Answered step by step

Verified Expert Solution

Question

1 Approved Answer

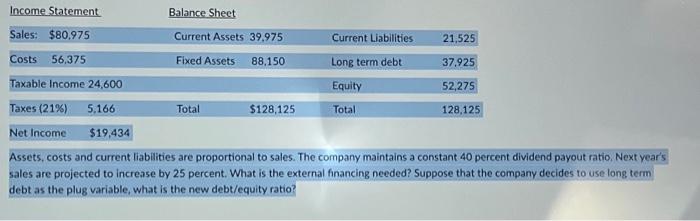

Income Statement Sales: $80,975 Costs 56,375 Taxable Income 24,600 Taxes (21%) 5,166 Balance Sheet Current Assets 39,975 Net Income Fixed Assets Total 88,150 $128,125 Current

Income Statement Sales: $80,975 Costs 56,375 Taxable Income 24,600 Taxes (21%) 5,166 Balance Sheet Current Assets 39,975 Net Income Fixed Assets Total 88,150 $128,125 Current Liabilities Long term debt Equity Total 21,525 37,925 52,275 128,125 $19,434 Assets, costs and current liabilities are proportional to sales. The company maintains a constant 40 percent dividend payout ratio. Next year's sales are projected to increase by 25 percent. What is the external financing needed? Suppose that the company decides to use long term debt as the plug variable, what is the new debt/equity ratio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started