Answered step by step

Verified Expert Solution

Question

1 Approved Answer

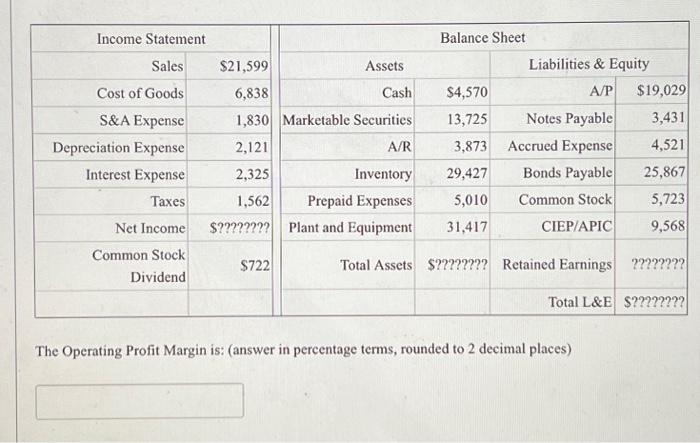

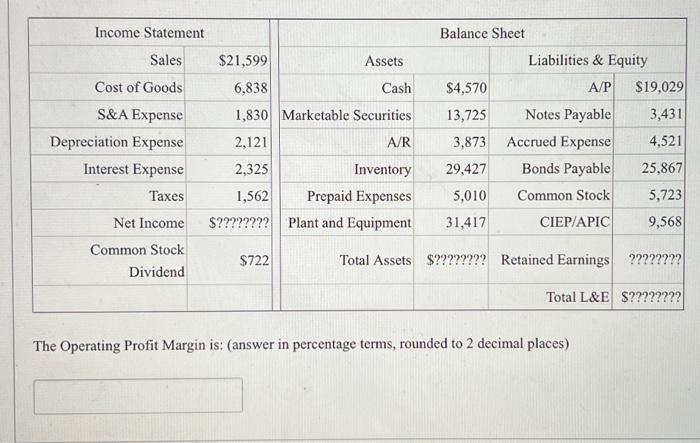

Income Statement Sales Cost of Goods S&A Expense Depreciation Expense Interest Expense Taxes Net Income Common Stock Dividend $21,599 6,838 Cash 1,830 Marketable Securities 2,121

Income Statement Sales Cost of Goods S&A Expense Depreciation Expense Interest Expense Taxes Net Income Common Stock Dividend $21,599 6,838 Cash 1,830 Marketable Securities 2,121 2,325 1,562 $???????? Assets $722 A/R Inventory Prepaid Expenses Plant and Equipment Balance Sheet $4,570 13,725 3,873 29,427 5,010 31,417 Liabilities & Equity A/P Notes Payable Accrued Expense Bonds Payable Common Stock CIEP/APIC Total Assets $???????? Retained Earnings $19,029 3,431 4,521 25,867 5,723 9,568 The Operating Profit Margin is: (answer in percentage terms, rounded to 2 decimal places) ???????? Total L&E $????????

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started