Question

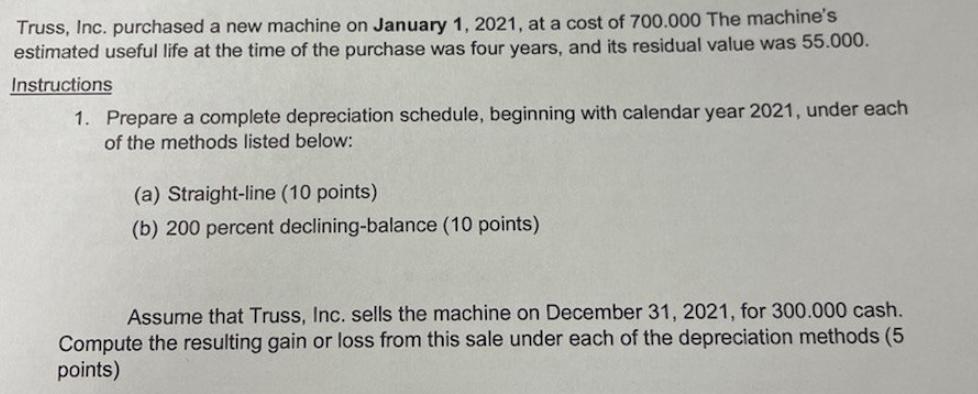

Truss, Inc. purchased a new machine on January 1, 2021, at a cost of 700.000 The machine's estimated useful life at the time of

Truss, Inc. purchased a new machine on January 1, 2021, at a cost of 700.000 The machine's estimated useful life at the time of the purchase was four years, and its residual value was 55.000. Instructions 1. Prepare a complete depreciation schedule, beginning with calendar year 2021, under each of the methods listed below: (a) Straight-line (10 points) (b) 200 percent declining-balance (10 points) Assume that Truss, Inc. sells the machine on December 31, 2021, for 300.000 cash. Compute the resulting gain or loss from this sale under each of the depreciation methods (5 points)

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer I The depreciation expense is charged on fixed assets as reduction in the value of fixed asse...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting the basis for business decisions

Authors: Jan Williams, Susan Haka, Mark Bettner, Joseph Carcello

17th edition

007802577X, 978-0078025778

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App