Answered step by step

Verified Expert Solution

Question

1 Approved Answer

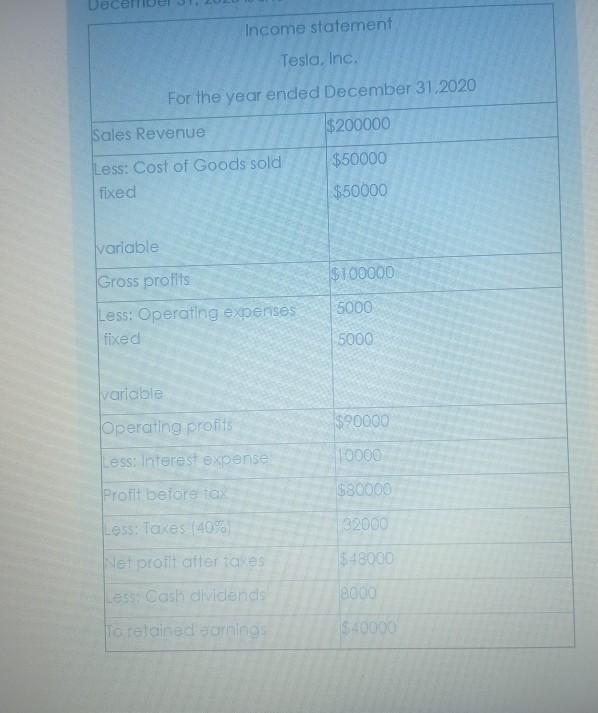

Income statement Tesla, Inc. For the year ended December 31,2020 Sales Revenue $200000 Less: Cost of Goods sold fixed $50000 $50000 Variable $100000 Gross profits

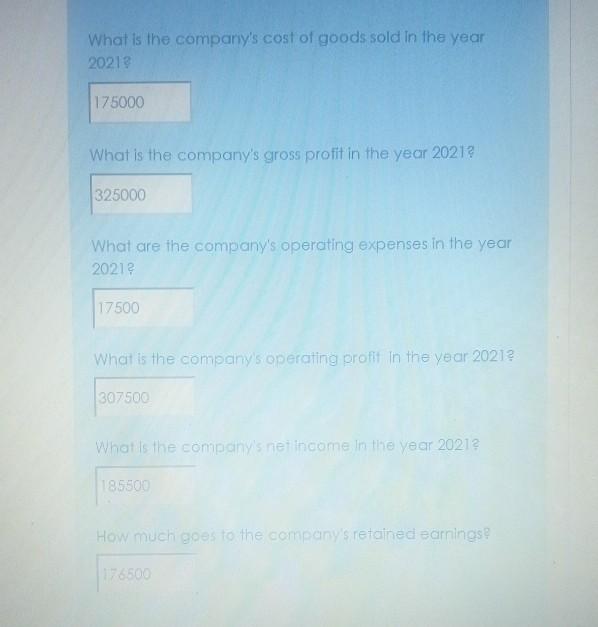

Income statement Tesla, Inc. For the year ended December 31,2020 Sales Revenue $200000 Less: Cost of Goods sold fixed $50000 $50000 Variable $100000 Gross profits Less: Operating expenses fixed 5000 5000 variable Operating profil Less: Interest expense $90000 10000 Profit belove to 580000 32000 Less: Taxes 40% Net profit after taxes 1548000 Less Cash dividends 1800 To retained agring 540000 What is the company's cost of goods sold in the year 20213 175000 What is the company's gross profit in the year 20219 325000 What are the company's operating expenses in the year 20212 17500 What is the company's operating profit in the year 20212 307500 What is the company's mei income in the year 20213 How much goes to the company's retained earrings 6500 Income statement Tesla, Inc. For the year ended December 31,2020 Sales Revenue $200000 Less: Cost of Goods sold fixed $50000 $50000 Variable $100000 Gross profits Less: Operating expenses fixed 5000 5000 variable Operating profil Less: Interest expense $90000 10000 Profit belove to 580000 32000 Less: Taxes 40% Net profit after taxes 1548000 Less Cash dividends 1800 To retained agring 540000 What is the company's cost of goods sold in the year 20213 175000 What is the company's gross profit in the year 20219 325000 What are the company's operating expenses in the year 20212 17500 What is the company's operating profit in the year 20212 307500 What is the company's mei income in the year 20213 How much goes to the company's retained earrings 6500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started