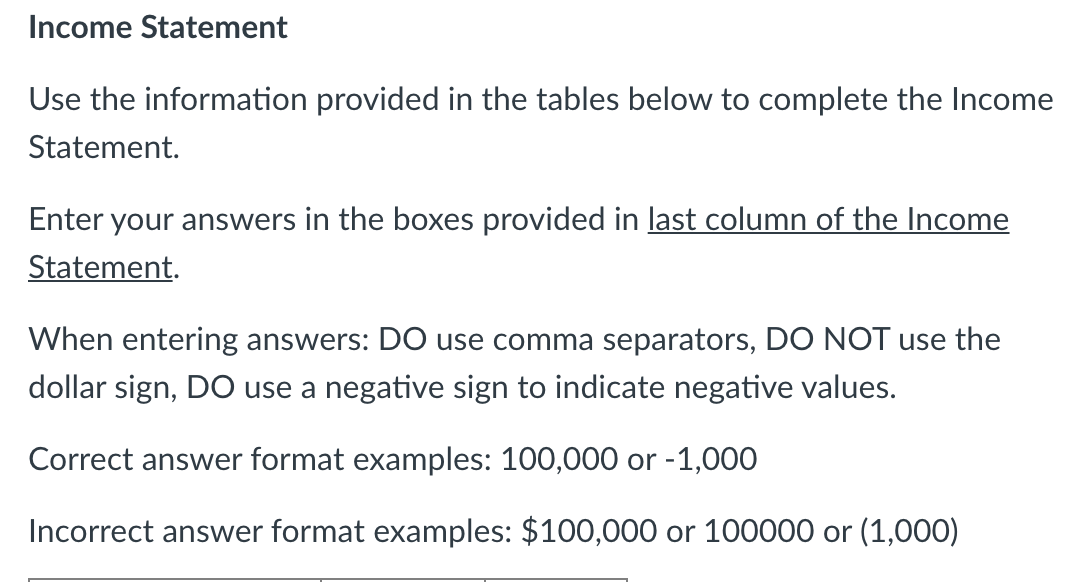

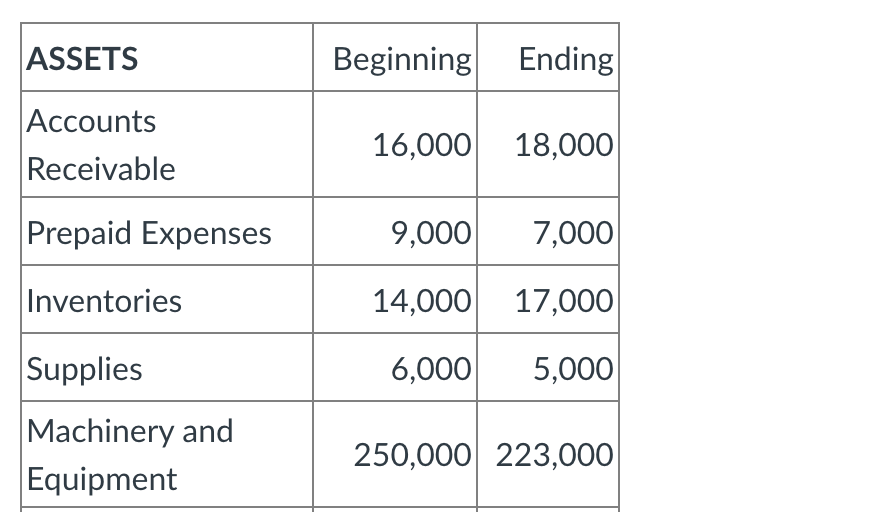

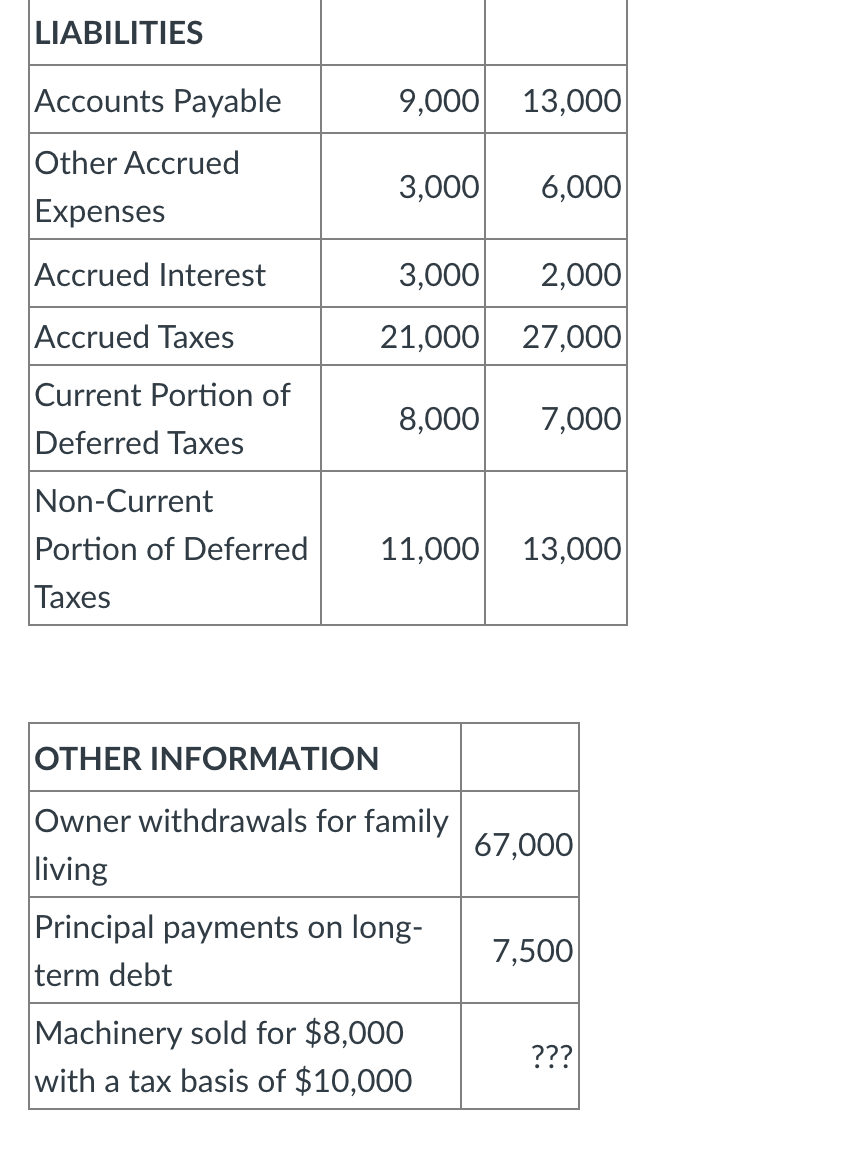

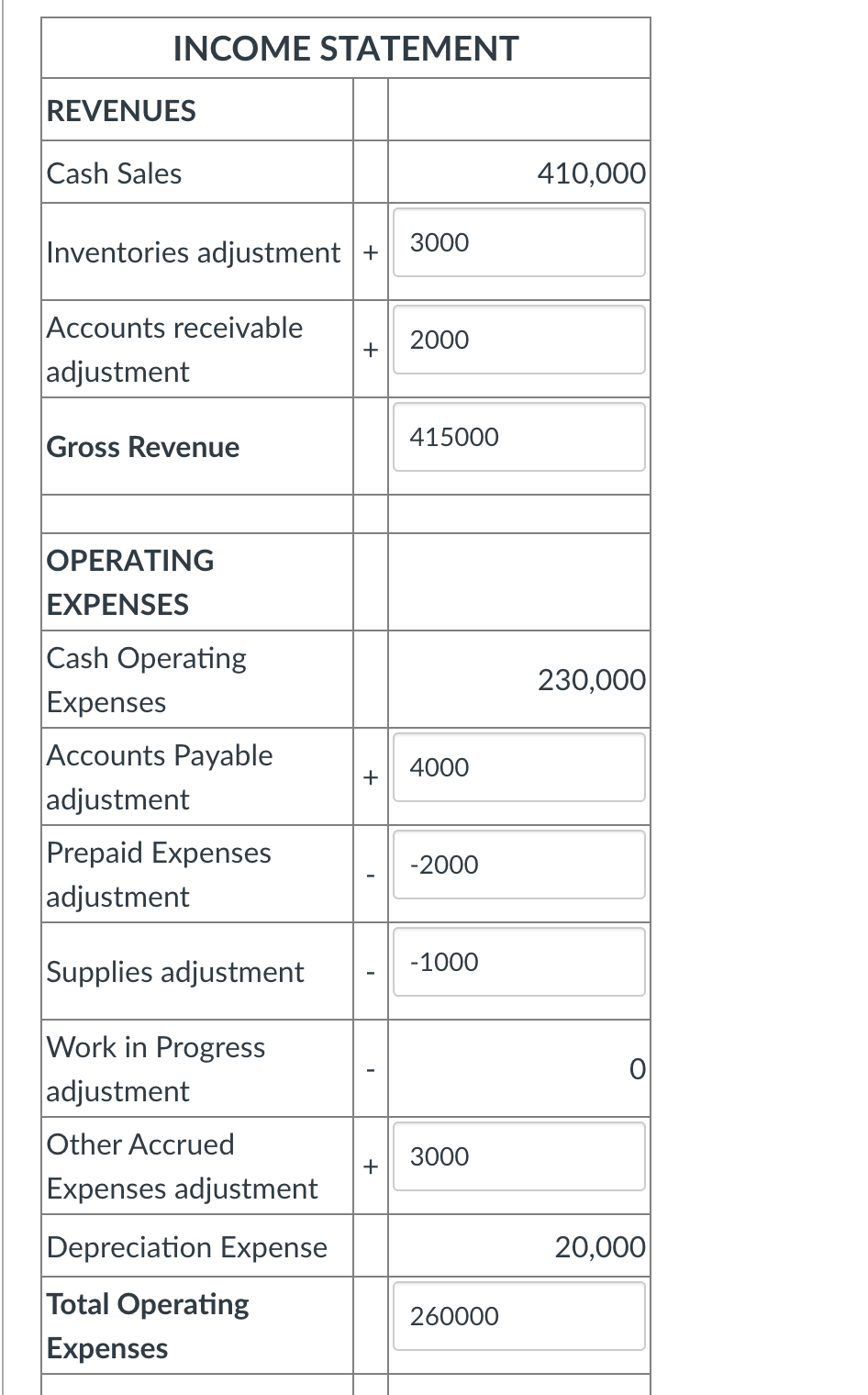

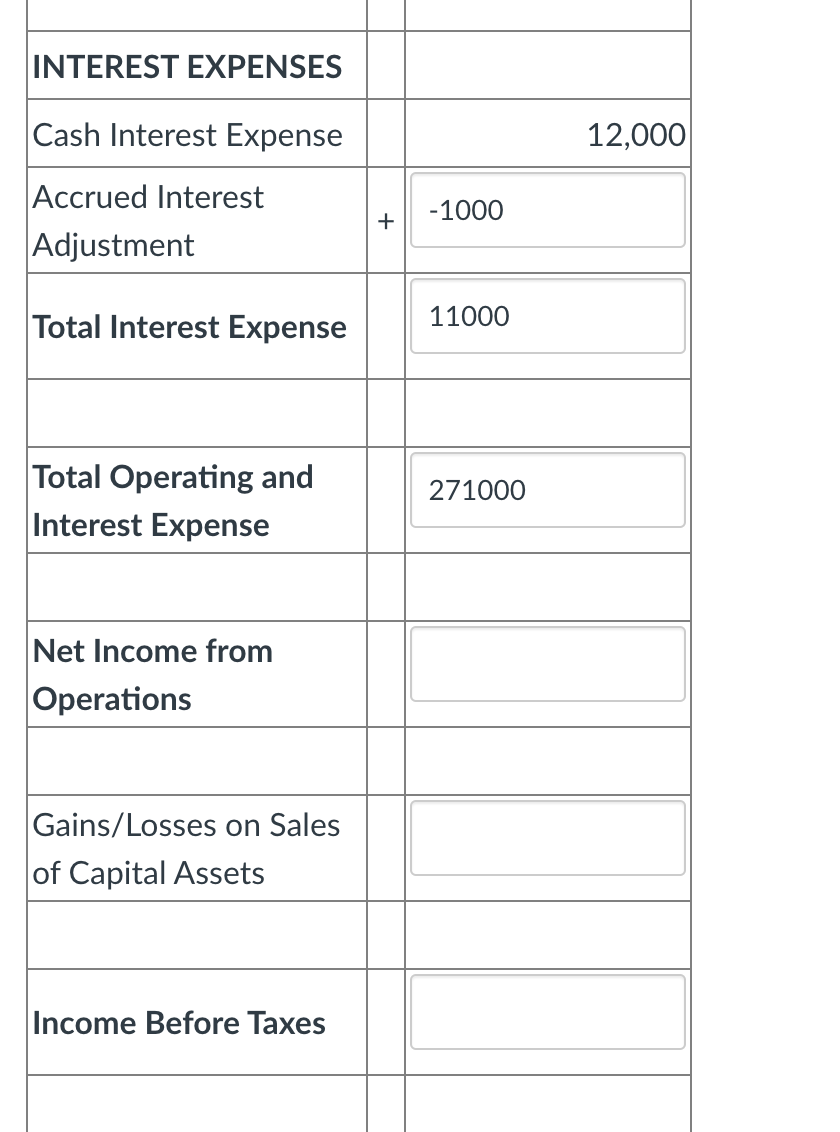

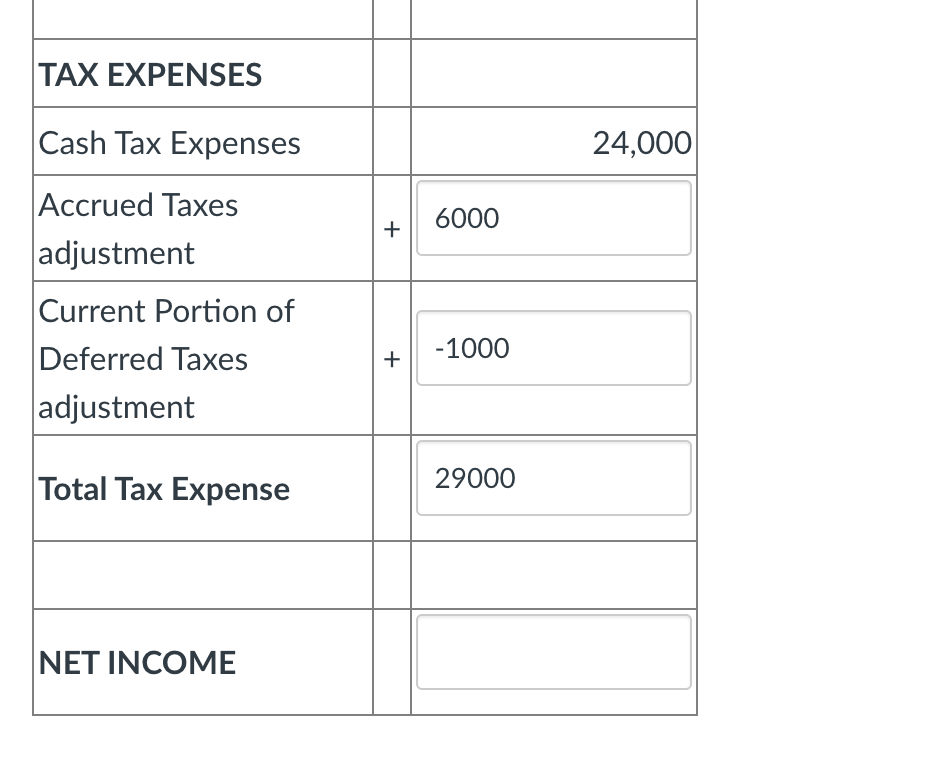

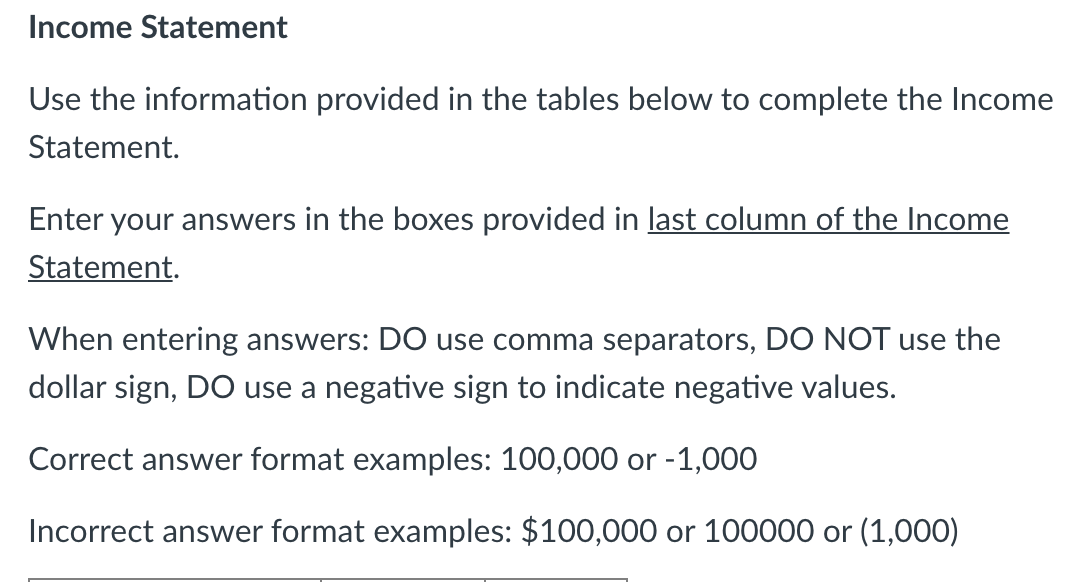

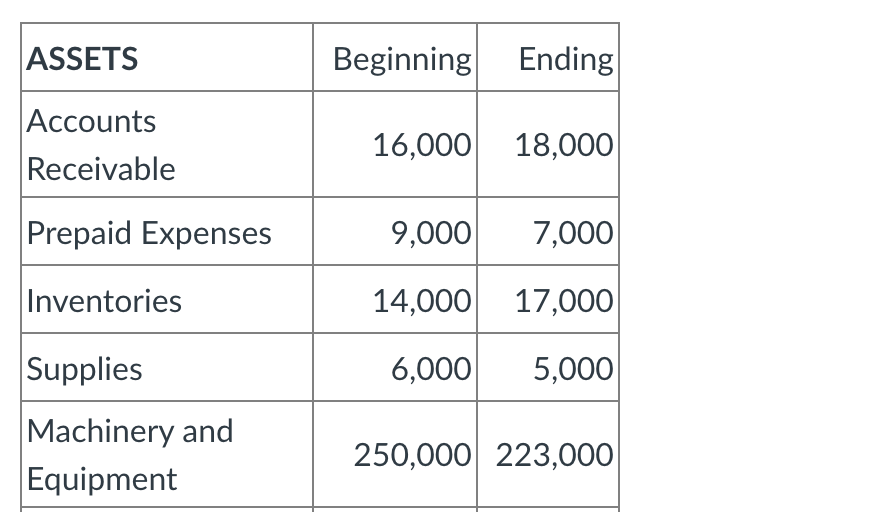

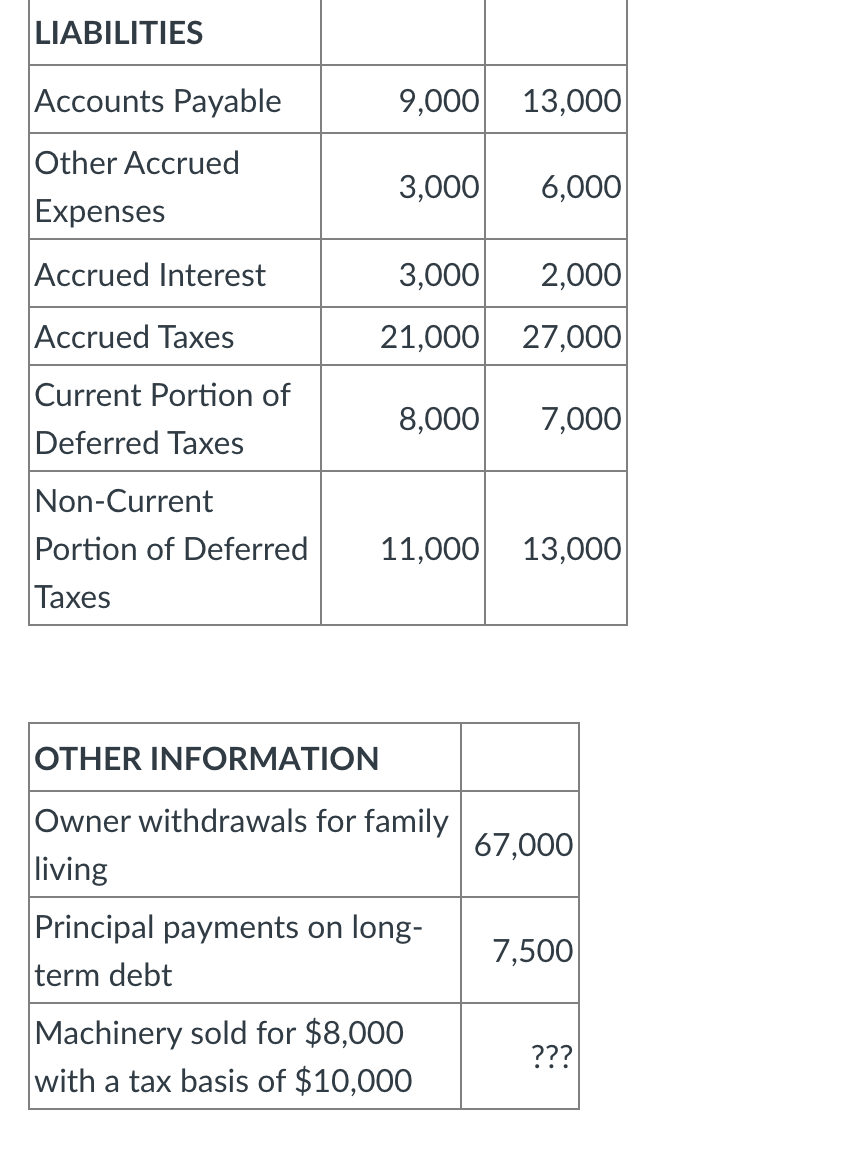

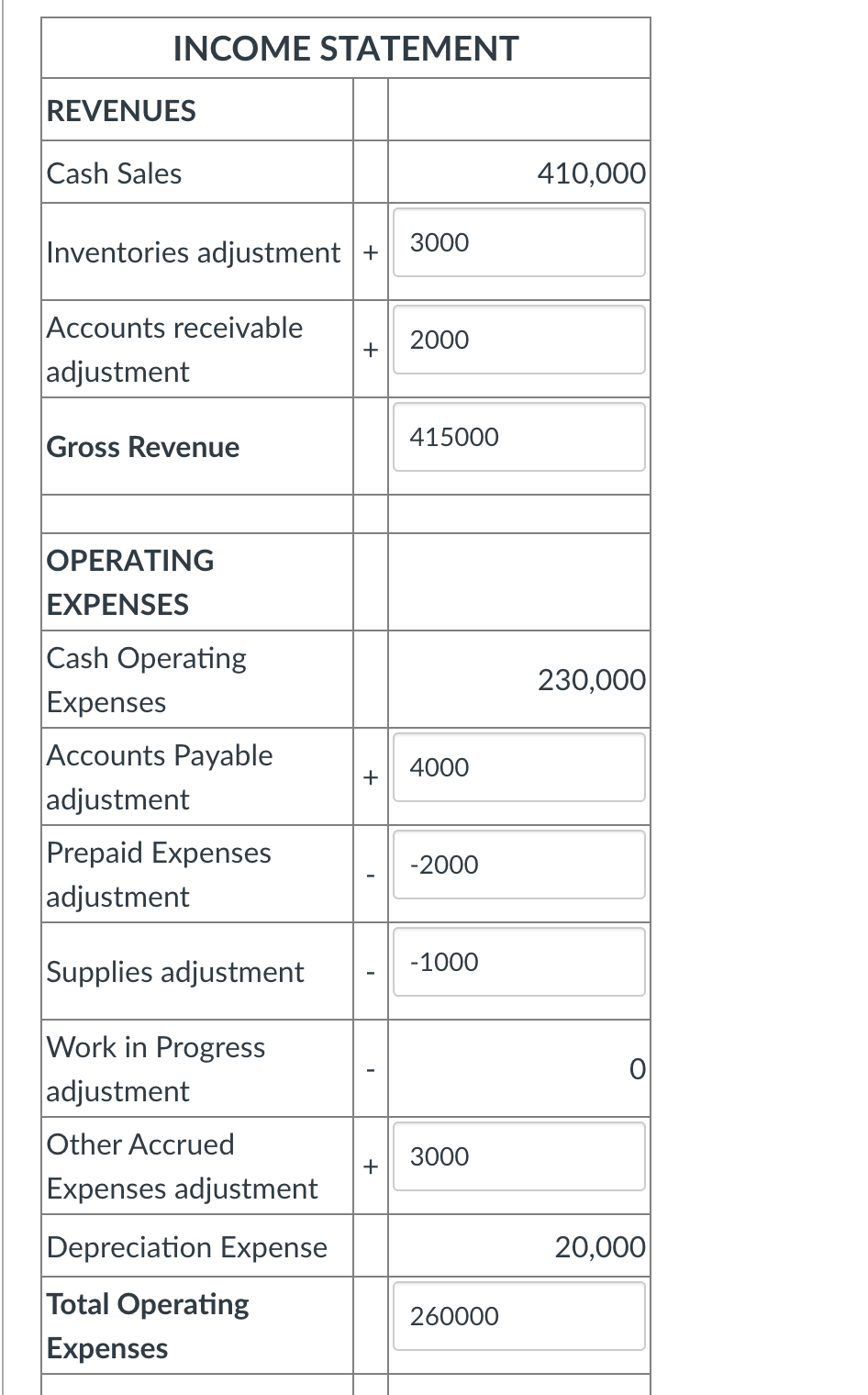

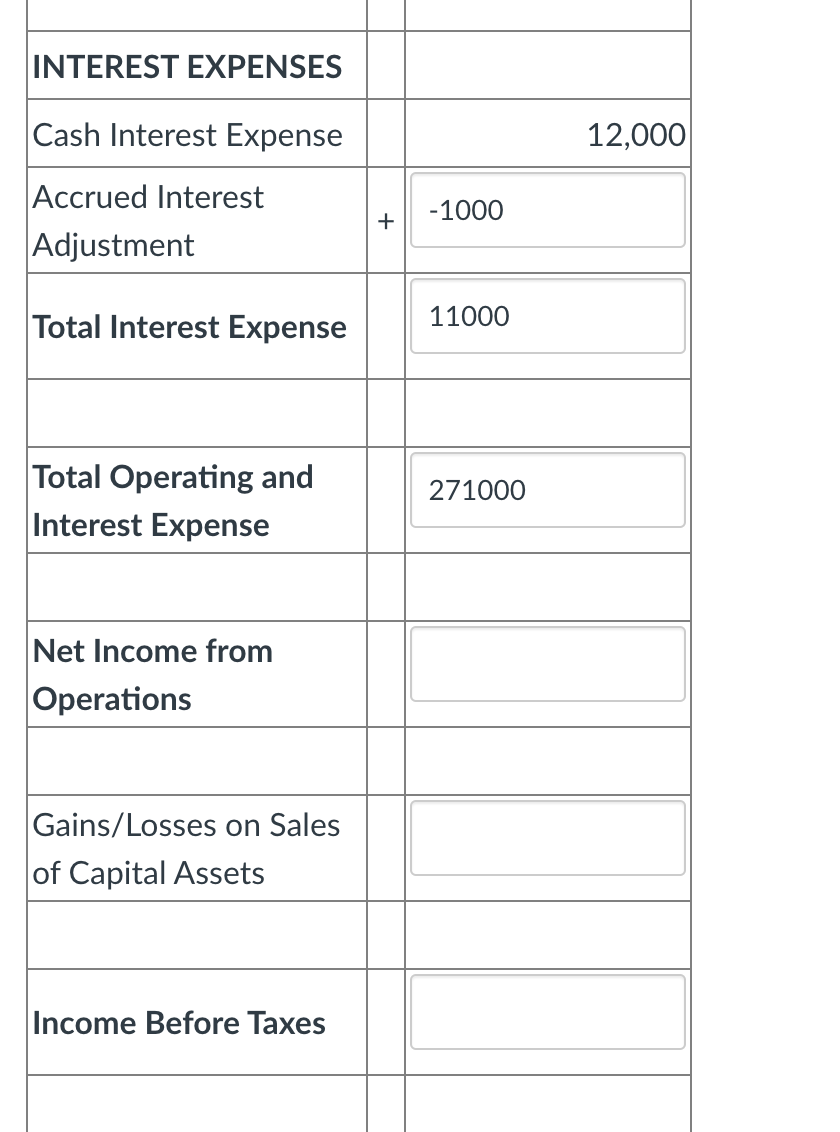

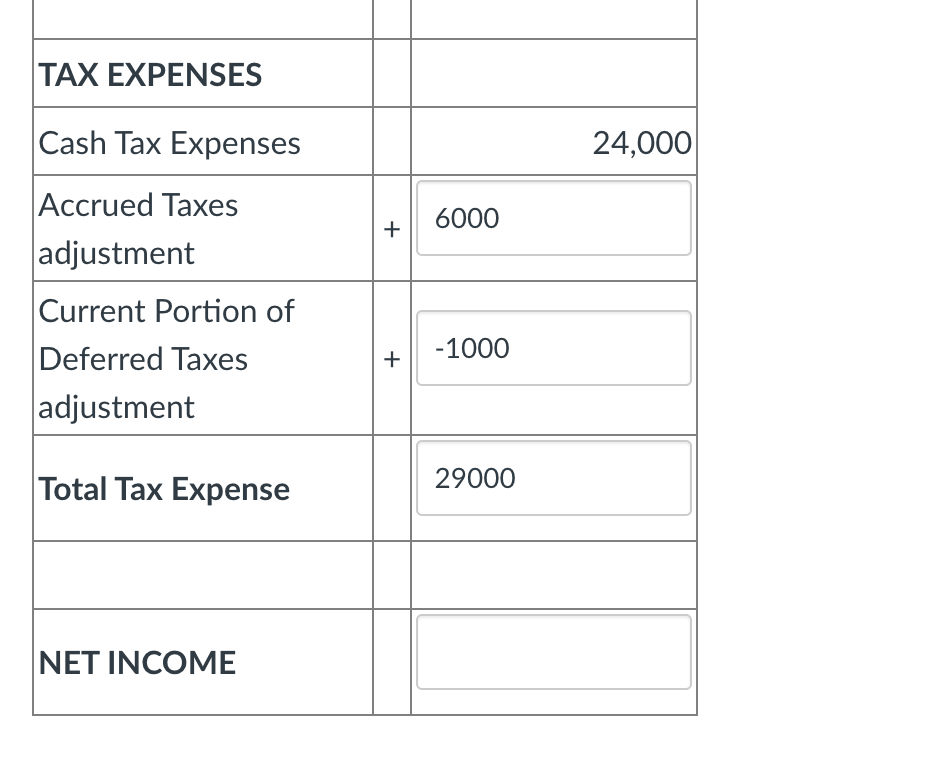

Income Statement Use the information provided in the tables below to complete the Income Statement. Enter your answers in the boxes provided in last column of the Income Statement. When entering answers: DO use comma separators, DO NOT use the dollar sign, DO use a negative sign to indicate negative values. Correct answer format examples: 100,000 or -1,000 Incorrect answer format examples: $100,000 or 100000 or (1,000) ASSETS Beginning Ending Accounts Receivable 16,000 18,000 Prepaid Expenses 9,000 7,000 Inventories 14,000 17,000 Supplies 6,000 5,000 Machinery and Equipment 250,000 223,000 LIABILITIES Accounts Payable 9,000 13,000 Other Accrued Expenses 3,000 6,000 Accrued Interest 3,000 2,000 Accrued Taxes 21,000 27,000 Current Portion of Deferred Taxes 8,000 7,000 Non-Current Portion of Deferred Taxes 11,000 13,000 OTHER INFORMATION Owner withdrawals for family living 67,000 7,500 Principal payments on long- term debt Machinery sold for $8,000 with a tax basis of $10,000 ??? INCOME STATEMENT REVENUES Cash Sales 410,000 Inventories adjustment + 3000 2000 Accounts receivable adjustment + Gross Revenue 415000 OPERATING EXPENSES 230,000 Cash Operating Expenses Accounts Payable adjustment Prepaid Expenses adjustment 4000 + -2000 -1000 Supplies adjustment O Work in Progress adjustment Other Accrued Expenses adjustment 3000 + Depreciation Expense 20,000 260000 Total Operating Expenses INTEREST EXPENSES Cash Interest Expense 12,000 -1000 Accrued Interest Adjustment + Total Interest Expense 11000 Total Operating and Interest Expense 271000 Net Income from Operations Gains/Losses on Sales of Capital Assets Income Before Taxes TAX EXPENSES Cash Tax Expenses 24,000 Accrued Taxes adjustment + 6000 -1000 Current Portion of Deferred Taxes adjustment + Total Tax Expense 29000 NET INCOME Income Statement Use the information provided in the tables below to complete the Income Statement. Enter your answers in the boxes provided in last column of the Income Statement. When entering answers: DO use comma separators, DO NOT use the dollar sign, DO use a negative sign to indicate negative values. Correct answer format examples: 100,000 or -1,000 Incorrect answer format examples: $100,000 or 100000 or (1,000) ASSETS Beginning Ending Accounts Receivable 16,000 18,000 Prepaid Expenses 9,000 7,000 Inventories 14,000 17,000 Supplies 6,000 5,000 Machinery and Equipment 250,000 223,000 LIABILITIES Accounts Payable 9,000 13,000 Other Accrued Expenses 3,000 6,000 Accrued Interest 3,000 2,000 Accrued Taxes 21,000 27,000 Current Portion of Deferred Taxes 8,000 7,000 Non-Current Portion of Deferred Taxes 11,000 13,000 OTHER INFORMATION Owner withdrawals for family living 67,000 7,500 Principal payments on long- term debt Machinery sold for $8,000 with a tax basis of $10,000 ??? INCOME STATEMENT REVENUES Cash Sales 410,000 Inventories adjustment + 3000 2000 Accounts receivable adjustment + Gross Revenue 415000 OPERATING EXPENSES 230,000 Cash Operating Expenses Accounts Payable adjustment Prepaid Expenses adjustment 4000 + -2000 -1000 Supplies adjustment O Work in Progress adjustment Other Accrued Expenses adjustment 3000 + Depreciation Expense 20,000 260000 Total Operating Expenses INTEREST EXPENSES Cash Interest Expense 12,000 -1000 Accrued Interest Adjustment + Total Interest Expense 11000 Total Operating and Interest Expense 271000 Net Income from Operations Gains/Losses on Sales of Capital Assets Income Before Taxes TAX EXPENSES Cash Tax Expenses 24,000 Accrued Taxes adjustment + 6000 -1000 Current Portion of Deferred Taxes adjustment + Total Tax Expense 29000 NET INCOME