Answered step by step

Verified Expert Solution

Question

1 Approved Answer

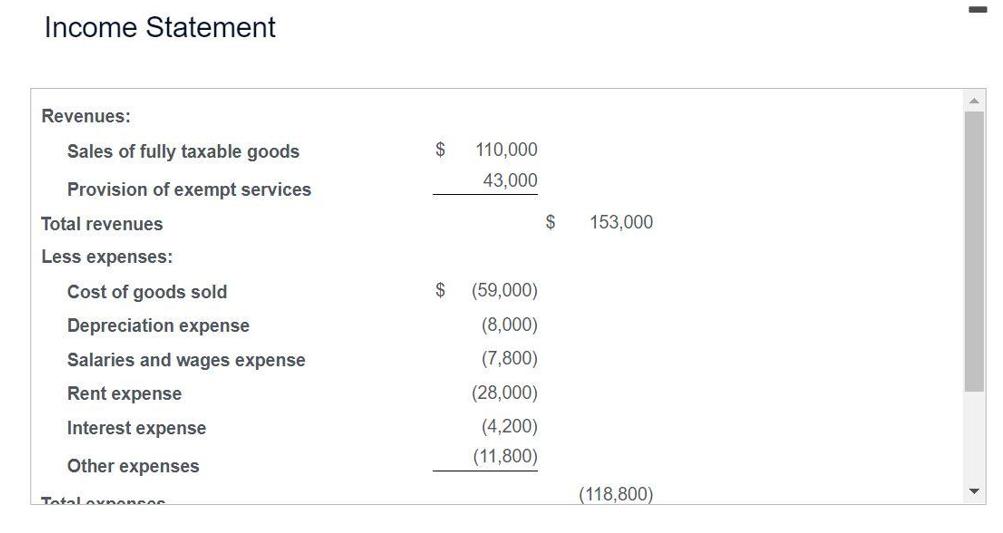

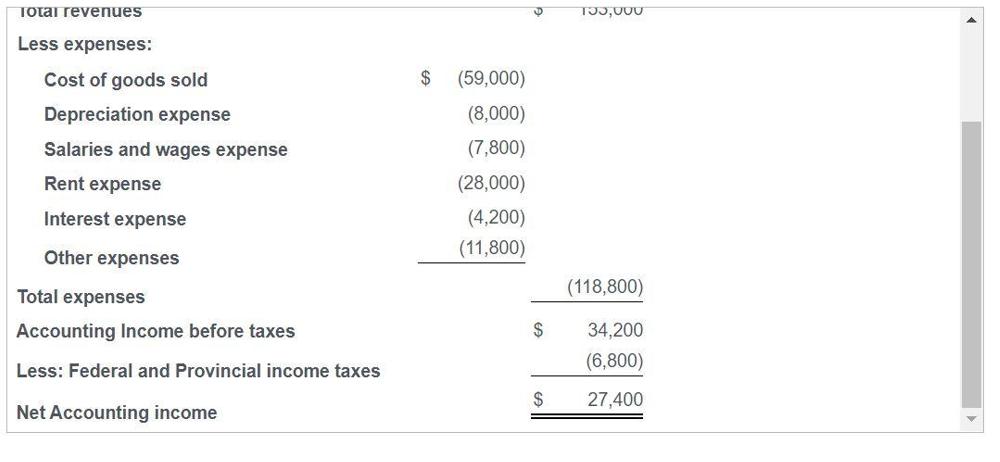

Income Statement Revenues: Sales of fully taxable goods Provision of exempt services Total revenues Less expenses: Cost of goods sold Depreciation expense Salaries and

![]()

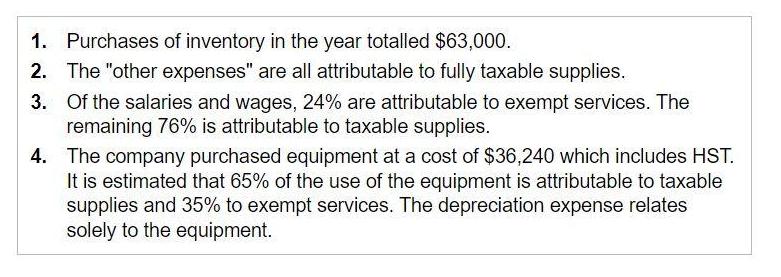

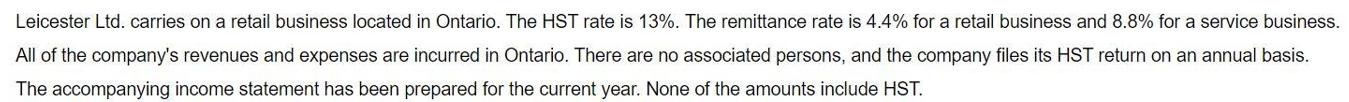

Income Statement Revenues: Sales of fully taxable goods Provision of exempt services Total revenues Less expenses: Cost of goods sold Depreciation expense Salaries and wages expense Rent expense Interest expense Other expenses Tatalovnoncer $ 110,000 43,000 $ (59,000) (8,000) (7,800) (28,000) (4,200) (11,800) $ 153,000 (118,800) I Total revenues Less expenses: Cost of goods sold Depreciation expense Salaries and wages expense Rent expense Interest expense Other expenses Total expenses Accounting Income before taxes Less: Federal and Provincial income taxes Net Accounting income $ (59,000) (8,000) (7,800) (28,000) (4,200) (11,800) $ $ 135,000 (118,800) 34,200 (6,800) 27,400 1. Purchases of inventory in the year totalled $63,000. 2. The "other expenses" are all attributable to fully taxable supplies. 3. Of the salaries and wages, 24% are attributable to exempt services. The remaining 76% is attributable to taxable supplies. 4. The company purchased equipment at a cost of $36,240 which includes HST. It is estimated that 65% of the use of the equipment is attributable to taxable supplies and 35% to exempt services. The depreciation expense relates solely to the equipment. Leicester Ltd. carries on a retail business located in Ontario. The HST rate is 13%. The remittance rate is 4.4% for a retail business and 8.8% for a service business. All of the company's revenues and expenses are incurred in Ontario. There are no associated persons, and the company files its HST return on an annual basis. The accompanying income statement has been prepared for the current year. None of the amounts include HST. Requirement A. Calculate Leicester's net HST payable or HST refund for the current year using the regular HST method. Leicester's net HST payable (HST refund) for the current year is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate Leicesters net HST payable or refund for the current year using the regular HST method we need to follow the steps below 1 Calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started