82,000 98,000 1,400 352,400 622,000 Non-current assets at costa Depreciation Non-current assets at NBV Current assets: Inventory Trade receivables Cash Total assets Equity and liabilities Ordinary 1 shares Share Premium Retained earnings Revaluation reserve Debentures Bank overdraft Trade payables Taxation 240,000 20,000 42,000 300,000 30,000 116,000 2,000 60,000 6,500 102,300 5,200 622,000 le ka 48,500 1,900 352,4002