Question

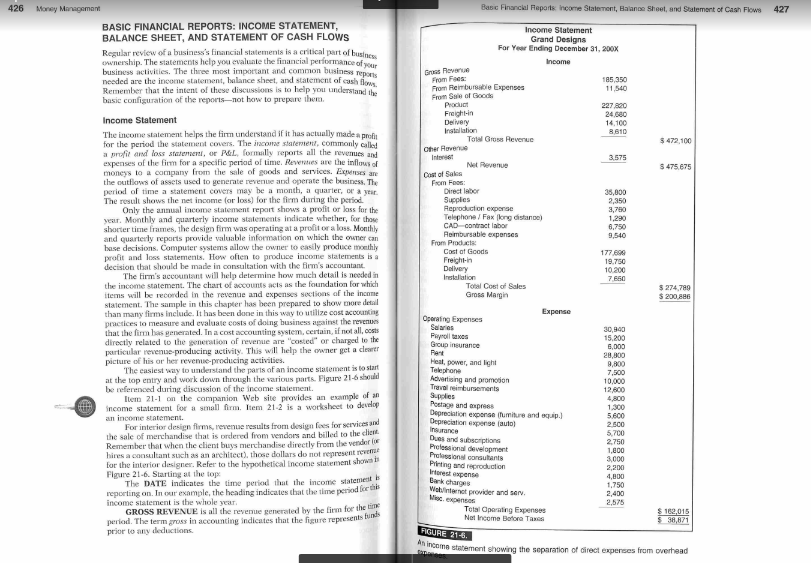

Income Statement of an interior design firm, Grand Designs, that makes money by selling hours (fees) and by selling furniture or other items (Sale of

Income Statement of an interior design firm, Grand Designs, that makes money by selling hours (fees) and by selling furniture or other items (Sale of Goods).

1) Using the formula for Profit Margin, what is the profit margin for Grand Designs? Use the item listed as Net Income Before Taxes as Total Income and use the item listed as Total Gross Revenue as Total Revenue.

2) An owner of a firm can increase the Profit, and therefore the Profit Margin, by either increasing revenues or reducing expenses. Looking at the Income Statement for Grand Designs, provide three examples of what an owner could do to increase Profit Margin.

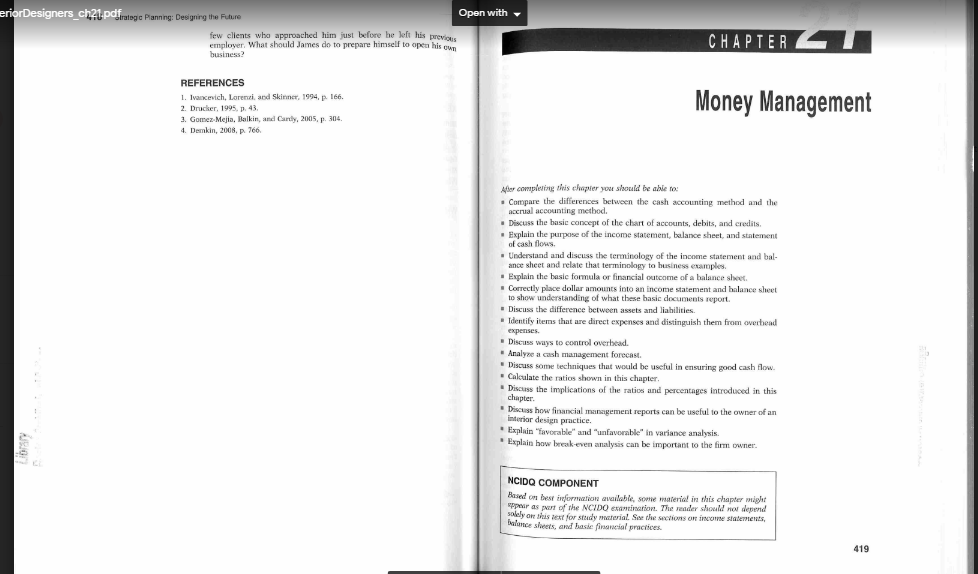

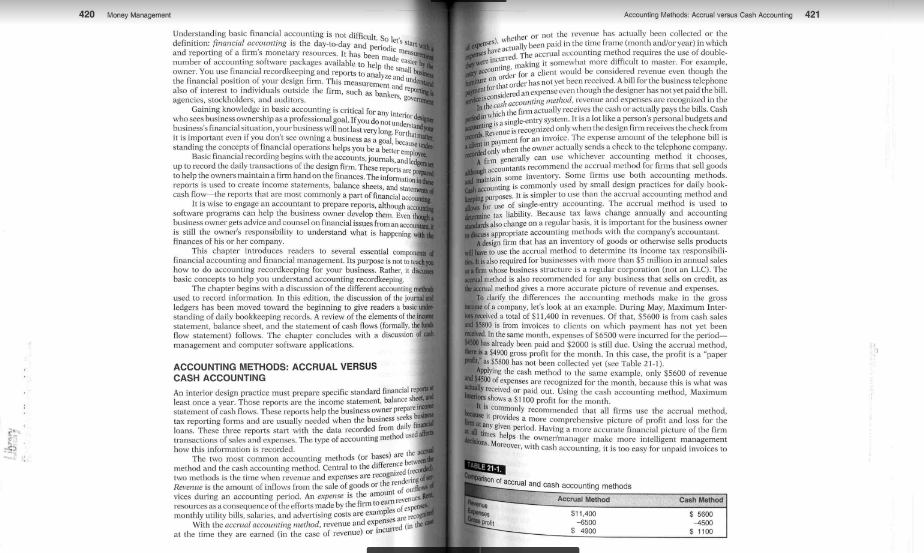

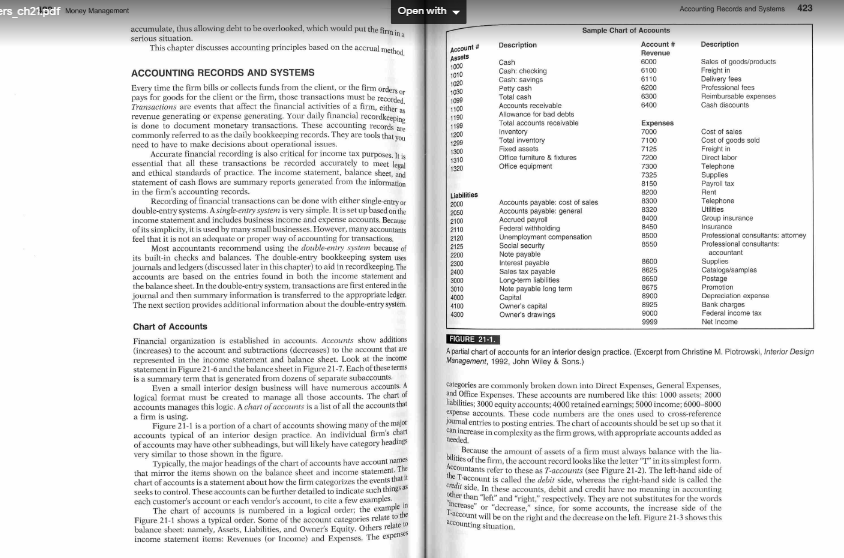

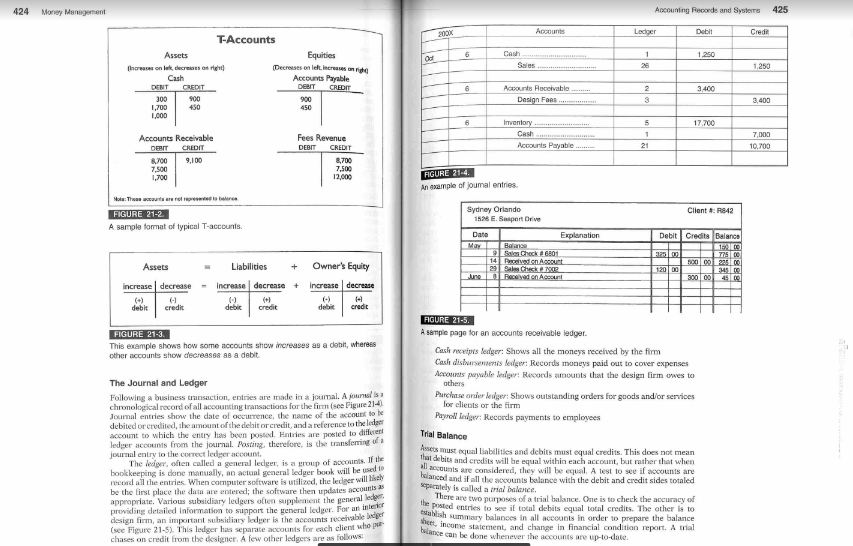

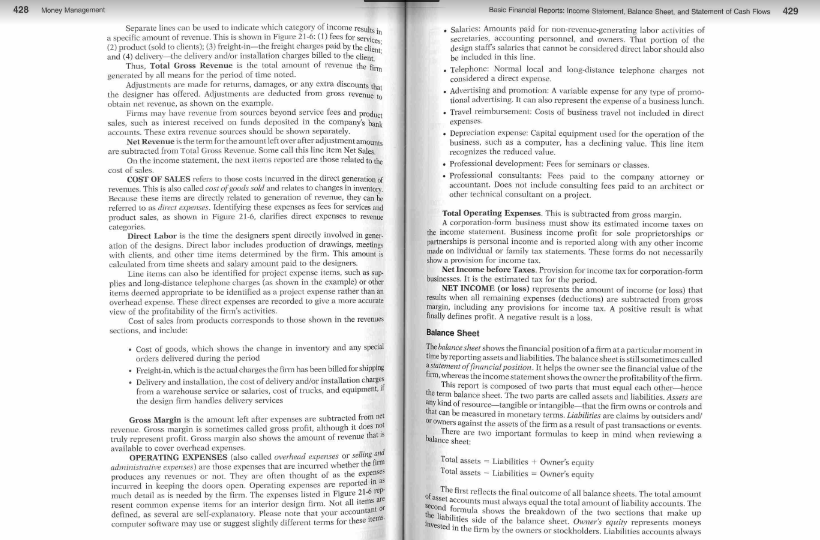

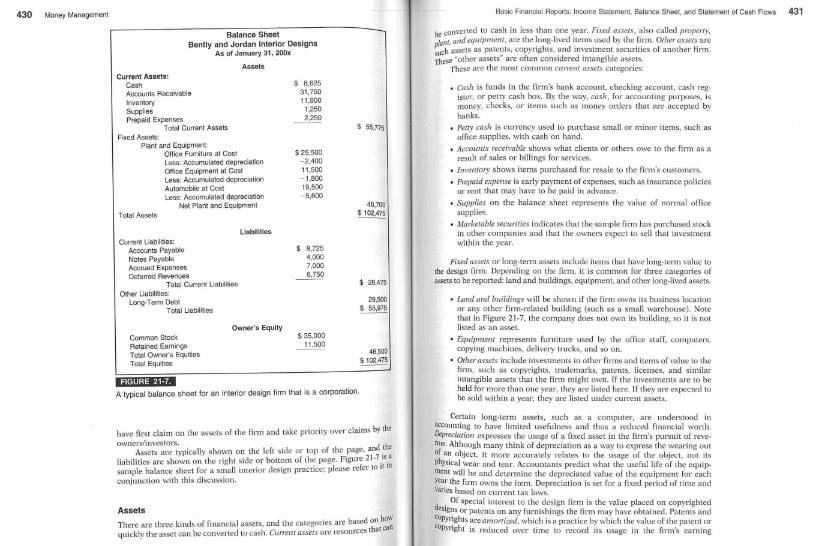

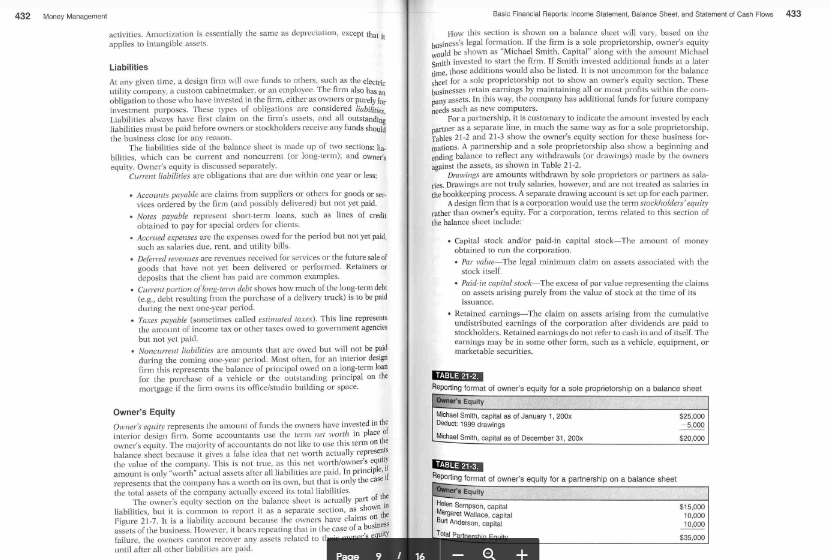

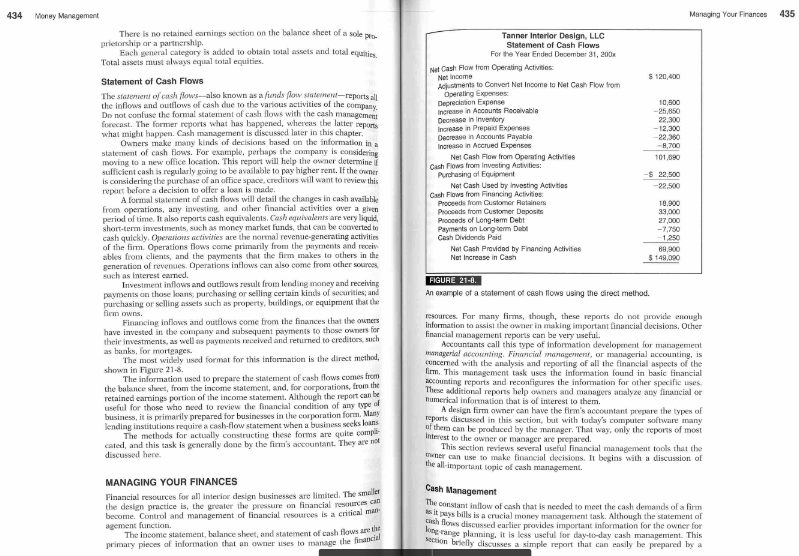

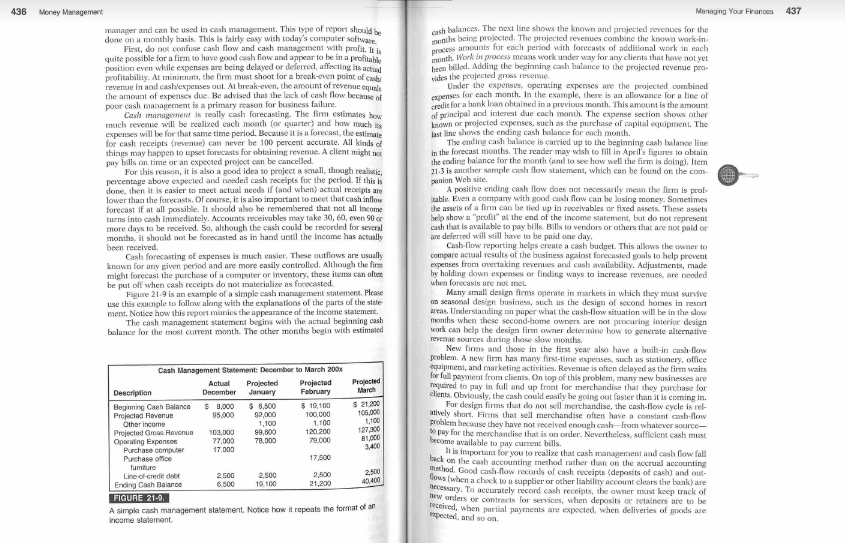

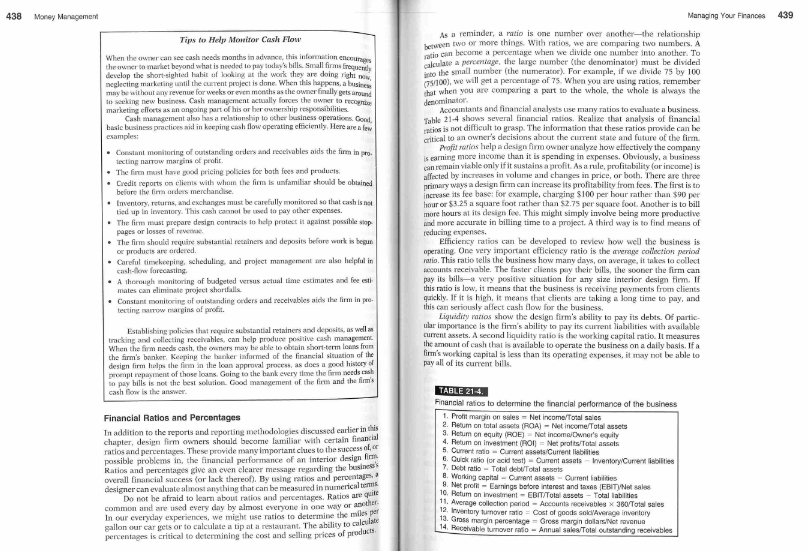

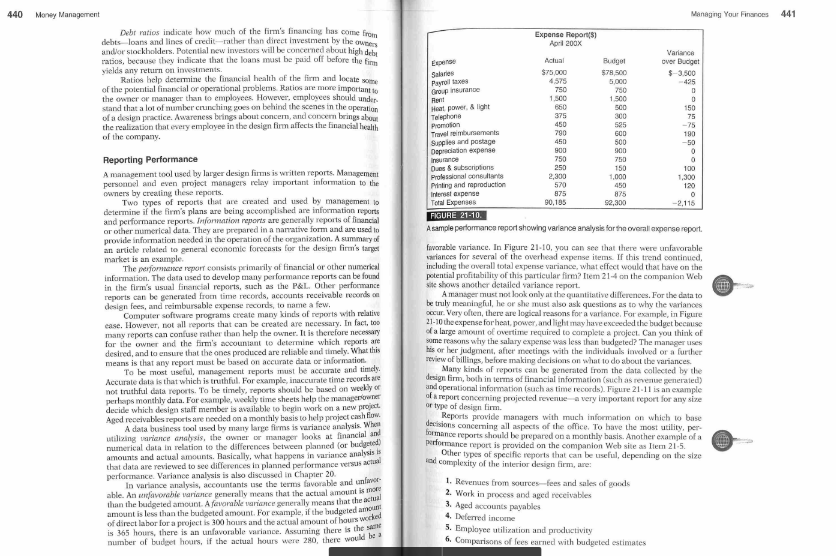

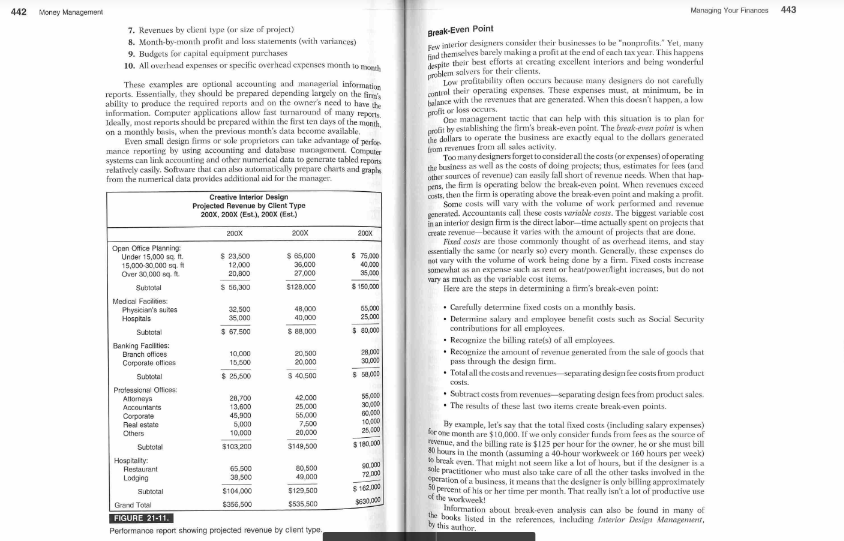

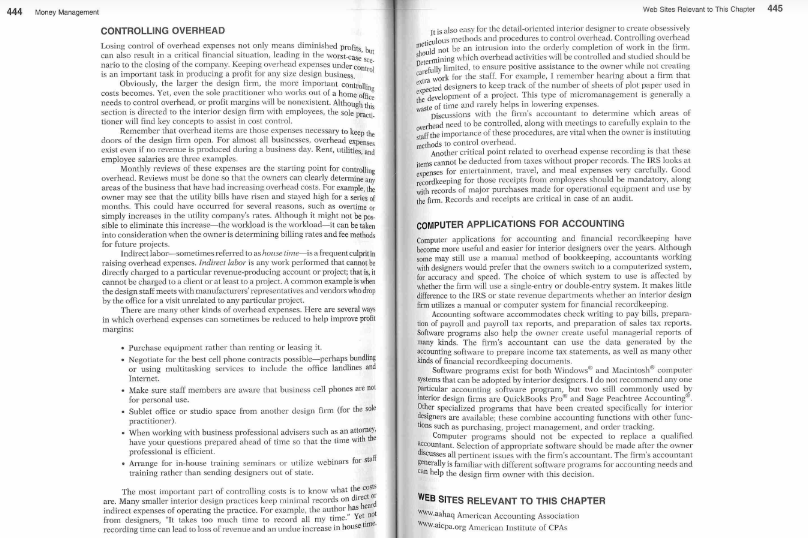

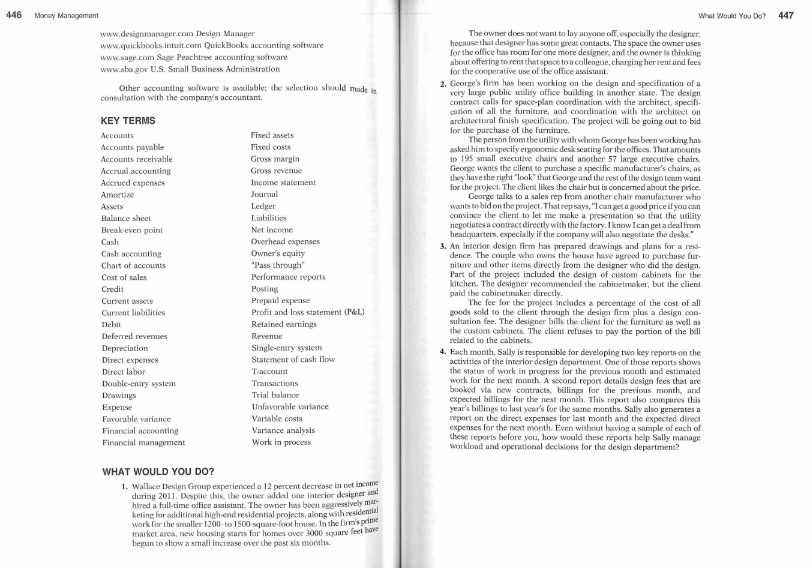

erior Designers_ch?1.pdfrategic Planning Designing the Future Open with few clients who approached him just before he left his previous employer. What should James do to prepare himself to open his own business? CHAPTER REFERENCES 1. Ivacevich, Lorenzi and Skinner, 1994, p. 166. 2. Drucker, 1995, p. 43 3. Gomez Mejia, Balkin, and Carly, 2005, p. 304 4. Demkin, 2008, p766 Money Management After completing this chapter you should be able to . Compare the differences between the cash accounting method and the accrual accounting method. Discuss the basic concept of the chart of accounts, debits, and credits. Explain the purpose of the income statement, balance sheet, and statement of cash flows. Understand and discuss the terminology of the income statement and bal- ance sheet and relate that terminology to business examples. Explain the basic formula or financial outcome of a balance sheet Correctly place dollar amounts into an income statement and balance sheet to show understanding of what these basic documents report Discuss the difference between assets and liabilities Identify items that are direct expenses and distinguish them from overhead expenses. - Discuss ways to control overhead. Analyze a cash management forecast Discuss some techniques that would be useful in ensuring good cash flow. Calculate the ratios shown in this chapter - Discuss the implications of the ratios and percentages introduced in this chapter Discuss how financial management reports can be useful to the owner of an interior design practice * Explain "favorable and unfavorable" in variance analysis Explain how break-even analysis can be important to the firm owner. NCIDO COMPONENT Based on best information available, some material in this chapter might spoir as put of the NCIDO examination. The reader should not depend solely on this text for study material. See the actions or income statements, balance sheets, and haste facial practices 419 420 421 in partent for an imice. The expense amount of the telephone bill is Money Management Understanding basic financial accounting is that difficult. So let's starta definition financial conting is the day-to-day and perform and reporting of a firm's monetary resources. It has been made by the number of accounting software packages available to help the small be the financial position of your design firm. This measurement and owner. You use financial recordkeeping and reports to analytande also of interest to individuals outside the firm, such as agencies, stockholders, and auditors Gaining knowledge in base accounting is critical for any interio de who sees business ownership as a professional goal. If you do not understand busines's financial situation, your business will not last very long Purbalintures standing the concepts of financial operations helps you be a better emple up to record the daily transactions of the design firm. These reports are present reports is used to create income statements, balance sheets, and started to help the owners maintain a firm hand on the finances. The information here cash flow the reports that are most commonly a part of financial conting It is wise to engage an accountant to prepare reports, although acom software programs can help the business owner develop them. Even though business owner gets advice and counsel on financial issues from an accountant is still the owner's responsibility to understand what is happening with the finances of his or her company, This chapter introduces readers to several essential compcom financial accounting and financial management. Its purpose is not to che how to do accounting recordkeeping for your business. Rather, die basic concepts to help you understand accounting recordkeeping The chapter begins with a discussion of the different accounting methods used to record information In this edition, the discussion of the journal and ledgers has been moved toward the beginning to give readers a basic unde standing of daily bookkeeping records A review of the elements of the income statement, balance sheet, and the statement of cash flows (formally, then flow statement) follows. The chapter concludes with a diction of cash management and computer software applications ACCOUNTING METHODS: ACCRUAL VERSUS CASH ACCOUNTING An interior design practice must prepare specific standard financial reports least once a year. Those reports are the income statement, bulunce sheet, statement of cash flows. These reports help the business owner prepare income tax reporting forms and are usually needed when the business seks loans. These three reports start with the data recorded from doily financial transactions of sales and expenses. The type of accounting method usedalista how this information is recorded. The two most common accounting methods (or hass) are the sol Accounting Methods: Accrual versus Cash Accounting eps whether or not the revenue has actually been collected on the actually been paid in the time frame (monchandor Your) in which here. The accounting method requires the use of double uning, maka it somewhat more difficultater. For emple. ETY for a client would be considered revenue though the Berlust order has not yet been moved. A bill for the business telephone cada expense even though the designer has not yet paid the bill. the cash accounting placed revenue and expenses are recognized in the die which the firm actually receives the cash or actually pass the bills. Cash counting is a singlo-entry system. It is a lot like a person's personal budgets and corded caly when the owner actually sends a check to the telephone company. aboul .countants recommend the accrual method for forms that sell goods and maintain some inventory. Some firms use both accounting methods. Cash accounting is commonly used by small design practices for daily book- leeping purposes. It is simpler to use than the accrual accounting method and allows for use of single entry accounting. The accrual method is used to determine tax liability. Because tax laws change annually and accounting sterlands also change on a regular basis, it is important for the business owner un discuss appropriate accounting methods with the company's accountant. A design firm that has an inventory of goods or otherwise sells products wil leve to use the accrual method to determine its income tax responsibili ties. It is also required for businesses with more than $5 million in annual sales urafer whose business structure is a regular corporation (not an LLC). The Keral method is also recommended for any business that sells on credit, as the accrual method gives a more accurate picture of revenue and expenses To clarify the differences the accounting methods make in the gross lane of a company, let's look at an example. During May, Maximum Inter- Les received a total of $11,400 in revenues. Of that, $5600 is from cash sales and 55800 is from imales to clients on which payment has not yet been received. In the same month, expenses of S6500 were incurred for the period 5.800 les already been paid and $2000 is still due. Using the accrual method. there is a $4900 gross profit for the month. In this case, the profit is a "paper pas $5.00 has not been collected yet (nee Table 21-1) Applying the cash method to the same example, only $5600 of revenue and 54500 of expenses are recognized for the month, because this is what was Actually received or paid out. Using the cash counting method, Maximum Ieries shows a 1100 profit for the month Ris commonly recommended that all firms use the accrual method. case provides a more comprehensive picture of profit and loss for the se any given period. Having a more accurate financial pleture of the firm alties helps the ownerlmanager make more intelligent management decisions. Moreover, with cash accounting, it is too easy for unpaid invoices to Dorpation of accrual and cash accounting methods method and the cash accounting method. Central to the difference the Was is the time when revenue and expenses are in treceded Revenue is the amount of intlows from the sale of goods or the rendering vices during an accounting period. An expense is the amount of our TOOL Ceof the fortsade by the most monthly utility bills salaries, and advertising care amples of esp at the time they are cared in the case of concrete With the chadrende and expenses are Espen Accrual Method $ 11,400 -6500 $4900 Cash Method $ 5800 4500 $ 1100 1000 1010 1100 10 7128 310 2110 R450 2500 ers_ch21.pdf Mary Management Open with Accounting Records and Systems 423 accumulate, thus allowing dient to be overlooked, which would put the firm in a Sample Chart of Accounts This chapter discusses accounting principles based on the accrual method Description Account Description Revenue Cash 6000 Salos of good products ACCOUNTING RECORDS AND SYSTEMS Cash checking 6100 Freight in Cash: savings 6110 Delivery fees Every time the firm bills or collects funds from the client, or the firm orders or Patty cash Professionales pays for goods for the client or the firm, those transactions must be recorded. Totalcah Reimbursable expenses Transactions are events that affect the financial activities of a firm, either Accounts receivable 6400 Cash discounts revenue generating or expense generating Your daily financial recordktepine Alowance for bad debts is done to document monetary transactions. These accounting records are 1100 Total score receivable Expenses commonly referred to as the daily bookkeeping records. They are tools that you Inventory 7000 Cost of sales need to have to make decisions about operationalistes Total inventory 7100 Cost of goods sold Accurate financial recording is also critical for income tax purposes. It is Freight in 7200 essential that all these transactions be recorded accurately to meet legal Offio fumiture & fitures Direct labor Office equipment 7300 and ethical standards of practice. The income statement, balance sheet, and Telephone 7325 statement of cash flows are summary reports generated from the information Supplies 8150 in the firm's accounting records. Payrol tax 8200 Rent Recording of financial transactions can be done with either single-entry or 2000 Accounts payable cost of sales 8300 Telephone double-entry systems. A single exury system is very simple. It is set up based on the 2050 Accounts payable general 8320 Utles income statement and includes business income and expense accounts. Because 2100 Accrued payrol 3400 Group insurance of its simplicity, it is used by many small businesses. However, many accountants Federal withholding Insurance feel that it is not an adequate or proper way of accounting for transactions 2120 Unemployment compensation Professonal consultants: attorney Most accountants recommend using the double-entry system because of 2198 8550 Social security Professional consultants: its built-in checks and balances. The double-entry bookkeeping systems 2200 Note payable accountant 2300 journal and ledgers (discussed later in this chapter) to aid in record keeping The 8600 real payable Supplies 2400 accounts are based on the entries found in both the income statement and 8825 Sales tax payable Cataloglamples Long-term bites 8650 the balance sheet. In the double-entry system, transactions are first entered in the S010 Note payable long term 8675 journal and then summary information is transferred to the appropriate ledger Promotion 4000 Capital 8900 Depreciation expanse The next section provides additional information about the double-entry system 4100 Owner's capital Bank charges 4300 Owner's drawings 8000 Federal income tax Chart of Accounts 9999 Net Income Financial organization is established in accounts, Accounts show additions FIGURE 21.1. increases) to the account and subtractions (decreases) to the account that are h partial chart of accounts for an interior design practice. (Excerpt from Christine M. Piotrowski, Interior Design represented in the income statement and balance sheet. Look at the income Management, 1992, John Wicy & Sons.) statement in Figure 21-6 and the balance sheet in Figure 21-7. Each of these terms is a summary term that is generated from dozens of separate subaccounts Even a small interior design business will have numerous accounts Salegories are commonly broken down into Direct Expenses, General Expenses, logical format must be created to manage all those accounts. The chart of and Office Expenses. These accounts are numbered like this: 1000 assets: 2000 accounts manages this logic. A chart of course is a list of all the accounts that habilities: 3000 equity accounts:4000 retained earnings: 5000 income, 6000-6000 a fimm is using expense accounts. These code numbers are the ones used to cross-reference Figure 21-1 is a portion of a chart of accounts showing many of the ma jumal entries to posting entries. The chart of accounts should be set up so that it accounts typical of an interior design practice. An individual firm's chist can increase in complexity as the firm grows, with appropriate accounts added as of accounts may have other subheadings, but will likely have categoy headines very similar to those shown in the figure. Because the amount of assets of a firm must always balance with the lin- Typically, the major headings of the chart of accounts have account names bilities of the firm, the account record looks like the letter "Tin its simplest form that mirror the items shown on the balance sheet and income statement. The Accountants refer to these as 7-accounts (see Figure 21-2). The left hand side of chart of accounts is a statement about how the firm categorizes the events that the account is called the debt side, whereas the right-hand side is called the seeks to control. These accounts can be further detailed to indicate such things traditside. In these accounts, debit and credit have no meaning in accounting each customer's account or each vendor's account, to cite a few examples. der than "left" and "right" respectively. They are not substitutes for the words The chart of account is numbered in a logical order the example in There" or "decrease, since, for some accounts, the increase side of the Figure 21-1 shows a typical order. Some of the account categories relate to the Taccount will be on the right and the decrease on the left. Figure 21-3 shows this balance sheet namely, Assets, Liabilities, and Owner's Equity. Others relate income statement items: Revenues for Income) and Expenses. The expenses 3000 Postage 8925 Accounting station 424 Money Management Accounting Records and Systems 425 300x Accounts Ledger Debit Credi 1 1.250 Odf T-Accounts Equities Decreases on latine Accounts Payable DERIT CREDIT Cash Sales 26 Assets Increases on lake, deciso Cash DEBIT CREDIT 300 900 1,700 1.000 1.250 3400 Accounts Receivable Design Fans 2 3 3,400 450 6 5 17.700 Inventory Cash Accounts Payable 1 7,000 10,700 CREDIT 21 Accounts Receivable D 8.700 9.100 7.500 1,700 Fees Revenue DEBIT CREDIT 8,700 12.000 7.500 FIGURE 21-4. An example of joumal entries FIGURE 21-2 A sample format of typical T-accounts. Sydney Orlando 1526 E. Sepert Drive Client : 842 Date Explanation Debit Credits Balance 1 75 500 00225.00 30000 4500 9 Salos Check 6801 14 Peeled on Account 29 Sal Check Paceved on Account Assets Liabilities Owner's Equity increase decrease - Increase decrease + increase decrease June debit credit debit credit debit credit FIGURE 21-3. This example shows how some accounts show increases as a debit, where other accounts show decreases as a debit FIGURE 21-5 A sample page for an accounts receivable ledger. Cash receipts ledger: Show all the money received by the firm Cash disburses leger: Records menys paid out to cover expenses Accounts payable ledger Records amounts that the design firm unes to others Purchase and lower Shows outstanding orders for goods and/or services for clients or the firm Payroll Ledger Records payments to employees Trial Balance The Journal and Ledger Following a business transaction entries are made in a journal. A souris chronological record of all accounting transactions for the firm (see Figure 214 Journal entries show the date of Ourence, the name of the account to be debited or credited, the amount of the debitor credit, and a reference to the ledes account to which the entry has been posted Entries are posted to different ledger accounts from the journal. Pasting, therefore, is the transferring of a journal entry to the correct ledger account The edge often called a general ledger, is a group of accounts. If the bookkeeping is done manually, an actual general ledger book will be used to record all the entries. When computer software is willed, the ledger will likely be the first place the data are entered; the software then updates accounts appropriate. Various subsidiary lodgers often supplement the general ledger providing detailed information to support the general ledger. For an interior design firm, an important subsidiary later is the accounts receivable Ledger (see Figure 21-5). This ledger has separate accounts for each client who chases on credit from the designer. A few other ledgers are as follows: Assets must qual liabilities and debits must equal credits. This does not mean that debits and credits will be equal within each account, but rather that when All counts are considered, they will be equal. A test to see if accounts are belanced and if all the accounts balance with the debit and credit sides totaled separately is called a trial balance There are two purposes of a trial balance. One is to check the accuracy of the posted ontries to if total debits equal total credits. The other ls to het, income statement, and change in financial condition report. A trial bulance can be done whenever the accounts are up-to-date 426 Basic Financial Reports income Statement, Balance Shout, and Statement of Cash Flows 427 Gris Revue From Fees: Income Statement Grand Designs For Year Ending December 31, 200X Income 185,350 From Reimbursable Expenses 11,540 From Sale of Goods Product 227.000 Freight-in 24.000 Delivery 14,100 8.610 Total Gross Revenue Cher Havene 3.575 Net Revenue $ 472,100 $ 475675 35,000 2,350 8,750 1,290 6.750 9,540 Money Management BASIC FINANCIAL REPORTS: INCOME STATEMENT, BALANCE SHEET, AND STATEMENT OF CASH FLOWS Regular review of a business's financial statements is a critical part of business ownership. The statements help you evaluate the financial performance of your business activities. The three most important and common business reports needed are the income statement, balance sheet, and statement of cash flows Remember that the intent of these discussions is to help you understand the basic configuration of the reports,not how to prepare them. Income Statement The income statement helps the firm understand if it has actually made a profil for the period the statement covers. The income statement, commonly called a profit and loss steremer, or PL formally reports all the revenues and expenses of the firm for a specific period of time. Reveries are the inflows of money to a company from the sale of goods and services. Exes are the outflow of assets used to generate revenue and operate the business. The period of time a statement covers may be a month, a quarter, or a year. The result shows the net income (or loss) for the firm during the period Only the annual income statement report shows a profit or loss for the year. Monthly and quarterly income statements indicate whether, for those shorter time frames, the design firm was operating at a profit or a loss. Monthly and quarterly reports provide valuable information on which the owner can base decisions. Computer systems allow the owner to easily produce mothly profit and loss statements. How often to produce income statements is a decision that should be made in consultation with the firm's accountant The firm's accountant will help determine how much detail is needed in the income statement. The chart of accounts acts as the foundation for which items will be recorded in the revenue and expenses sections of the income statement. The sample in this chapter has been prepared to show more detail than many firms include. It has been done in this way to utilize cost accounting practices to measure and evaluate costs of doing business against the revenues that the firm bas generated. In a cost accounting system. certain, if not all costs directly related to the generation of revenue are "Costed or charged to the particular revenue-producing activity. This will help the owner get a clear picture of his or her revenue-producing activities The easiest way to understand the parts of an income statement is to start at the top entry and work down through the various parts. Figure 21-6 should be referenced during discussion of the income statement. Item 21.1 on the companion Web site provides an example of an Income statement for a small firm. Item 21-2 is a worksheet to develop an income statement. For interior design firms, revenue results from design foes for services and the sale of merchandise that is ordered from vendors and billed to the client Remember that when the client buys merchandise directly from the venderlo hires a consultant such as an architect), those dollars do not represent rever for the interior designer. Refer to the hypothetical income statement shown Figure 21-6. Starting at the top The DATE indicates the time period that the income statement reporting on. In our example, the heading indicates that the time period for this income statement is the whole year GROSS REVENUE is all the revenue generated by the firm for the time period. The term gross in accounting indicates that the figure represents fundo prior to any deductions. 177.690 19.750 10.200 7.650 $274,789 $ 200.886 From : Direct labor Supplies Reproduction expense Telephone / Fax long distance) CAD contract labor Reimbursable expenses From Product Cost of Goods Freight-in Delivery Installation Total Cost of Sales Gross Margin Expense Operating Expenses Salaries Payroll taxes Group insurance Pent Heal, power, and light Telephone Advertising and promotion Travalimbursements Supplies Postage and maps Depreciation expense fumiture and equip Depreciation expense auto Dues and subscriptions Profesional development Profissional consultants Printing and reproduction 30,990 15.200 6,000 28,800 9,800 7.500 10,000 12,600 4,800 1.300 5.600 2.500 5,700 2.750 1,800 3,000 2,200 4,000 1,750 2,400 2,575 Voresponse Dark changes Wohin not provider and son Total Operating Expenses Not Income Before Taxes $ 162,015 38,871 FIGURE 21-6. An income statement showing the separation of direct experces from overhead 430 Money Management 431 Balance Sheet Bently and Jordan Interior Designs As of January 31, 200x Assets Current Assets Cash $ 8,625 Accounts Receivable 31,750 Inventory 11.900 Supplies 1250 Prepaid Expenses 2.250 Total Current Assets Fixed Assets Plant and Equipment Oflice Furniture at Cost $ 25,500 Less: Accumulated depreciation -2.400 Omice Equipment at Cost 11.500 Less: Accumulated depreciation -1.000 Automobile at 19.500 Less: Accumulated depreciation 5,600 Net Plant and Equipment Total Assets $ 55.775 46.700 $ 102,475 Liabilities Current Labities: Accounts Payable $ 8.725 Notes Payable 4,000 Accrued Expenses 7,000 Deferred Revenues 6,750 Total Current Liabilities $ 26,475 Other Liabilities: Long Term Del 29,500 Total Liabilities $ 55,975 Owner's Equity Common Stock $ 35,000 Retained Earings 11,500 Total Owner's Equises 4600 Total Equities 102.475 FIGURE 21-7. A typical balance sheet for an interior design firm that is a corporation Basic Financial Reports: Income Statement, Balance Sheet and Statement of Cash Fions la converted to cash in less than one year. Fixed assets, also called property. plent, and experient, are the long-lived items used by the firm Other assets are such assets as patents, copyrights and investment securities of another firm. These other assets" are often considered intangible assets. These are the most common Corrent assets categories Cash is funds in the firm's bank account, checking account, cash reg ister, or petty cash box. By the way, cash, for accounting purposes, is money, checks, or items such as money orders that are accepted by banks. Petty cash is currency used to purchase small or minor items, such as office supplies, with cash on hand. Accounts receivable shows what clients or others owe to the firm as a result of sales or billines for services . mestory shows items purchased for resale to the firm's customers. Prepaid experise is early payment of expenses, such as insurance policies or rent that may have to be paid in advance. Spilles on the balance sheet represents the value of normal office supplies Marketable securities indicates that the sample firm has purchased stock in other companies and that the owners expect to sell that investment within the year. Pued assets or long-term assets include items that have long-term value to the design Cirm. Depending on the firm, it is common for three categories of assets to be reported land and buildings, equipment, and other long-lived assets. Land and buildings will be shown if the firm owns its business location or any other firm-related building (such as a small warehouse) Note that in Figure 21-7, the company does not own its building, so it is not listed as an asset. Equipment represents furniture used by the office staff, computers, copying machines, delivery trucks, and so on. Other assets include investments in other forms and items of value to the firm, such as copyrights, trademarks, patents, licenses, and similar intangible assets that the firm might own. If the investments are to be held for more than one year, they are listed here. If they are expected to be sold within a year, they are listed under current assets. Certain long-term assets, such as a computer, are understood in Accounting to have limited usefulness and thus a reduced financial worth Depreciation expresses the use of a fixed asset in the firm's pursuit of reve nue. Although many think of depreciation as a way to express the wearing out of an object, it more accurately relates to the usage of the object, not its physical wear and tear. Accountants predict what the useful life of the equip ment will be and determine the depreciated value of the equipment for each year the firm owns the item. Depreciation is set for a fixed period of time and Varles based on current tax laws Of special interest to the design firm is the value placed on copyrighted desiens or potents on any furnishings the firm may have obtained. Patents and copyrights are amored, which is a practice by which the value of the parent or Copyright is reduced over time to record its usage in the firm's earning have first claim on the assets of the firm and take priority over claims by the owners/investors. Assets are typically shown on the left side or top of the page, and the liabilities are shown on the right side or bottom of the page. Figure 21-7 is! sample balance sheet for a small interior design practice, please refer to it in conjunction with this discussion Assets There are three kinds of financial assets, and the categories are based on how quickly the asset can be converted to cash. Carnevar assets are resources that can 432 433 Money Management activities. Amortization is essentially the same as depreciation, except that applies to intangible ases Liabilities At any given time, a design firm will owe funds to others, such as the electric utility company, a custom cabinetmaker, or an comployee. The firm also has a obligation to those who have invested in the firm, either as owners or purely for investment purposes. These types of obligations are considered liabilities Liabilities always have first claim on the firm's assets, and all outstanding liabilities must be paid before owners or stockholders receive any funds should the business close for any reason The liabilities side of the balance sheet is made up of two sectionslia bilities, which can be current and noncurrent (or long-term) and owner's equity. Owner's equity is discussed separately. Current liabilities are obligations that are due within one year or less Account prble are claims from suppliers or others for goods or se vices ordered by the firm and possibly delivered) but not yet paid . Nors puble represent short-term loans, such as lines of credil obtained to pay for special orders for clients - Accred expenses are the expenses owed for the period but not yet paid such as salaries due, rent, and utility bills Deferred revenues are revenues received for services or the future sale of goods that have not yet been delivered or performed. Retainees or deposits that the client has paid are common examples. . Current portion of long-term der shows how much of the long-term del (e.g. debt resulting from the purchase of a delivery truck) is to be paid during the next one-year period Taxes poble (sometimes called estimated foxes). This line represents the amount of income tax or other taxes owed to government agencies but not yet paid Norwrwbies are amounts that are owed but will not be paid during the coming one-year period. Most often, for an interior design firm this represents the balance of principal owed on a long-term kan for the purchase of a vehicle or the outstanding principal on the mortgage if the firm owns its officestudio building or space. Basic Financial Reports Income talenten, Balance Sheet, and Statement of Cash Flows How this section is shown on a balance sheet will vary based on the business's legal formation. If the firm is a sole proprietorship, owner's equity would be shown as "Michael Smith, Capital" along with the amount Michael Smith invested to start the firm. If Smith invested additional funds at a later time, these additions would also be listed. It is not uncommon for the balance sheet for a sole proprietorship not to show an owner's equity section. These businesses retain earnings by maintaining all or most profits within the com pany assets. In this way, the company has acklitical funds for future company needs such as new computers For a partnership, it is customary to indicate the amount invested by each partner as a separateline, in much the same way as for a sole proprietorship. Tables 21-2 and 21-3 show the owner's equity section for these business for mations. A partnership and a sole proprietorship also show a beginning and ending balance to reflect any withdrawals (or drawings) made by the owners against the assets, as shown in Table 21-2 Drawings are amounts withdrawn by sole proprietors or partners as sala ries. Drawings are not truly salaries, however, and are not treated as salaries in the bookkeeping process. A separate drawing account is set up for each partner, A design firm that is a corporation would use the term stockholders exity rather than owner's equity. For a corporation, terms related to this section of the balance sheet include: . Capital stock ander paid in capital stock-The amount of money oblained to run the corporation Par wlw.-The legal minimum claim on assets associated with the stock Puid-in capital stock-The excess of pair value representing the claims on assets arising purely from the value of stock at the time of its Issuance Retnined camings-The claim on assets arising from the cumulative undistributed earnings of the corporation after dividends are paid to Stockholders. Retnined eamings do not refer to cash in and of itself. The earnings may be in some other form, such as a vehicle, equipment, or marketable securities. TABLE 21-2 Reporting format of awner's equity for a sole proprietorship on a balance sheet Owner's Equity Michael Smith, capital as of January 1, 2004 $25.000 Daduct: 1990 drawings 5.000 Michael Smith, capital as of December 31, 200x $20,000 TABLE 213. Reporting format of owner's equity for a partnership on a balance sheet Owner's Equity Owner's quity represents the amount of funds the owners have invested in the interior design firm. Some accountants use the term worth in place of owner's equity. The majority of accountants do not like to use this term on balance she because it gives a las idea that net worth actually represens the value of the company. This is not true, as this net worthwest amount is only worth actual assets after all abilities are paid. In principk, il represents that the company has a worth on its own, but that is only the case ! the total assets of the company actually exceed its total liabilities The owner's equity section on the balance sheet is actually put of the liabilities, but it is common to report it as a separate section, as shown in Figure 21-7. It is a liability account because the owners have claims on the assets of the business. Tlowever, it bears repeating that in the case of a business failure, the owners cannot recover any assets related to until after all other liabilities are paid Page Owner's Equity Helen Sempen, capital Margaret Wallace, captal But in capital $15,000 10,000 10,000 $35,000 + 434 Managing Your Frances 435 $ 120,400 Tanner Interior Design, LLC Statement of Cash Flows For the Year Ended December 31, 200x Net Cash Flow from Operating Activities Net Income Achments to Convert Net Income to Net Cash Flow from Operating Expenses Depreciation Expense Increase in Accounts Receivable Decrease in inventory Increase in Prepaid Expenses Decrease in Accounts Payabia Increase in Accrued Expenses Net Cash Flow from Opening Activities Cash Flows from investing Activities: Purchasing al Equipment Net Cash Used by Investing Activities Cash Flows from Financing Activities Proceeds from Customer Retainers Proceeds from Customer Deposts Proceds of Long-tem Debt Payments on Long term Debt Cash Dividends Paid Net Cash Provided by Financing Activities Net Increase in Cash 10,500 -25,850 22,300 -12,300 -22.350 -9,700 101.08 Money Management There is no retained coming section on the balance sheet of a sole pro- prietorship or a partnership Each general category is added to obtain total assets and total equities. Total assets must always equal total equities. Statement of Cash Flows The statement of cash flows also known as a tands flow statement reports all the inflows and outflows of cash due to the various activities of the company. Do not confuse the formal statement of cash flows with the cash management forecast. The former reports what has happened, whereas the latter reports what might happen. Cash management is discussed later in this chapter Owners make many kinds of decisions based on the information in a statement of cash flows. For example, perhaps the company is considering moving to a new office location. This report will help the owner determine sufficient cash is regularly going to be available to pay higher rent. If the owner is considering the purchase of an office space, creditors will want to review this report before a decision to offer a loen is made A formal statement of cash flows will detail the changes in cash available from operations, any investing, and other financial activities over a given period of time. It also reports cash equivalents. Cashewivalents are very liquid, short-term investments, such as money market funds that can be converted to cash quickly. Operations activities are the normal revenue generating activities of the firm. Operations flows come primarily from the payments and recei ables from clients, and the payments that the firm makes to others in the generation of revenues Operations intlows can also come from other sources such as interest earned Investment inflows and outflows result from lending money and receiving payments on those bens purchasing or selling certain kinds of securities, and purchasing or selling assets such as property, buildings, or equipment that the firm own. Financing inflows and outflows come from the finances that the owners have invested in the company and subsequent payments to those owners for their investments, as well as payments received and returned to creditors, such as banks, for morteages. The most widely used format for this information is the direct method, shown in Figure 21-8. The information used to prepare the statement of cash flows comes from the balance sheet from the income statement, and, for corporations, from the retained earnings portion of the income statement. Although the report can be useful for those who need to review the financial condition of any type of business, it is primarily prepared for businesses in the corporation form. Many lending institutions require a cash flow statement when a business seeks loans The methods for actually constructing these forms are quite compe cated, and this task is generally done by the firm's accountant. They are not discussed here -$ 22,500 --22,500 10.900 29,000 27,000 -7,750 -1.250 89.900 $ 149,000 FIGURE 21-8. An example of a statement of cash flows using the direct method. resources. For many firms, though, these reports do not provide enough information to assist the owner in making important financial decisions. Other financial management reports can be very useful Accountants call this type of information development for management Hagerial Accounting Minicial management, or managerial accounting, is concerned with the analysis and reporting of all the financial aspects of the firm. This management task uses the information found in basic financial accounting reports and reconfigures the information for other specific uses These additional reports help owners and managers analyze any financial or humerical information that is of interest to them. A design firm owner can have the firm's accountant prepare the types of reports discussed in this section, but with today's computer software many of the can be produced by the manager. That way, only the reports of most Interest to the owner or manager are prepared. This section reviews several useful financial management tools that the trwner can use to make financial decisions. It begins with a discussion of the all-important topic of cash management Cash Management MANAGING YOUR FINANCES Financial resources for all interior design businesses are limited. The smaller the design practice is the greater the pressure on financial resources can become. Control and management of financial resources is a critical mall agement function The income statement, bulance sheet, and statement of cash flows are the primary pieces of information that an owner uses to manage the financial The constant in low of cash that is needed to meet the cash demands of a firm Is it pays bills is a crucial money gement task. Although the statement of wish flows discussed earlier provides important information for the owner for Lorange planning, it is less useful for day-to-day cash management. This Section briefly discusses a simple report that can easily be prepared by a 436 Money Management manager and can be used in cash management. This type of report should be done on a monthly basis. This is fairly easy with today's computer software. First, do not confuse cash flow and cash management with profit. It is quite possible for a firm to have good cash flow and appear to be in a profitable position even while expenses are being delayed or deferred, affecting its actual profitability. At minimum, the firm must shoot for a break-even point of case revenue in and cashlexpenses out. Atbreak-even, the amount of revenue quals the amount of expenses due. Be advised that the lack of cash flow because of poor cash management is a primary reason for business failure. Cash Management is really cash forecasting. The finestimates how much revenue will be realized each month (or quarter) and how much its expenses will be for that same time period. Because it is a forecast, the estimate for cash receipts (revenue) can never be 100 percent accurate. All kinds of things may happen to upset forecasts for obtaining revenue. A client might not pay bills on time or an expected project can be cancelled For this reason, it is also a good idea to project a small, though realisti, percentage above expected and needed cash receipts for the period. If this is done, then it is easier to meet actual needs if and when) actual receipts are lower than the forecasts. Of course, it is also important to meet that cash inflow forecast if at all possible. It should also be remembered that not all income turns into cash Immediately. Accounts receivables may take 30, 60, even 90 more days to be received. So, although the cash could be recorded for several months, it should not be forecasted as in hand until the income has actually been received Cash forecasting of expenses is much easier. These outflows are usually known for any given period and are more easily controlled. Although the firme might forecast the purchase of a computer or inventory, these items can often he put off when cash receipts do not materialize as forecasted. Figure 21-9 is an example of a simple cash management statement. Please use this example to follow along with the explanations of the parts of the state ment. Notice how this report mimics the appearance of the income statement. The cash management statement begins with the actual beginning cash balance for the most current month. The other months begin with estimated Managing Your Finances 437 cash balances. The next line shows the known and projected revenues for the months beine projected. The projected revenues combine the known work in process amounts for each period with forecasts of additional work in ench month. Work in process means work under way for any clients that have not yet been billed. Adding the beginning cash balance to the projected revenue pro- vides the projected gross revenue Under the expenses operating expenses are the projected combined expenses for each month. In the example, there is an allowance for a line of credit for a bank loan obtained in a previous month. This amount is the amount of principal and interest due cach month. The expense section shows other known or projected expenses, such as the purchase of capital equipment. The Lastline shows the ending cash balance for each month. The ending cash balance is carried up to the beginning cash balance line in the forecast months. The reader may wish to fill in April's figures to obtain the ending balance for the month and to see how well the firm is doing). Tiem 21-3 is another sample cash flow statement, which can be found on the com panion Website A positive ending cash flow does not necessarily mean the firm is prots itable. Even a company with good cash flow can be losing money. Sometimes the assets of a firm can be tied up in receivables or fixed assets. These assets help show a "profit at the end of the income statement, but do not represent cash that is available to pay bills. Bills to vendors or others that are not paid or are deferred will still have to be paid one day, Cash-Flow reporting helps create a cash budget. This allows the owner to compare actual results of the business against forecasted goals to help prevent expenses from overtaking revenues and cash availability. Adjustments, made by holding down expenses or finding ways to increase revenues, are needed when forecasts are not mel. Many small design firms operate in markets in which they must survive on seasonal design business, such as the design of second homes in resort areas. Understanding on paper what the cash-low situation will be in the slow months when these second-home owners are not procuring interior design work can help the design firm owner determine how to generate alternative revenue sources during those slow months. New firms and those in the first year also have a built-in cash flow peoblem. A new firm has many first time expenses, such as stationery, office equipment, and marketing activities. Revenue is often delayed as the firm waits for full payment from clients. On top of this problem, many new businesses are Taquired to pay in full and up front for merchandise that they purchase for clients. Obviously, the cash could easily he going out faster than it is coming in. For design firms that do not sell merchandise, the cash flow cycle is rel- atively short firms that sell merchandise often have a constant cash-flow problem because they have not received enough cash from whatever source pay for the merchandise that is an order. Nevertheless, sufficient cash mast become available to pay current bills. It is important for you to realize that cash management and cash flow fall back on the cash accounting method rather than on the accrual accounting Tethod. Good cash flow records of cash receipts (deposits of cash) and out- flows (when a check to a supplier or other liability account clean the lank) are necessary. To accurately record cash receipts, the owner must keep track of new orders or contracts for services, when deposits or retainers are to be received, when partial payments are expected, when deliveries of goods are 106.000 1100 1000 Cash Management Statement: December to March 2004 Actual Projected Projected Projected Description December January February March Beginning Cash Balance $ 3,000 $ 8,500 $ 19,100 $ 21200 Projected Havenue 95,000 92.000 100,000 Other income 1,100 1.100 Projected Gross Revenue 103,000 99,000 120 200 127,300 Operating Expenses 77.000 78,000 79.000 Purchase computer 17,000 Purchase office 17.500 fumhure Line of credit del 2.500 2.500 2,500 Ending Cash Balance 6.500 19.100 FIGURE 21-0 A simple cash management statement. Notice how it repeats the format of an income statement 2.500 21,200 expected, and so on. 438 Money Management 439 denominator Tips to Help Monitor Cash Flow When the owner can see cash needs months in advance, this information energies the owner to market beyond what is needed to pay today's bills Small firm fireguently develop the short-sighted habit of booking at the work they are doing right now neglecting marketing until the current project is done. When this happens, a business may be without any revenue for weeks or even months as the owner finally gets around to seeking new business. Cash management actually forces the owner to recognice marketing ellots as an ongoing part of his or her ownership respotwibilities Cash management also has a relationship to other business operatives Coal basic business practices id in keeping cash flow operating efficiently. Here are a few examples: . Constant monitoring of cutstanding orders and receivables aids the firm in pro. tecting narrow margins of profit The firm must have good pricing policies for both foes and products Credit reports on clients with whom the firm is unfamiliar should be obtained before the fim de merchandise Inventory, returns, and exchanges must be carefully monitored so that cash is not tied up in luwentory. This cash cannot be used to pay other expenses. . The firm must prepare design contracts to help protect it against possible top pages or losses of rever . The firm should require substantial retainers and deposits before work is begun ce products are ordered . Careful timekeeping scheduling and project management are also helpful in cash-flow forecasting A thorough monitoring of budgeted versus actualtime estimates and feest mates can eliminate project shortfalls Constant monitoring of outstanding orders and receivables all the firm in pre tecting to margins of profil Establishing policies that require substantial retainers and deposits, as well as tracking and collecting receivables, can help produce positive cash management When the firm needs cash, the owners may be able to obtain short-term loans from the firm's bunker Keeping the banker informed of the financial situation of the design firm has the firm in the loan approval process, as does a good history proposent of those loans. Going to the bank every time the firm needs cash to pay bills is not the best solution. Good management of the firm and the firm's cash flow is the answer Managing Your France As a reminder, a ratio is one number over another the relationship etween two or more things. With ratios, we are comparing two numbers. A ratio can become a percentage when we divide one number into another. To calculate a renge, the large number the denominator) must be divided to the small number the numerator). For example, if we divide 75 by 100 075/100), we will get a percentage of 75. When you are using ratios, remember hat when you are comparing a part to the whole, the whole is always the Accountants and financial analysts use many ratios to evaluate a business, Table 21-4 shows several financial ratios. Realize that analysis of financial inties is not difficult to grasp. The information that these ratios provide can be critical to an owner's decisions about the current state and future of the firm. Profis rarios help a design firm owner analyze how effectively the company is earning more income than it is spending in expenses. Obviously, a business can remain viable only if it sustains a profit. As a rule, profitability for income) is affected by increases in volume and changes in price, or both. There are three primary ways a design firm can increase its profitability from fees. The first is to increase its fee base: for example, charging $100 per hour rather than $90 per hour or $3.25 a square foot rather than $2.75 per square foot. Another is to bill more hours at its design fee. This might simply involve being more productive and more accurate in billing time to a project. A third way is to find means of reducing expenses. Efficiency ratios can be developed to review how well the business is operating One very important efficiency ratio is the average collection period ratio. This ratio tells the business how many days, on average, it takes to collect sccounts receivable. The faster clients pay their bills, the sooner the firm can pay its bills a very positive situation for any size interior design firm. If this ratio is low, it means that the business is receiving pyments from clients quickly. If it is high, it means that clients are taking a long time to pay, and this can seriously affect cash flow for the business Liquidity ratios show the design firm's ability to pay its debts. Of partic- ular importance is the firm's ability to pay its current liabilities with available current assets. A second liquidity ratio is the working capital ratio. Il measures the amount of cash that is available to operate the business on a daily basis. If a firm's working capital is less than its operating expenses, it may not be able to pay all of its current bill Financial Ratios and Percentages In addition to the reports and reporting methodologies discussed earlier in this chapter, design firm owners should become familiar with certain financial ratios and percentages. These provide many important clues to the success of possible problems in the financial performance of an interior design fim. Ration and percentages give an even clearer message regarding the busines' overall financial success (or lack thereof). By using ratios and percentage designer can evaluate almost anything that can be measured in numericaltoms Do not be afraid to learn about ratios and percentages. Ratios are quite common and are used every day by almost everyone in one way or another In our everyday experiences, we might use ratios to determine the miles per gallon our car gets or to calculate a tip at a restaurant. The ability to calculate percentages is critical to determining the cost and selling prices of products TABLE 21-4 Financial ratios to determine the financial performance of the business 1. Profit margin on sales - Net Income/Total sales 2. Retum en total (ROA) - Net Income Total assets 3. Retum en equity (ROE) Not incomOwner's equity 4. Retum on investment Pol Net prots/Total assets 5. Current roto - Current Assets/Current Tables 6. Quick ratio for acid sost) - Current assets - Inventory Currentlisbilities 7. Det ratio - Total de Total assets 8. Working capital - Current AS - Ourrentiabities 8. Net profit - Earnings before interest and taxes (EBIT)Ne sale 10. Rotum on investment - EBIT/Total assets - Total abilities 11. Average collection period - Accounts receivable 380/Total sales 12. Inventory turnoverato Cost of goods so were inventory 13. Grass mergin percentage - Gross margin dollars. It revenus 14. Reivable turnover ratio - Annual sales/Total outstanding receivables 440 Managing Your Finances 441 Money Management Debr ratios indicate how much of the firm's financing has come from dehts loans and lines of credit-rather than direct investment by the own ander stockholders. Potential new investors will be concerned about high debe ratios, because they indicate that the loans must be paid off before the finn yields any return on investments Ratios belp determine the financial health of the firm and locate of the potential financial or operational problems Ratios are more important to the owner or manager than to employees. However, employees should under stand that a lot of number crunching goes on behind the scenes in the operation of a design practice Awareness beings about concern and concern brings about the realization that every employee in the design firm affects the financial bath of the company. Reporting Performance A management tool used by larger design firms is written reports. Management personnel and even project managers relay important information to the owners by creating these reports. Two types of reports that are created and used by management to determine if the firm's plans are being accomplished are information reports and performance reports. Information reports are generally reports of financial or other numerical data. They are prepared in a narrative form and are used to provide information needed in the operation of the organization. A sum of an article related to general economic forecasts for the design firm's target market is an example The performance report consists primarily of financial or other numerical information. The data used to develop many performance reports can be found in the firm's usual financial reports, such as the P&L Other performance reports can be generated from time records, accounts receivable records design fees, and reimbursable expense records, to name a few. Computer software programs create many kinds of reports with relative case. However, not all reports that can be created are necessary. In fact, too many reports can confuse rather than help the owner. It is therefore necesary for the owner and the firm's accountant to determine which reports are desired, and to ensure that the ones produced are reliable and timely. What this means is that any report must be based on accurate data or information To be most useful management reports must be accurate and timely Accurate data is that which is truthful. For example, inaccurate time records are not truthful data reports. To be timely, reports should be based on weekly or perhaps monthly data. For example, weekly time sheets help the manager decide which design staff member is available to begin work on a new project Aged receivables reports are needed on a monthly basis to help project cash flow. A data business tool used by many larpe firms is variance analysis. When utilizing vrience chalysis, the owner or manager looks at financial and numerical data in relation to the differences between planned (or budgeted amounts and actual amounts. Basically, what happens in variance analysis is that data are reviewed to see differences in planned performance versus actual performance Variance analysis is also discussed in Chapter 20 In variance analysis, accountants use the terms favorable and unfo able. An favorable variance generally means that the actual amount is more than the budgeted amount. A favorable wariance generally means that the actual amount is less than the budgeted amount. For example, if the budgeted amo of direct labor for a project is 800 hours and the actual amount of hours wided is 365 hours, there is an unfavorable variance. Assuming there is the same number of bedoel hours, if the actual hours were 280, there would be Expense Reports April 200X Varlance Actual Budget over Budget Salaries $75.000 579,500 $-3.500 Payroll taxes 4.575 5.000 425 Group insurance 750 750 Rent 1.500 1.500 0 Heat power & light 650 500 150 Telephone 375 300 75 Promotion 450 525 -75 Tre reimbursements 790 60D 190 Supple and postage 450 500 -50 Depreciation expense 900 900 0 Insurance 750 750 0 Des subscriptions 250 150 100 Professional con 2,300 1,000 1,300 Printing and reproduction 570 450 120 Interest expense 875 875 0 Total Expenses 90,105 $2,300 -2.115 FIGURE 21-10 A sample performance report showing variance analysis for the overall expense report favorable variance. In Figure 21.10. you can see that there were unfavorable variances for several of the overhead expense items. If this trend continued including the overall total expense variance, what effect would that have on the potential profitability of this particular firm?Item 21-4 on the companion Web Site shows another detailed variance report. A manager must not look only at the quantitative differences. For the data to be truly meaningful, he or she must also ask questions as to why the variances occur. Very often, there are logical reasons for a variance. For example, in Figure 21-10 the expense forhent power and light may have exceeded the budget because of a large amount of overtime required to complete a project. Can you think of some reasons why the salary expense was less than budgeted? The manager uses his or her judgment, after meetings with the individuals wolved or a further review of billings, before making decisions on what to do about the variances Many kinds of reports can be generated from the data collected by the design firm, both in terms of financial information (such as revenue generated) and operational information such as time records). Figure 21.11 is an example of report concerning projected revente a very important report for any size or type of design firm Reports provide managers with much information on which to base decisions concering all aspects of the office. To bave the most utility, per formance reports should be prepared on a monthly basis. Another example of a performance report is provided on the companion Website as Item 215 Other types of specific reports that can be useful, depending on the size ad complexity of the interior design firm, are: 1. Revenues from sources-fees and sales of goods 2. Work in process and aged receivables 3. Aged accounts payables 4. Deferred income 5. Employee utilization and productivity 6. Comparisons of lees earned with budgeted estimates Managing Your Finances 443 Break-Even Point 442 Money Management 7. Revenues by client type (or size of project) 8. Month-by-month profit and lass statements (with variances) 9. Budgets for capital equipment purchases 10. All overhead expenses or specific overhead expenses month to ricet These examples are optional accounting and managerial informatie reports. Essentially, they should be prepared depending largely on the firm's ability to produce the required reports and on the owner's need to have the information. Computer applications allow fast turnaround of many reports Ideally, most reports should be prepared within the first ten days of the month, on a monthly basis, when the previous month's data become available, Even small design firms or sole proprietors can take advantage of perice mance reporting by using accounting and database management Computer systems can link accountine and other numerical data to generate tabled reports relatively easily, Software that can also automatically prepare charts and graphe from the numerical data provides additional aid for the manager Creative Interior Design Projected Revenue by Client Type 2007, 200X (Est.), 200X (Est.) 200X $ 75,000 40,000 35,000 $ 150,000 Few interior designers consider their businesses to be nonprofits' Yet, many find themselves barely making a profit at the end of each tax year. This happens despite their best efforts at creating excellent interiors and being wonderful problem solvers for their clients. Low pralitability often occurs because many designers do not carefully control their operating expenses. These expenses must, at minimum, be in salace with the revenues that are generated. When this doesn't happen, a low profit or loss occurs Obe management actie that can help with this situation is to plan for profit by establishing the firm's break-even point. The break even point is when the dollars to operate the business are exactly equal to the dollars generated from revenues from all sales activity, Too many designers forget to consider all the costs (or expenses) of operating the business as well as the costs of doing projects, thus, estimates for lees and other sources of revenue) can easily fall short of revenue needs. When that hap pens, the firm is operating below the break-even point. When revenues exceed costs, then the firm is operating above the break even point and making a profit Some costs will vary with the volume of work performed and revenue generated. Accountants call these costs variable costs. The biggest variable cost in an interior design firm is the direct labor-time actually spent on projects that create revenue-because it varies with the amount of projects that are done. Mied costs are those commonly thought of as overhead items, and stay essentially the same or nearly so) every month. Generally, these expenses do not vary with the volume of work being done by a firm. Fixed costs increase somewhat as an expense such as rent or hest/powerlight increases, but do not vary as much as the variable cost items Here are the steps in determining a firm's break-even poinStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started