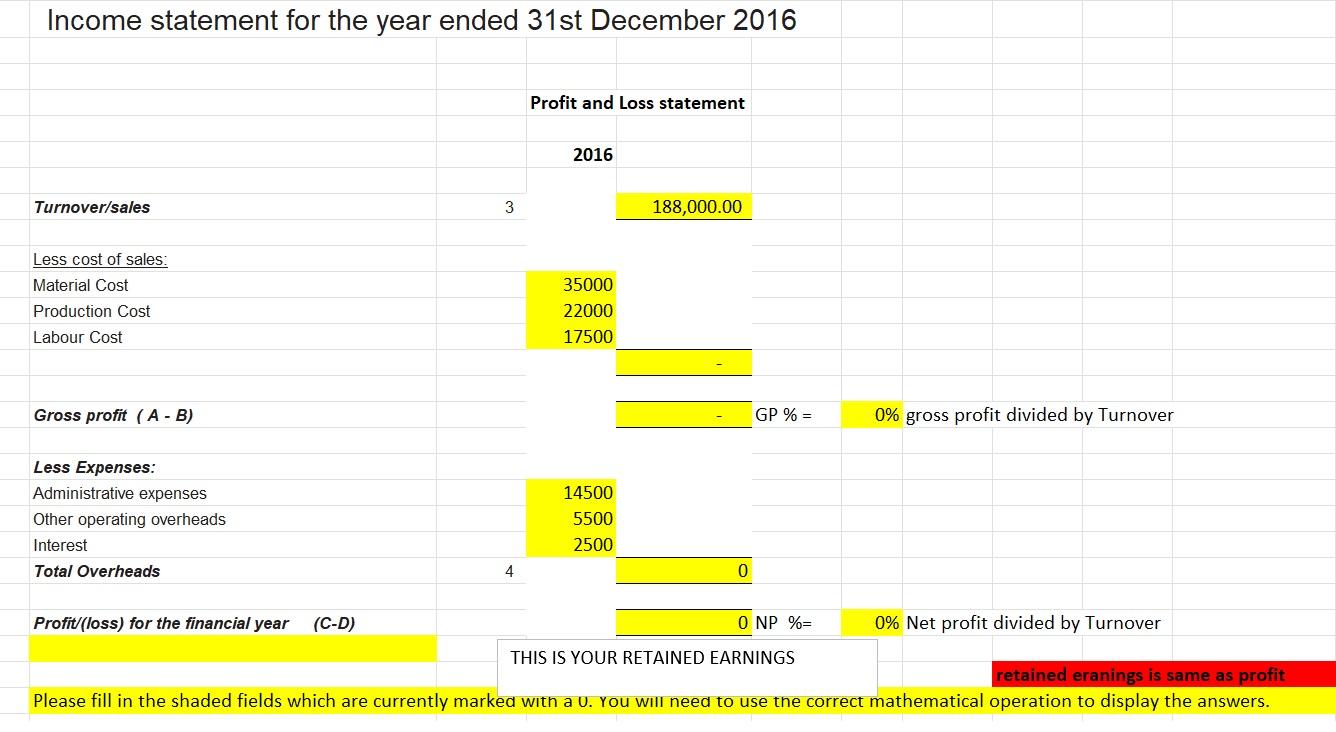

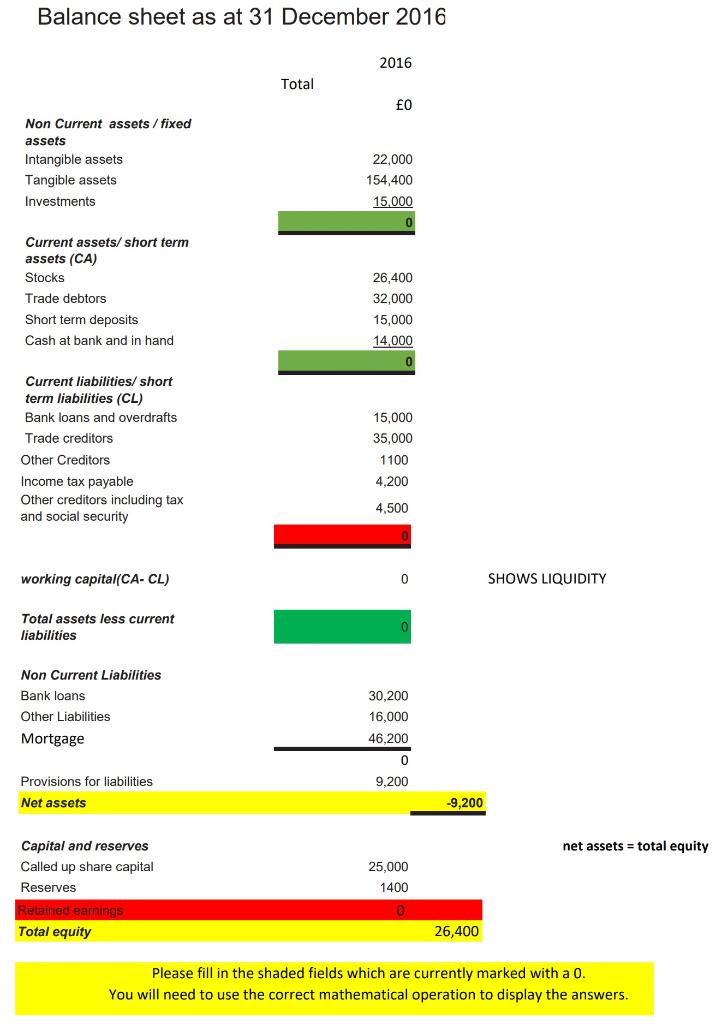

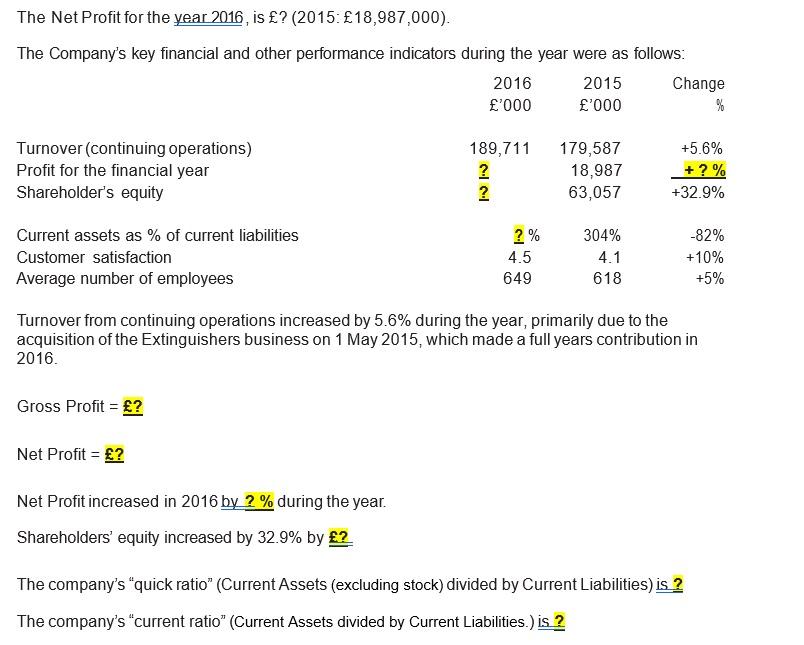

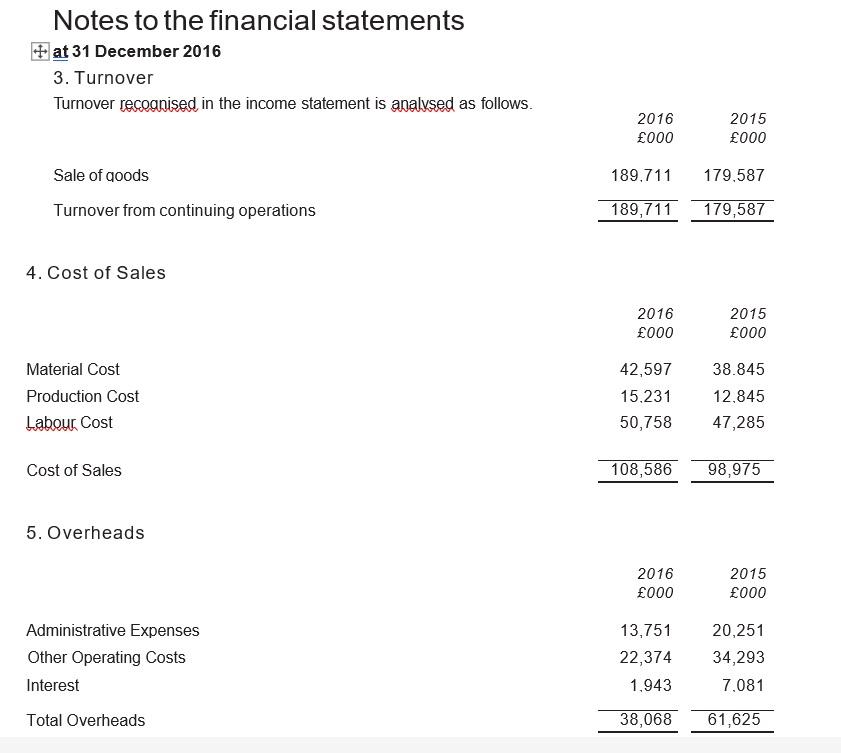

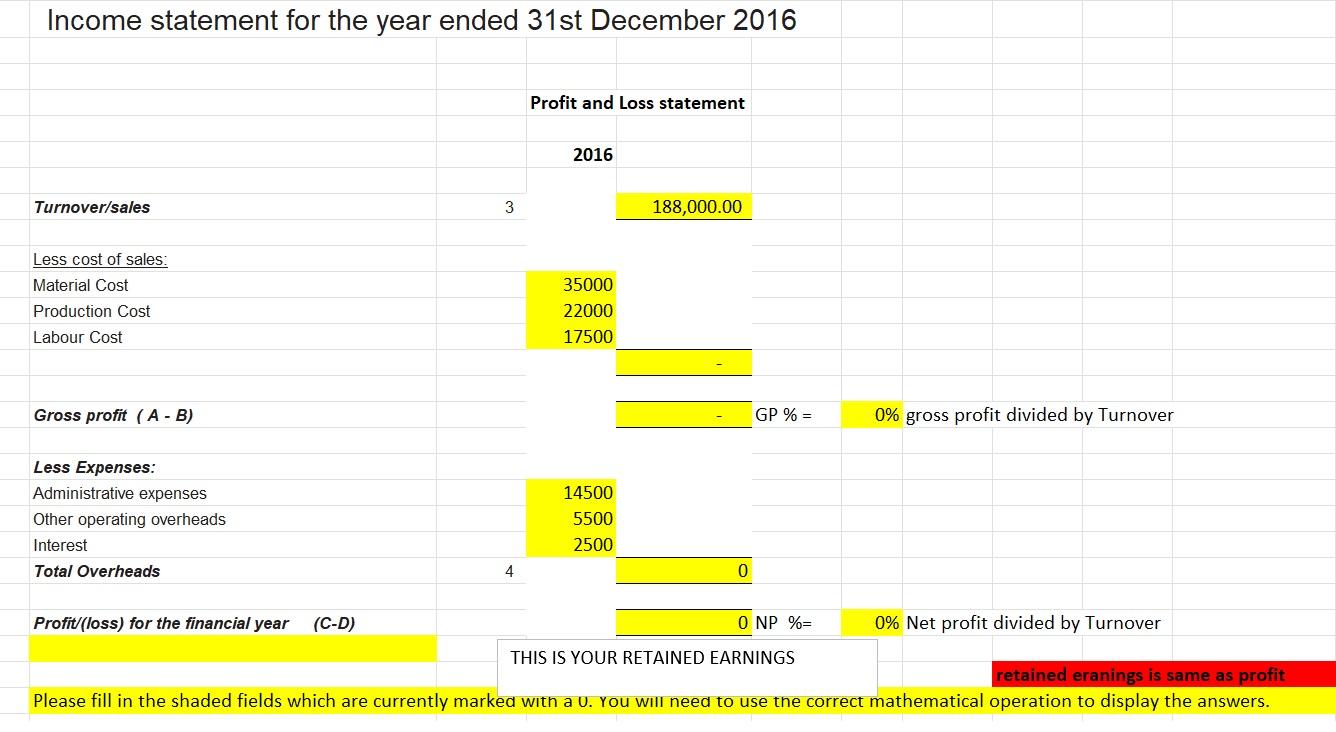

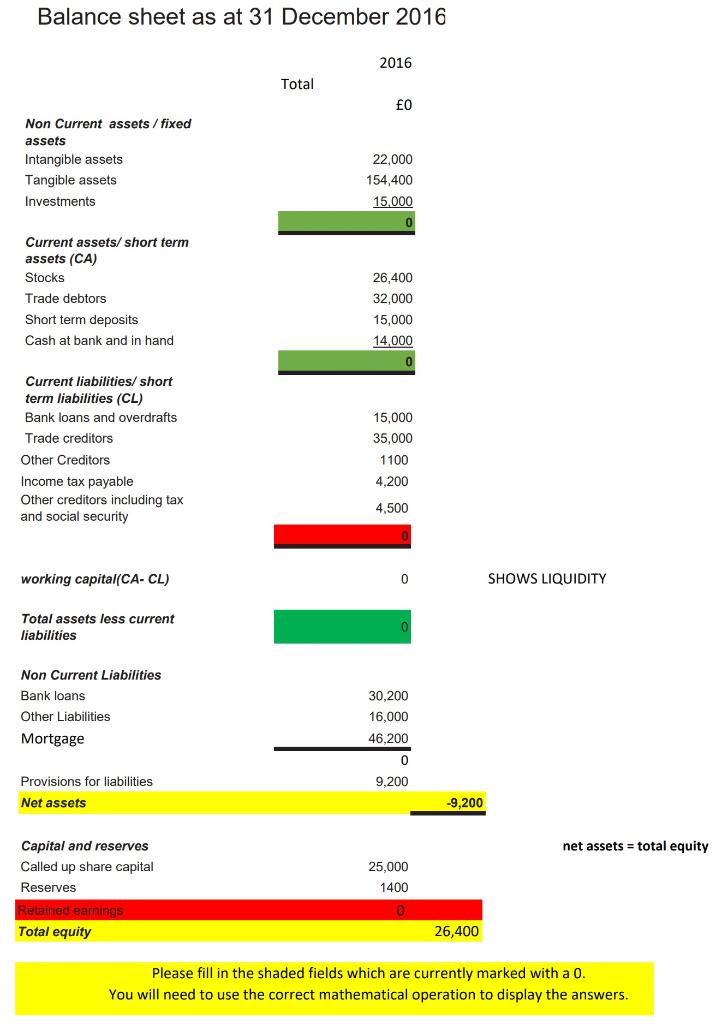

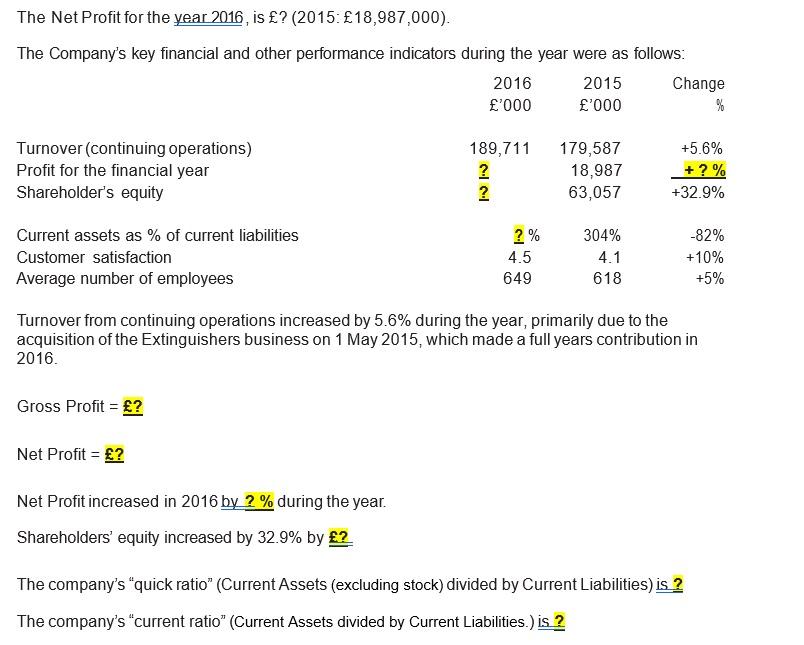

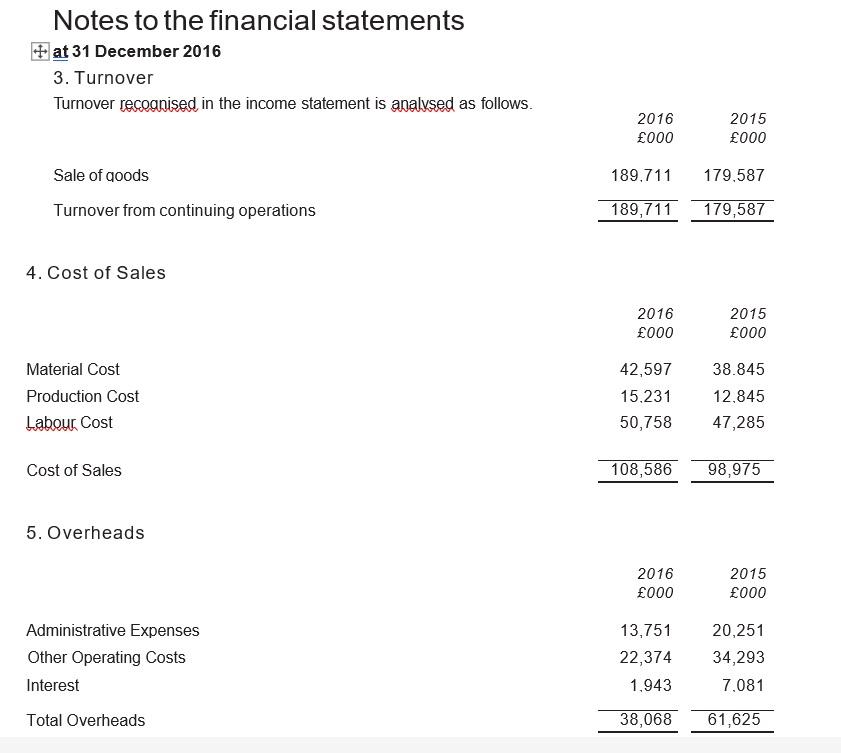

Income statement for the year ended 31st December 2016 Profit and Loss statement 2016 Turnover/sales 3 188,000.00 Less cost of sales: Material Cost Production Cost Labour Cost 35000 22000 17500 Gross profit (A-B) GP % = 0% gross profit divided by Turnover Less Expenses: Administrative expenses Other operating overheads Interest Total Overheads 14500 5500 2500 4 0 Profit/(loss) for the financial year (C-D) O NP %= 0% Net profit divided by Turnover THIS IS YOUR RETAINED EARNINGS retained eranings is same as profit Please fill in the shaded fields which are currently marked with a 0. You will need to use the correct mathematical operation to display the answers. Balance sheet as at 31 December 2016 2016 Total EO Non Current assets / fixed assets Intangible assets Tangible assets Investments 22,000 154,400 15,000 Current assets/ short term assets (CA) Stocks Trade debtors Short term deposits Cash at bank and in hand 26,400 32,000 15,000 14,000 Current liabilities/ short term liabilities (CL) Bank loans and overdrafts Trade creditors Other Creditors Income tax payable Other creditors including tax and social security 1111 15,000 35,000 1100 4,200 4,500 working capital(CA-CL) SHOWS LIQUIDITY Total assets less current liabilities Non Current Liabilities Bank loans Other Liabilities Mortgage 30,200 16,000 46,200 0 9,200 Provisions for liabilities Net assets -9,200 net assets = total equity Capital and reserves Called up share capital Reserves 25,000 1400 Retained earnings Total equity 26,400 Please fill in the shaded fields which are currently marked with a 0. You will need to use the correct mathematical operation to display the answers. The Net Profit for the year 2016, is ? (2015: 18,987,000). The Company's key financial and other performance indicators during the year were as follows: 2016 2015 Change '000 '000 % Turnover (continuing operations) Profit for the financial year Shareholder's equity 189,711 ? ? 179,587 18,987 63,057 +5.6% + ? % +32.9% 2% Current assets as % of current liabilities Customer satisfaction Average number of employees 4.5 649 304% 4.1 618 -82% +10% +5% Turnover from continuing operations increased by 5.6% during the year, primarily due to the acquisition of the Extinguishers business on 1 May 2015, which made a full years contribution in 2016. Gross Profit = ? Net Profit = ? Net Profit increased in 2016 by 2 % during the year. Shareholders' equity increased by 32.9% by ? The company's "quick ratio" (Current Assets (excluding stock) divided by Current Liabilities) is? The company's "current ratio" (Current Assets divided by Current Liabilities.) is? Notes to the financial statements + at 31 December 2016 3. Turnover Turnover recognised in the income statement is analysed as follows. 2016 000 2015 000 189.711 179,587 Sale of goods Turnover from continuing operations 189,711 179,587 4. Cost of Sales 2016 000 2015 000 Material Cost Production Cost Labour Cost 42,597 15.231 50,758 38.845 12,845 47,285 Cost of Sales 108,586 98,975 5. Overheads 2016 000 2015 000 Administrative Expenses Other Operating costs Interest 13,751 22,374 1.943 20,251 34,293 7.081 Total Overheads 38,068 61,625