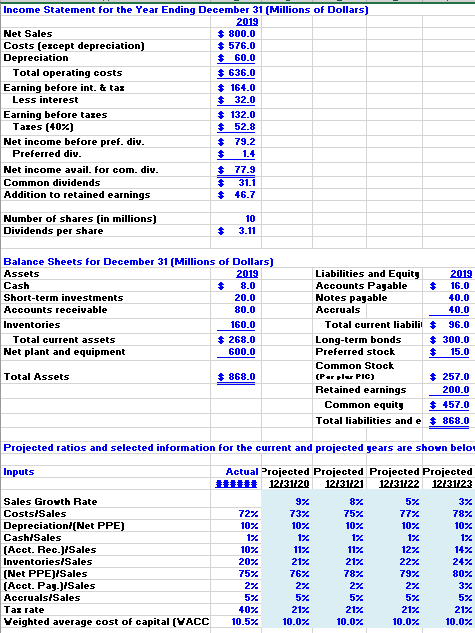

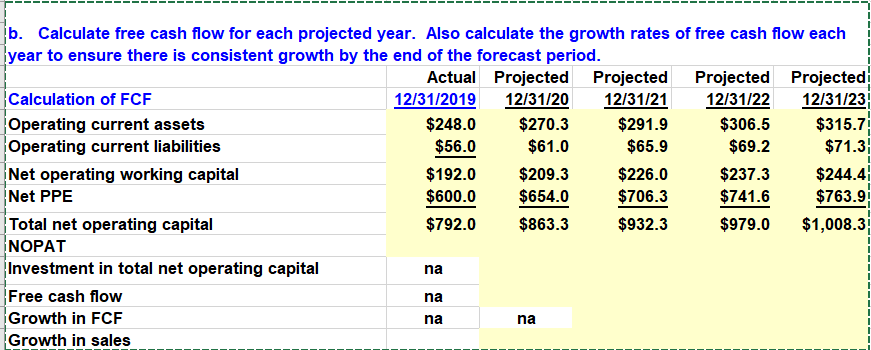

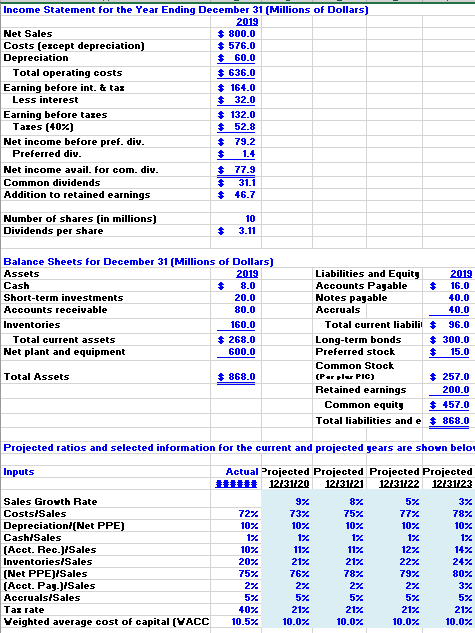

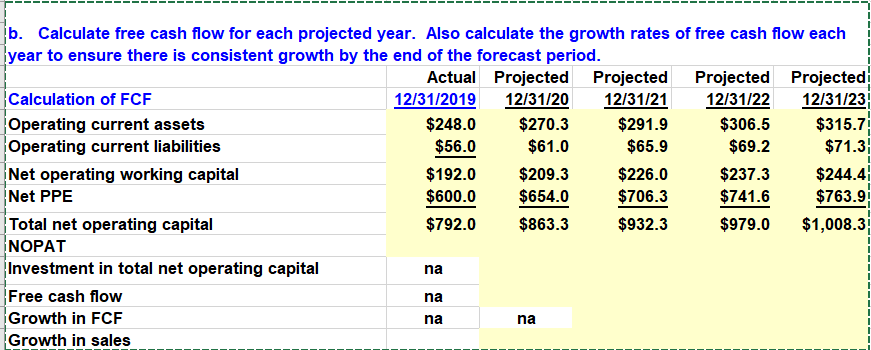

Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 Net Sales $ 800.0 Costs (except depreciation) $ 576.0 Depreciation $ 60.0 Total operating costs $ 636.0 Earning before int. & tar $164.0 Less interest $ 32.0 Earning before taxes $ 132.0 Tares (407) $ 52.8 Net income before pref. div. $ 79.2 Preferred div. $ 1.4 Net income avail. for com. div. $ 77.9 Common dividends $ 31.1 Addition to retained earnings $ 46.7 Number of shares (in millions) Dividends per share 10 3.11 $ Balance Sheets for December 31 (Millions of Dollars) Assets 2019 Cash $ 8.0 Short-term investments 20.0 Accounts receivable 80.0 Inventories 160.0 Total current assets $268.0 Net plant and equipment 600.0 Liabilities and Equity 2019 Accounts Payable $ 16.0 Notes pagable 40.0 Accruals 40.0 Total current liabilit $ 96.0 Long-term bonds $ 300.0 Preferred stock $ 15.0 Common Stock (Par plor PIC) $ 257.0 Retained earnings 200.0 Common equity $ 457.0 Total liabilities and e $868.0 Total Assets $ 868.0 Projected ratios and selected information for the current and projected gears are shown belo Inputs Sales Groyth Rate Costs/Sales Depreciation/(Net PPE) Cash/Sales (Acct. Rec.)/Sales Inventories/Sales (Net PPE)/Sales (Acct. Pag.)/Sales Accruals/Sales Tax rate Veighted average cost of capital (VACC Actual Projected Projected Projected Projected W 12/31/20 12/31/21 12/31/22 12/31/23 97 87 5% 37 72% 737 75% 77% 78% 10% 10% 10% 10% 107 17 17 17 17 17 10% 117 117 12% 147 20% 2172 21% 227 24% 75% 76% 78% 79% 80% 27 27 27 27 37 5% 5% 5% 5% 5% 40% 217 21% 217 217 10.5% 10.07 10.0% 10.0% 10.07 b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure there is consistent growth by the end of the forecast period. Actual Projected Projected Projected Projected Calculation of FCF 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 Operating current assets $248.0 $270.3 $291.9 $306.5 $315.7 Operating current liabilities $56.0 $61.0 $65.9 $69.2 $71.3 Net operating working capital $192.0 $209.3 $226.0 $237.3 $244.4 Net PPE $600.0 $654.0 $706.3 $741.6 $763.9 Total net operating capital $792.0 $863.3 $932.3 $979.0 $1,008.3 NOPAT Investment in total net operating capital Free cash flow Growth in FCF Growth in sales na na na na Income Statement for the Year Ending December 31 (Millions of Dollars) 2019 Net Sales $ 800.0 Costs (except depreciation) $ 576.0 Depreciation $ 60.0 Total operating costs $ 636.0 Earning before int. & tar $164.0 Less interest $ 32.0 Earning before taxes $ 132.0 Tares (407) $ 52.8 Net income before pref. div. $ 79.2 Preferred div. $ 1.4 Net income avail. for com. div. $ 77.9 Common dividends $ 31.1 Addition to retained earnings $ 46.7 Number of shares (in millions) Dividends per share 10 3.11 $ Balance Sheets for December 31 (Millions of Dollars) Assets 2019 Cash $ 8.0 Short-term investments 20.0 Accounts receivable 80.0 Inventories 160.0 Total current assets $268.0 Net plant and equipment 600.0 Liabilities and Equity 2019 Accounts Payable $ 16.0 Notes pagable 40.0 Accruals 40.0 Total current liabilit $ 96.0 Long-term bonds $ 300.0 Preferred stock $ 15.0 Common Stock (Par plor PIC) $ 257.0 Retained earnings 200.0 Common equity $ 457.0 Total liabilities and e $868.0 Total Assets $ 868.0 Projected ratios and selected information for the current and projected gears are shown belo Inputs Sales Groyth Rate Costs/Sales Depreciation/(Net PPE) Cash/Sales (Acct. Rec.)/Sales Inventories/Sales (Net PPE)/Sales (Acct. Pag.)/Sales Accruals/Sales Tax rate Veighted average cost of capital (VACC Actual Projected Projected Projected Projected W 12/31/20 12/31/21 12/31/22 12/31/23 97 87 5% 37 72% 737 75% 77% 78% 10% 10% 10% 10% 107 17 17 17 17 17 10% 117 117 12% 147 20% 2172 21% 227 24% 75% 76% 78% 79% 80% 27 27 27 27 37 5% 5% 5% 5% 5% 40% 217 21% 217 217 10.5% 10.07 10.0% 10.0% 10.07 b. Calculate free cash flow for each projected year. Also calculate the growth rates of free cash flow each year to ensure there is consistent growth by the end of the forecast period. Actual Projected Projected Projected Projected Calculation of FCF 12/31/2019 12/31/20 12/31/21 12/31/22 12/31/23 Operating current assets $248.0 $270.3 $291.9 $306.5 $315.7 Operating current liabilities $56.0 $61.0 $65.9 $69.2 $71.3 Net operating working capital $192.0 $209.3 $226.0 $237.3 $244.4 Net PPE $600.0 $654.0 $706.3 $741.6 $763.9 Total net operating capital $792.0 $863.3 $932.3 $979.0 $1,008.3 NOPAT Investment in total net operating capital Free cash flow Growth in FCF Growth in sales na na na na