Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income Statement Statement of Financial Position Calculate the following ratio analysis. (a) Gross profit margin (b) Debt to equity ratio (c) return on assets (d)

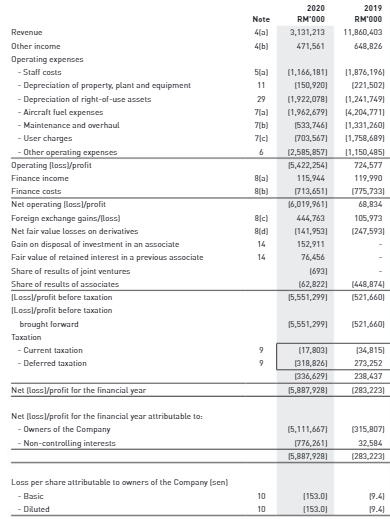

Income Statement

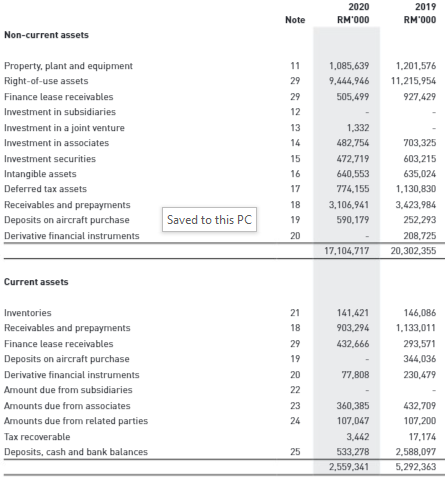

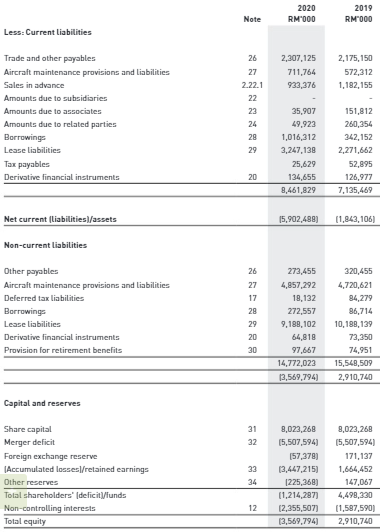

Statement of Financial Position

Calculate the following ratio analysis.

(a) Gross profit margin

(b) Debt to equity ratio

(c) return on assets

(d) earnings per share

(e) Net assets turnover

(f) Fixed assets turnover

(g) Inventory turnover days

(h) Debtors Turnover

(i) Acid test ratio (Quick ratio)

(j) Current Ratio

Note 41a) 4[b] 2020 RM1000 3,131,213 471,561 2019 RM000 11,860,403 648,826 mmm 5al 11 29 7 7[b 6 Revenue Other income Operating expenses - Staff costs - Depreciation of property, plant and equipment - Depreciation of right-of-use assets - Aircraft fuel expenses - Maintenance and overhaul User charges Other operating expenses Operating loss profit Finance income Finance costs Net operating lossl/profit Foreign exchange gains/loss) Netfair value losses derivative Gain on disposal of investment in an associate Fair value of retained interest in a previous associate Share of results of joint ventures Share of results of associates Lossl/profit before taxation Lossl/profit before taxation brought forward Taxation - Current taxation - Deferred taxation 8(a) 8[b] (1,166, 191] [150,920] (1,922,078] (1,962.6791 (533,746] 1703,5671 12,585,857) 15,422,254) 115,944 [713,651] 16,019,961) 444,763 [141,953 152,911 76,456 [693] (62.822) 15,551,2991 11,876.1961 (221,502) 11,241,7491 14,204.7711 11,331,260) 11.758,6891 11,150,485) 724,577 119.990 [775,733) 68,834 105,973 (247.593 810) 8(d) 14 14 (448,8741 (521,660) 15,551,2991 (521,660) 9 9 (17,803) 1318,826] 1336,6291 15,887,928) 134,8151 273.252 238,437 (283,223] Net (local/profit for the financial year Net (local/profit for the financial year attributable to: - Owners of the Company Non-controlling interests 15,111,667) 1776,261] 15,887,928) (315,807) 32,584 [283,223) Loss per share attributable to owners of the Company Isen) Basic Diluted 10 10 [153.0] [153.01 19.4 19.41 2020 RM'000 2019 RM'000 Note Non-current assets 11 29 29 12 1,085,639 9.444.946 505,499 1,201,576 11.215,954 927.429 13 Property, plant and equipment Right-of-use assets Finance lease receivables Investment in subsidiaries Investment in a joint venture Investment in associates Investment securities Intangible assets Deferred tax assets Receivables and prepayments Deposits on aircraft purchase Derivative financial instruments 14 15 16 17 18 19 1,332 482.754 472,719 640,553 774.155 3,106,941 590,179 703,325 603,215 635,024 1.130,830 3,423,984 252,293 208,725 20,302,355 Saved to this PC 20 17,104,717 Current assets 21 18 29 141,421 903,294 432,666 146,086 1.133,011 293,571 344,036 230,479 19 20 77.808 Inventories Receivables and prepayments Finance lease receivables Deposits on aircraft purchase Derivative financial instruments Amount due from subsidiaries Amounts due from associates Amounts due from related parties Tax recoverable Deposits, cash and bank balances 22 23 24 360,385 107,047 3.442 533.278 2,559,341 432,709 107,200 17.174 2.588,097 5.292,363 25 2020 RM"000 2019 RM1000 Note Less: Current liabilities 26 2,307,125 711,764 933,376 2,175,150 572,312 1,182,155 Trade and other payables Aircraft maintenance provisions and liabilities Sales in advance Amounts due to subsidiaries Amounts due to associates Amounts due to related parties Borrowings Lease Liabilities Tax payables Derivative financial instruments 27 2.22.1 22 23 24 28 29 35,907 49,923 1,016,312 3,247,138 25,629 134,655 8,461,829 151,812 260,354 342,152 2,271,662 52,895 126,977 7.135,469 20 Net current liabilities/assets 15,902,489) (1,843,106) Non-current liabilities 26 Other payables Aircraft maintenance provisions and liabilities Deferred tax liabilities Borrowings Lease Liabilities Derivative financial instruments Provision for retirement benefits 27 17 28 29 20 30 273,455 4,857,292 19,132 272,557 9,188,102 64,818 97,667 14,772,023 13,569,794) 320,455 4.720,621 84,279 86,714 10,188,139 73,350 74,951 15,548,509 2,910,740 Capital and reserves 31 32 Share capital Merger deficit Foreign exchange reserve Accumulated losses/retained earnings Other reserves Total shareholders' delicitlunds Non-controlling interests Total equity 33 34 8,023,268 (5,507,594) [57,378) 13.447,215) 1225,368) (1,214,287) 12,355,507 13,569,794) 8,023,268 (5,507,594) 171,137 1,664,452 147,067 4,498,330 (1,587,590) 2,910,740 12

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started