Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income Statement Vertical Analysis - The Clorox Company (All items on each statement is a % of net sales on the statements rounded to 1

Income Statement Vertical Analysis - The Clorox Company

(All items on each statement is a % of net sales on the statements rounded to 1 decimal point)

- Using Excel, compute common-size income statements for all three fiscal years. (Net sales = 100%) (10 pts)

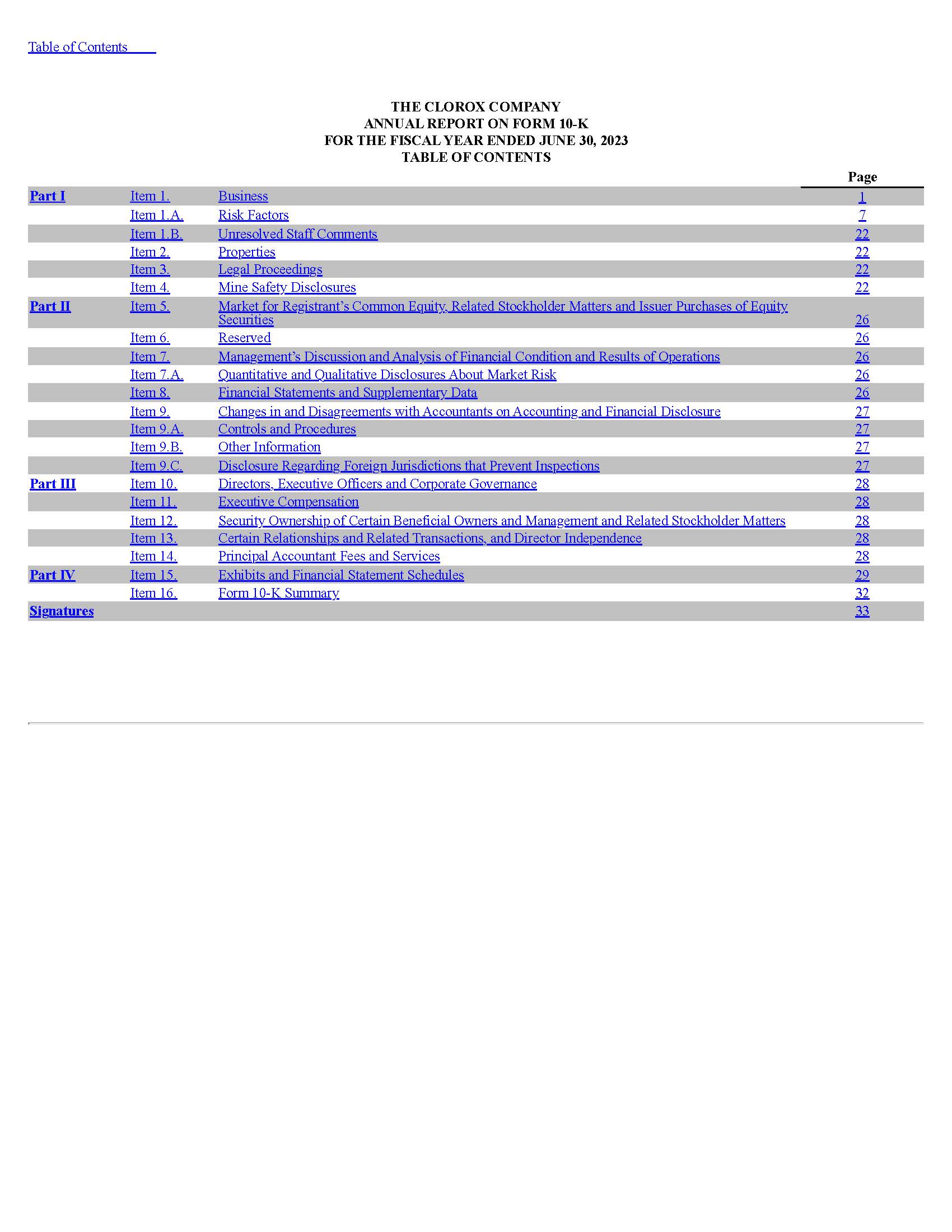

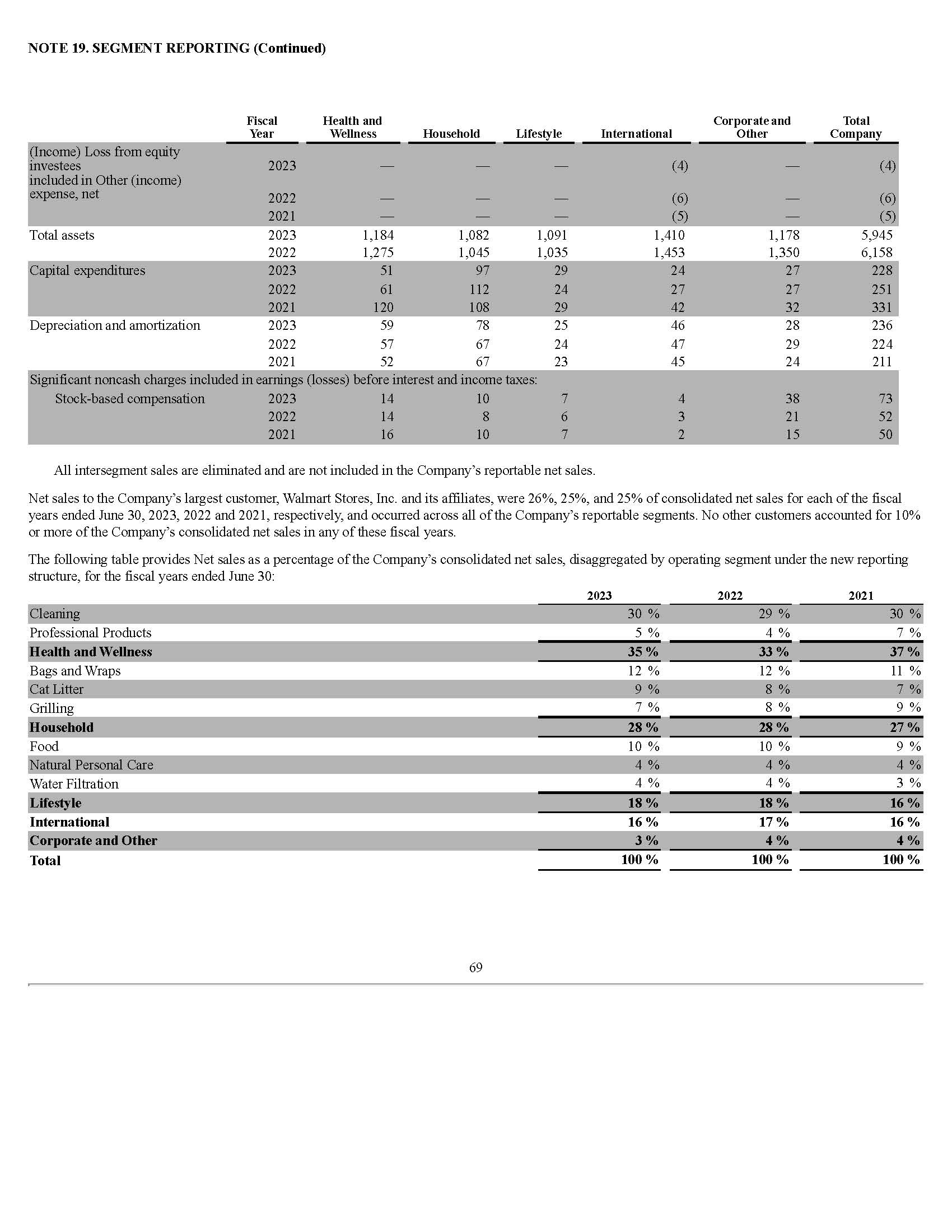

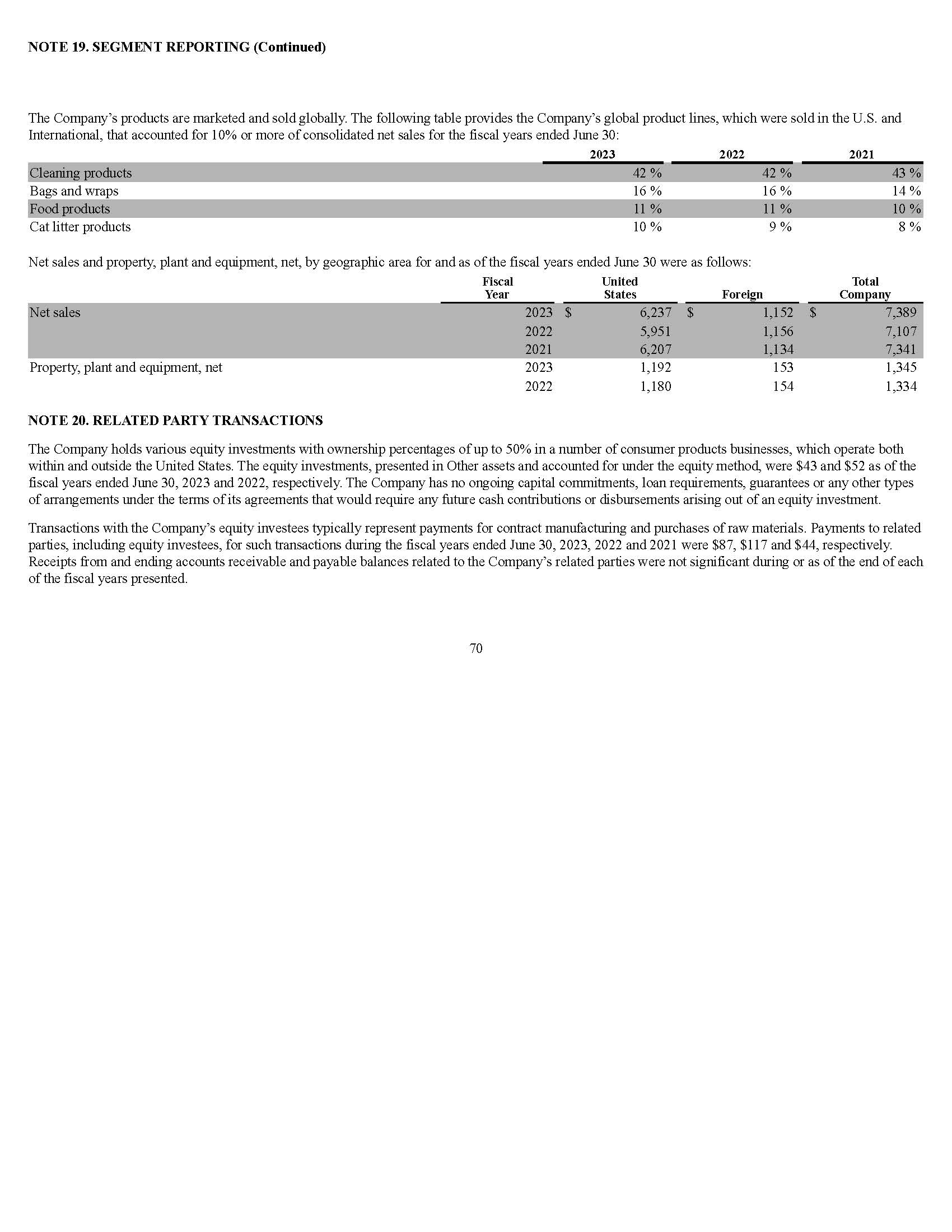

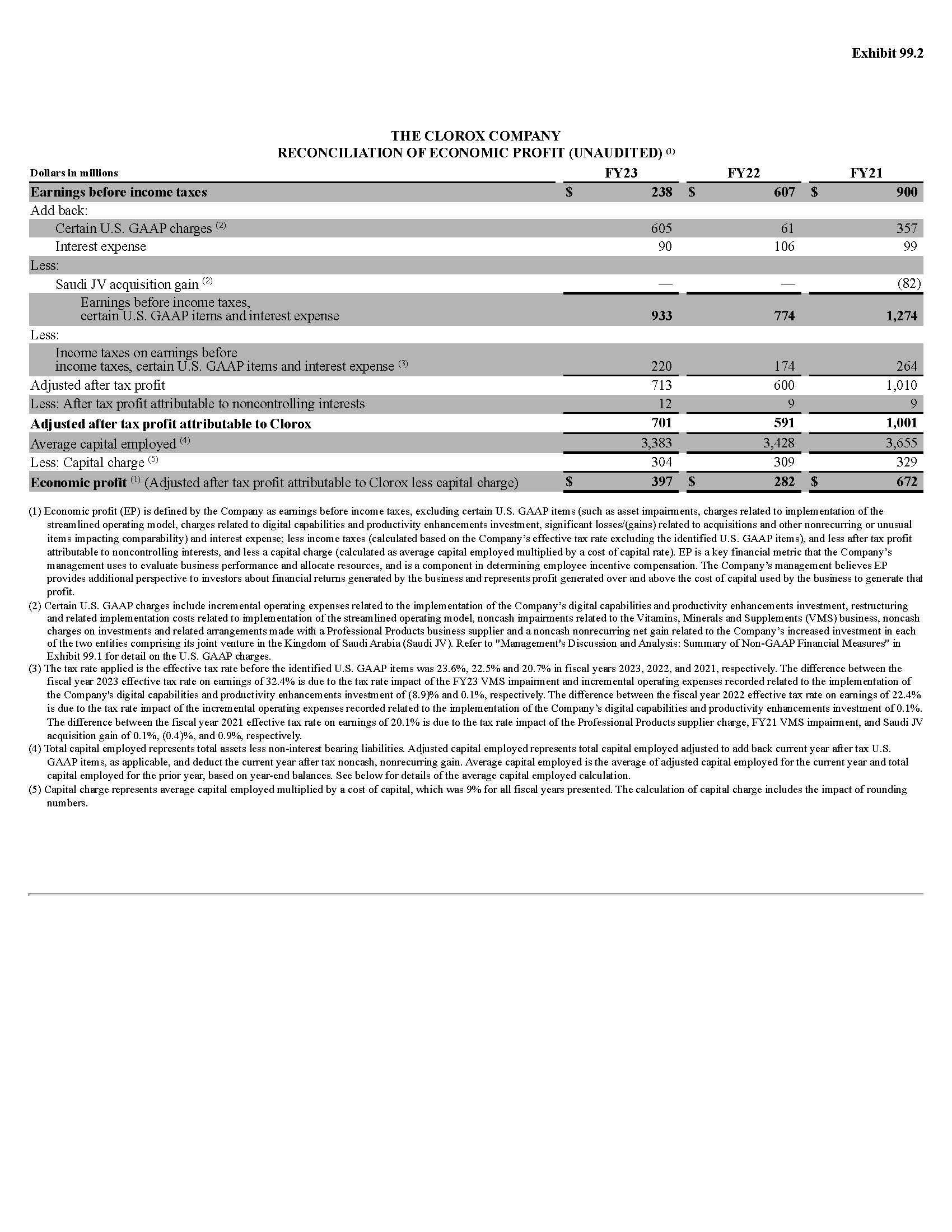

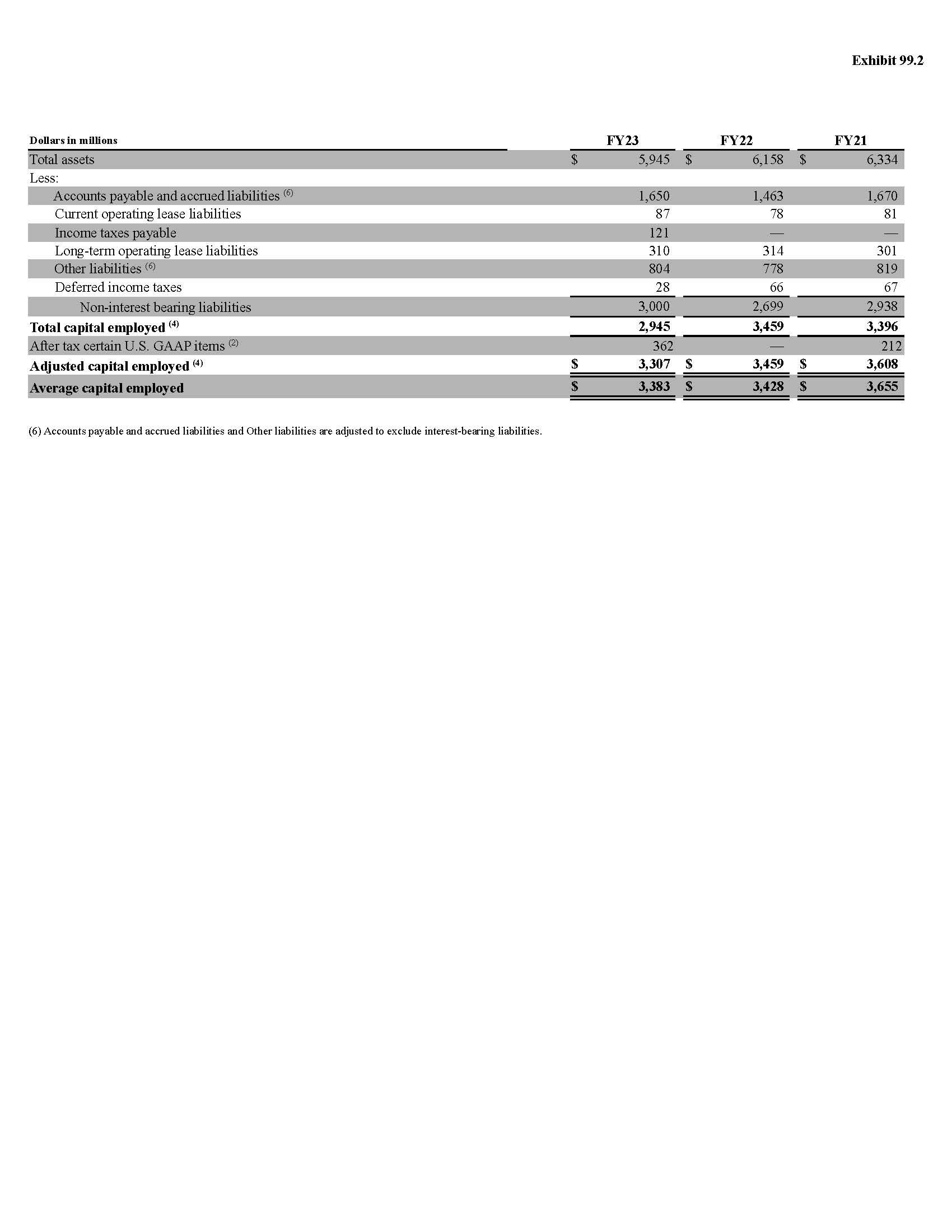

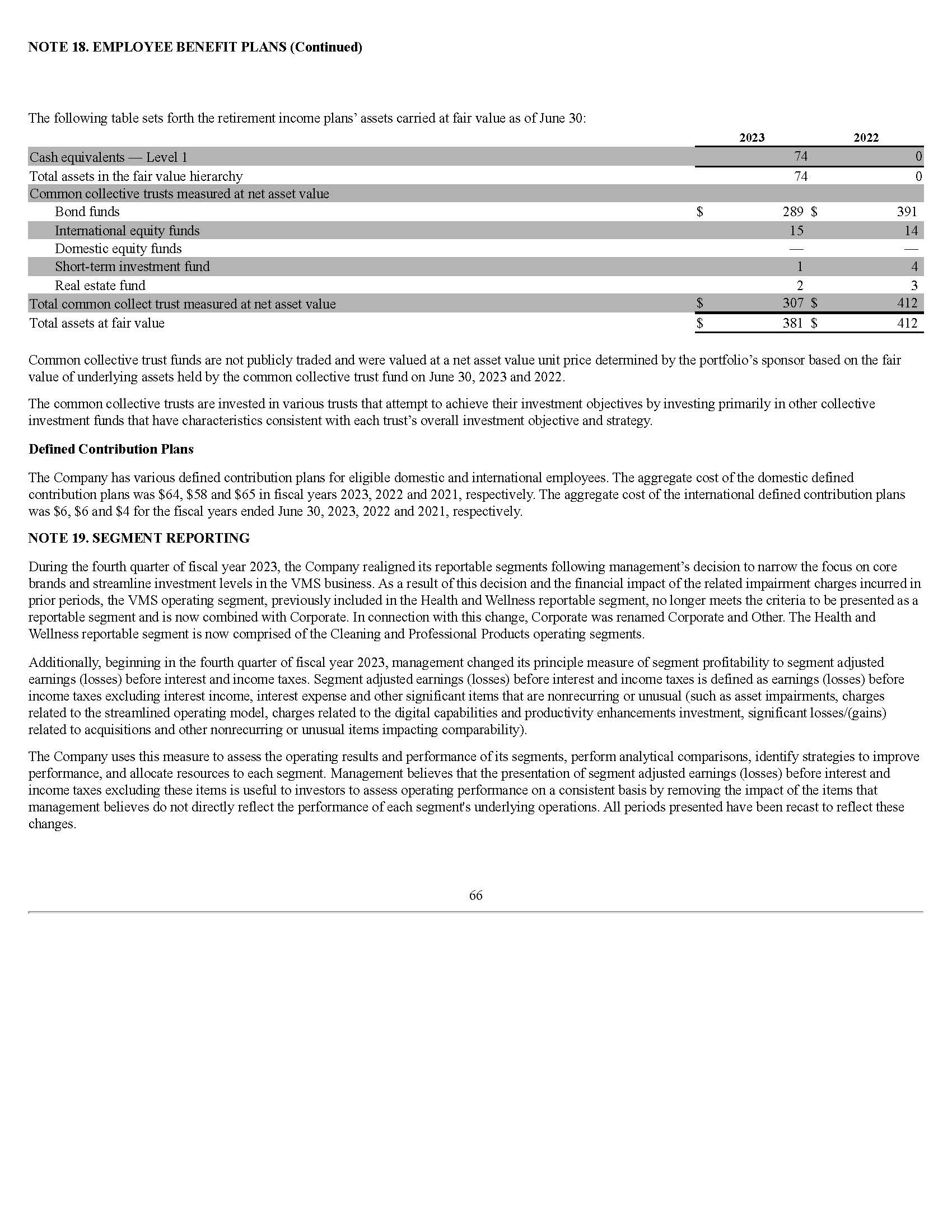

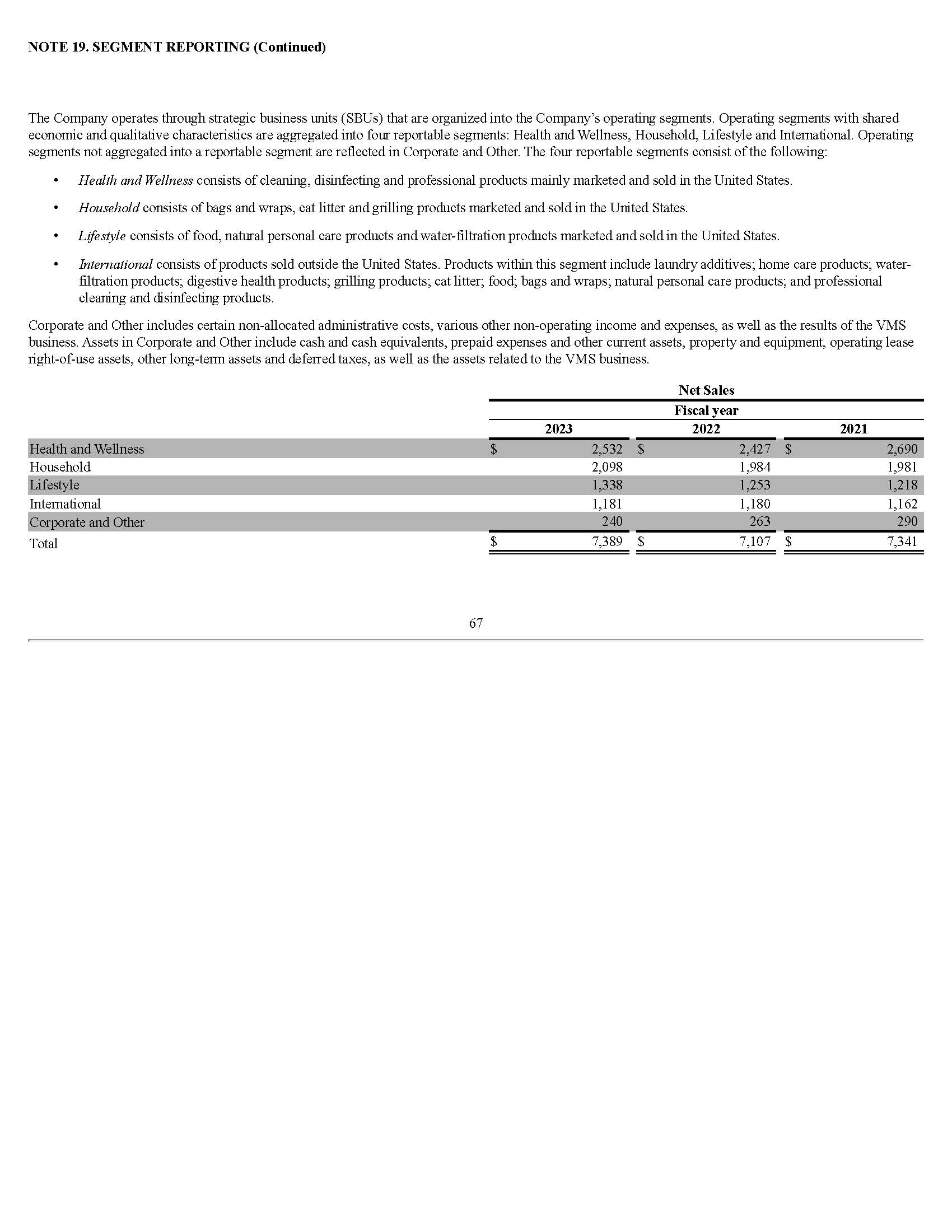

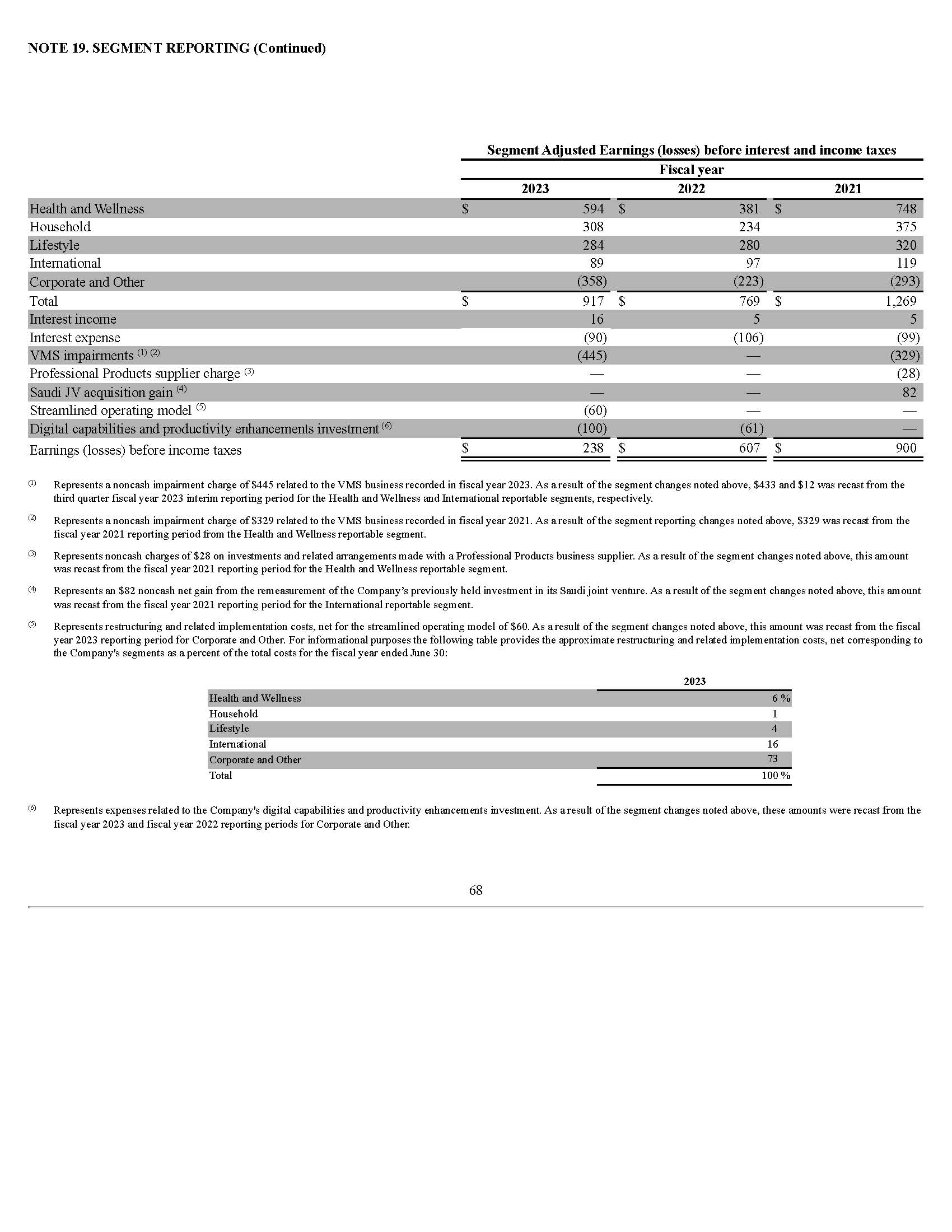

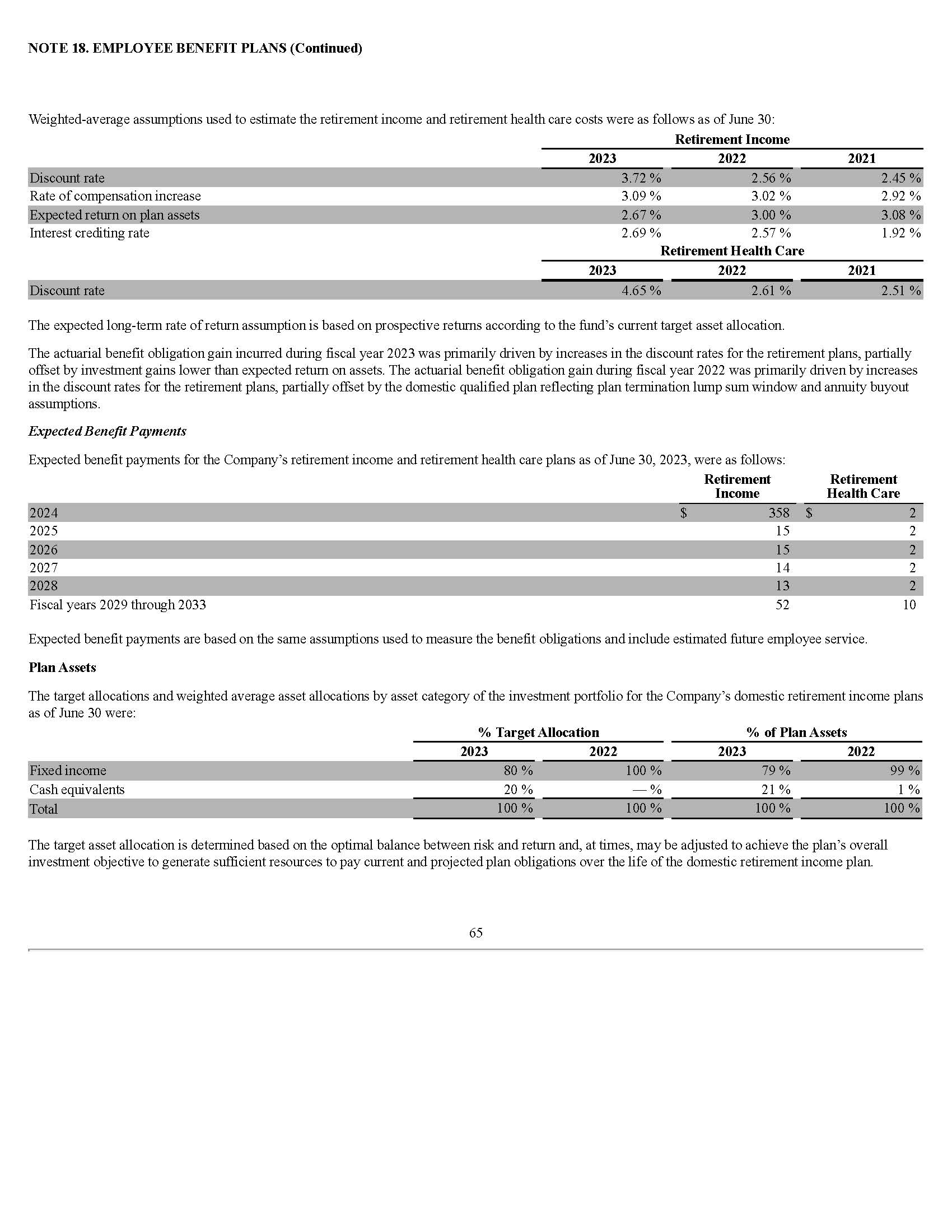

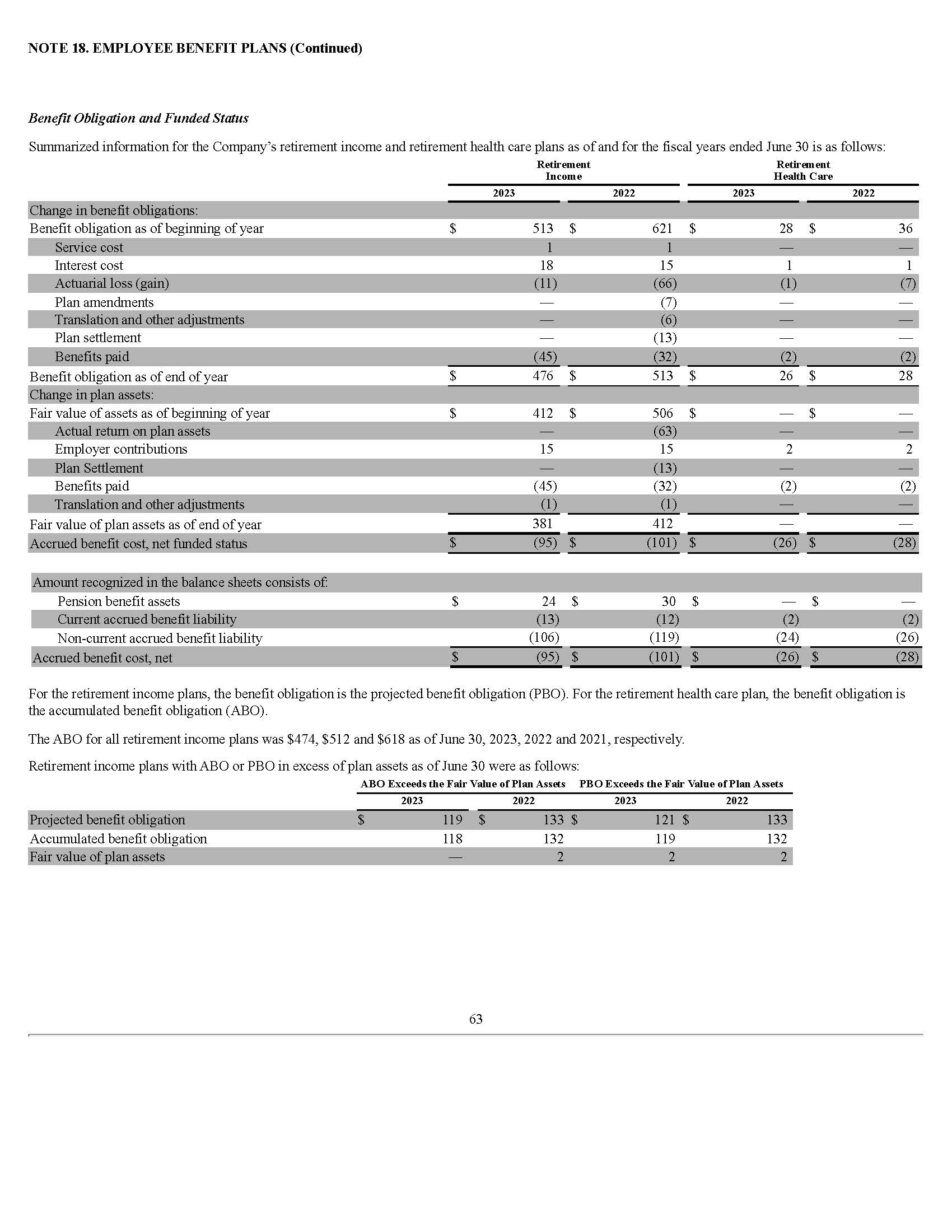

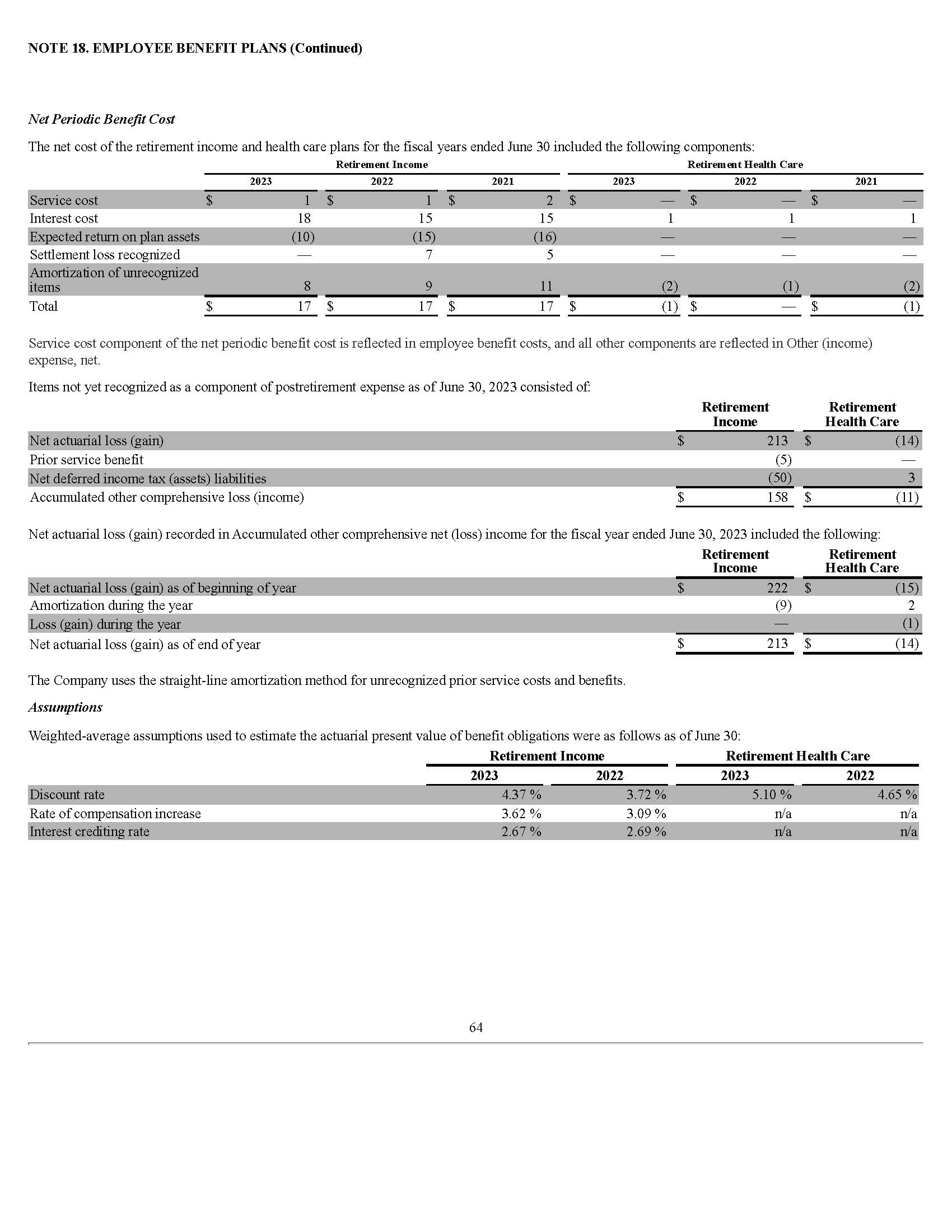

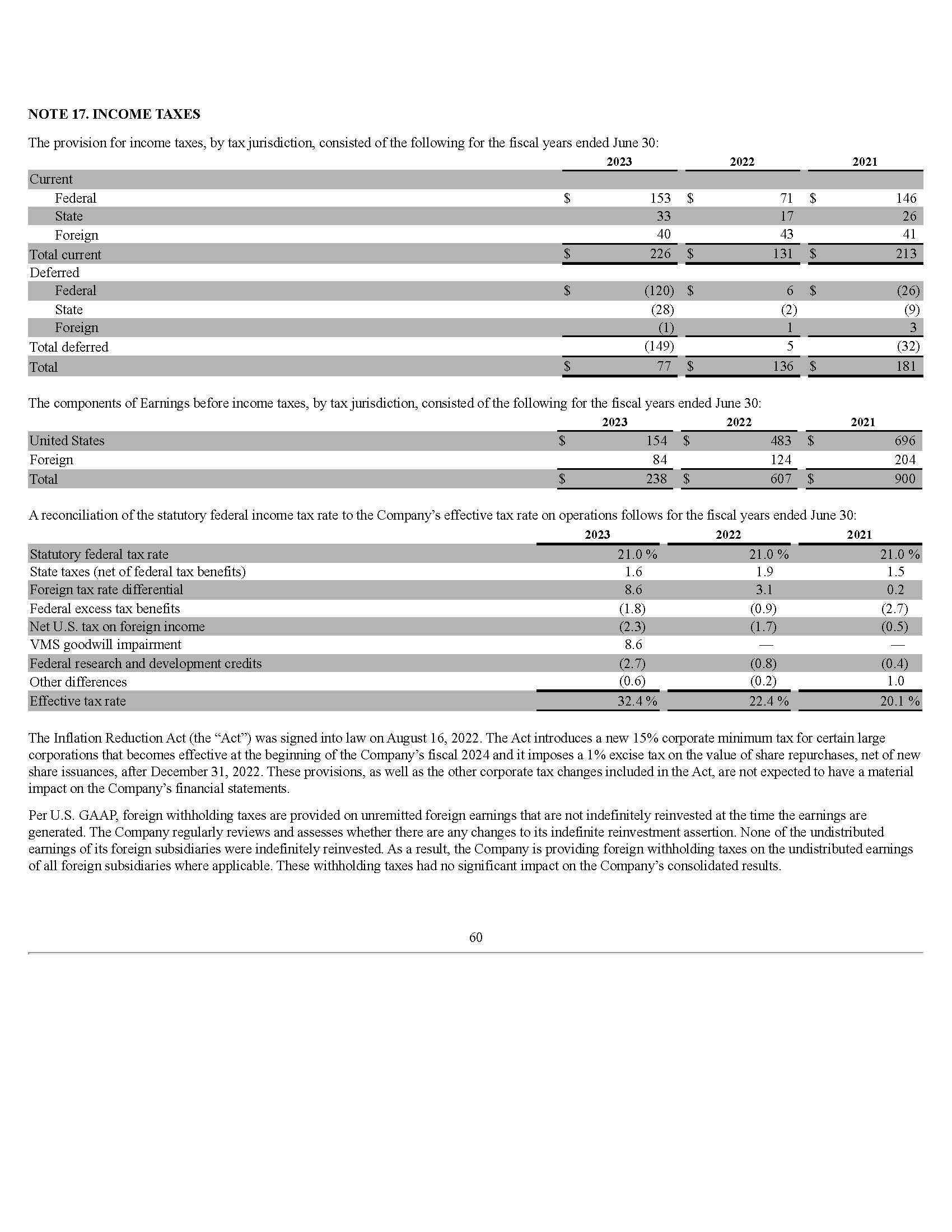

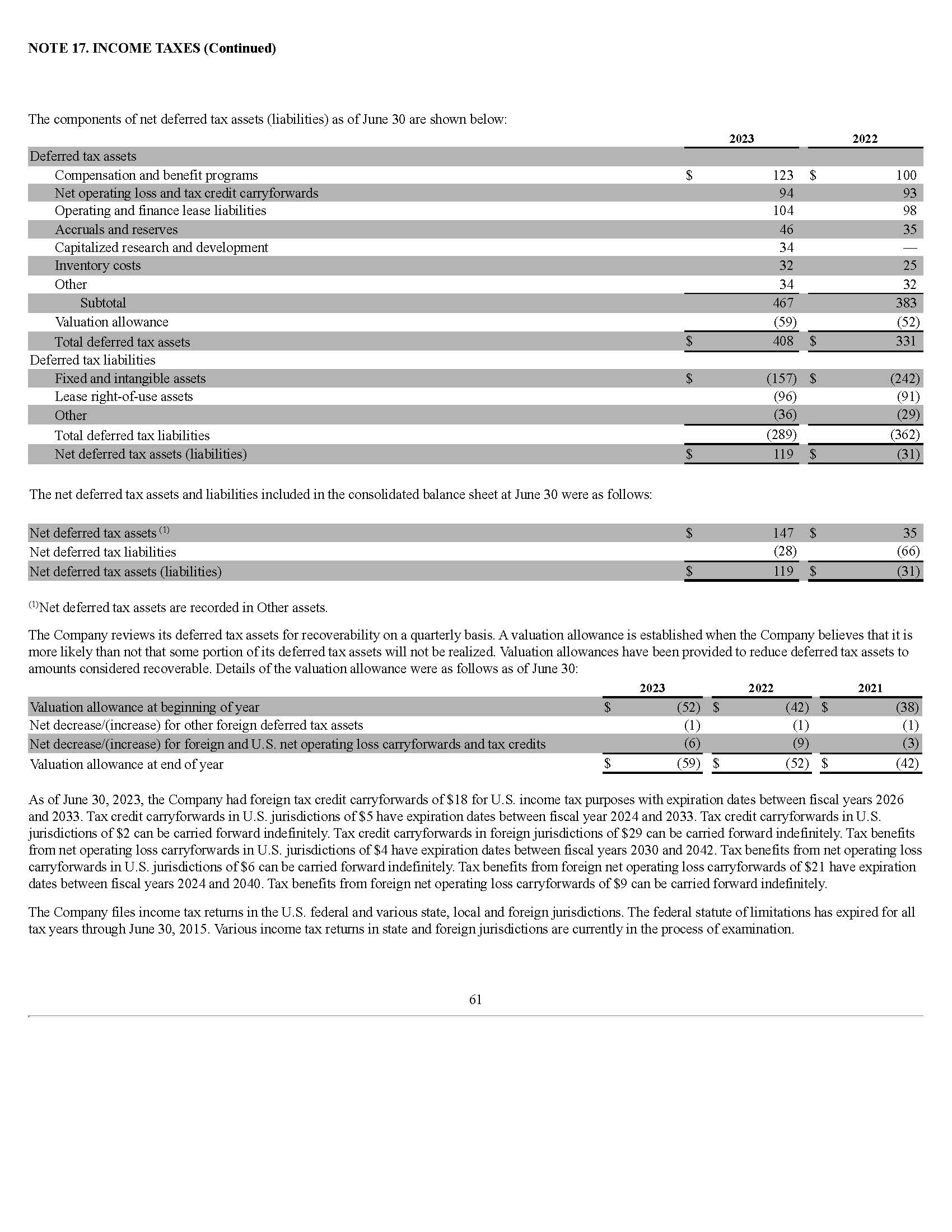

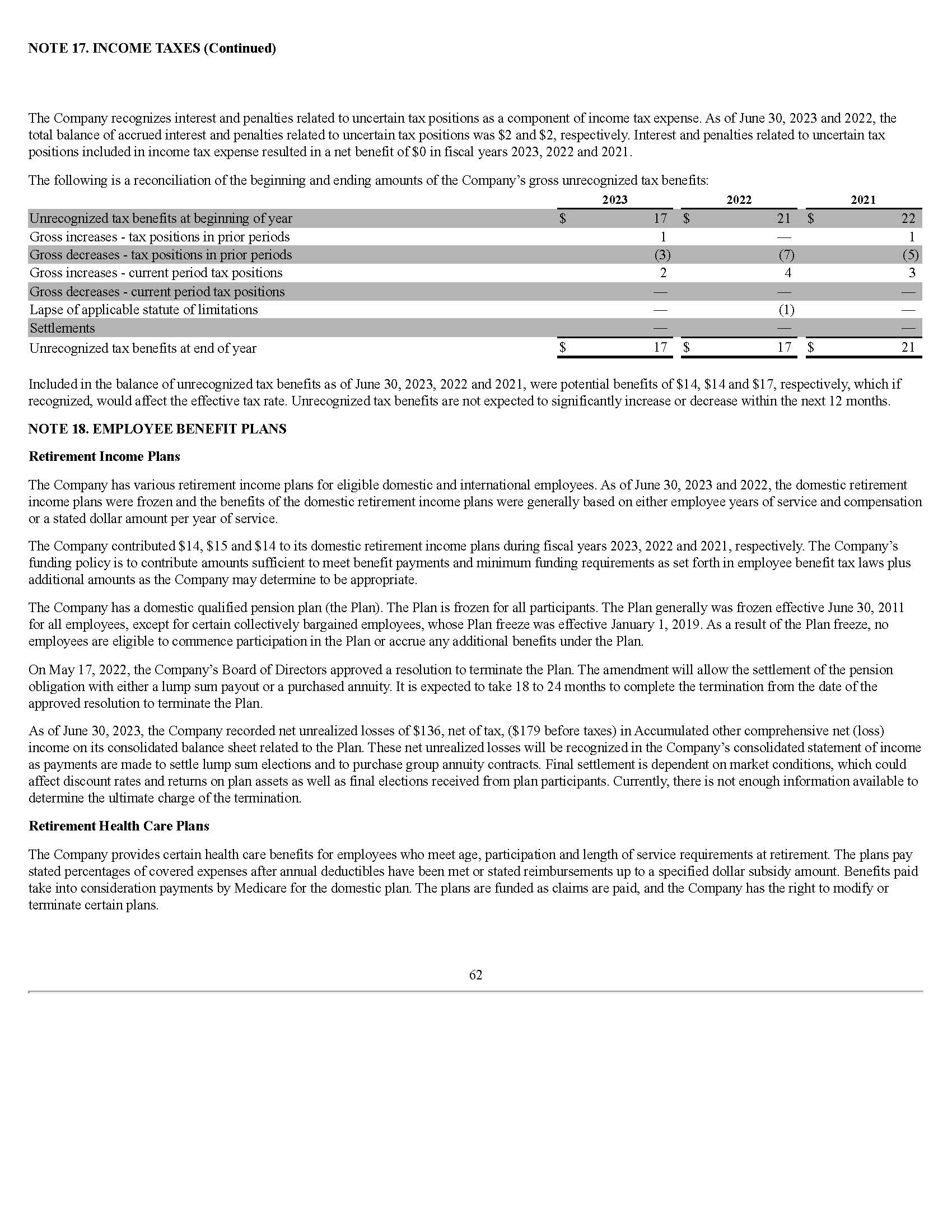

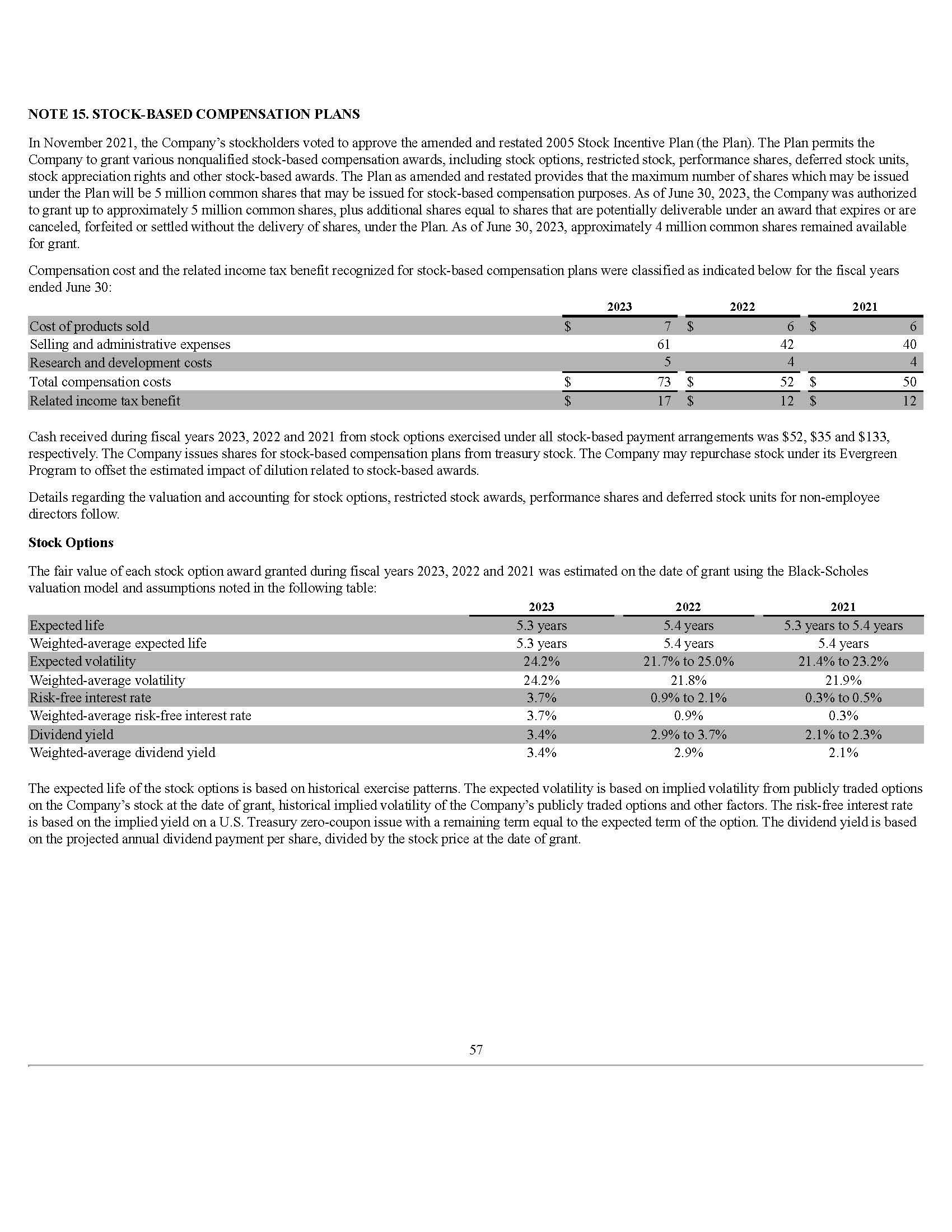

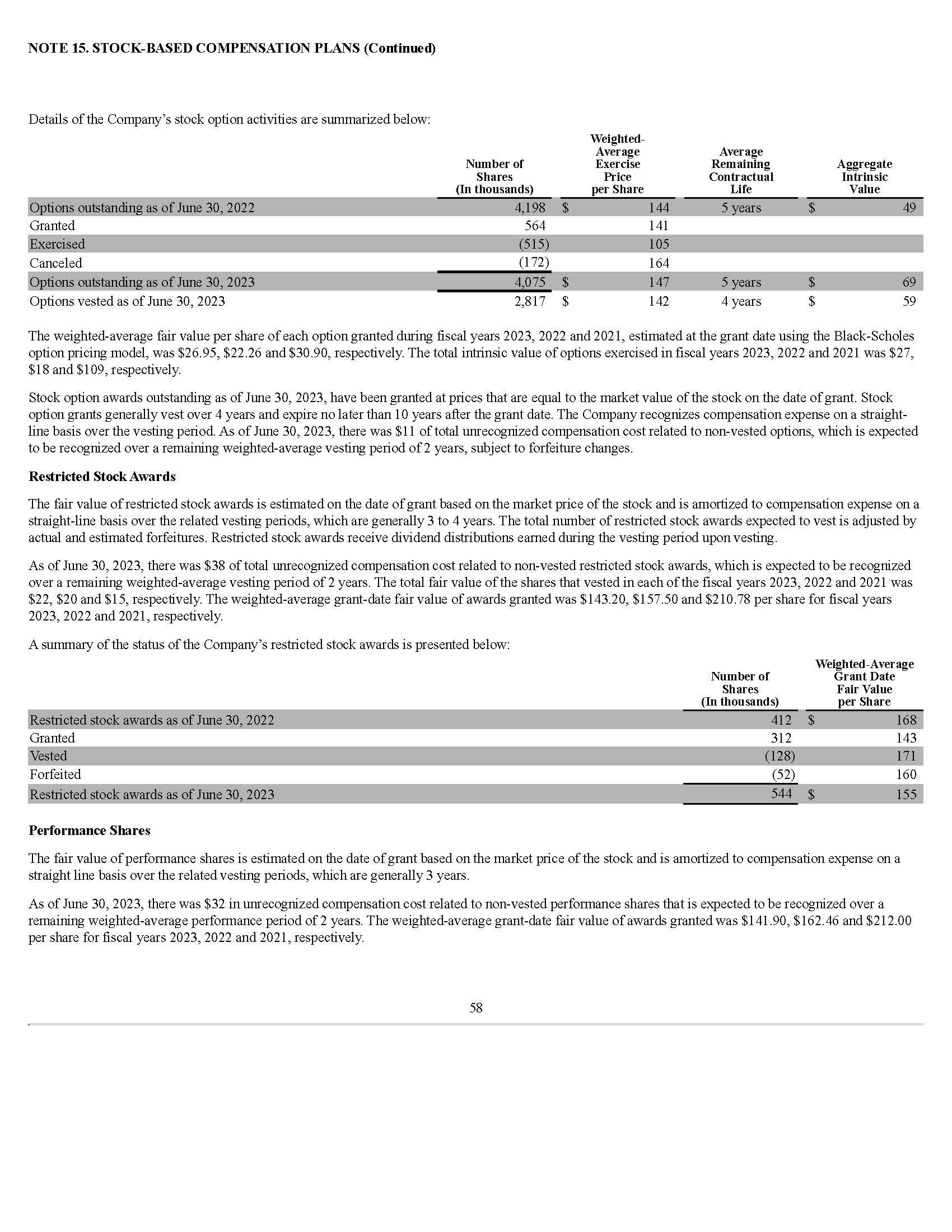

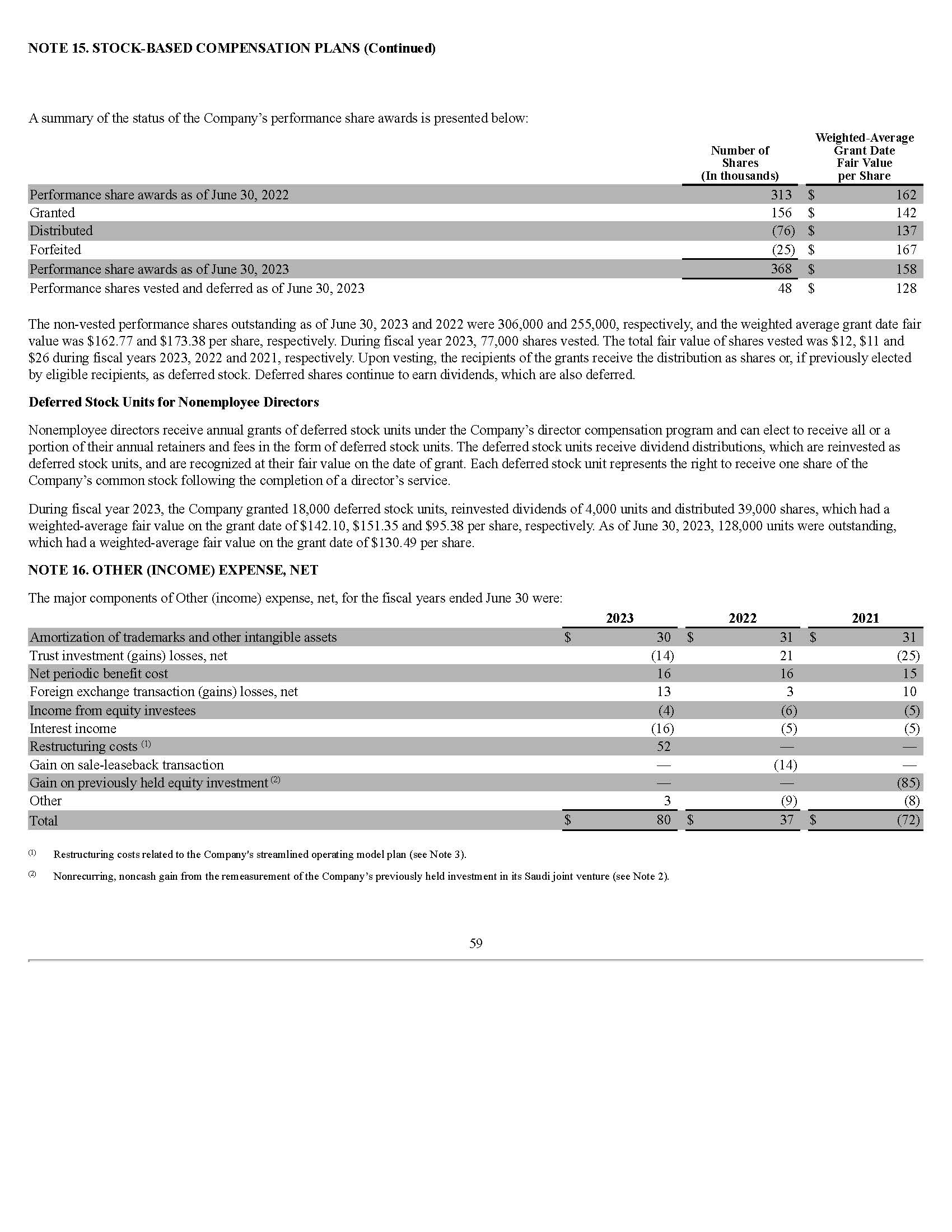

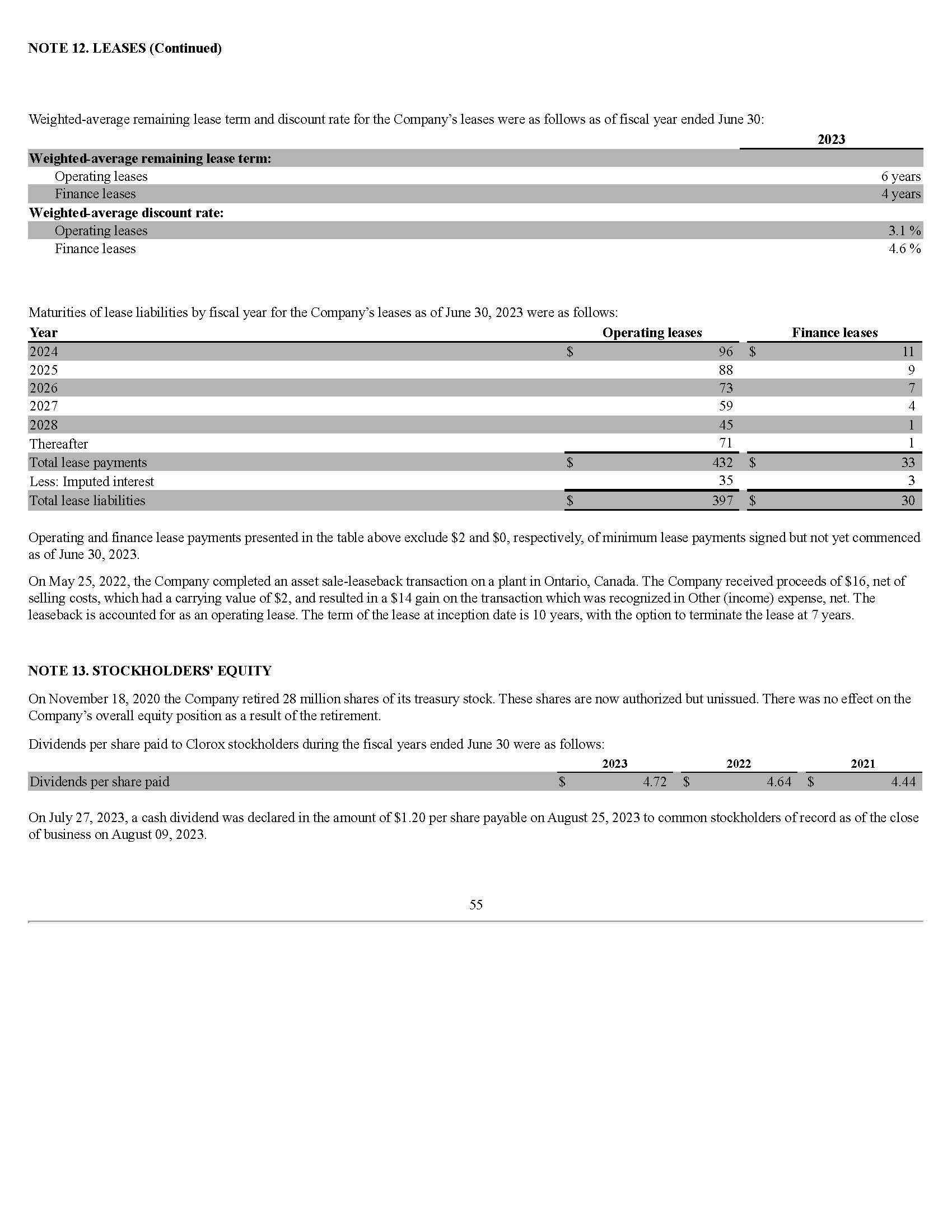

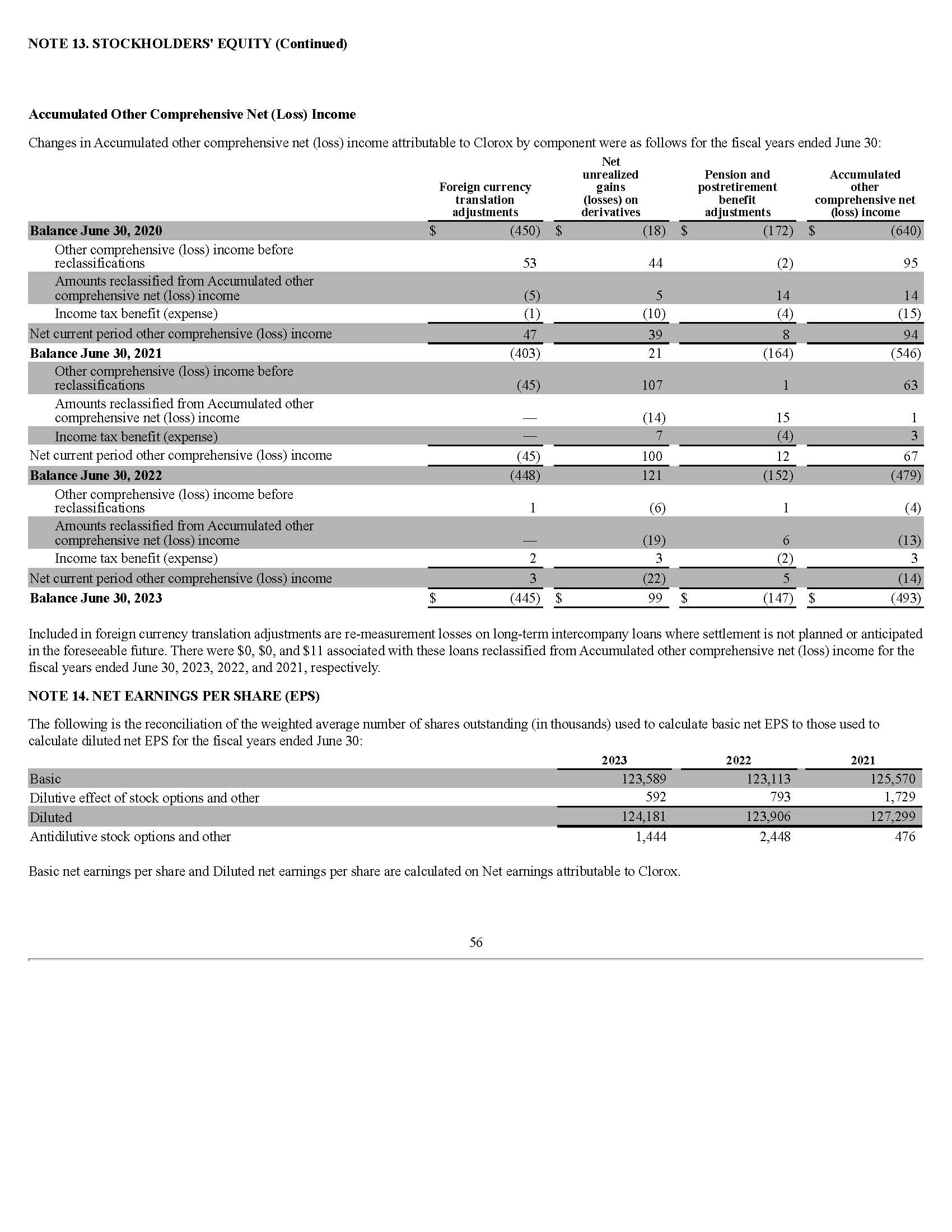

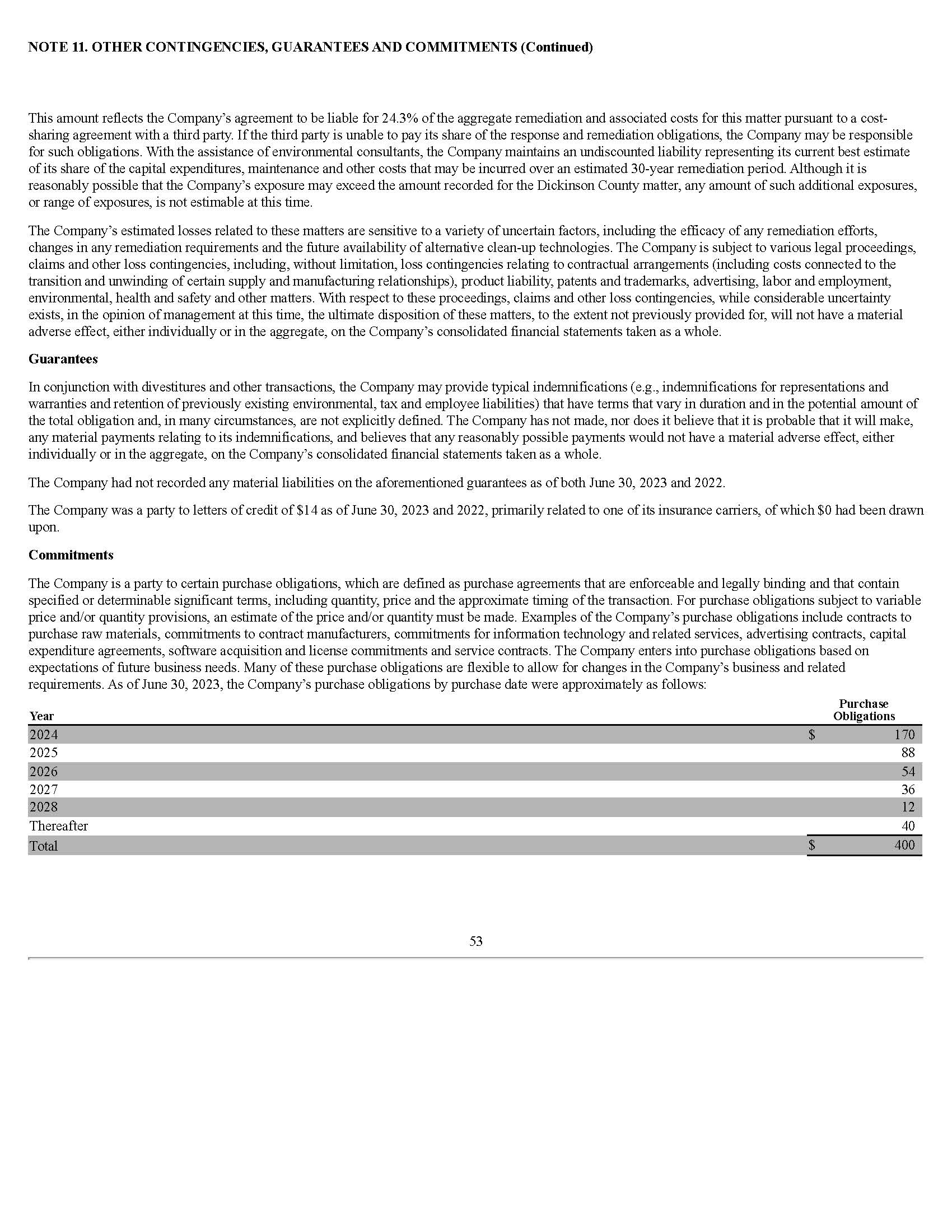

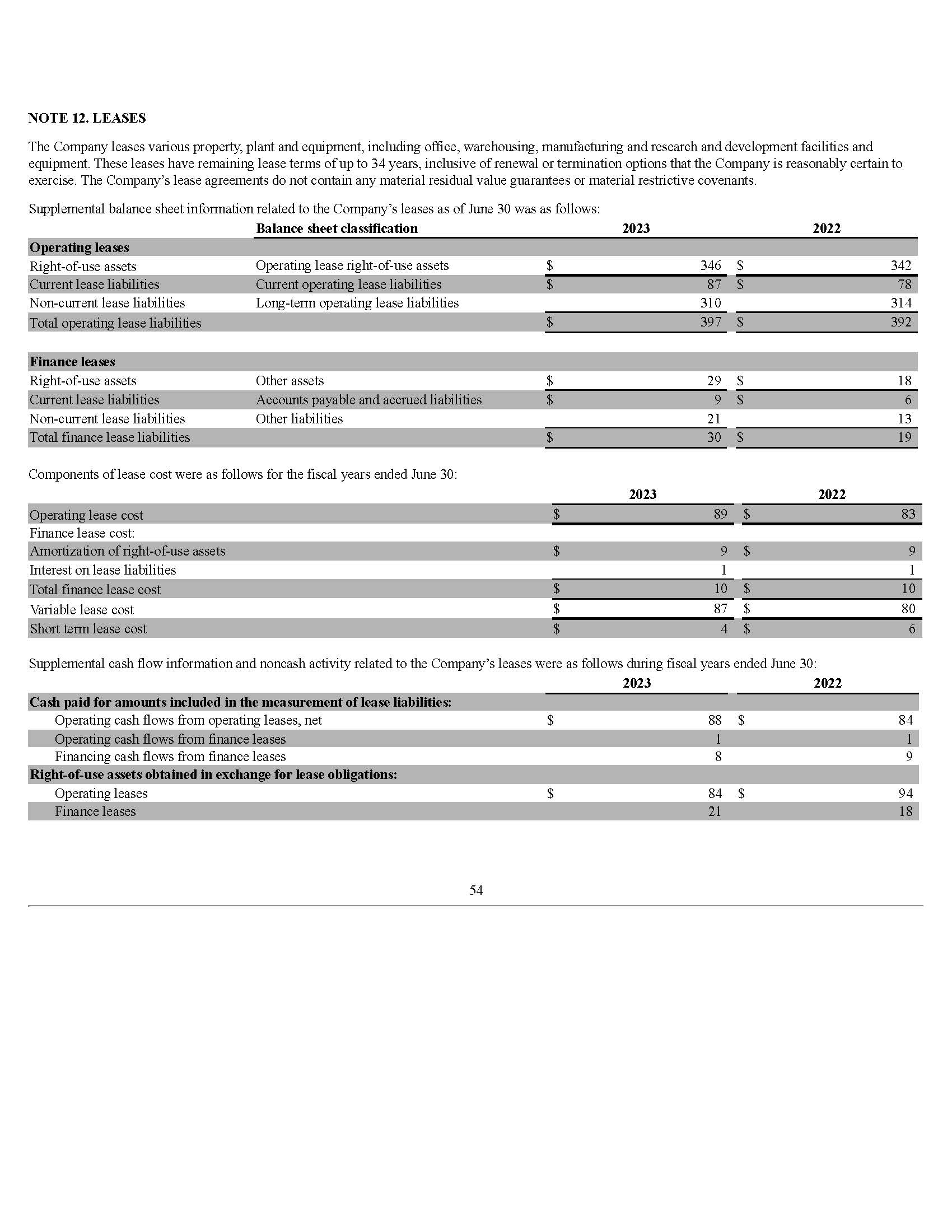

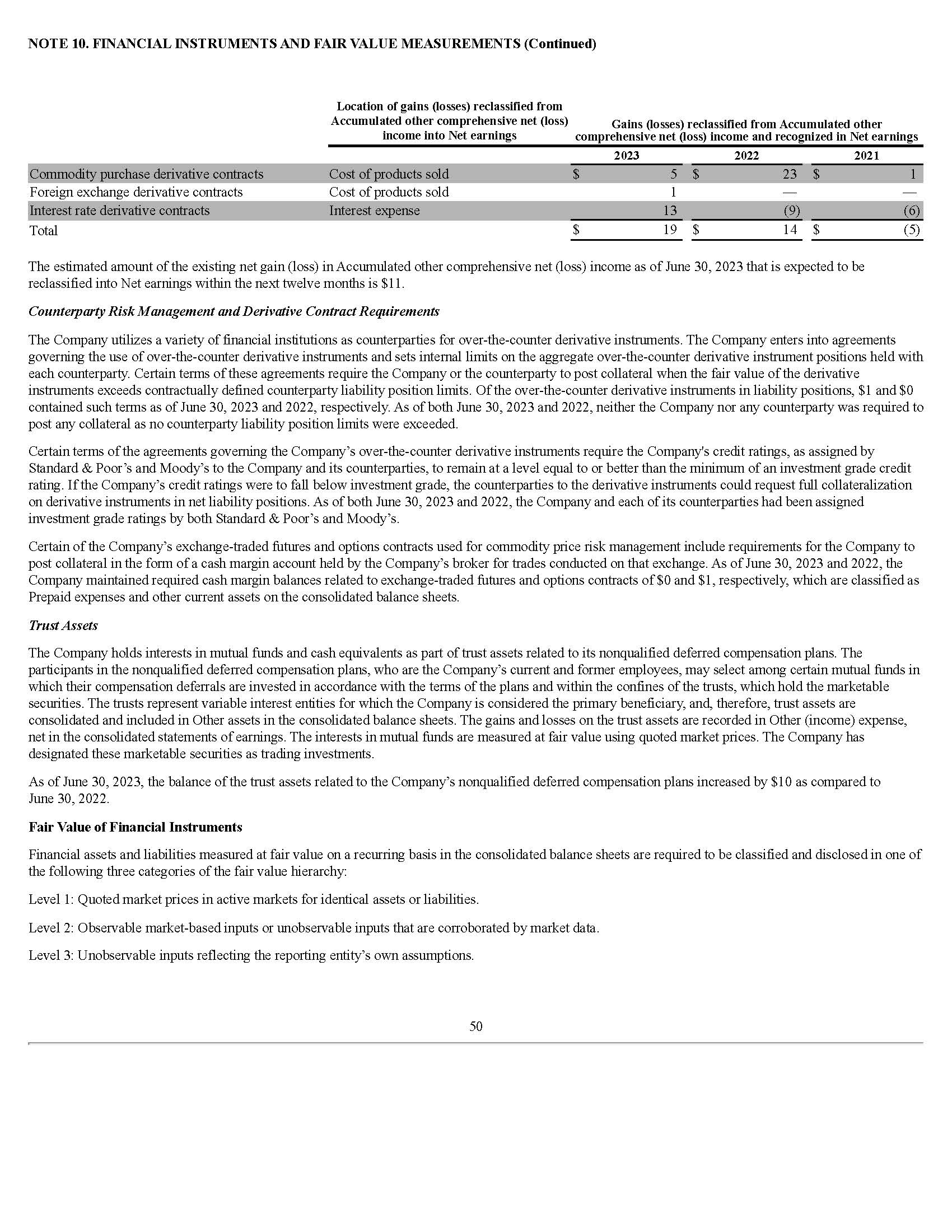

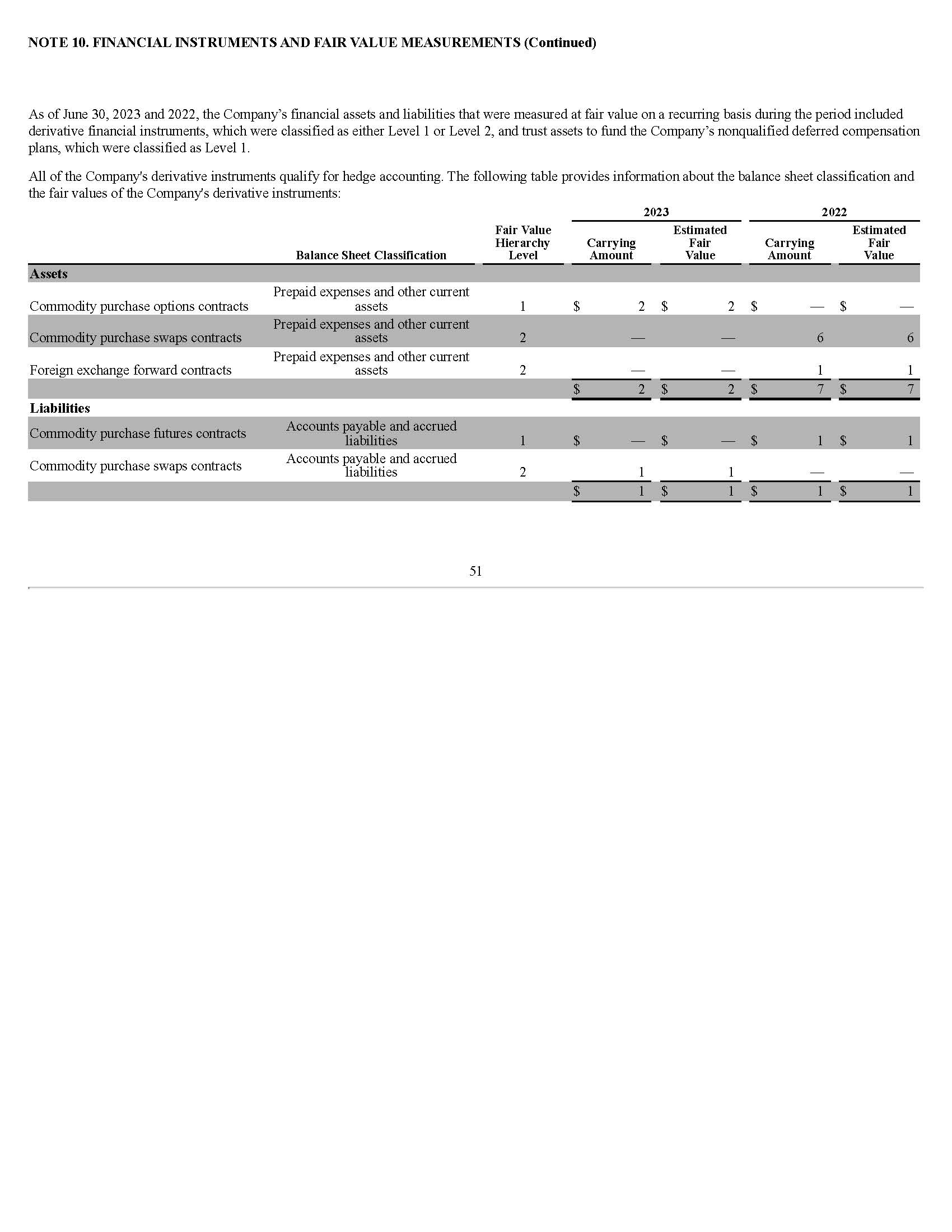

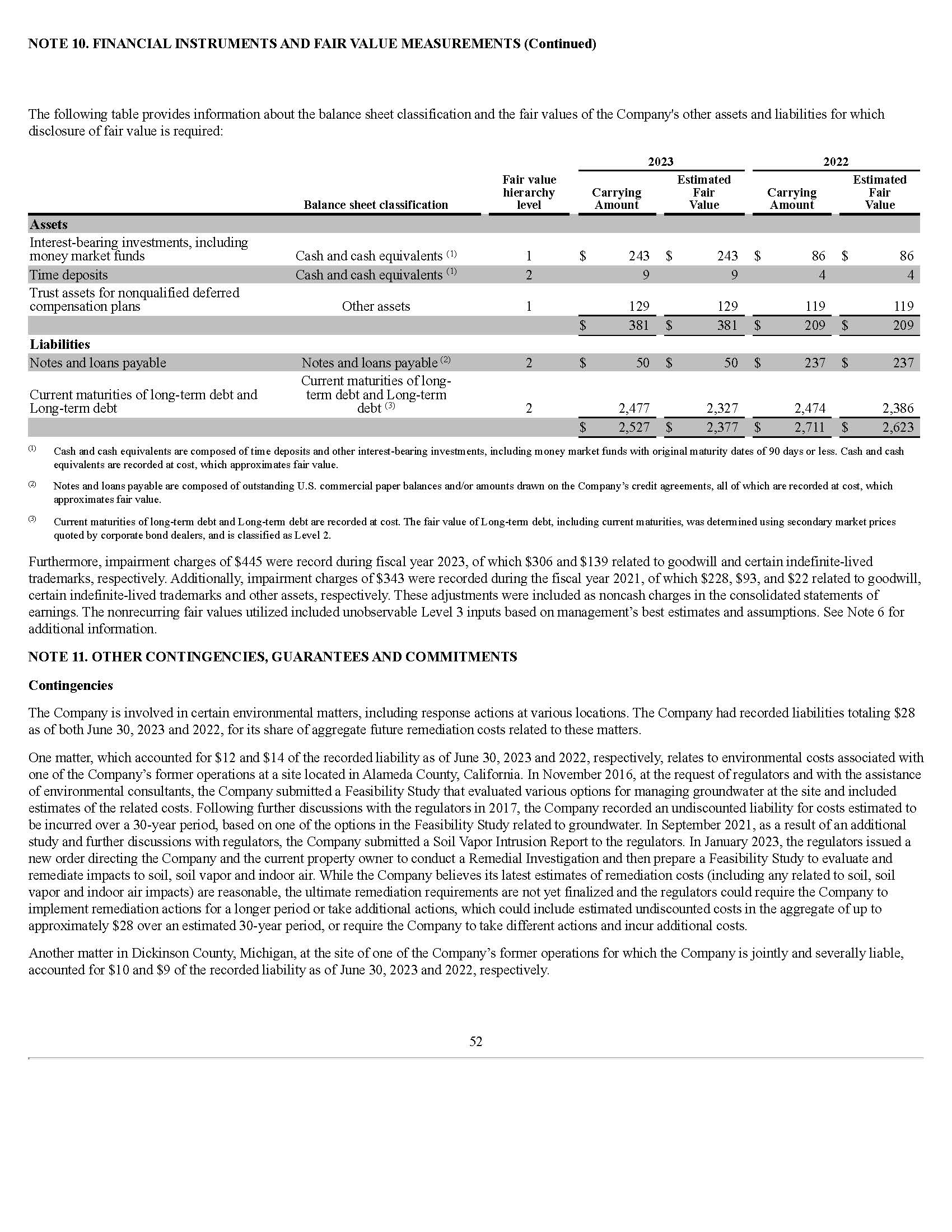

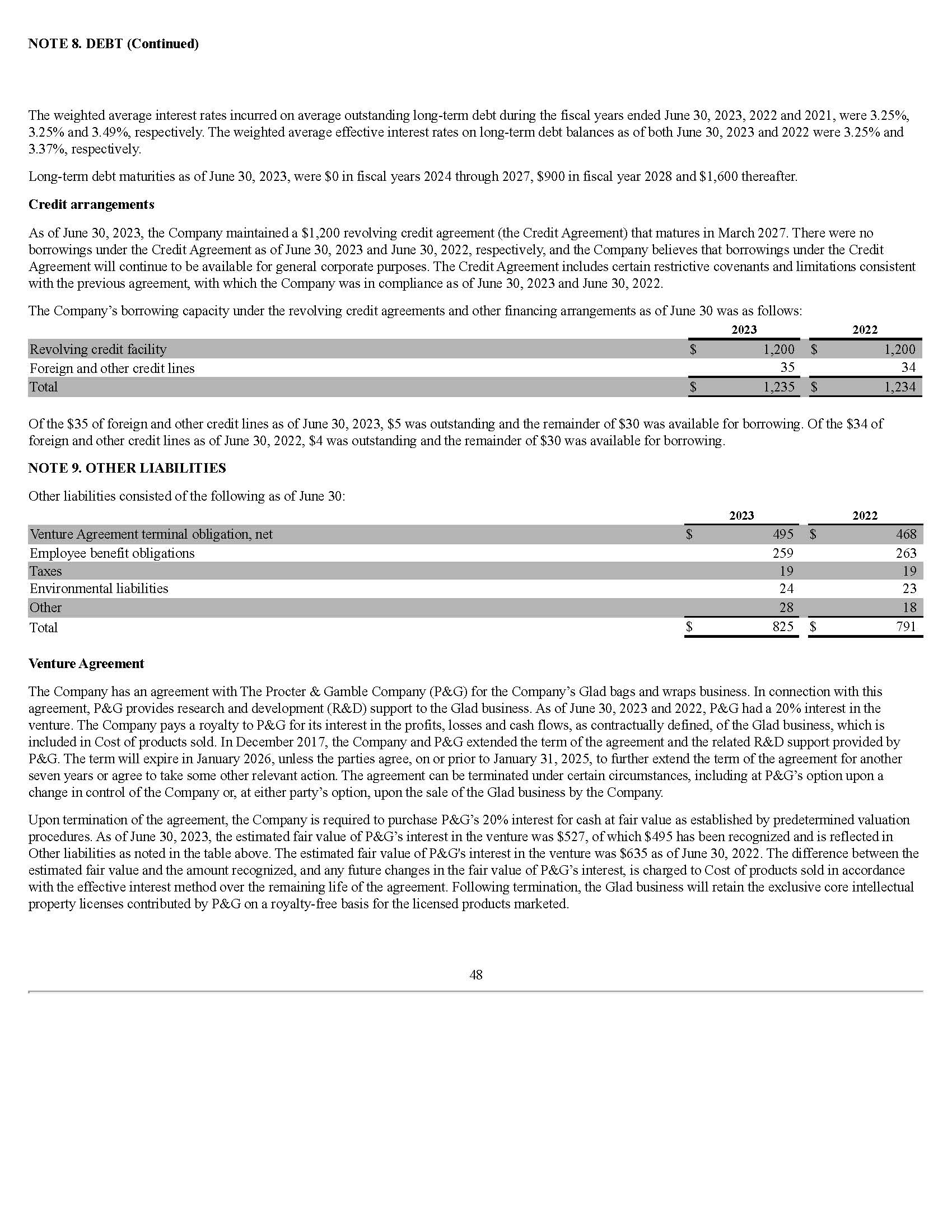

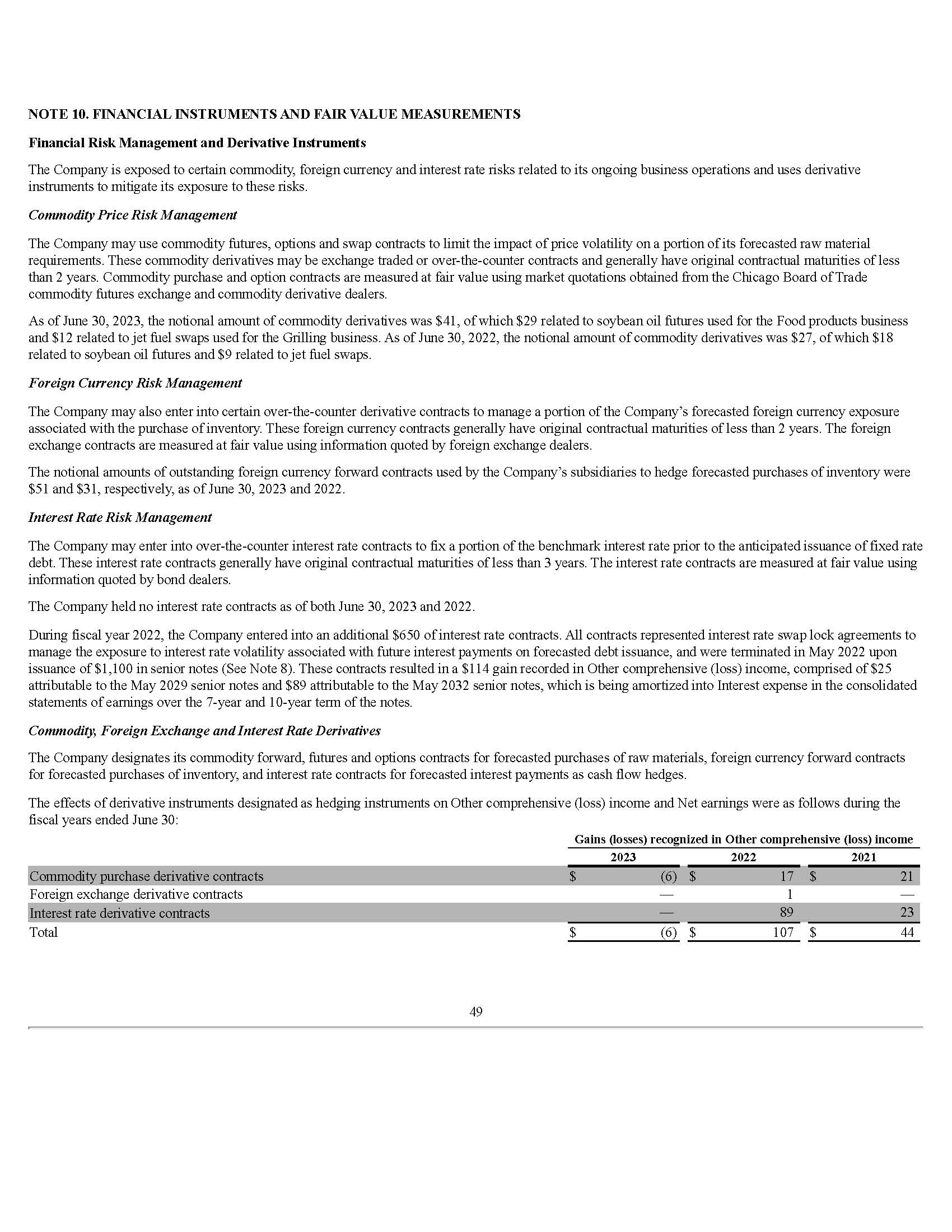

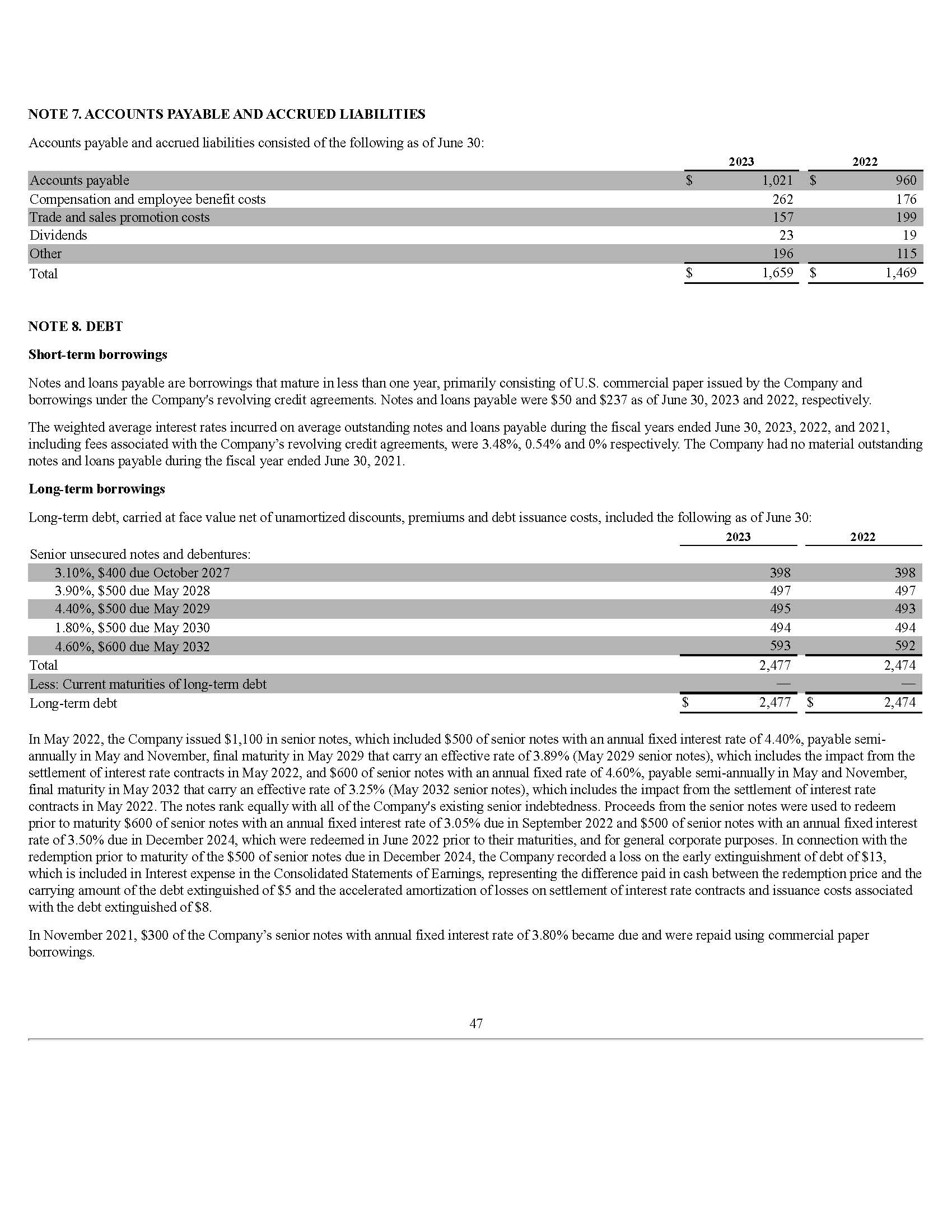

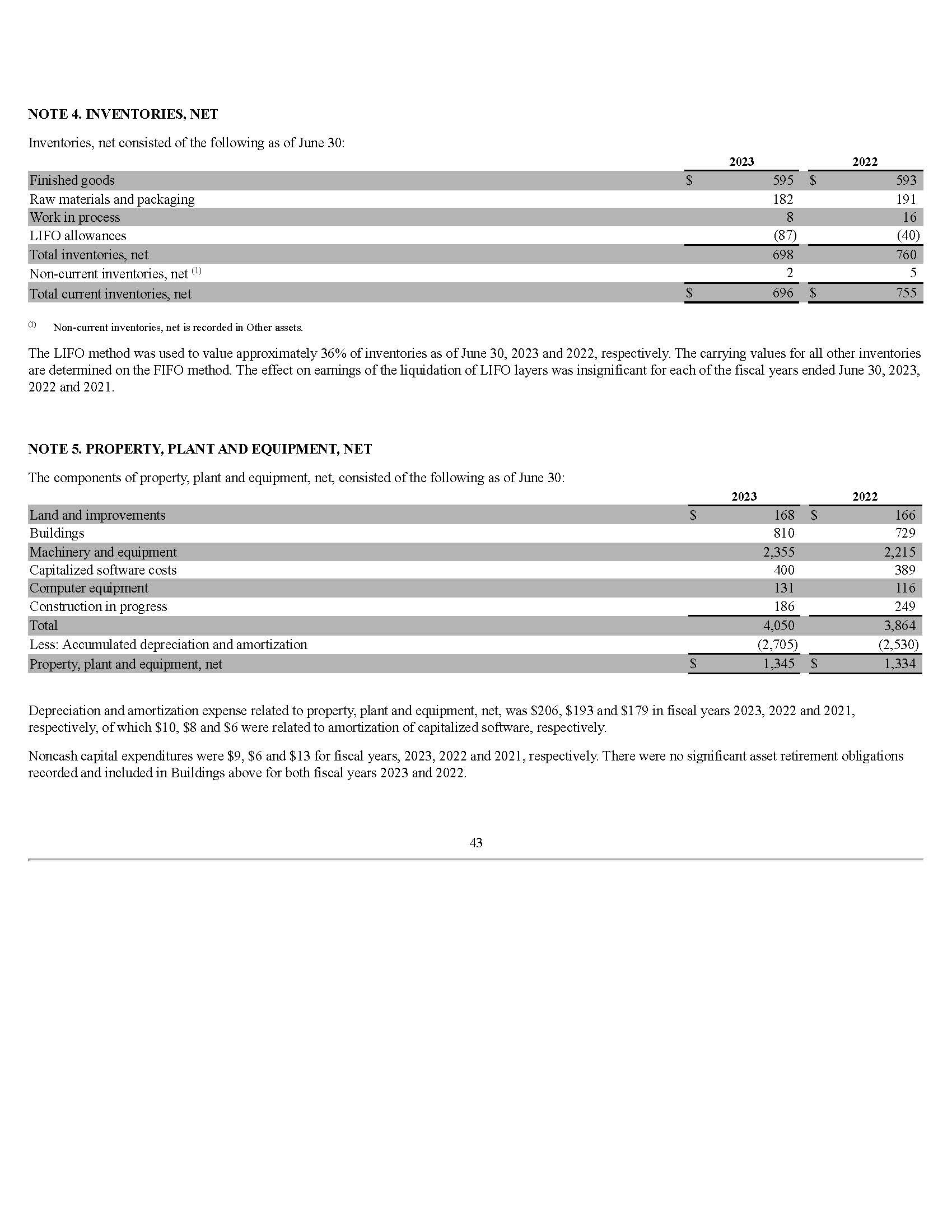

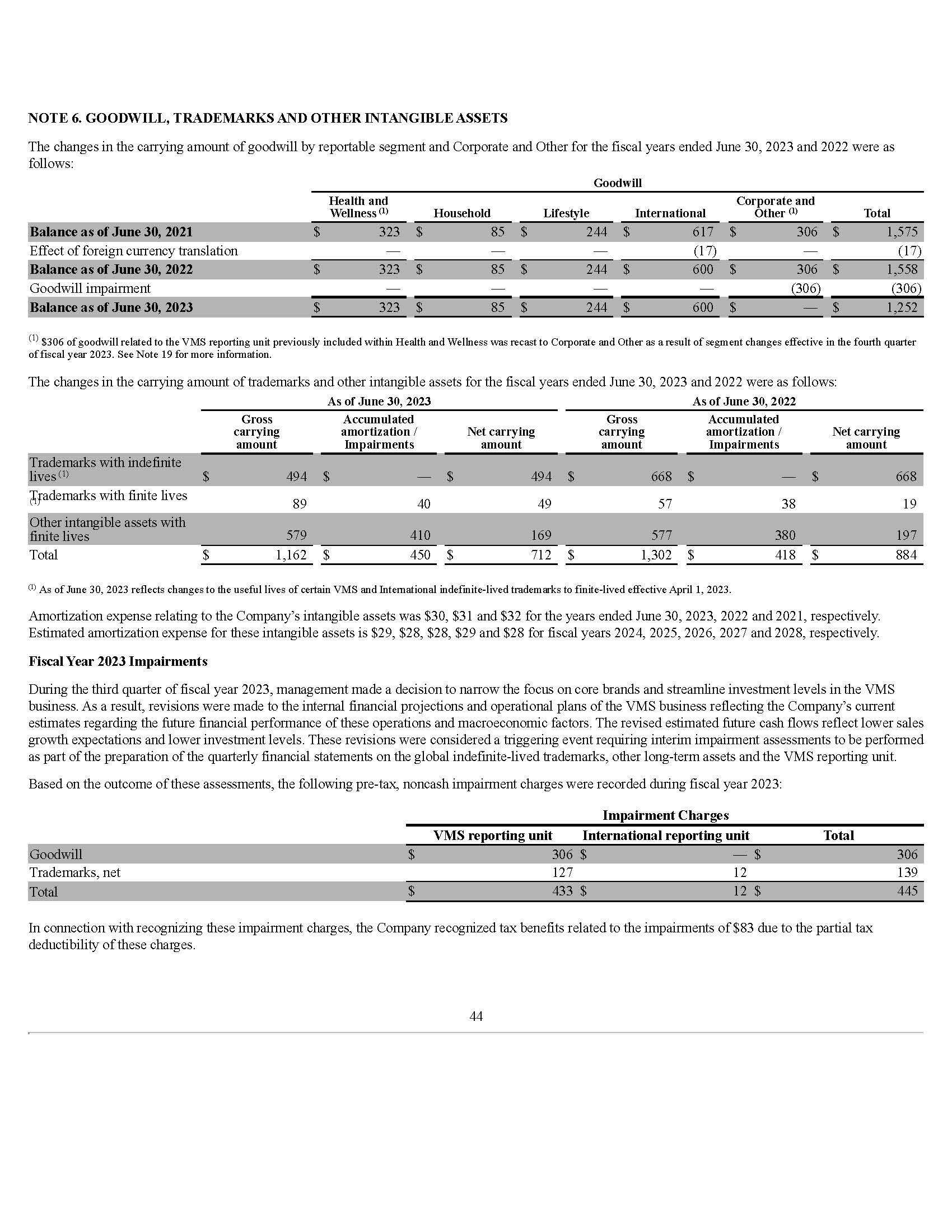

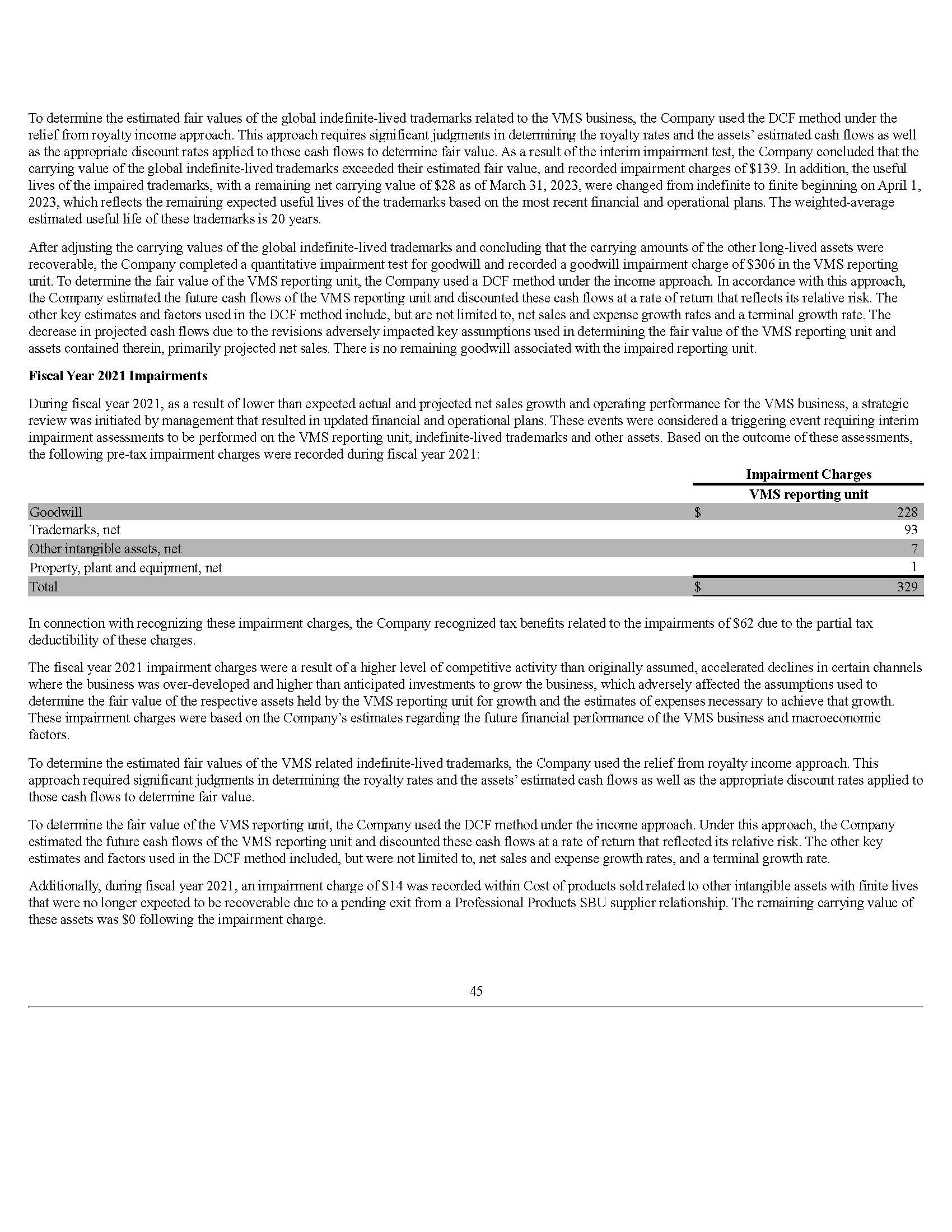

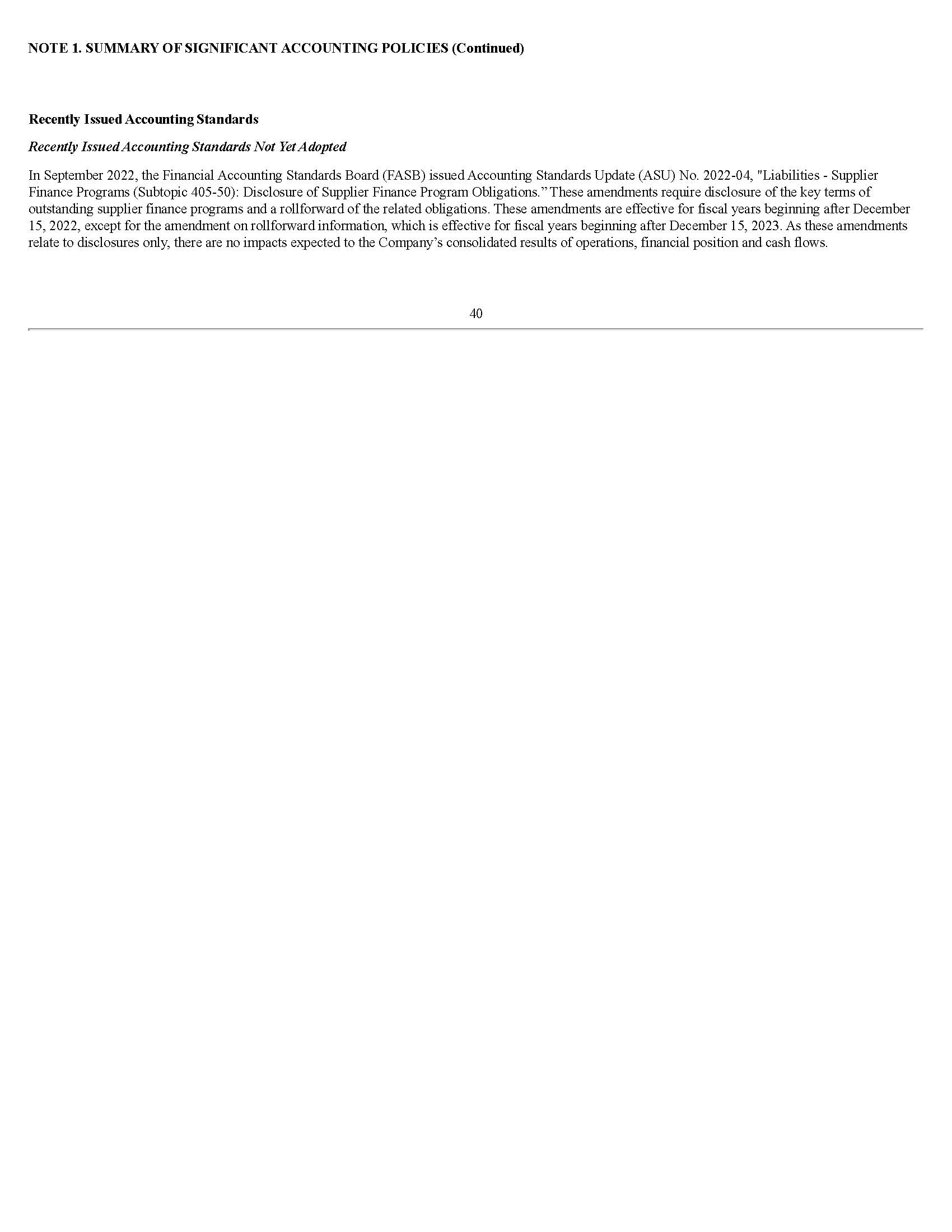

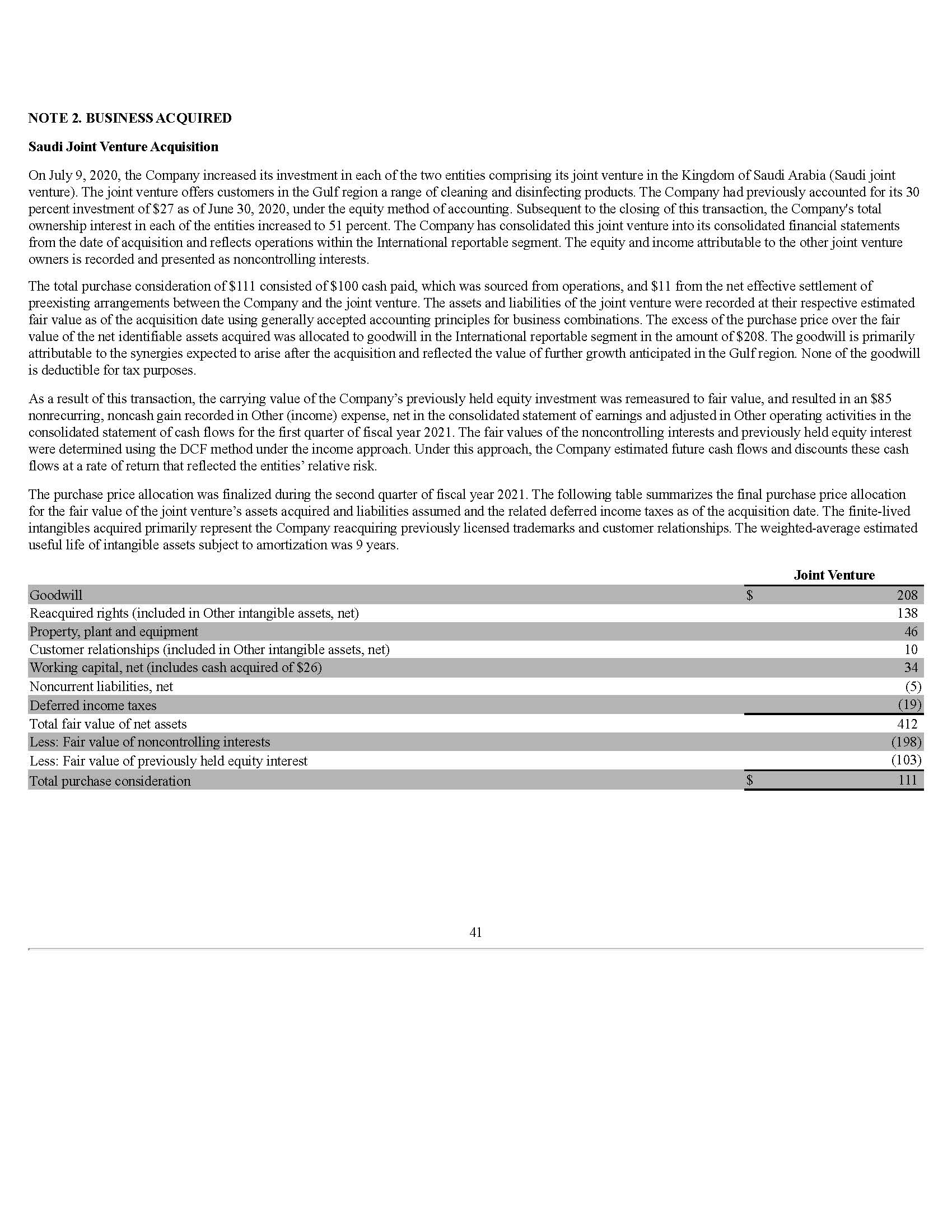

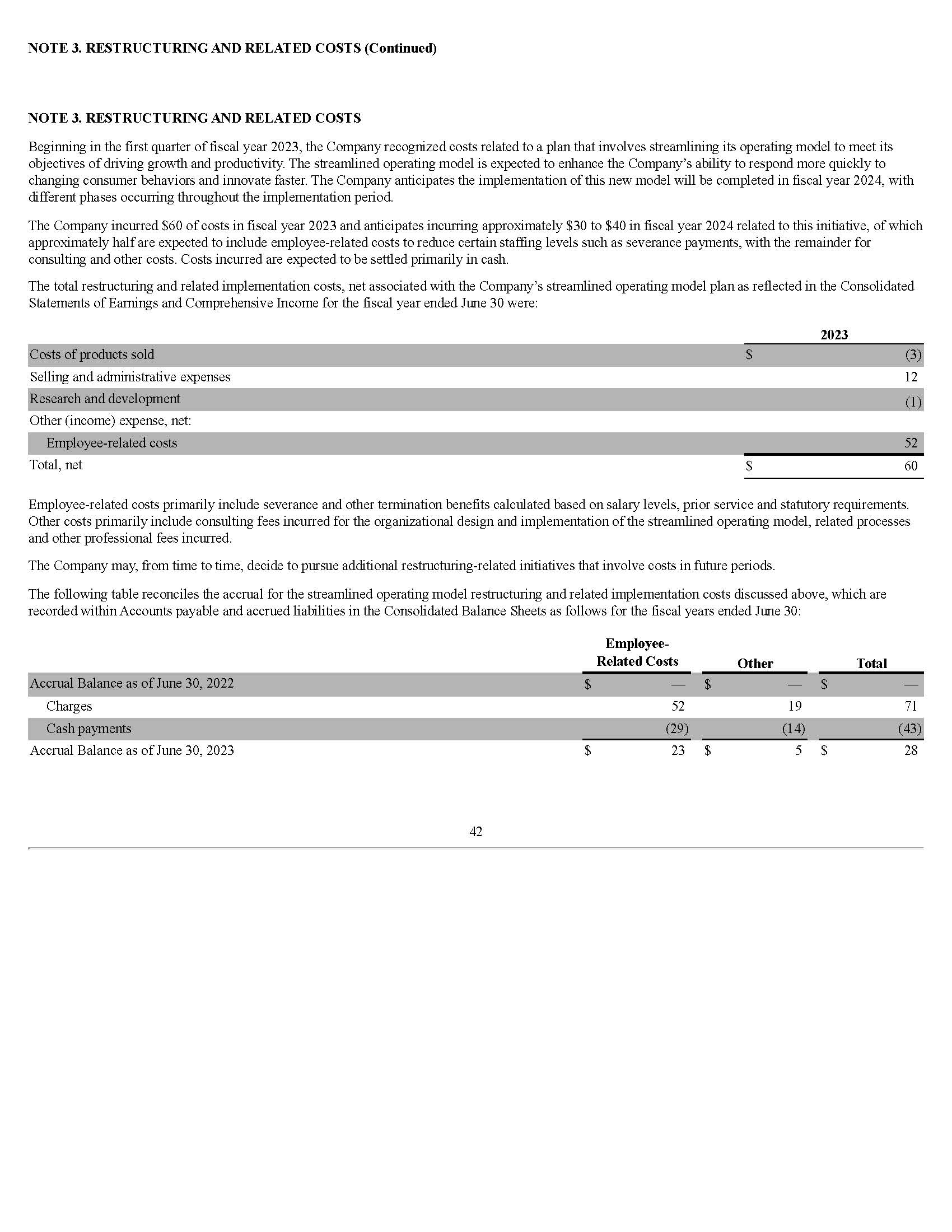

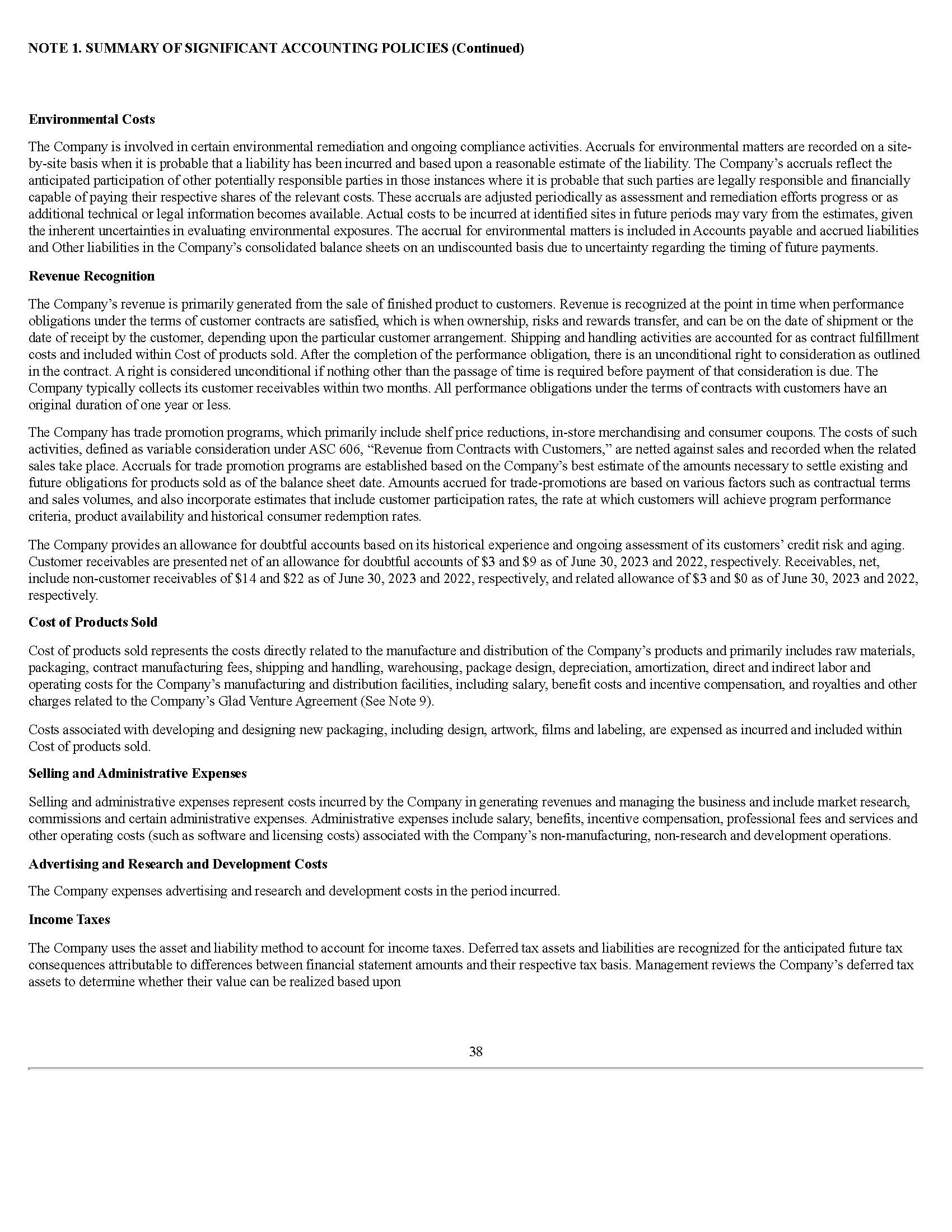

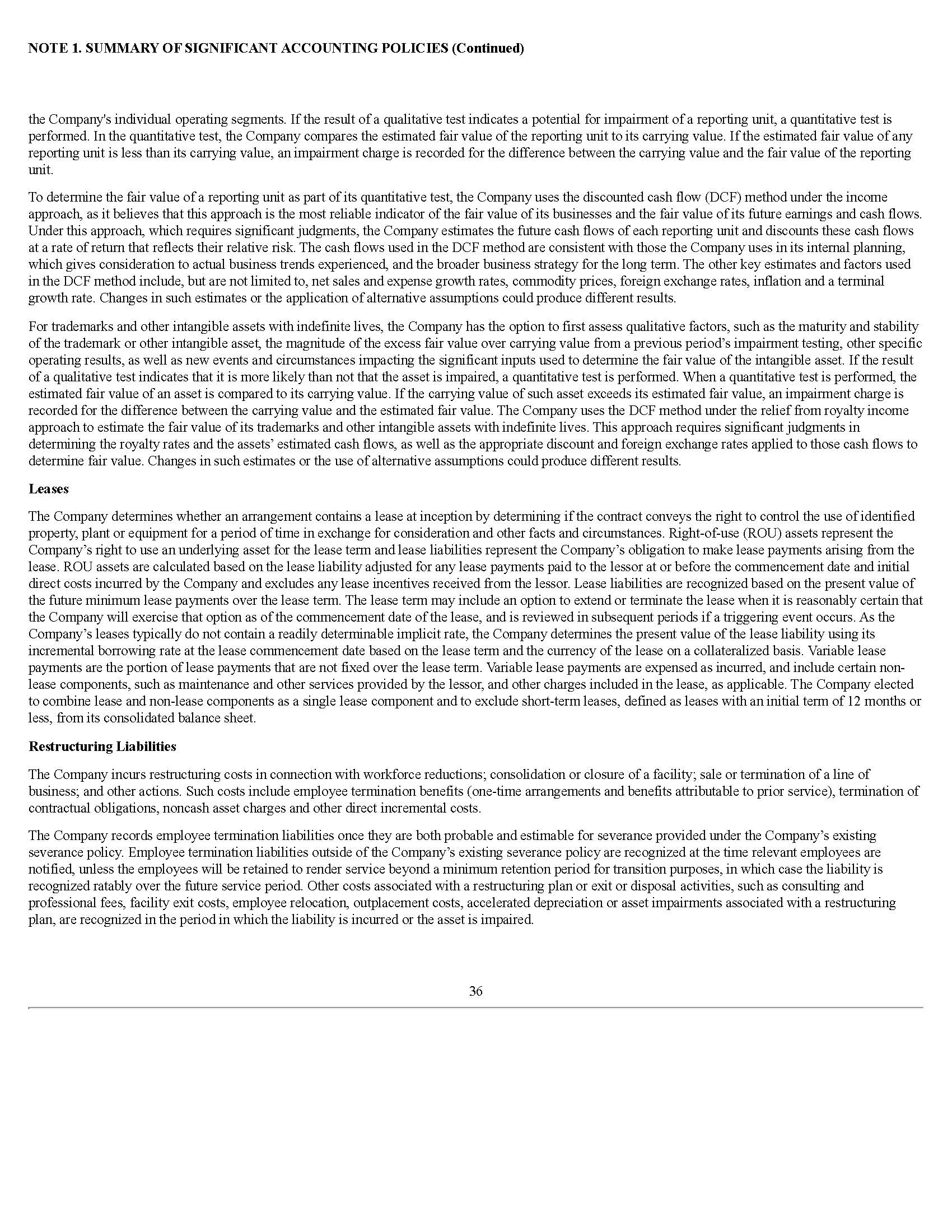

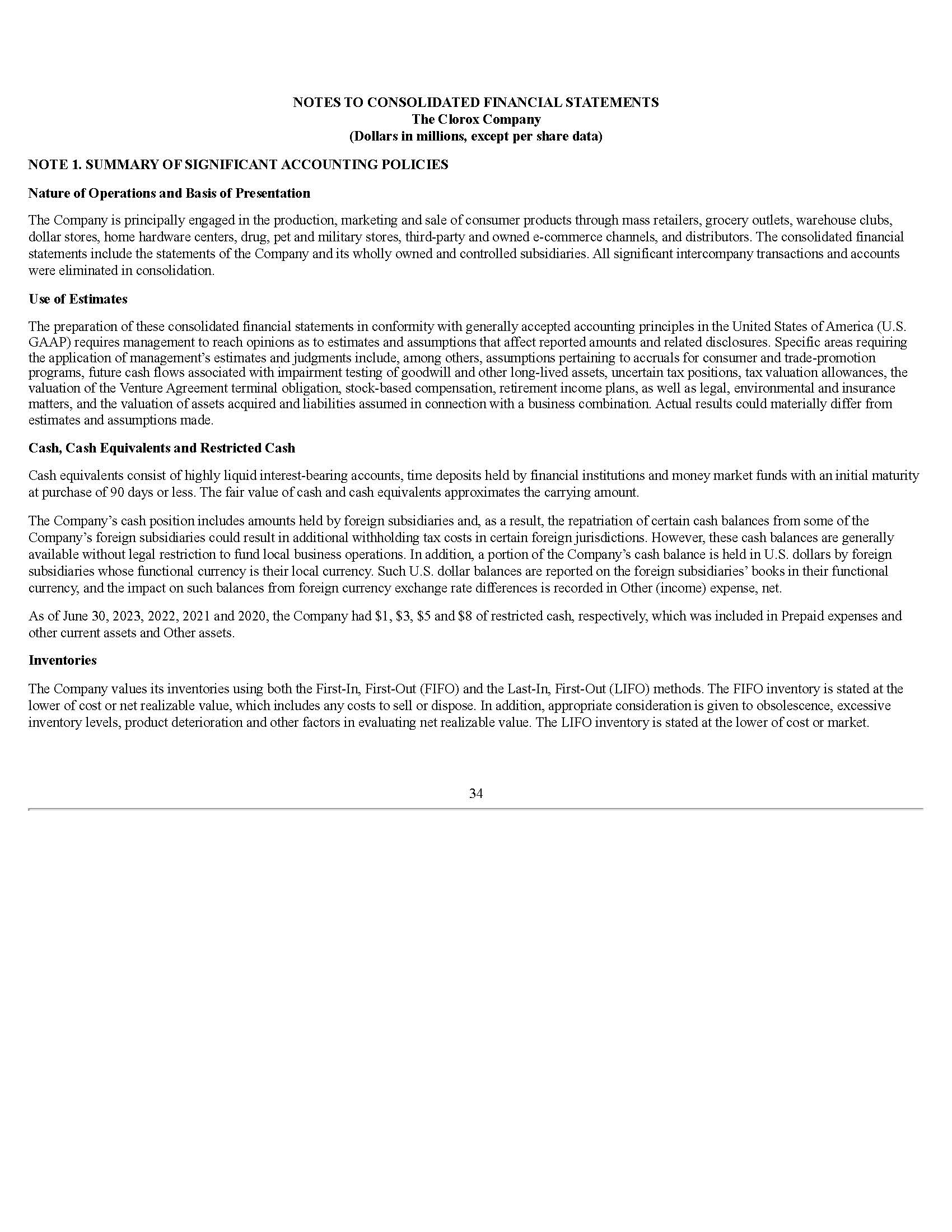

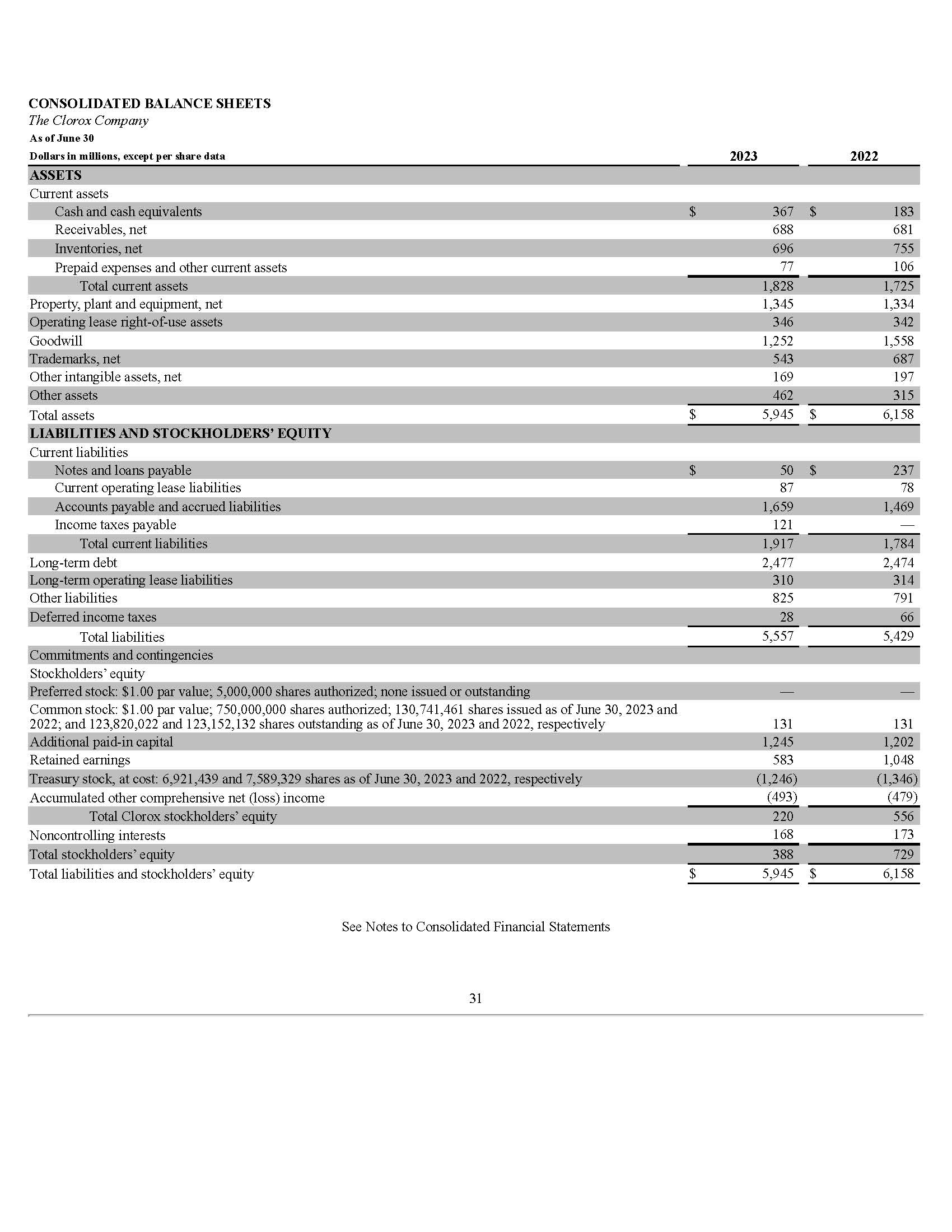

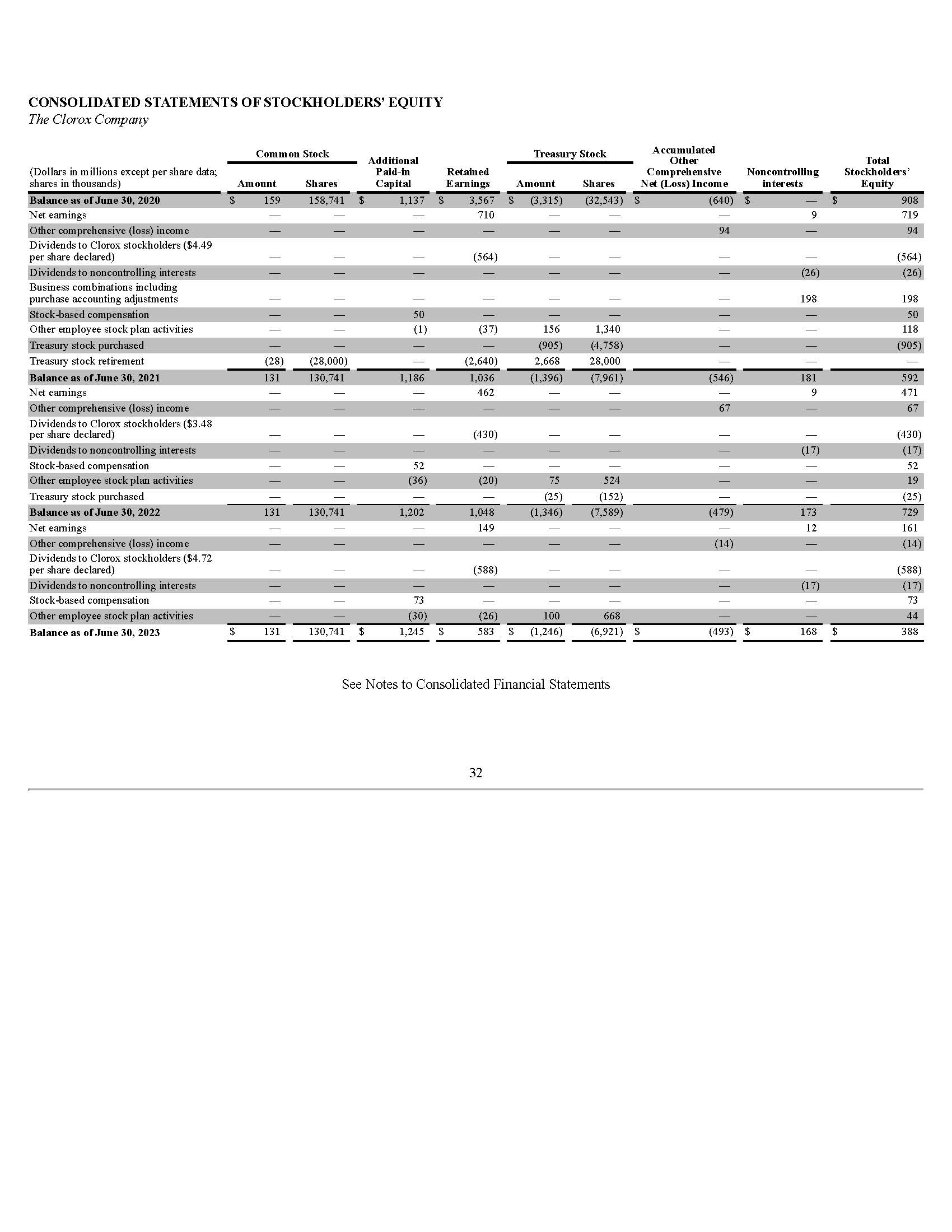

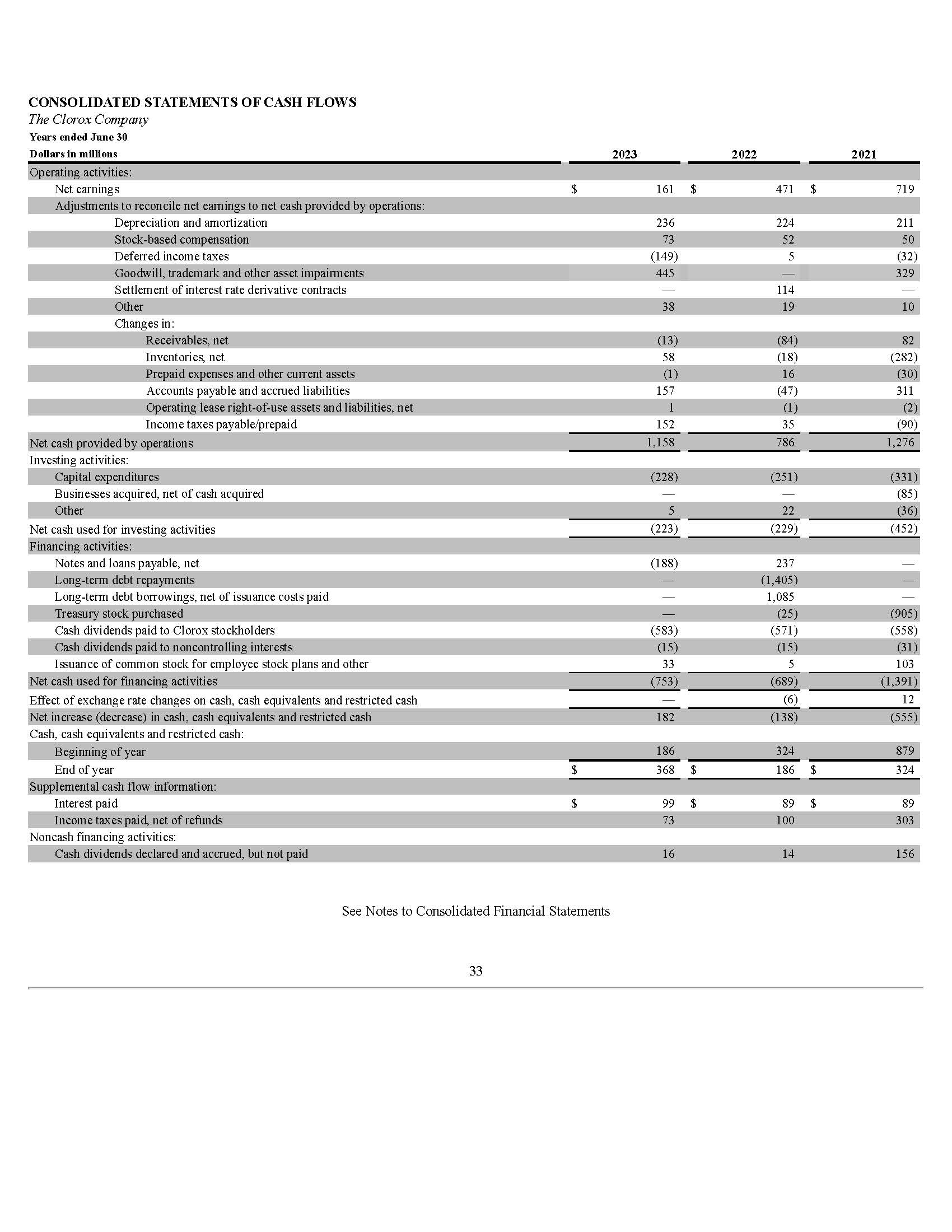

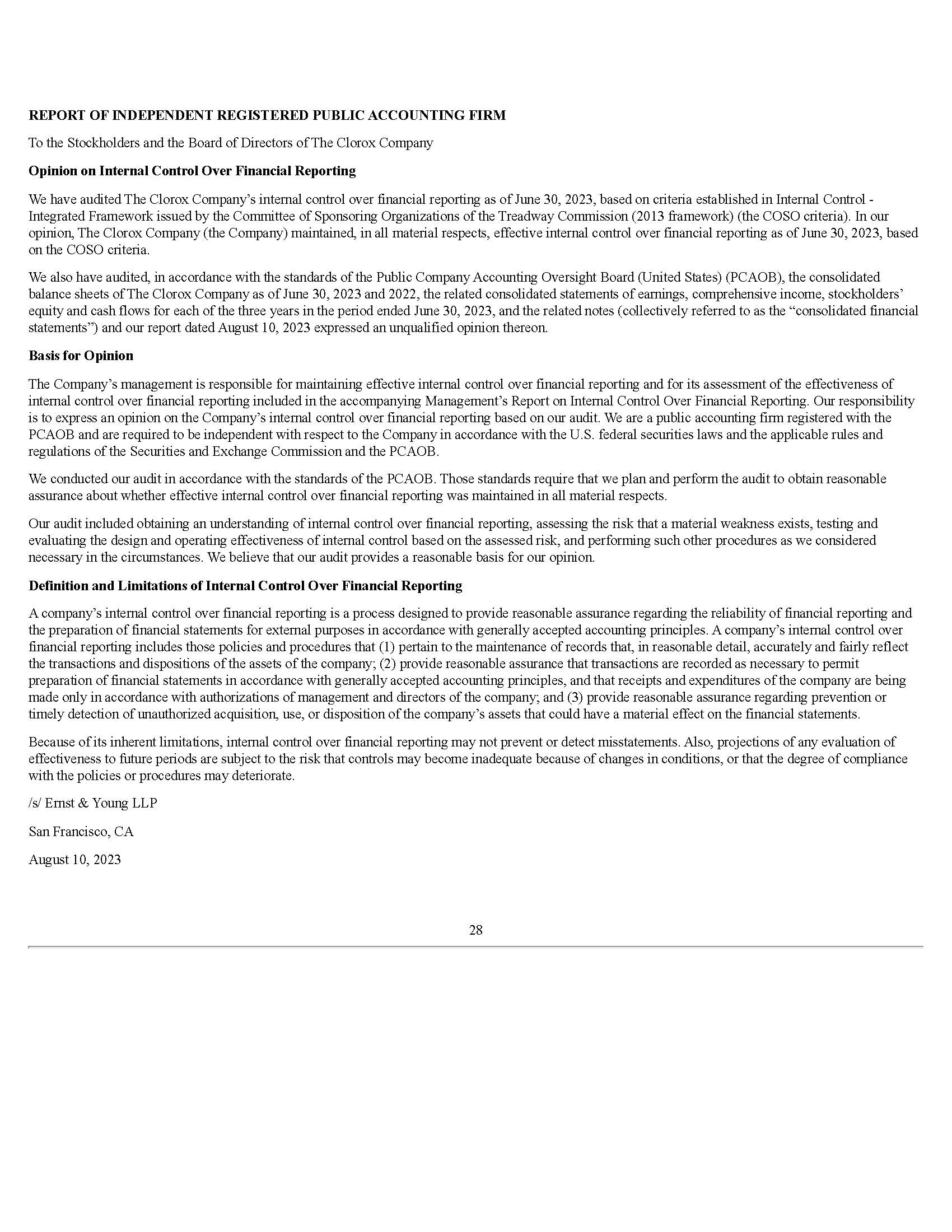

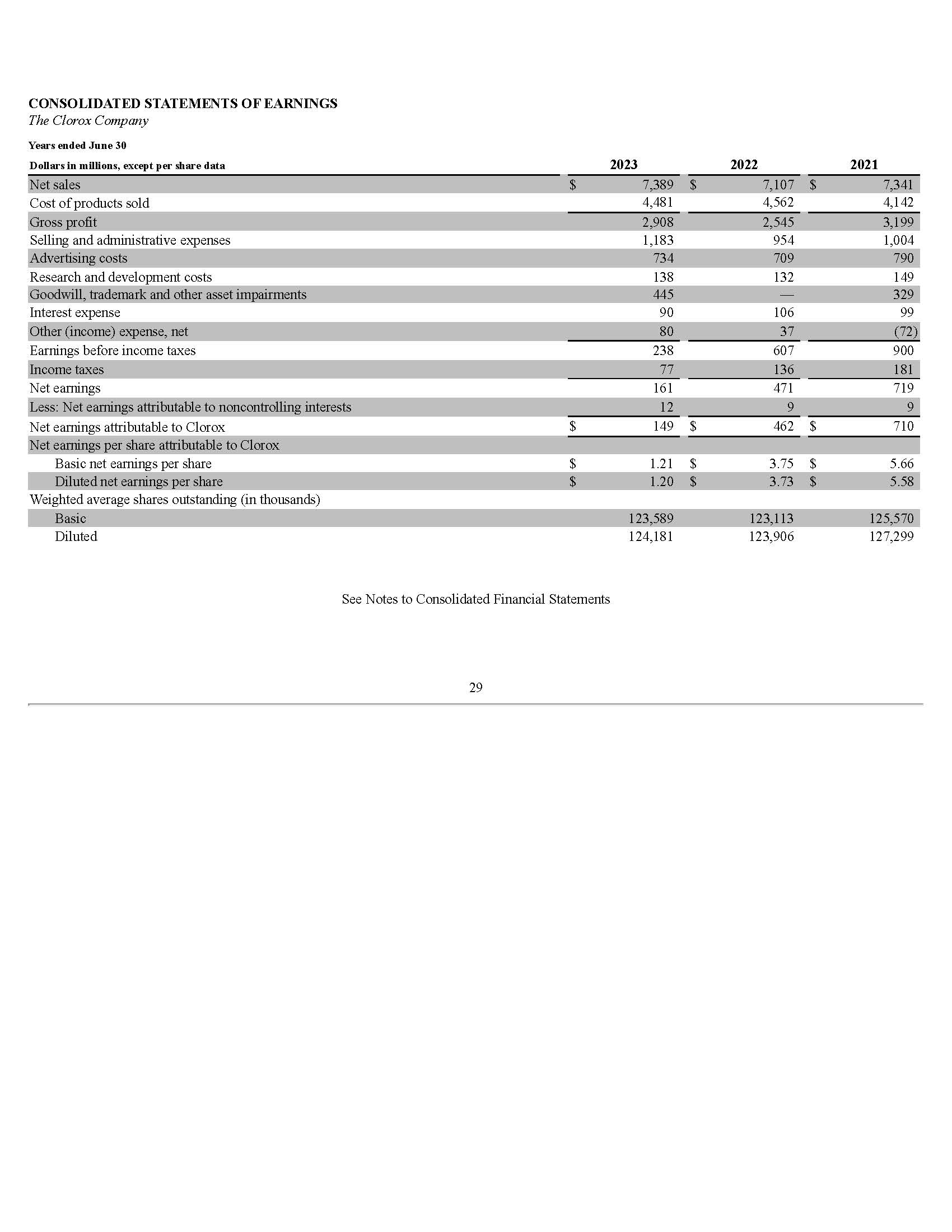

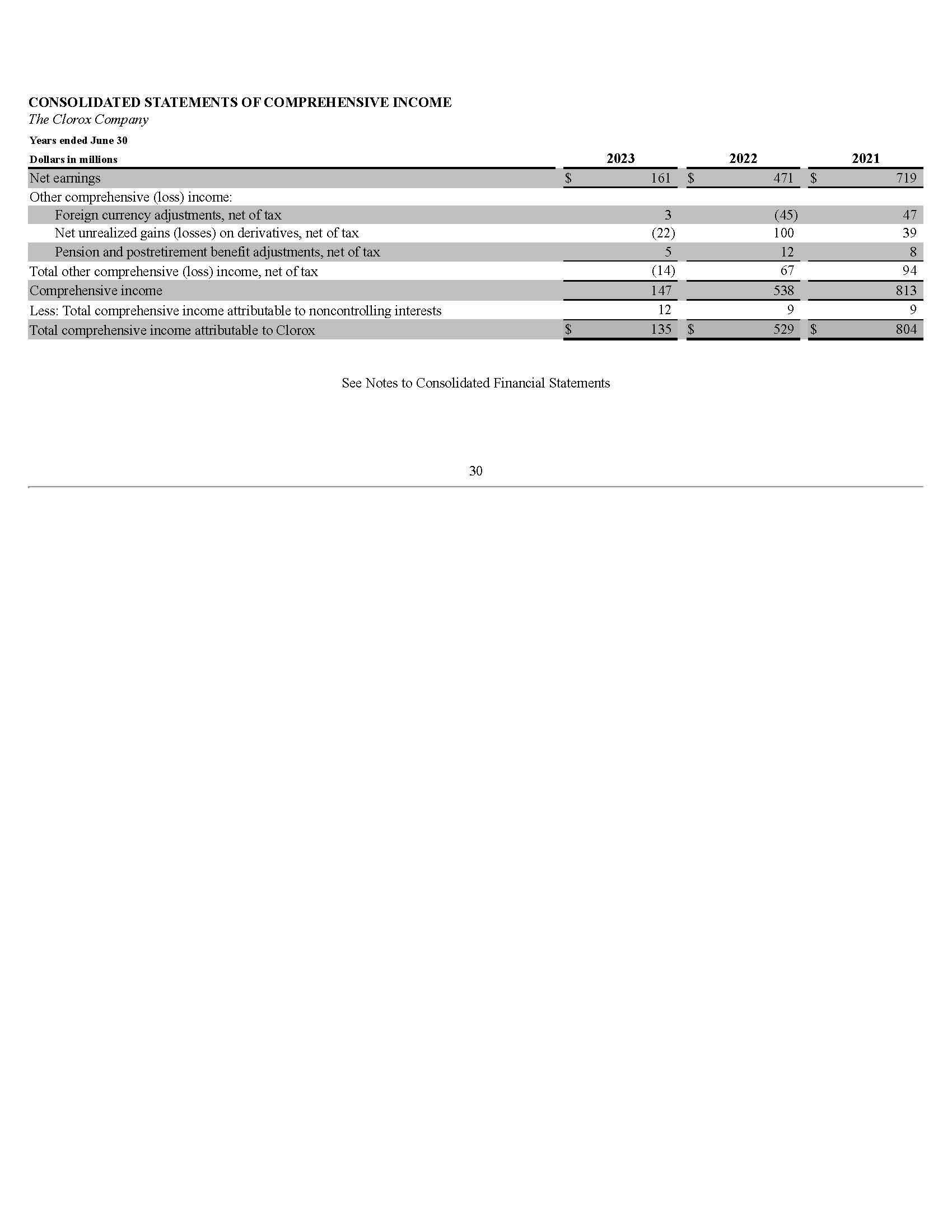

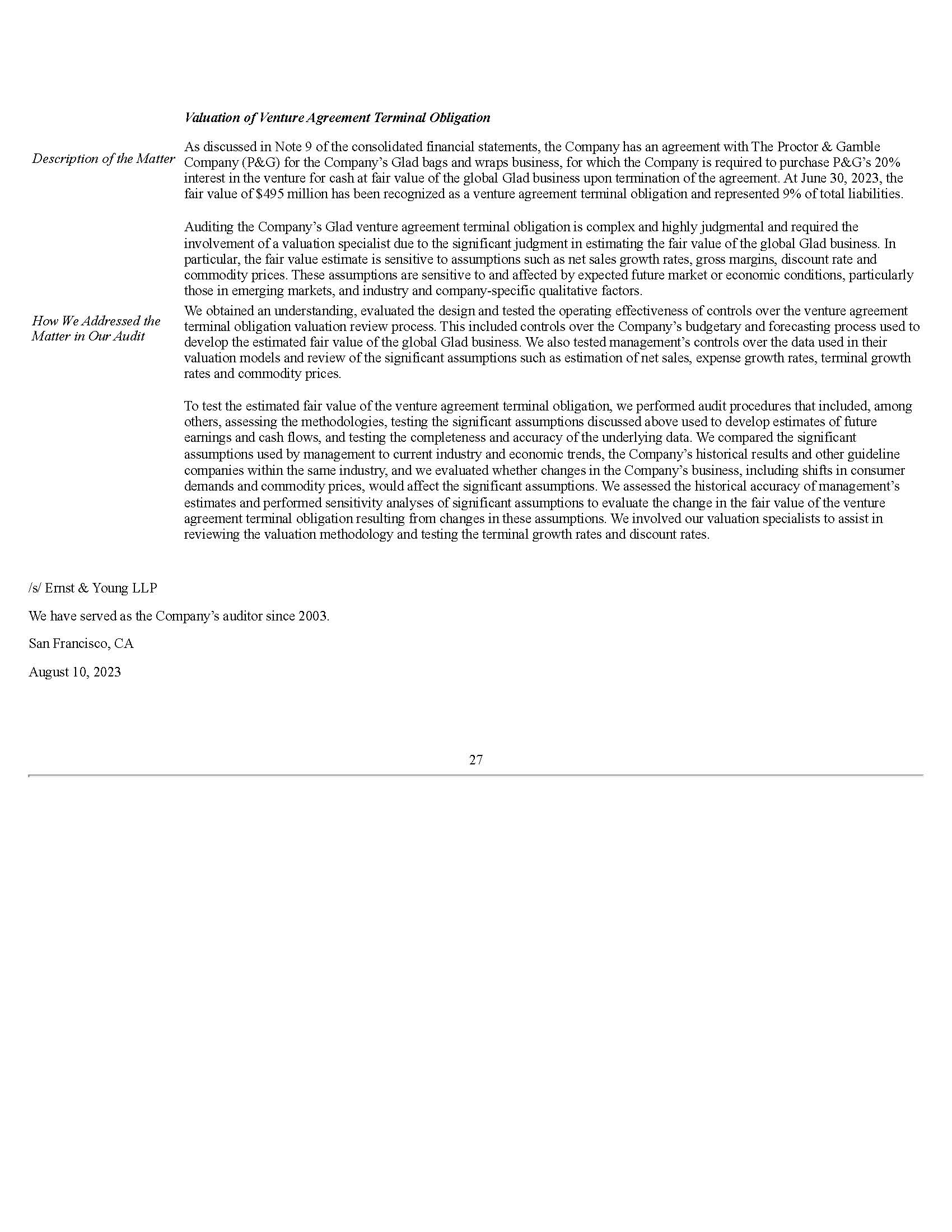

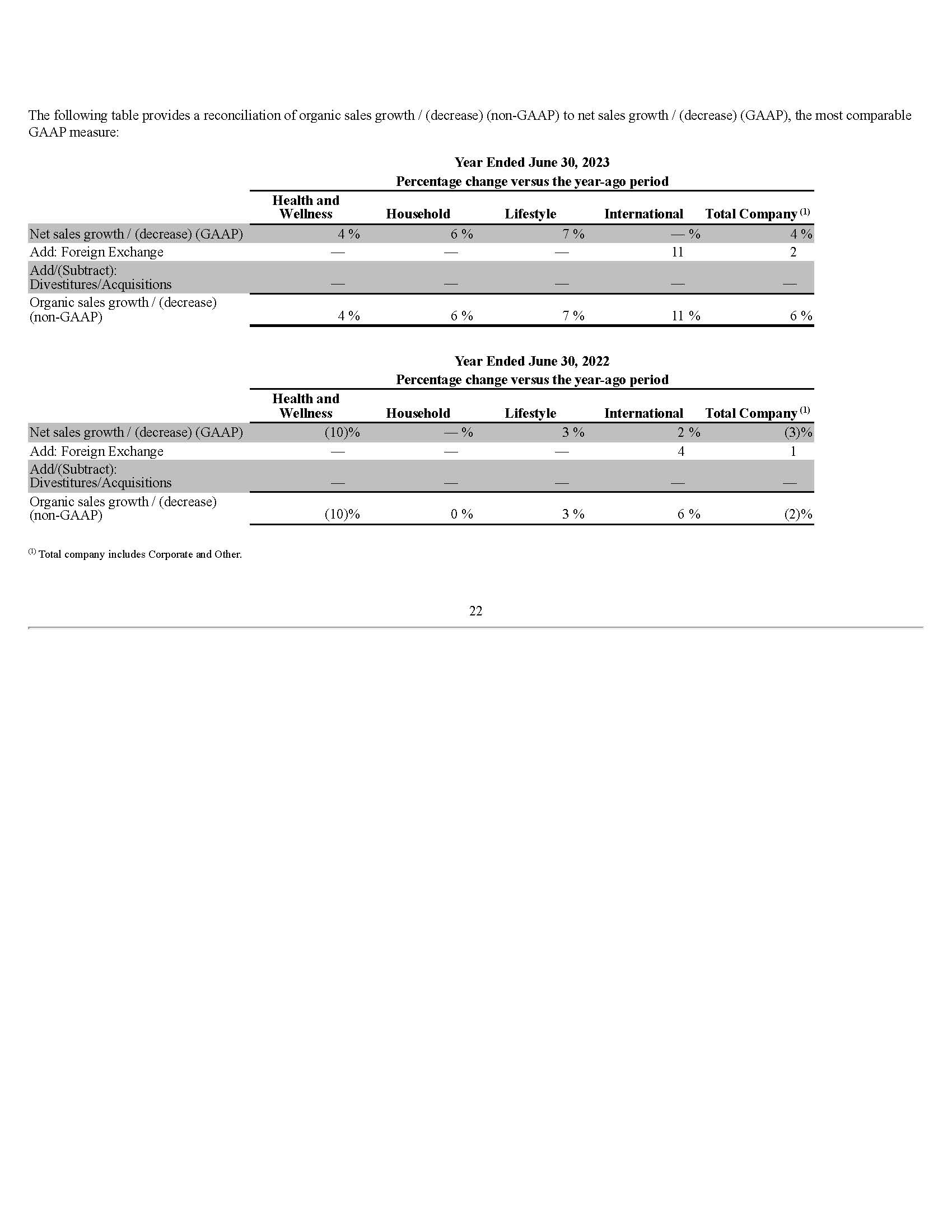

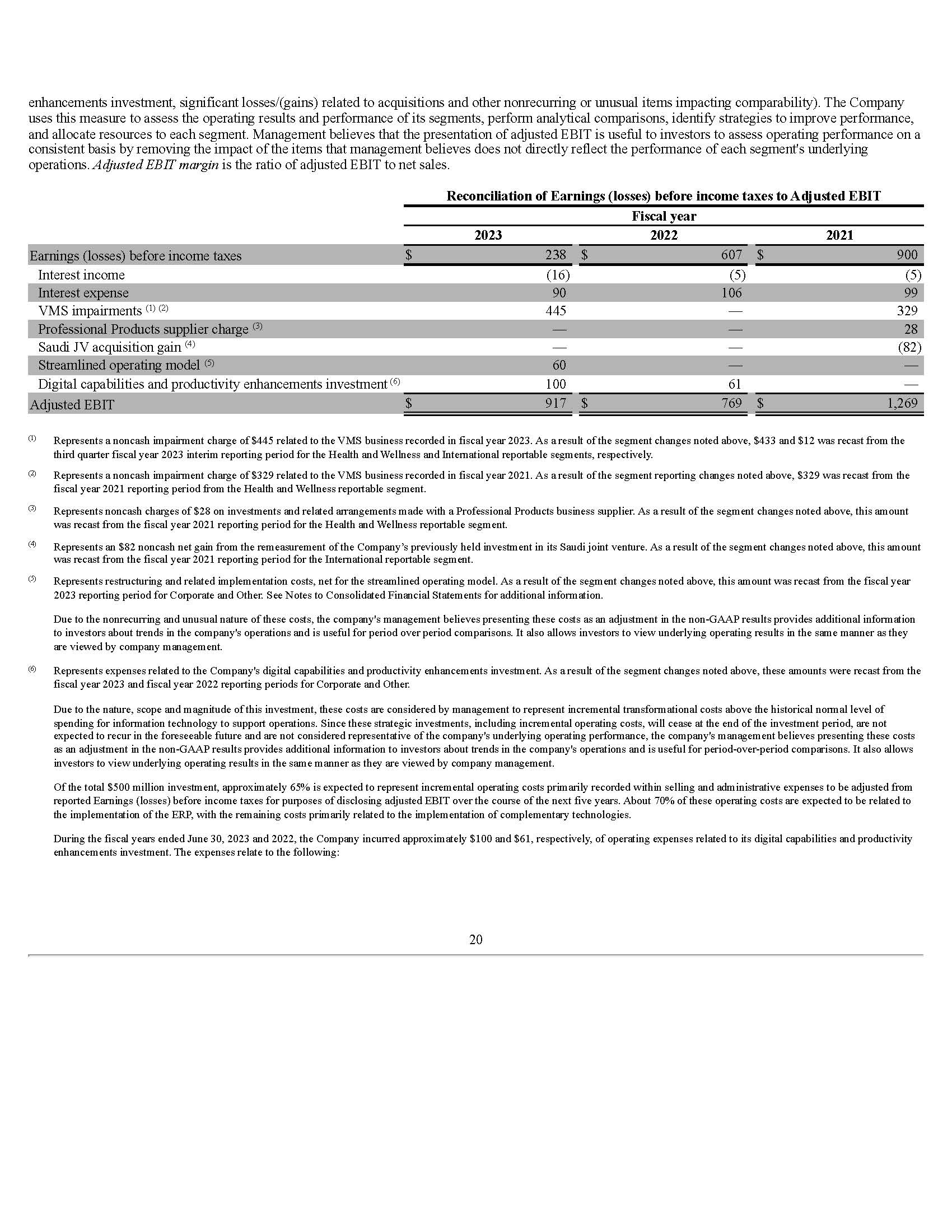

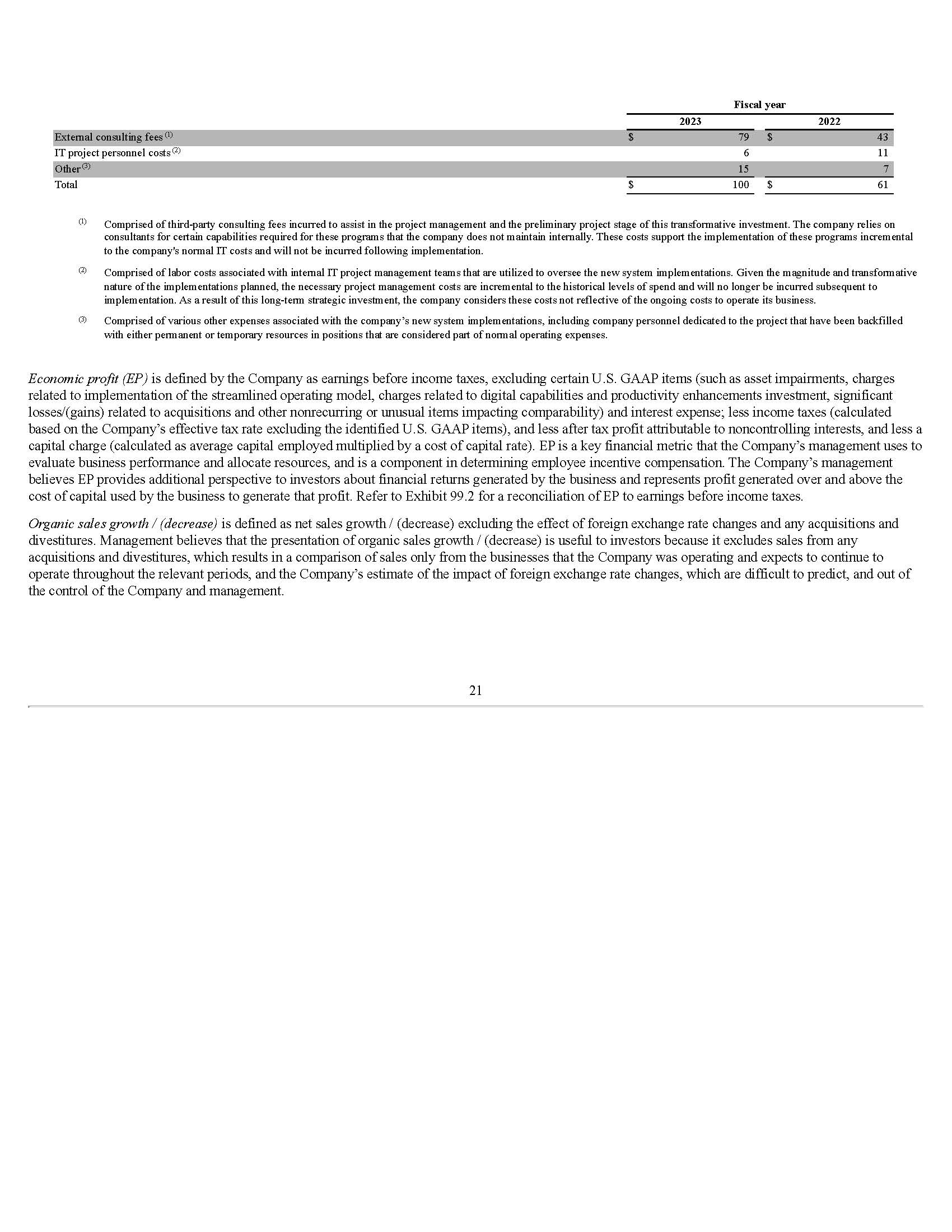

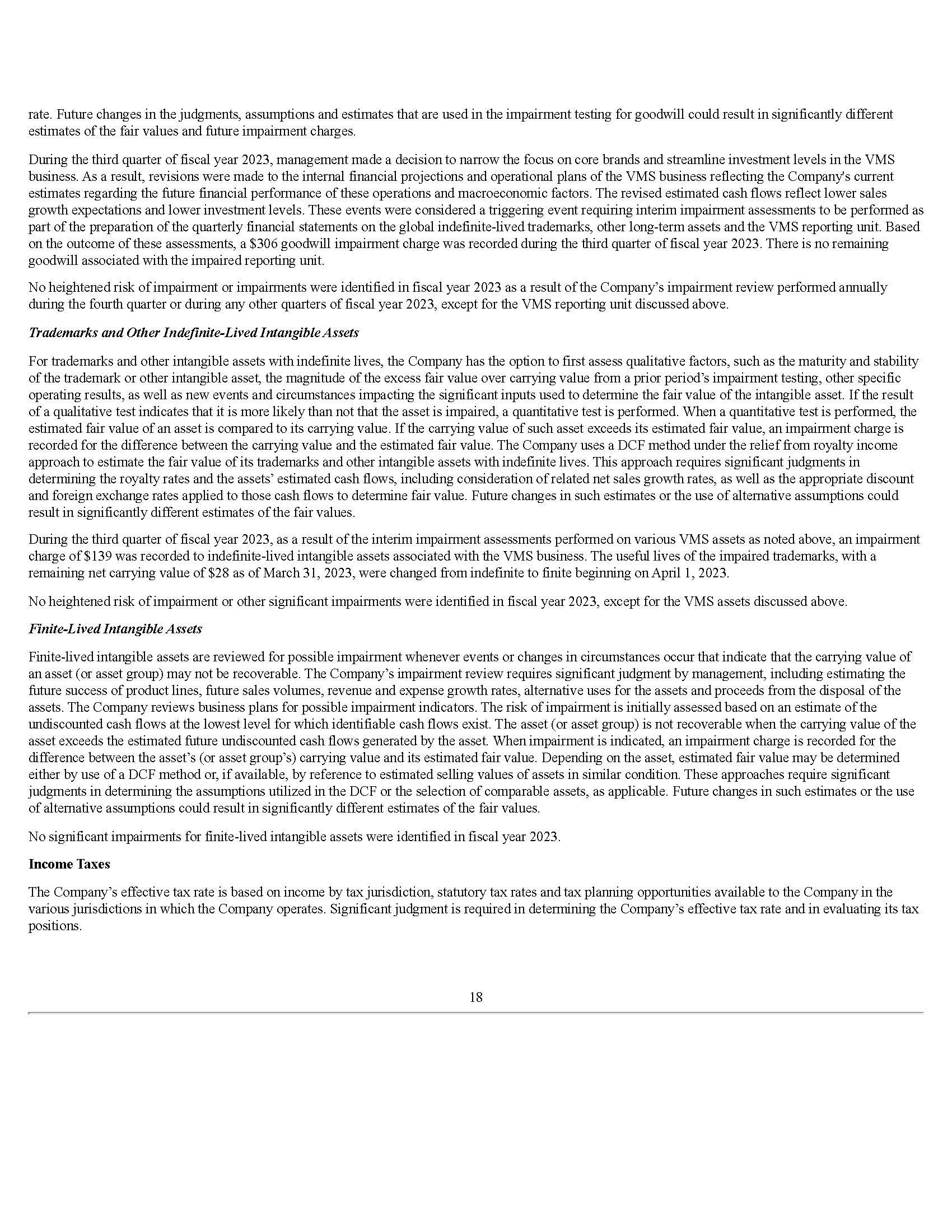

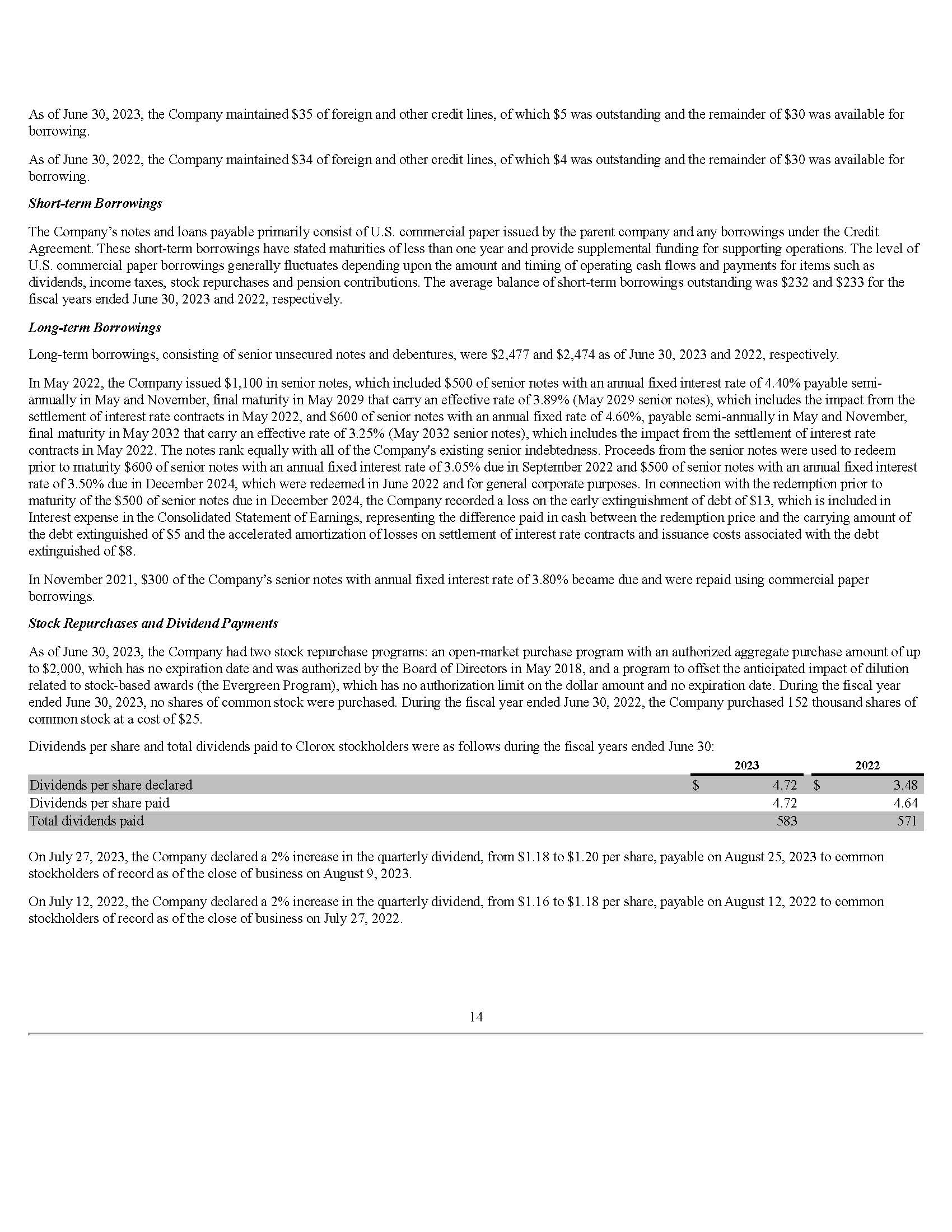

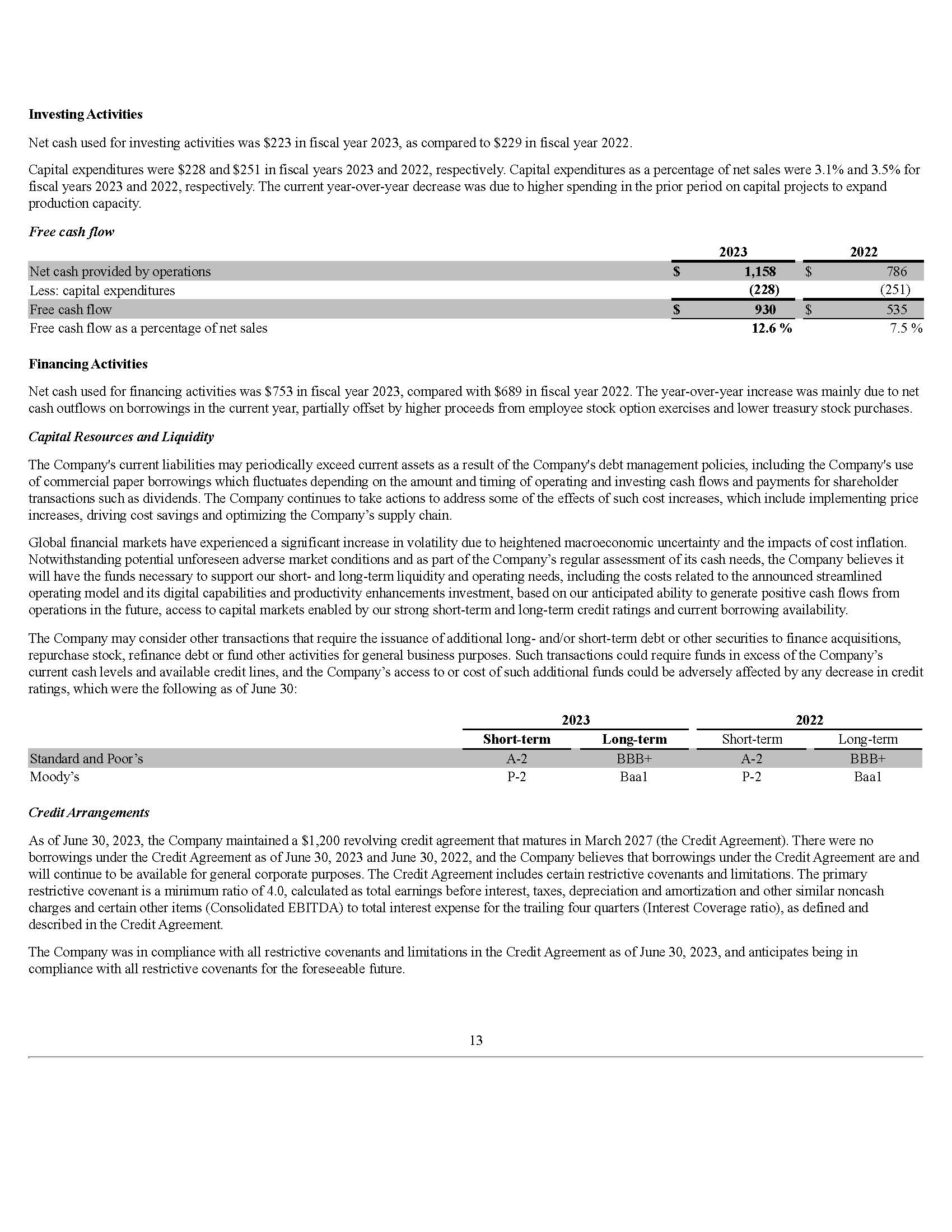

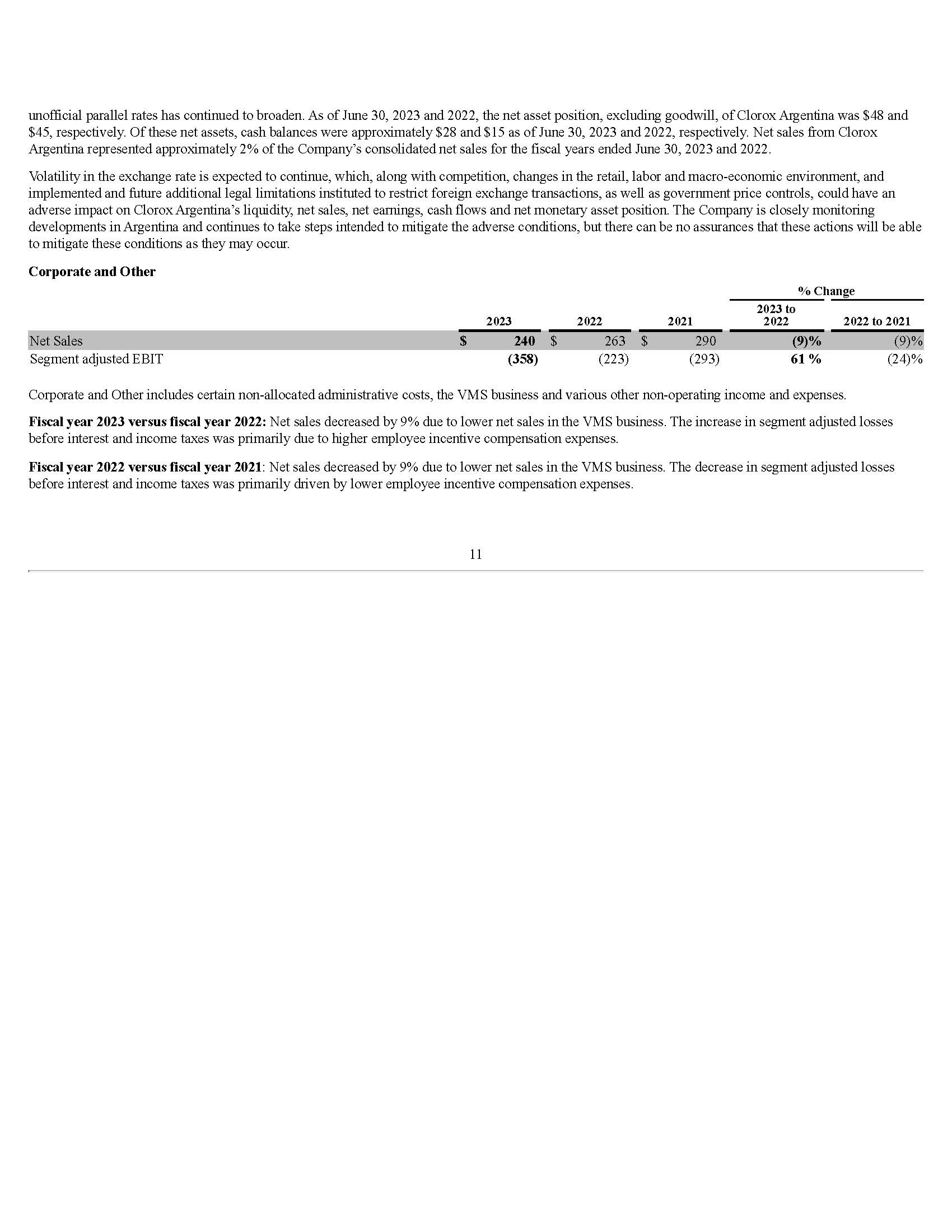

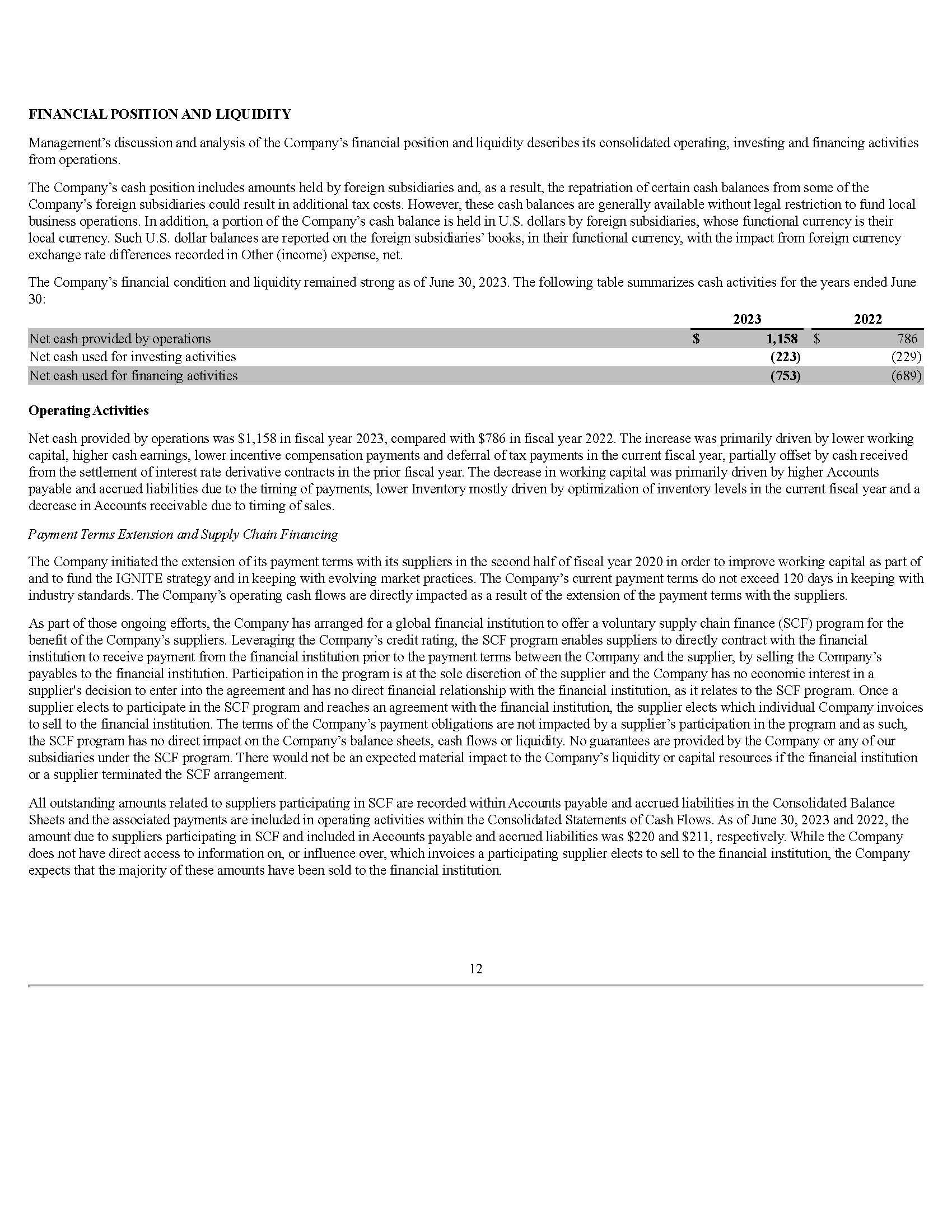

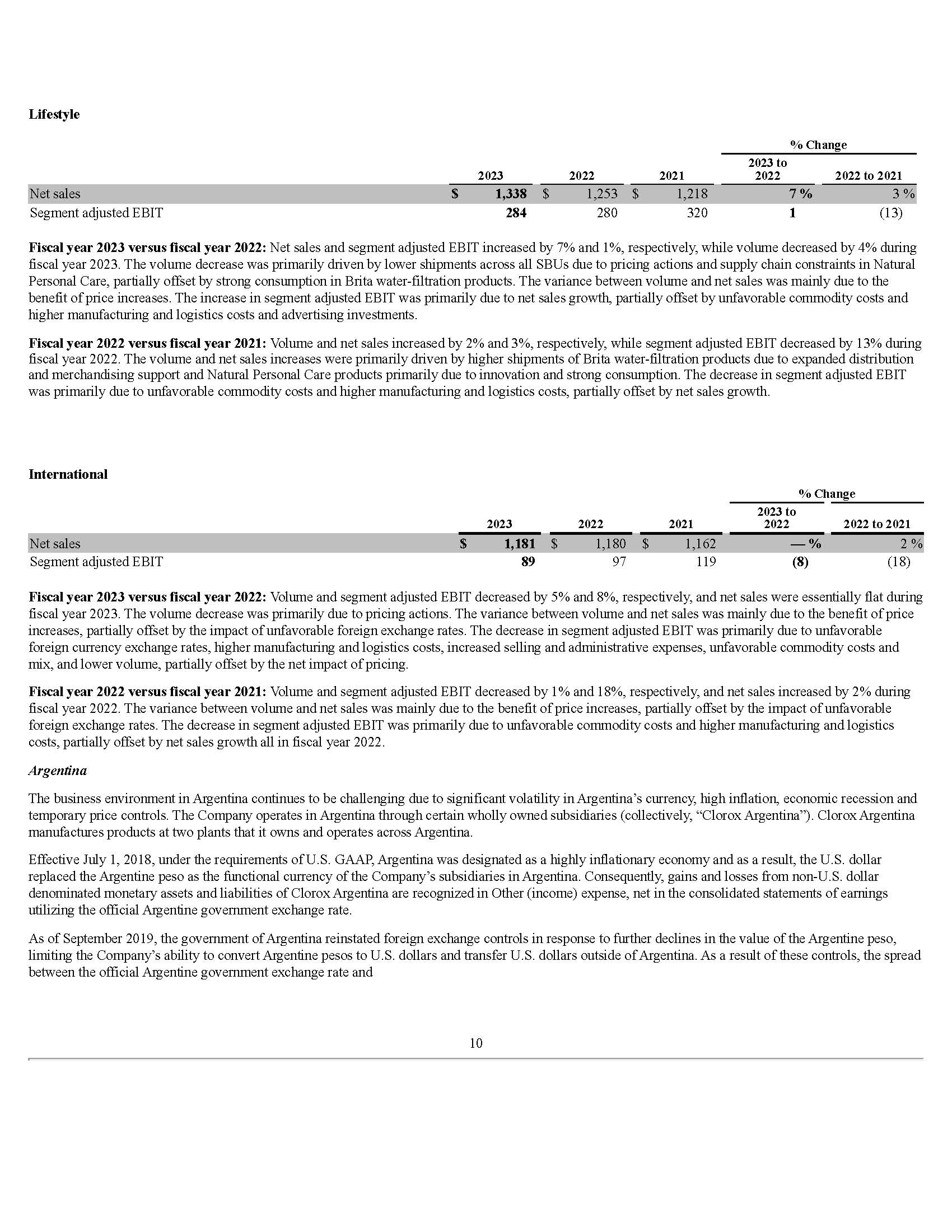

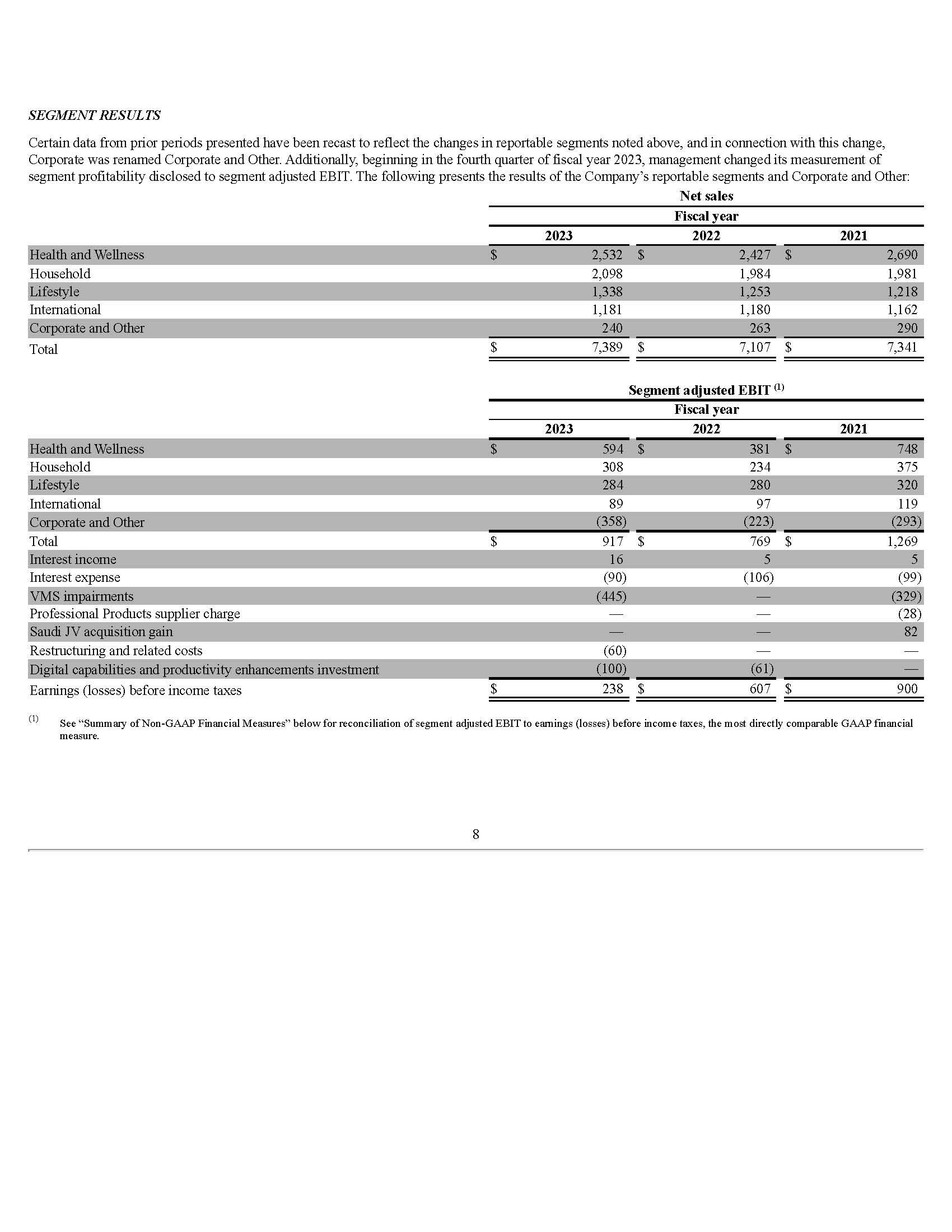

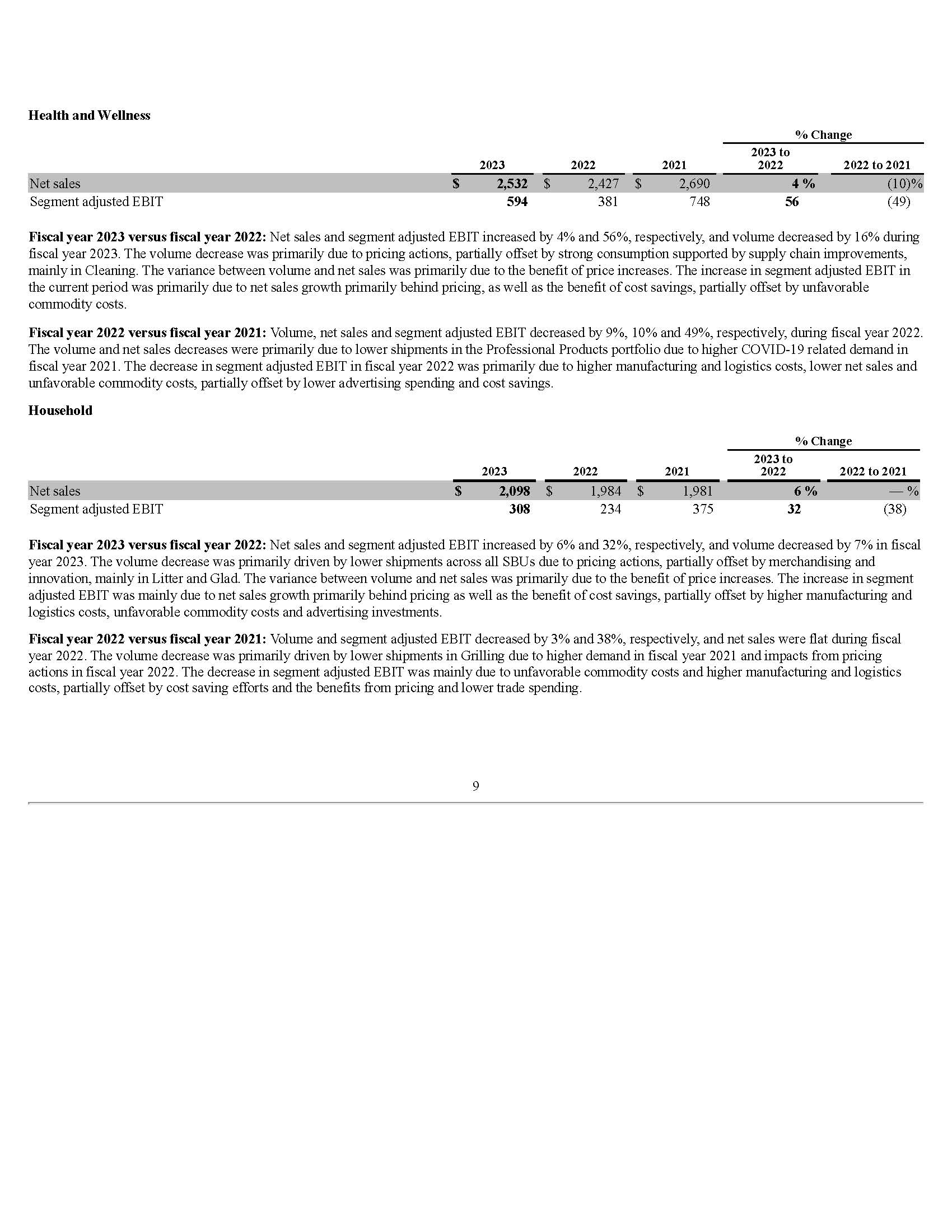

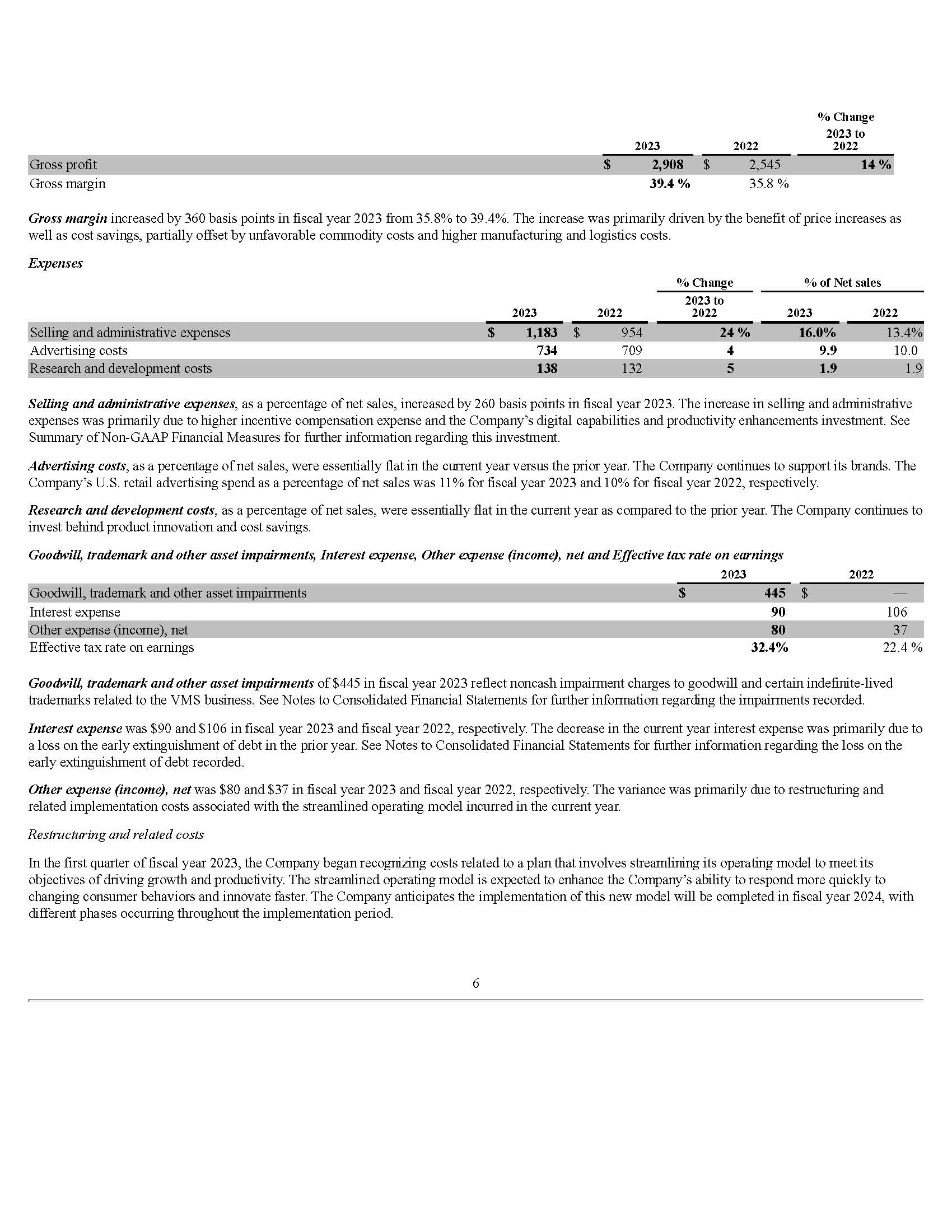

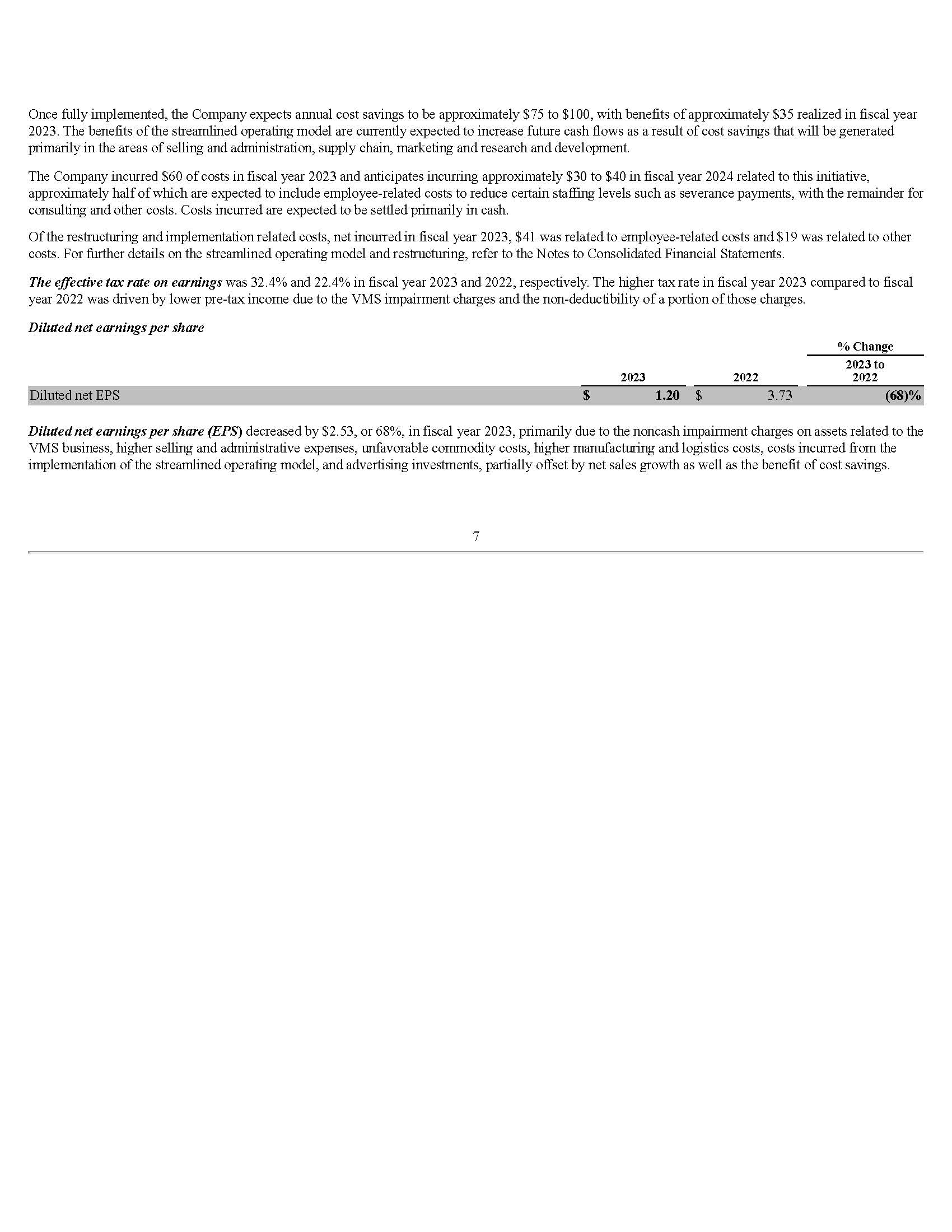

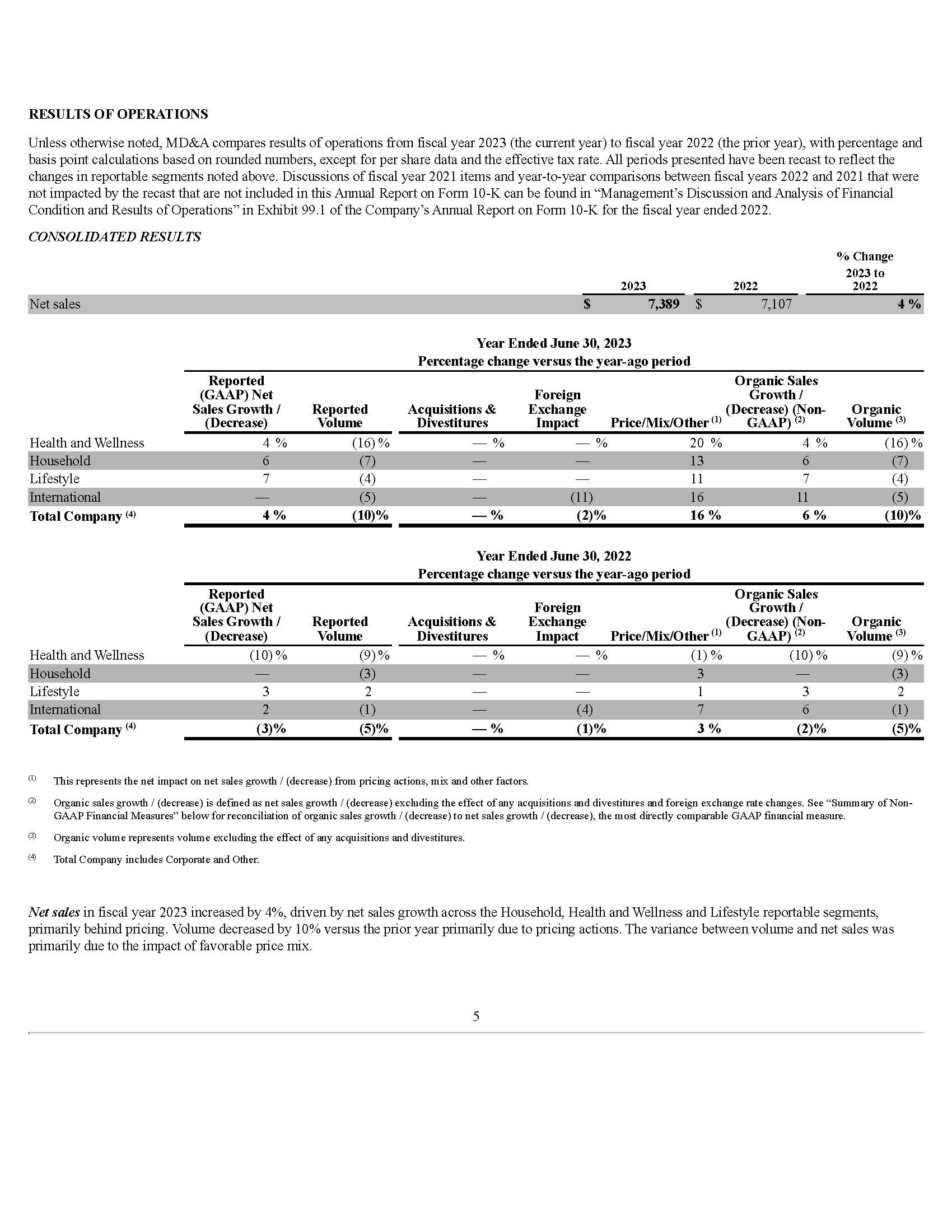

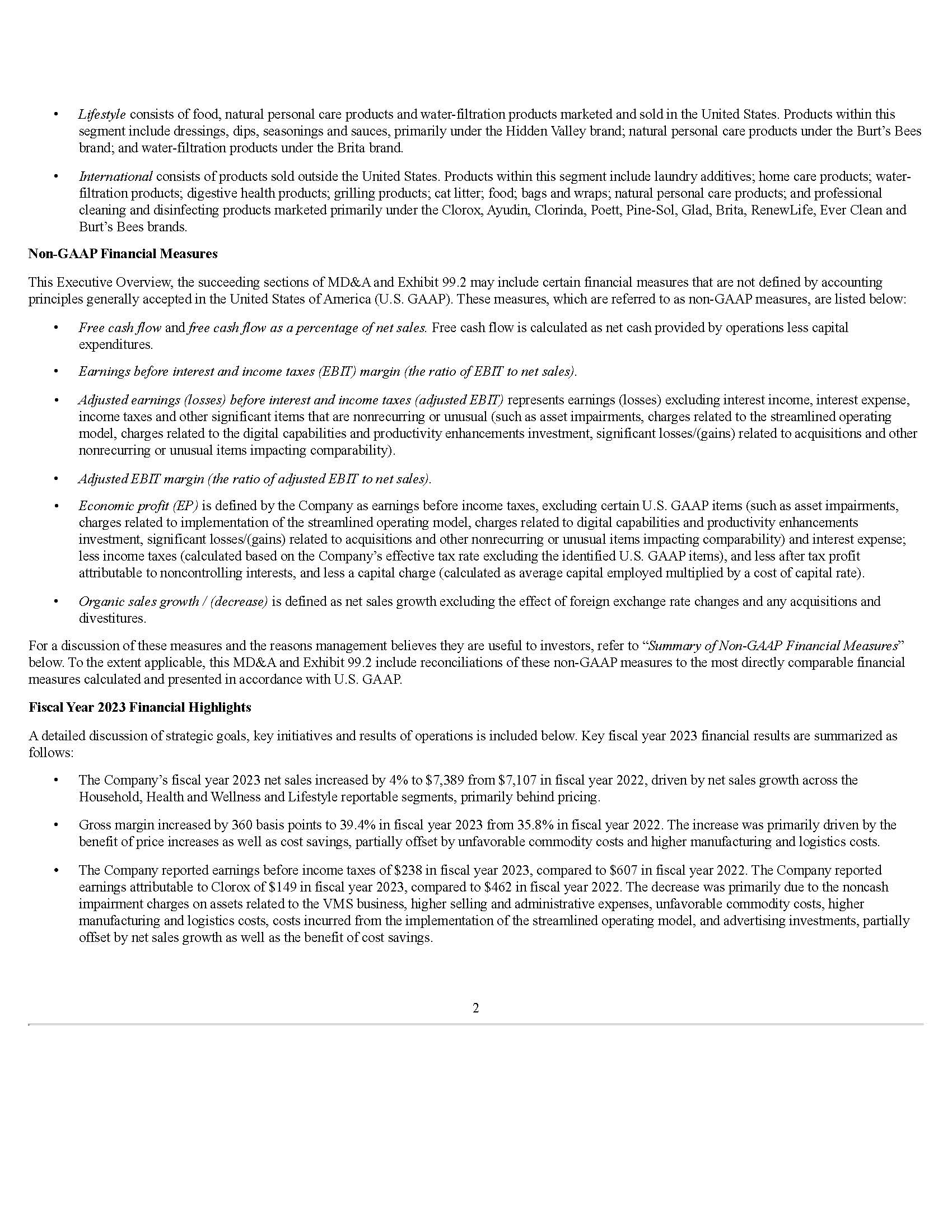

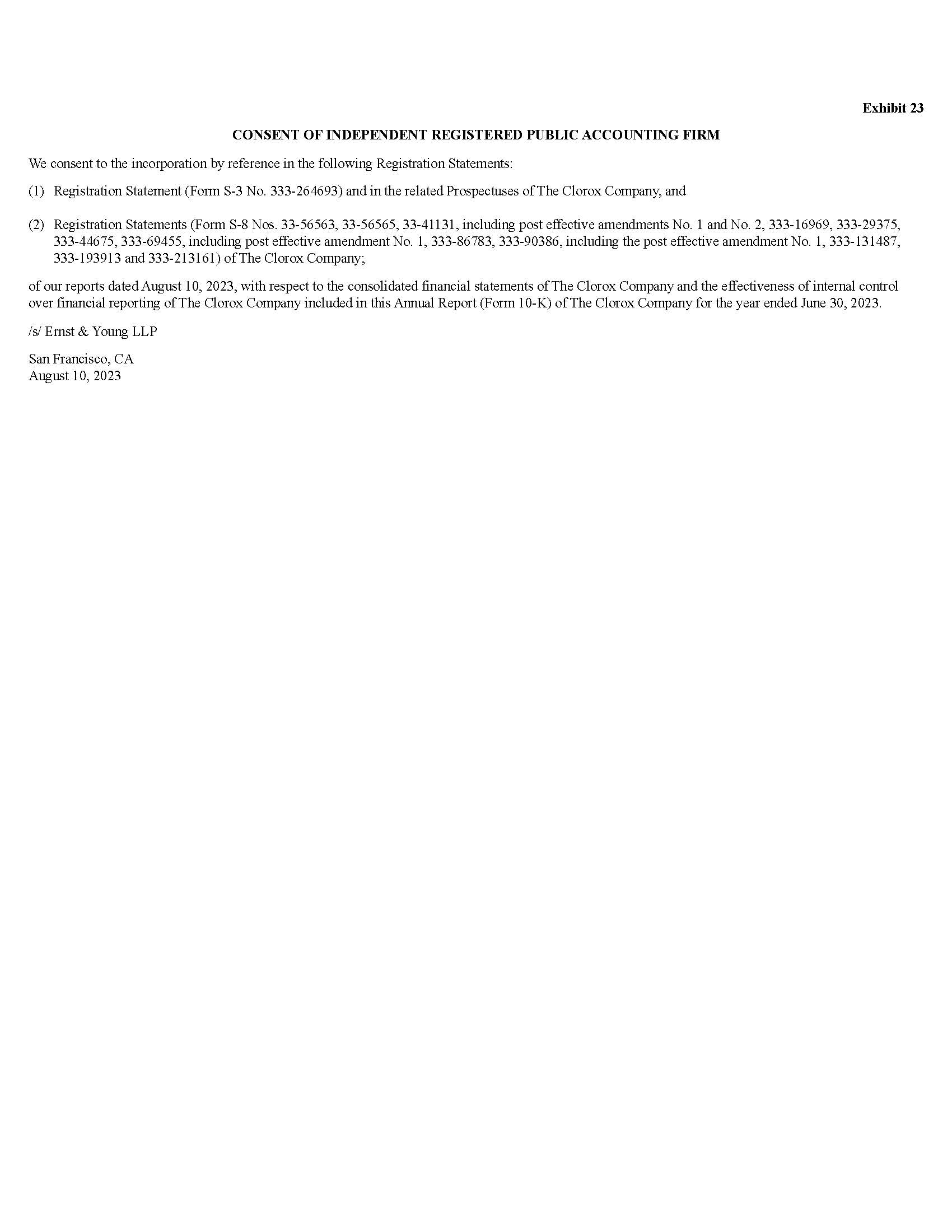

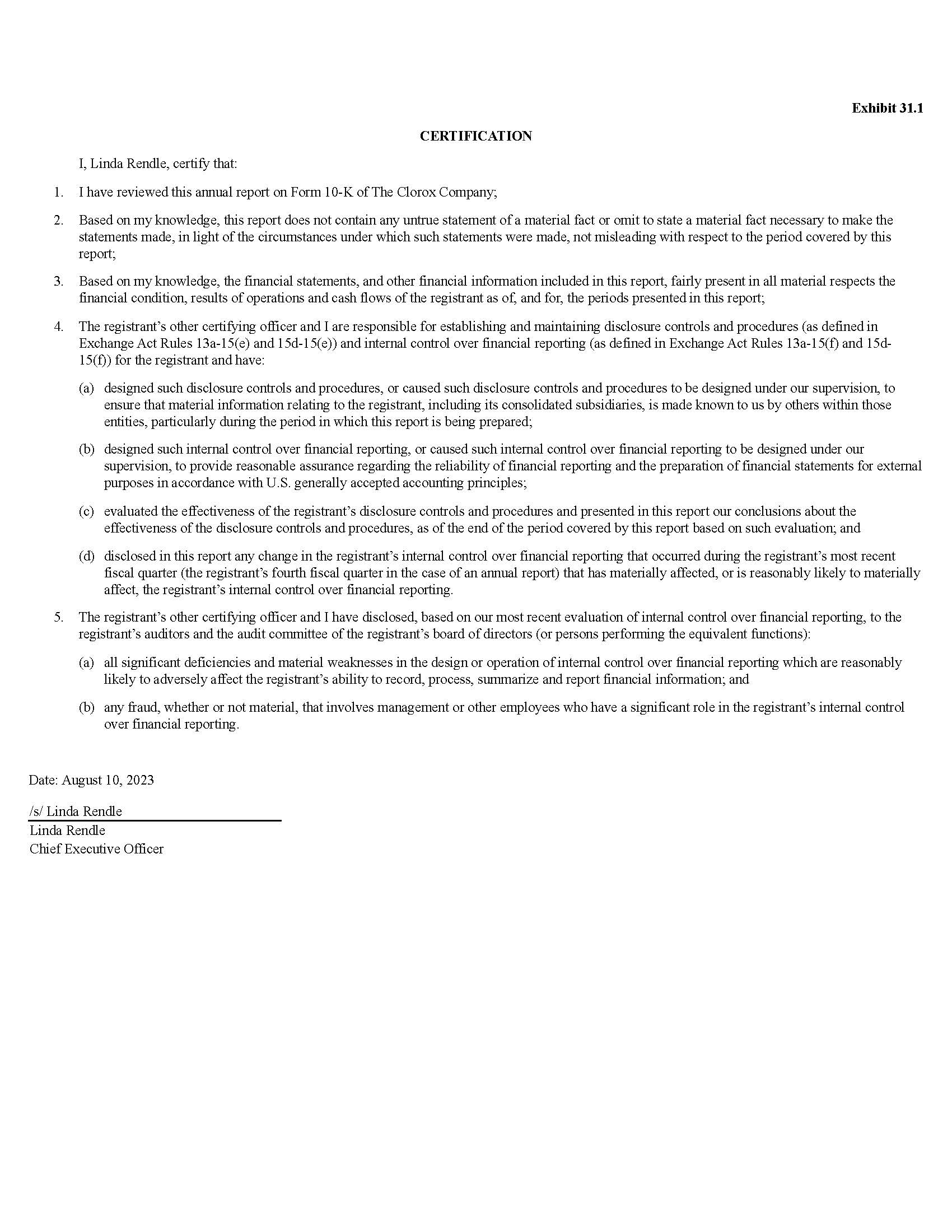

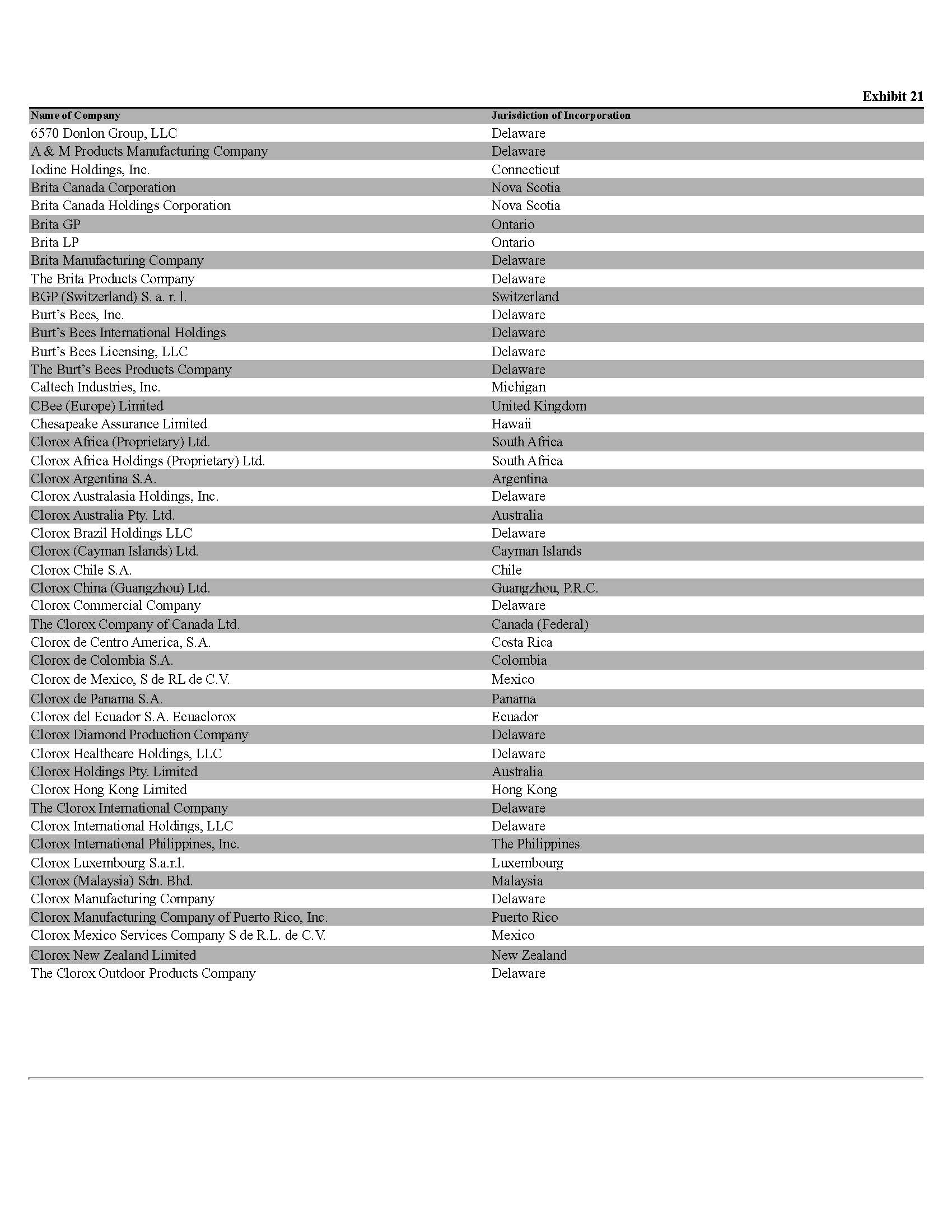

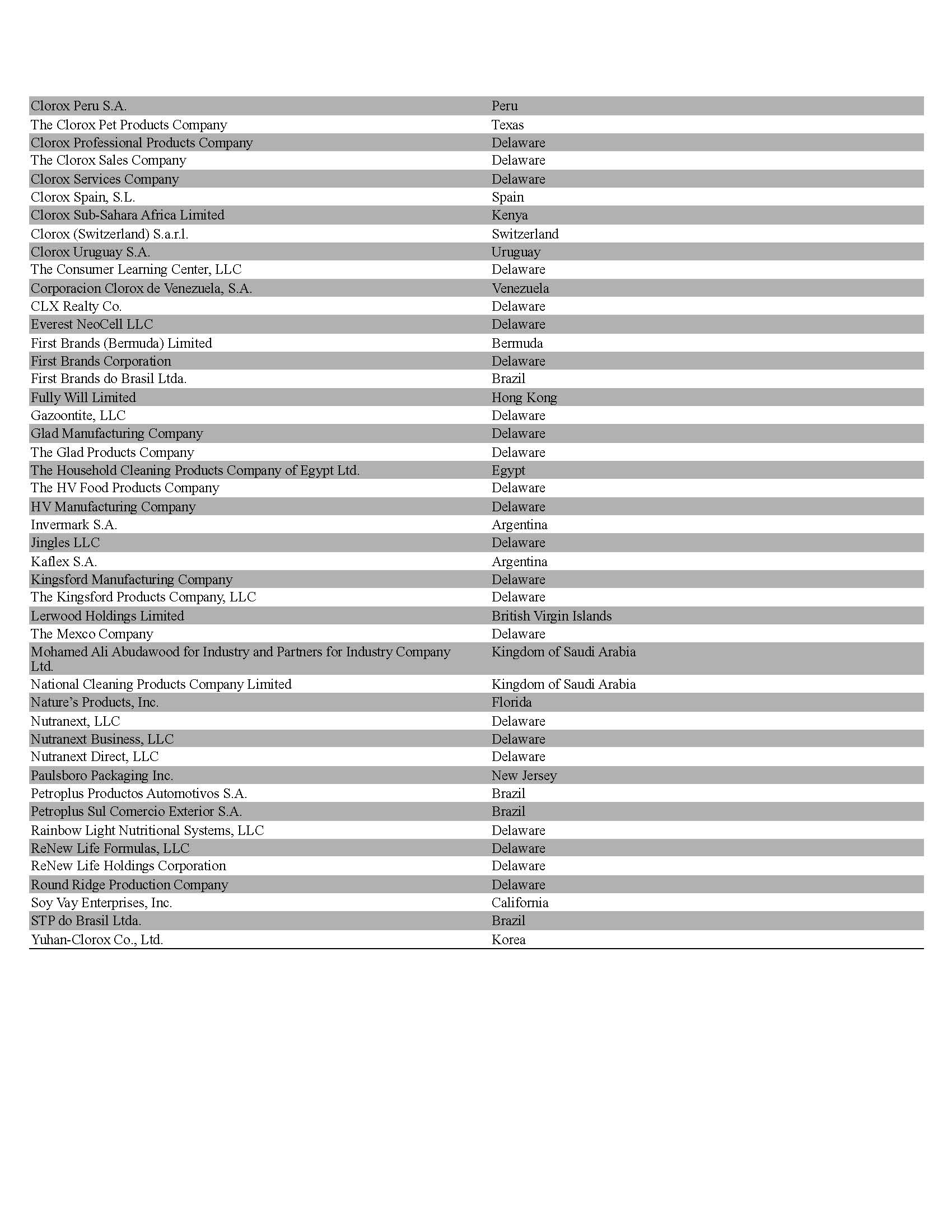

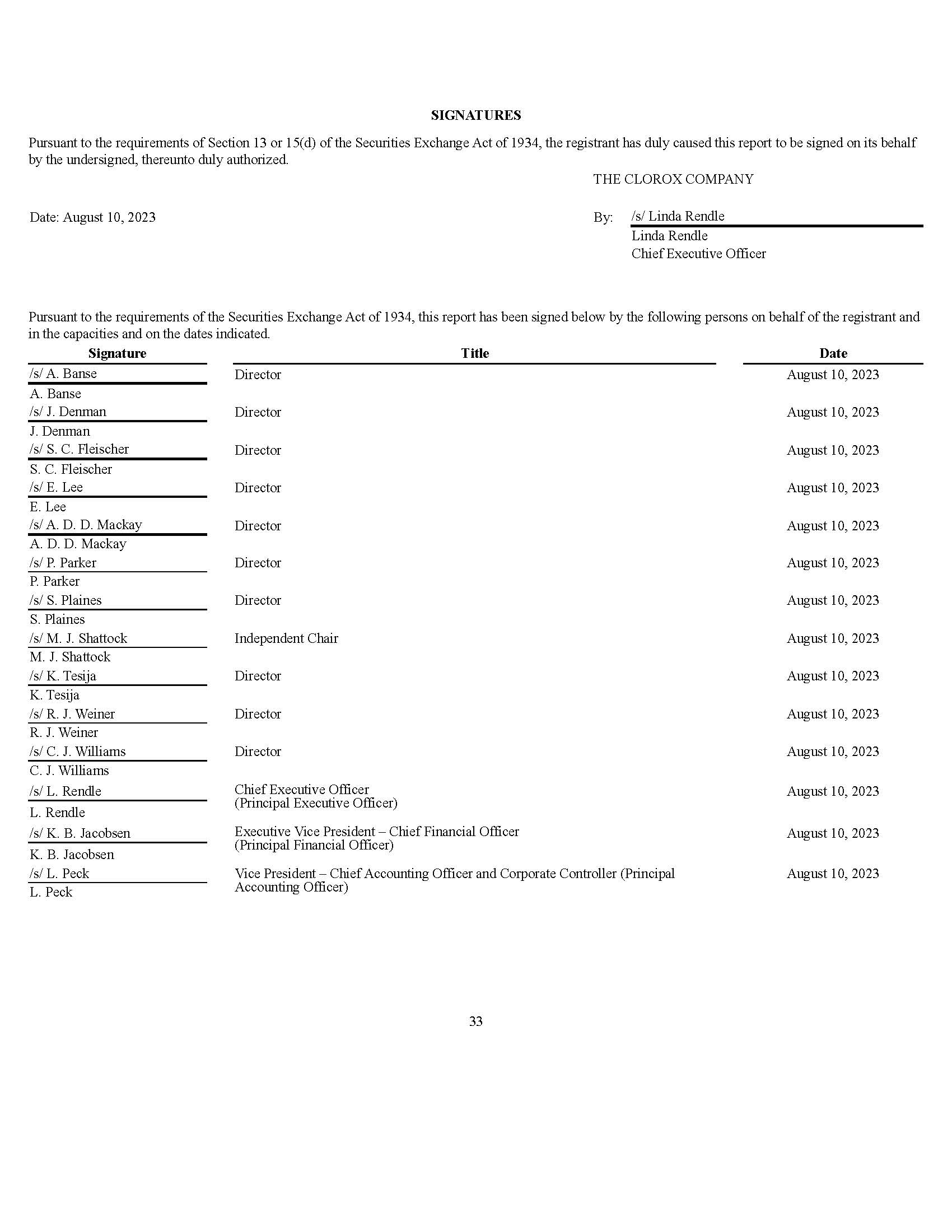

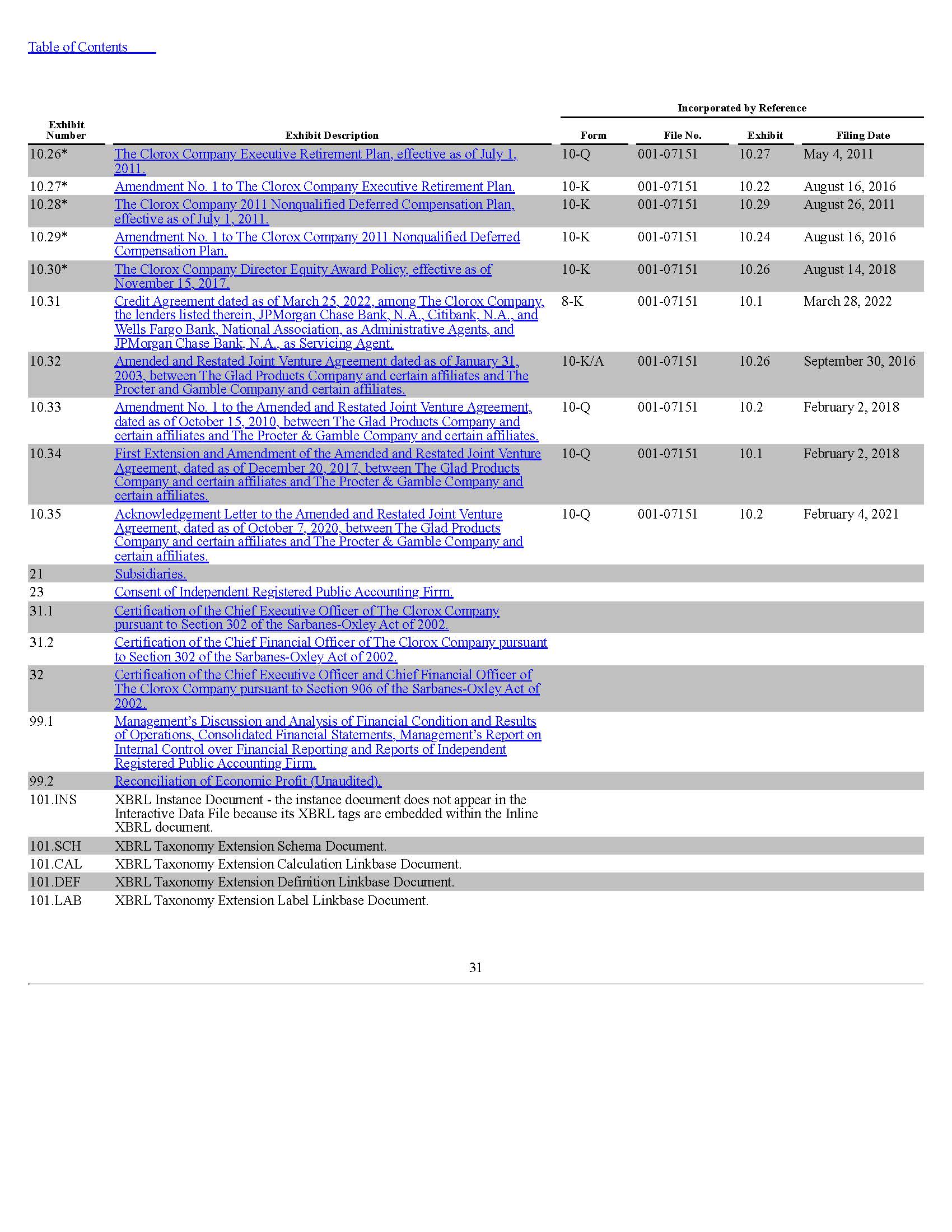

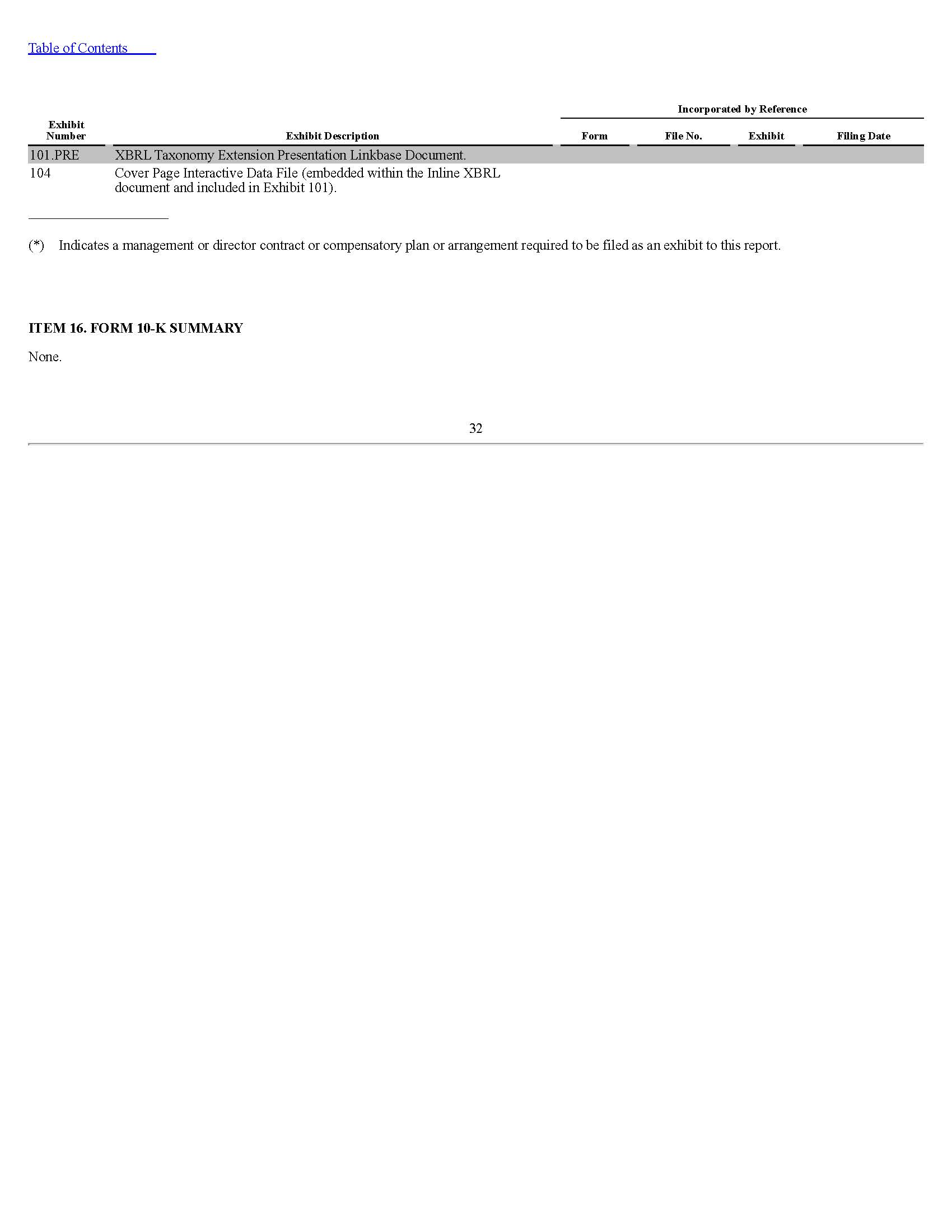

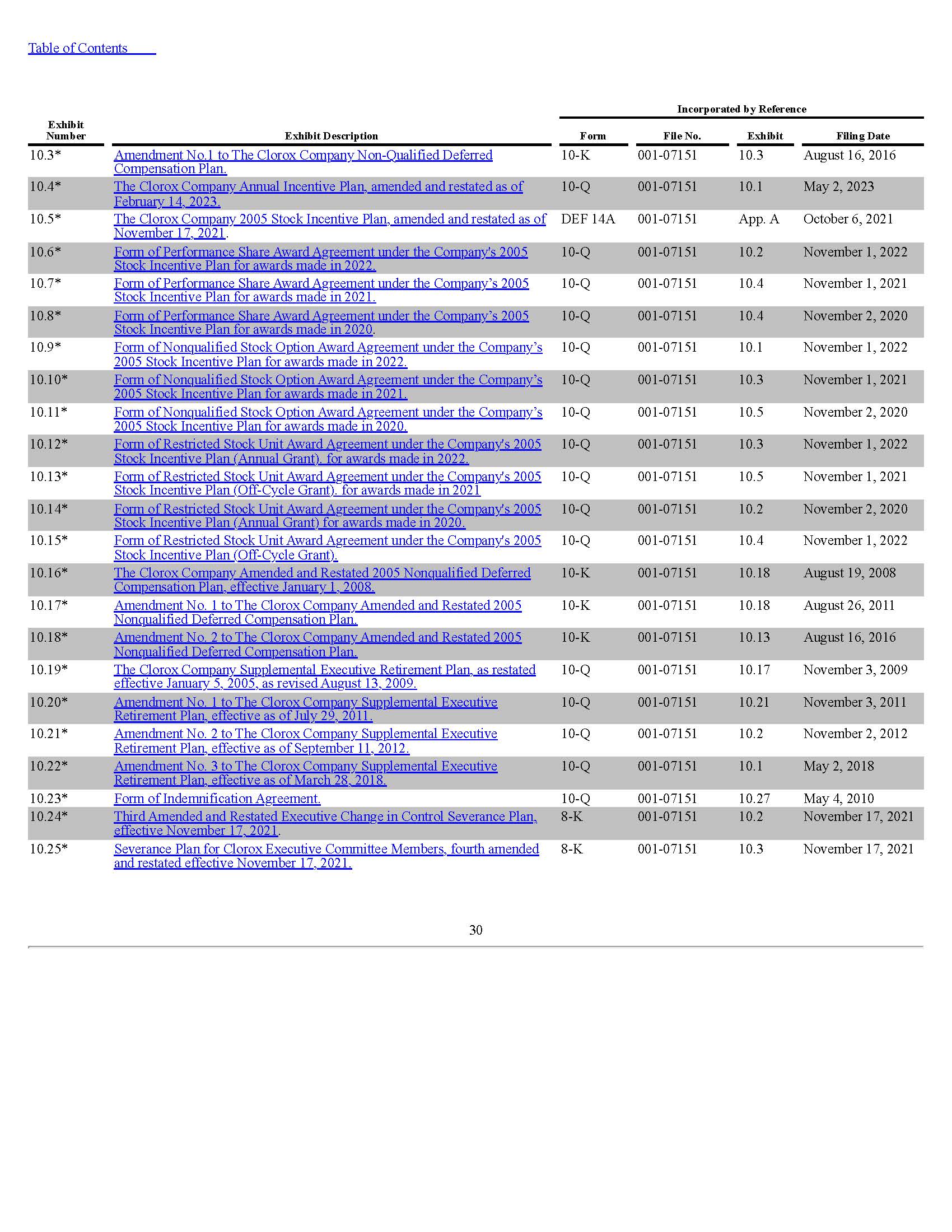

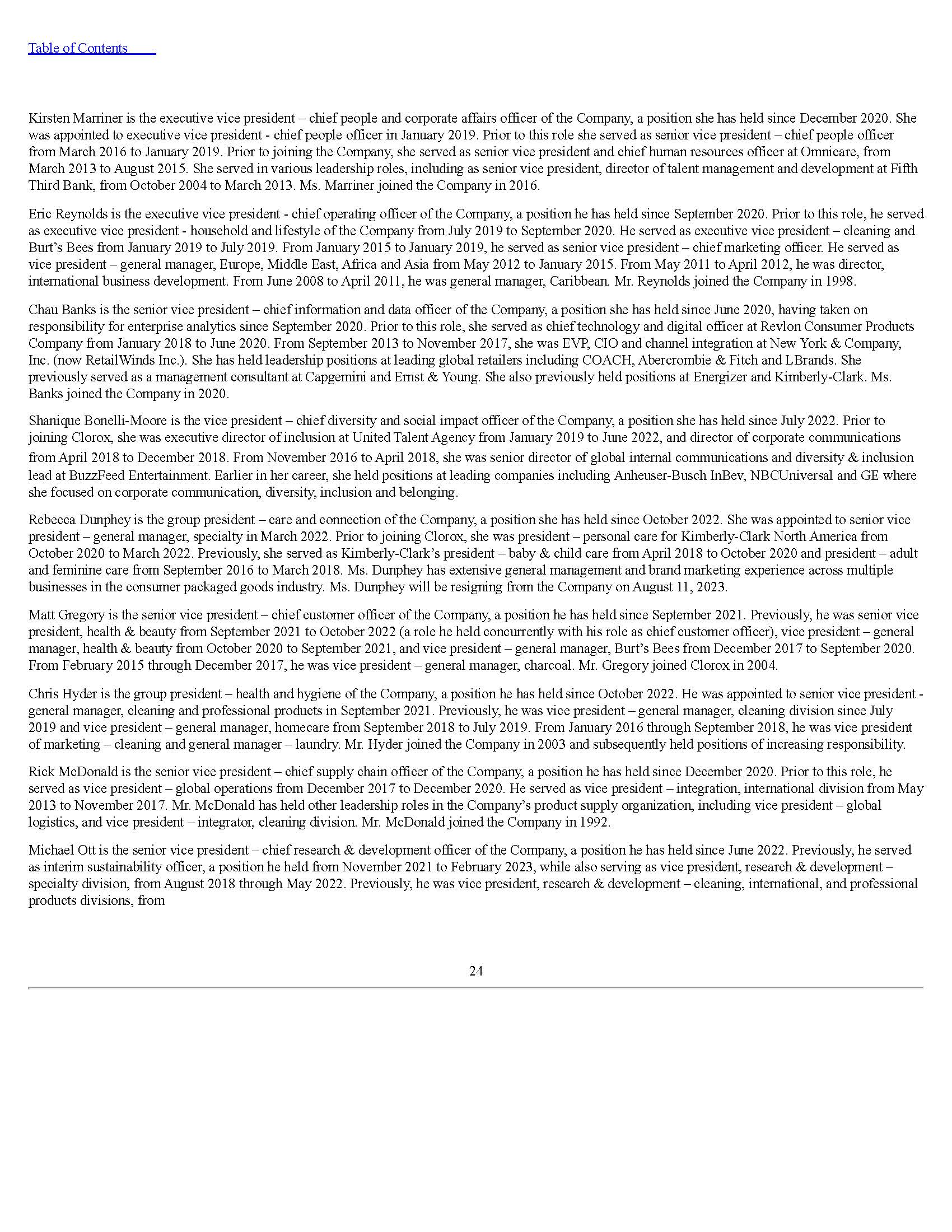

THE CLOROX COMPANY ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED JUNE 30, 2023 TABLE OF CONTENTS Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to $240.10d1 (b). Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No The aggregate market value of the registrant's common stock held by non-affiliates as of December 30, 2022 (the last business day of the registrant's most recently completed second fiscal quarter) was approximately $17.3 billion. As of July 25,2023 , there were 123,825,993 shares of the registrant's common stock outstanding. Documents Incorporated by Reference: Portions of the registrant's definitive proxy statement for the 2023 Annual Meeting of Stockholders (the "Proxy Statement"), to be filed within 120 days after June 30, 2023, are incorporated by reference into Part III, Items 10 through 14 of this Annual Report on Form 10-K. NOTE 19. SEGMENT REPORTING (Continued) All intersegment sales are eliminated and are not included in the Company's reportable net sales. Net sales to the Company's largest customer, Walmart Stores, Inc. and its affiliates, were 26%,25%, and 25% of consolidated net sales for each of the fiscal years ended June 30,2023, 2022 and 2021, respectively, and occurred across all of the Company's reportable segments. No other customers accounted for 10% or more of the Company's consolidated net sales in any of these fiscal years. The following table provides Net sales as a percentage of the Company's consolidated net sales, disaggregated by operating segment under the new reporting structure, for the fiscal years ended June 30 : NOTE 19. SEGMENT REPORTING (Continued) The Company's products are marketed and sold globally. The following table provides the Company's global product lines, which were sold in the U.S. and International, that accounted for 10% or more of consolidated net sales for the fiscal years ended June 30 : Net sales and property, plant and equipment, net, by geographic area for and as of the fiscal years ended June 30 were as follows: NOTE 20. RELATED PARTY TRANSACTIONS The Company holds various equity investments with ownership percentages of up to 50% in a number of consumer products businesses, which operate both within and outside the United States. The equity investments, presented in Other assets and accounted for under the equity method, were $43 and $52 as of the fiscal years ended June 30, 2023 and 2022, respectively. The Company has no ongoing capital commitments, loan requirements, guarantees or any other types of arrangements under the terms of its agreements that would require any future cash contributions or disbursements arising out of an equity investment. Transactions with the Company's equity investees typically represent payments for contract manufacturing and purchases of raw materials. Payments to related parties, including equity investees, for such transactions during the fiscal years ended June 30,2023,2022 and 2021 were $87, $117 and $44, respectively. Receipts from and ending accounts receivable and payable balances related to the Company's related parties were not significant during or as of the end of each of the fiscal years presented. Exhibit 99.2 profit. Exhibit 99.1 for detail on the U.S. GAAP charges. acquisition gain of 0.1%,(0.4)%, and 0.9%, respectively. capital employed for the prior year, based on year-end balances. See below for details of the average capital employed calculation. numbers. Exhibit 99.2 (6) Accounts payable and accrued liabilities and Other liabilities are adjusted to exclude interest-bearing liabilities. The Company operates through strategic business units (SBUs) that are organized into the Company's operating segments. Operating segments with shared economic and qualitative characteristics are aggregated into four reportable segments: Health and Wellness, Household, Lifestyle and International. Operating segments not aggregated into a reportable segment are reflected in Corporate and Other. The four reportable segments consist of the following: - Health and Wellness consists of cleaning, disinfecting and professional products mainly marketed and sold in the United States. - Household consists of bags and wraps, cat litter and grilling products marketed and sold in the United States. - Lifestyle consists of food, natural personal care products and water-filtration products marketed and sold in the United States. - International consists of products sold outside the United States. Products within this segment include laundry additives; home care products; waterfiltration products; digestive health products; grilling products; cat litter; food; bags and wraps; natural personal care products; and professional cleaning and disinfecting products. Corporate and Other includes certain non-allocated administrative costs, various other non-operating income and expenses, as well as the results of the VMS business. Assets in Corporate and Other include cash and cash equivalents, prepaid expenses and other current assets, property and equipment, operating lease right-of-use assets, other long-term assets and deferred taxes, as well as the assets related to the VMS business. NOTE 19. SEGMENT REPORTING (Continued) Segment Adjusted Earnings (losses) before interest and income taxes third quarter fiscal year 2023 interim reporting period for the Health and Wellness and Intemational reportable segments, respectively. fiscal year 2021 reporting period from the Health and Wellness reportable segment. was recast from the fiscal year 2021 reporting period for the Health and Wellness reportable segment. was recast from the fiscal year 2021 reporting period for the International reportable segment. the Company's segments as a percent of the total costs for the fiscal year ended June 30 : fiscal year 2023 and fiscal year 2022 reporting periods for Corporate and Other. NOTE 18. EMPLOYEE BENEFIT PLANS (Continued) Weighted-average assumptions used to estimate the retirement income and retirement health care costs were as follows as of June 30 : Discount rate Rate of compensation increase Expected return on plan assets Interest crediting rate Discount rate The expected long-term rate of return assumption is based on prospective returns according to the fund's current target asset allocation. The actuarial benefit obligation gain incurred during fiscal year 2023 was primarily driven by increases in the discount rates for the retirement plans, partially offset by investment gains lower than expected return on assets. The actuarial benefit obligation gain during fiscal year 2022 was primarily driven by increases in the discount rates for the retirement plans, partially offset by the domestic qualified plan reflecting plan termination lump sum window and annuity buyout assumptions. Expected Benefit Payments Expected benefit payments for the Company's retirement income and retirement health care plans as of June 30, 2023, were as follows: Retirement Retirement Expected benefit payments are based on the same assumptions used to measure the benefit obligations and include estimated future employee service. Plan Assets The target allocations and weighted average asset allocations by asset category of the investment portfolio for the Company's domestic retirement income plans as of June 30 were: Fixed income Cash equivalents Total The target asset allocation is determined based on the optimal balance between risk and return and, at times, may be adjusted to achieve the plan's overall investment objective to generate sufficient resources to pay current and projected plan obligations over the life of the domestic retirement income plan. NOTE 18. EMPLOYEE BENEFIT PLANS (Continued) Benefit Obligation and Funded Status Summarized information for the Company's retirement income and retirement health care plans as of and for the fiscal years ended June 30 is as follows: For the retirement income plans, the benefit obligation is the projected benefit obligation (PBO). For the retirement health care plan, the benefit obligation is the accumulated benefit obligation (ABO). The ABO for all retirement income plans was $474,$512 and $618 as of June 30,2023,2022 and 2021, respectively. Retirement income plans with ABO or PBO in excess of plan assets as of June 30 were as follows: ABO Exceeds the Fair Value of Plan Assets PBO Exceeds the Fair Value of Plan Assets NOTE 17. INCOME TAXES The provision for income taxes, by tax jurisdiction, consisted of the following for the fiscal years ended June 30 : The components of Earnings before income taxes, by tax jurisdiction, consisted of the following for the fiscal years ended June 30 : m. A reconciliation of the statutory federal income tax rate to the Company's effective tax rate on operations follows for the fiscal years ended June 30 : The Inflation Reduction Act (the "Act") was signed into law on August 16, 2022. The Act introduces a new 15\% corporate minimum tax for certain large corporations that becomes effective at the beginning of the Company's fiscal 2024 and it imposes a 1% excise tax on the value of share repurchases, net of new share issuances, after December 31, 2022. These provisions, as well as the other corporate tax changes included in the Act, are not expected to have a material impact on the Company's financial statements. Per U.S. GAAP, foreign withholding taxes are provided on unremitted foreign earnings that are not indefinitely reinvested at the time the earnings are generated. The Company regularly reviews and assesses whether there are any changes to its indefinite reinvestment assertion. None of the undistributed earnings of its foreign subsidiaries were indefinitely reinvested. As a result, the Company is providing foreign withholding taxes on the undistributed earnings of all foreign subsidiaries where applicable. These withholding taxes had no significant impact on the Company's consolidated results. NOTE 17. INCOME TAXES (Continued) The components of net deferred tax assets (liabilities) as of June 30 are shown below: The net deferred tax assets and liabilities included in the consolidated balance sheet at June 30 were as follows: 11 (1) Net deferred tax assets are recorded in Other assets. The Company reviews its deferred tax assets for recoverability on a quarterly basis. A valuation allowance is established when the Company believes that it is more likely than not that some portion of its deferred tax assets will not be realized. Valuation allowances have been provided to reduce deferred tax assets to amounts considered recoverable. Details of the valuation allowance were as follows as of June 30 : As of June 30,2023 , the Company had foreign tax credit carryforwards of $18 for U.S. income tax purposes with expiration dates between fiscal years 2026 and 2033. Tax credit carryforwards in U.S. jurisdictions of $5 have expiration dates between fiscal year 2024 and 2033 . Tax credit carryforwards in U.S. jurisdictions of $2 can be carried forward indefinitely. Tax credit carryforwards in foreign jurisdictions of $29 can be carried forward indefinitely. Tax benefits from net operating loss carryforwards in U.S. jurisdictions of $4 have expiration dates between fiscal years 2030 and 2042 . Tax benefits from net operating loss carryforwards in U.S. jurisdictions of $6 can be carried forward indefinitely. Tax benefits from foreign net operating loss carryforwards of $21 have expiration dates between fiscal years 2024 and 2040. Tax benefits from foreign net operating loss carryforwards of $9 can be carried forward indefinitely. The Company files income tax returns in the U.S. federal and various state, local and foreign jurisdictions. The federal statute of limitations has expired for all tax years through June 30,2015. Various income tax returns in state and foreign jurisdictions are currently in the process of examination. NOTE 15. STOCK-BASED COMPENSATION PLANS (Continued) A summary of the status of the Company's performance share awards is presented below: Performance share awards as of June 30,2022 Granted Distributed Forfeited Performance share awards as of June 30,2023 Performance shares vested and deferred as of June 30,2023 The non-vested performance shares outstanding as of June 30,2023 and 2022 were 306,000 and 255,000 , respectively, and the weighted average grant date fair value was $162.77 and $173.38 per share, respectively. During fiscal year 2023,77,000 shares vested. The total fair value of shares vested was $12,$11 and $26 during fiscal years 2023,2022 and 2021, respectively. Upon vesting, the recipients of the grants receive the distribution as shares or, if previously elected by eligible recipients, as deferred stock. Deferred shares continue to earn dividends, which are also deferred. Deferred Stock Units for Nonemployee Directors Nonemployee directors receive annual grants of deferred stock units under the Company's director compensation program and can elect to receive all or a portion of their annual retainers and fees in the form of deferred stock units. The deferred stock units receive dividend distributions, which are reinvested as deferred stock units, and are recognized at their fair value on the date of grant. Each deferred stock unit represents the right to receive one share of the Company's common stock following the completion of a director's service. During fiscal year 2023, the Company granted 18,000 deferred stock units, reinvested dividends of 4,000 units and distributed 39,000 shares, which had a weighted-average fair value on the grant date of $142.10,$151.35 and $95.38 per share, respectively. As of June 30,2023,128,000 units were outstanding, which had a weighted-average fair value on the grant date of $130.49 per share. NOTE 16. OTHER (INCOME) EXPENSE, NET The major components of Other (income) expense, net, for the fiscal years ended June 30 were: (1) Restructuring costs related to the Company's streamlined operating model plan (see Note 3). (2) Nonrecurring, noncash gain from the remeasurement of the Company's previously held investment in its Saudi joint venture (see Note 2). Weighted-average remaining lease term and discount rate for the Company's leases were as follows as of fiscal year ended June 30: 2 Maturities of lease liabilities by fiscal year for the Company's leases as of June 30, 2023 were as follows: Operating and finance lease payments presented in the table above exclude $2 and $0, respectively, of minimum lease payments signed but not yet commenced as of June 30,2023. On May 25, 2022, the Company completed an asset sale-leaseback transaction on a plant in Ontario, Canada. The Company received proceeds of $16, net of selling costs, which had a carrying value of $2, and resulted in a $14 gain on the transaction which was recognized in Other (income) expense, net. The leaseback is accounted for as an operating lease. The term of the lease at inception date is 10 years, with the option to terminate the lease at 7 years. NOTE 13. STOCKHOLDERS' EQUITY On November 18, 2020 the Company retired 28 million shares of its treasury stock. These shares are now authorized but unissued. There was no effect on the Company's overall equity position as a result of the retirement. Dividends per share paid to Clorox stockholders during the fiscal years ended June 30 were as follows: 2023 Dividends per share paid 2022 4.72 4.72 2021 4.44 On July 27,2023 , a cash dividend was declared in the amount of $1.20 per share payable on August 25,2023 to common stockholders of record as of the close of business on August 09, 2023. NOTE 13. STOCKHOLDERS' EQUITY (Continued) Accumulated Other Comprehensive Net (Loss) Income Changes in Accumulated other comprehensive net (loss) income attributable to Clorox by component were as follows for the fiscal years ended June 30 : Included in foreign currency translation adjustments are re-measurement losses on long-term intercompany loans where settlement is not planned or anticipated in the foreseeable future. There were $0,$0, and $11 associated with these loans reclassified from Accumulated other comprehensive net (loss) income for the fiscal years ended June 30,2023,2022, and 2021, respectively. NOTE 14. NET EARNINGS PER SHARE (EPS) The following is the reconciliation of the weighted average number of shares outstanding (in thousands) used to calculate basic net EPS to those used to calculate diluted net EPS for the fiscal years ended June 30 : Basic Dilutive effect of stock options and other Diluted Antidilutive stock options and other Basic net earnings per share and Diluted net earnings per share are calculated on Net earnings attributable to Clorox. NOTE 12. LEASES The Company leases various property, plant and equipment, including office, warehousing, manufacturing and research and development facilities and equipment. These leases have remaining lease terms of up to 34 years, inclusive of renewal or termination options that the Company is reasonably certain to exercise. The Company's lease agreements do not contain any material residual value guarantees or material restrictive covenants. Supplemental balance sheet information related to the Company's leases as of June 30 was as follows: Balance sheet classification 2023 2022 \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{2}{*}{\multicolumn{6}{|c|}{ Operating leases }} \\ \hline & & & & & \\ \hline Right-of-use assets & Operating lease right-of-use assets & $ & 346 & $ & 342 \\ \hline Current lease liabilities & Current operating lease liabilities & $ & 87 & $ & 78 \\ \hline Non-current lease liabilities & Long-term operating lease liabilities & & 310 & & 314 \\ \hline Total operating lease liabilities & & $ & 397 & $ & 392 \\ \hline \end{tabular} Components of lease cost were as follows for the fiscal years ended June 30 : As of June 30, 2023 and 2022, the Company's financial assets and liabilities that were measured at fair value on a recurring basis during the period included derivative financial instruments, which were classified as either Level 1 or Level 2, and trust assets to fund the Company's nonqualified deferred compensation plans, which were classified as Level 1. All of the Company's derivative instruments qualify for hedge accounting. The following table provides information about the balance sheet classification and the fair values of the Company's derivative instruments: NOTE 10. FINANCIAL INSTRUMENTS AND FAIR VALUE MEASUREMENTS Financial Risk Management and Derivative Instruments The Company is exposed to certain commodity, foreign currency and interest rate risks related to its ongoing business operations and uses derivative instruments to mitigate its exposure to these risks. Commodity Price Risk Management The Company may use commodity futures, options and swap contracts to limit the impact of price volatility on a portion of its forecasted raw material requirements. These commodity derivatives may be exchange traded or over-the-counter contracts and generally have original contractual maturities of less than 2 years. Commodity purchase and option contracts are measured at fair value using market quotations obtained from the Chicago Board of Trade commodity futures exchange and commodity derivative dealers. As of June 30,2023 , the notional amount of commodity derivatives was $41, of which $29 related to soybean oil futures used for the Food products business and $12 related to jet fuel swaps used for the Grilling business. As of June 30,2022 , the notional amount of commodity derivatives was $27, of which $18 related to soybean oil futures and $9 related to jet fuel swaps. Foreign Currency Risk Management The Company may also enter into certain over-the-counter derivative contracts to manage a portion of the Company's forecasted foreign currency exposure associated with the purchase of inventory. These foreign currency contracts generally have original contractual maturities of less than 2 years. The foreign exchange contracts are measured at fair value using information quoted by foreign exchange dealers. The notional amounts of outstanding foreign currency forward contracts used by the Company's subsidiaries to hedge forecasted purchases of inventory were $51 and $31, respectively, as of June 30,2023 and 2022 . Interest Rate Risk Management The Company may enter into over-the-counter interest rate contracts to fix a portion of the benchmark interest rate prior to the anticipated issuance of fixed rate debt. These interest rate contracts generally have original contractual maturities of less than 3 years. The interest rate contracts are measured at fair value using information quoted by bond dealers. The Company held no interest rate contracts as of both June 30, 2023 and 2022 . During fiscal year 2022, the Company entered into an additional $650 of interest rate contracts. All contracts represented interest rate swap lock agreements to manage the exposure to interest rate volatility associated with future interest payments on forecasted debt issuance, and were terminated in May 2022 upon issuance of $1,100 in senior notes (See Note 8). These contracts resulted in a $114 gain recorded in Other comprehensive (loss) income, comprised of $25 attributable to the May 2029 senior notes and $89 attributable to the May 2032 senior notes, which is being amortized into Interest expense in the consolidated statements of earnings over the 7-year and 10-year term of the notes. Commodity, Foreign Exchange and Interest Rate Derivatives The Company designates its commodity forward, futures and options contracts for forecasted purchases of raw materials, foreign currency forward contracts for forecasted purchases of inventory, and interest rate contracts for forecasted interest payments as cash flow hedges. The effects of derivative instruments designated as hedging instruments on Other comprehensive (loss) income and Net earnings were as follows during the fiscal years ended June 30 : NOTE 6. GOODWILL, TRADEMARKS AND OTHER INTANGIBLE ASSETS (Continued) No other significant impairments were identified as a result of the Company's impairment reviews during fiscal years 2023, 2022 and 2021. NOTE 4. INVENTORIES, NET Inventories, net consisted of the following as of June 30 : (1) Non-current inventories, net is recorded in Other assets. The LIFO method was used to value approximately 36% of inventories as of June 30,2023 and 2022 , respectively. The carrying values for all other inventories are determined on the FIFO method. The effect on earnings of the liquidation of LIFO layers was insignificant for each of the fiscal years ended June 30,2023 , 2022 and 2021 . NOTE 5. PROPERTY, PLANT AND EQUIPMENT, NET The components of property, plant and equipment, net, consisted of the following as of June 30 : Depreciation and amortization expense related to property, plant and equipment, net, was $206,$193 and $179 in fiscal years 2023 , 2022 and 2021 , respectively, of which $10,$8 and $6 were related to amortization of capitalized software, respectively. Noncash capital expenditures were $9,$6 and $13 for fiscal years, 2023,2022 and 2021 , respectively. There were no significant asset retirement obligations recorded and included in Buildings above for both fiscal years 2023 and 2022. To determine the estimated fair values of the global indefinite-lived trademarks related to the VMS business, the Company used the DCF method under the relief from royalty income approach. This approach requires significant judgments in determining the royalty rates and the assets' estimated cash flows as well as the appropriate discount rates applied to those cash flows to determine fair value. As a result of the interim impairment test, the Company concluded that the carrying value of the global indefinite-lived trademarks exceeded their estimated fair value, and recorded impairment charges of $139. In addition, the useful lives of the impaired trademarks, with a remaining net carrying value of $28 as of March 31,2023 , were changed from indefinite to finite beginning on April 1 , 2023, which reflects the remaining expected useful lives of the trademarks based on the most recent financial and operational plans. The weighted-average estimated useful life of these trademarks is 20 years. After adjusting the carrying values of the global indefinite-lived trademarks and concluding that the carrying amounts of the other long-lived assets were recoverable, the Company completed a quantitative impairment test for goodwill and recorded a goodwill impairment charge of $306 in the VMS reporting unit. To determine the fair value of the VMS reporting unit, the Company used a DCF method under the income approach. In accordance with this approach, the Company estimated the future cash flows of the VMS reporting unit and discounted these cash flows at a rate of return that reflects its relative risk. The other key estimates and factors used in the DCF method include, but are not limited to, net sales and expense growth rates and a terminal growth rate. The decrease in projected cash flows due to the revisions adversely impacted key assumptions used in determining the fair value of the VMS reporting unit and assets contained therein, primarily projected net sales. There is no remaining goodwill associated with the impaired reporting unit. Fiscal Year 2021 Impairments During fiscal year 2021, as a result of lower than expected actual and projected net sales growth and operating performance for the VMS business, a strategic review was initiated by management that resulted in updated financial and operational plans. These events were considered a triggering event requiring interim impairment assessments to be performed on the VMS reporting unit, indefinite-lived trademarks and other assets. Based on the outcome of these assessments, the following pre-tax impairment charges were recorded during fiscal year 2021: Impairment Charges In connection with recognizing these impairment charges, the Company recognized tax benefits related to the impairments of $62 due to the partial tax deductibility of these charges. The fiscal year 2021 impairment charges were a result of a higher level of competitive activity than originally assumed, accelerated declines in certain channels where the business was over-developed and higher than anticipated investments to grow the business, which adversely affected the assumptions used to determine the fair value of the respective assets held by the VMS reporting unit for growth and the estimates of expenses necessary to achieve that growth. These impairment charges were based on the Company's estimates regarding the future financial performance of the VMS business and macroeconomic factors. To determine the estimated fair values of the VMS related indefinite-lived trademarks, the Company used the relief from royalty income approach. This approach required significant judgments in determining the royalty rates and the assets' estimated cash flows as well as the appropriate discount rates applied to those cash flows to determine fair value. To determine the fair value of the VMS reporting unit, the Company used the DCF method under the income approach. Under this approach, the Company estimated the future cash flows of the VMS reporting unit and discounted these cash flows at a rate of return that reflected its relative risk. The other key estimates and factors used in the DCF method included, but were not limited to, net sales and expense growth rates, and a terminal growth rate. Additionally, during fiscal year 2021, an impairment charge of $14 was recorded within Cost of products sold related to other intangible assets with finite lives that were no longer expected to be recoverable due to a pending exit from a Professional Products SBU supplier relationship. The remaining carrying value of these assets was $0 following the impairment charge. NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued) Recently Issued Accounting Standards Recenty Issued Accounting Standards Not Yet Adopted In September 2022, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2022-04, "Liabilities - Supplier Finance Programs (Subtopic 405-50): Disclosure of Supplier Finance Program Obligations." These amendments require disclosure of the key terms of outstanding supplier finance programs and a rollforward of the related obligations. These amendments are effective for fiscal years beginning after December 15,2022 , except for the amendment on rollforward information, which is effective for fiscal years beginning after December 15,2023 . As these amendments relate to disclosures only, there are no impacts expected to the Company's consolidated results of operations, financial position and cash flows. NOTE 3. RESTRUCTURING AND RELATED COSTS Beginning in the first quarter of fiscal year 2023, the Company recognized costs related to a plan that involves streamlining its operating model to meet its objectives of driving growth and productivity. The streamlined operating model is expected to enhance the Company's ability to respond more quickly to changing consumer behaviors and innovate faster. The Company anticipates the implementation of this new model will be completed in fiscal year 2024 , with different phases occurring throughout the implementation period. The Company incurred $60 of costs in fiscal year 2023 and anticipates incurring approximately $30 to $40 in fiscal year 2024 related to this initiative, of which approximately half are expected to include employee-related costs to reduce certain staffing levels such as severance payments, with the remainder for consulting and other costs. Costs incurred are expected to be settled primarily in cash. The total restructuring and related implementation costs, net associated with the Company's streamlined operating model plan as reflected in the Consolidated Statements of Earnings and Comprehensive Income for the fiscal year ended June 30 were: Employee-related costs primarily include severance and other termination benefits calculated based on salary levels, prior service and statutory requirements. Other costs primarily include consulting fees incurred for the organizational design and implementation of the streamlined operating model, related processes and other professional fees incurred. The Company may, from time to time, decide to pursue additional restructuring-related initiatives that involve costs in future periods. The following table reconciles the accrual for the streamlined operating model restructuring and related implementation costs discussed above, which are recorded within Accounts payable and accrued liabilities in the Consolidated Balance Sheets as follows for the fiscal years ended June 30 : available evidence. A valuation allowance is established when management believes that it is more likely than not that some portion of its deferred tax assets will not be realized. Changes in valuation allowances from period to period are included in the Company's income tax provision in the period of change. In addition to valuation allowances, the Company provides for uncertain tax positions when such tax positions do not meet certain recognition thresholds or measurement standards. Amounts for uncertain tax positions are adjusted in quarters when new information becomes available or when positions are effectively settled. Per U.S. GAAP, foreign withholding taxes are provided on unremitted foreign earnings that are not indefinitely reinvested at the time the earnings are generated. The Company regularly reviews and assesses whether there are any changes to its indefinite reinvestment assertion and determined that none of the undistributed earnings of its foreign subsidiaries are indefinitely reinvested. As a result, the Company is providing foreign withholding taxes on the undistributed earnings of all foreign subsidiaries where applicable. Foreign Currency Transactions and Translation Local currencies are the functional currencies for substantially all of the Company's foreign operations. When the transactional currency is different than the functional currency, transaction gains and losses are included as a component of Other (income) expense, net. In addition, certain assets and liabilities denominated in currencies other than a foreign subsidiary's functional currency are reported on the subsidiary's books in its functional currency, with the impact from exchange rate differences recorded in Other (income) expense, net. Assets and liabilities of foreign operations are translated into U.S. dollars using the exchange rates in effect at the balance sheet date, while income and expenses are translated at the respective average monthly exchange rates during the year. Gains and losses on foreign currency translations are reported as a component of Other comprehensive (loss) income. The income tax effect of currency translation adjustments is recorded as a component of deferred taxes with an offset to Other comprehensive (loss) income where appropriate. Effective July 1, 2018, under the requirements of U.S. GAAP, Argentina was designated as a highly inflationary economy, since it has experienced cumulative inflation of approximately 100 percent or more over a three-year period. As a result, beginning July 1, 2018, the U.S. dollar replaced the Argentine peso as the functional currency of the Company's subsidiaries in Argentina (collectively, "Clorox Argentina"). Consequently, gains and losses from non-U.S. dollar denominated monetary assets and liabilities for Clorox Argentina are recognized in Other (income) expense, net in the consolidated statement of earnings. Derivative Instruments The Company's use of derivative instruments, principally exchange-traded futures and options contracts, and over-the counter swaps and forward contracts, is limited to non-trading purposes and is designed to partially manage exposure to changes in commodity prices, foreign currencies and interest rates. The Company's contracts are hedges for transactions with notional amounts and periods consistent with the related exposures and do not constitute investments independent of these exposures. The changes in the fair value (i.e., gains or losses) of a derivative instrument are recorded as either assets or liabilities in the consolidated balance sheets with an offset to Net earnings or Other comprehensive (loss) income depending on whether, for accounting purposes, it has been designated and qualifies as an accounting hedge and, if so, on the type of hedging relationship. The criteria used to determine if hedge accounting treatment is appropriate are: (a) formal designation and documentation of the hedging relationship, the risk management objective and hedging strategy at hedge inception; (b) eligibility of hedged items, transactions and corresponding hedging instrument; and (c) effectiveness of the hedging relationship both at inception of the hedge and on an ongoing basis in achieving the hedging objectives. For those derivative instruments designated and qualifying as hedging instruments, the Company must designate the hedging instrument either as a fair value hedge or as a cash flow hedge. The Company designates its commodity futures, options and swaps contracts for forecasted purchases of raw materials, foreign currency forward contracts for forecasted purchases of inventory and interest rate contracts for forecasted interest payments as cash flow hedges. During the fiscal years ended June 30, 2023, 2022 and 2021, the Company had no hedging instruments designated as fair value hedges. For derivative instruments designated and qualifying as cash flow hedges, gains or losses are reported as a component of Other comprehensive (loss) income and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings. From time to time, the Company may have contracts not designated as hedges for accounting purposes, for which it recognizes changes in the fair value in the consolidated statement of earnings in the current period. Cash flows from hedging activities are classified as operating activities in the consolidated statements of cash flows. Property, Plant and Equipment and Finite-Lived Intangible Assets Property, plant and equipment and finite-lived intangible assets are stated at cost. Depreciation and amortization expense are primarily calculated by the straight-line method using the estimated useful lives or lives determined by reference to the related lease contract in the case of leasehold improvements. The table below provides estimated useful lives of property, plant and equipment by asset classification. Estimated Finite-lived intangible assets are amortized over their estimated useful lives, which range from 7 to 30 years. Property, plant and equipment and finite-lived intangible assets are reviewed for impairment whenever events or changes in circumstances occur that indicate that the carrying amount of an asset (or asset group) may not be fully recoverable. The risk of impairment is initially assessed based on an estimate of the undiscounted cash flows at the lowest level for which identifiable cash flows exist. Impairment occurs when the carrying value of the asset (or asset group) exceeds the estimated future undiscounted cash flows generated by the asset (or asset group). When impairment is indicated, an impairment charge is recorded for the difference between the carrying value of the asset (or asset group) and its estimated fair market value. Depending on the asset, estimated fair market value may be determined either by use of a discounted cash flow model or by reference to estimated selling values of assets in similar condition. Capitalization of Software Costs The Company capitalizes certain qualifying costs incurred in the acquisition and development of software for internal use, including the costs of the software, materials, consultants, interest and payroll and payroll-related costs for employees during the application development stage. Internal and external costs incurred during the preliminary project stage and post implementation-operation stage, mainly training and maintenance costs, are expensed as incurred. Once the application is substantially complete and ready for its intended use, qualifying costs are amortized on a straight-line basis over the software's estimated useful life. Capitalized internal use software is included in Property, plant and equipment. Capitalized software as a service is included in Prepaid expenses and other current assets or Other assets and is amortized using the straight-line method over the term of the hosting arrangement which is typically no greater than 10 years. Business Combinations The Company records acquired businesses within the consolidated financial statements using the acquisition method prospectively from the acquisition date. Under the acquisition method, once control is obtained, assets acquired and liabilities assumed, including amounts attributable to noncontrolling interests, are recorded at their respective fair values on the acquisition date. The Company's estimates of fair value are inherently uncertain and subject to refinement. The excess of the total of the purchase consideration, fair value of the noncontrolling interest and fair value of the previously held equity interest over the identifiable assets acquired and liabilities assumed is recorded as goodwill. Measurement period adjustments to the fair values of the identifiable assets acquired and liabilities assumed with the corresponding offset to goodwill, if applicable, are applied in the reporting period in which the adjustment amounts are determined based on new information obtained during the measurement period. In the event of a step acquisition, the Company records a gain or loss in Other income (expense), net on the consolidated statement of earnings as a result of remeasuring a previously held equity interest to fair value on the acquisition date. Transaction expenses are recognized separately from the business combination and are expensed as incurred. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS The Clorox Company (Dollars in millions, except per share data) NOTE 1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Nature of Operations and Basis of Presentation The Company is principally engaged in the production, marketing and sale of consumer products through mass retailers, grocery outlets, warehouse clubs, dollar stores, home hardware centers, drug, pet and military stores, third-party and owned e-commerce channels, and distributors. The consolidated financial statements include the statements of the Company and its wholly owned and controlled subsidiaries. All significant intercompany transactions and accounts were eliminated in consolidation. Use of Estimates The preparation of these consolidated financial statements in conformity with generally accepted accounting principles in the United States of America (U.S. GAAP) requires management to reach opinions as to estimates and assumptions that affect reported amounts and related disclosures. Specific areas requiring the application of management's estimates and judgments include, among others, assumptions pertaining to accruals for consumer and trade-promotion programs, future cash flows associated with impairment testing of goodwill and other long-lived assets, uncertain tax positions, tax valuation allowances, the valuation of the Venture Agreement terminal obligation, stock-based compensation, retirement income plans, as well as legal, environmental and insurance matters, and the valuation of assets acquired and liabilities assumed in connection with a business combination. Actual results could materially differ from estimates and assumptions made. Cash, Cash Equivalents and Restricted Cash Cash equivalents consist of highly liquid interest-bearing accounts, time deposits held by financial institutions and money market funds with an initial maturity at purchase of 90 days or less. The fair value of cash and cash equivalents approximates the carrying amount. The Company's cash position includes amounts held by foreign subsidiaries and, as a result, the repatriation of certain cash balances from some of the Company's foreign subsidiaries could result in additional withholding tax costs in certain foreign jurisdictions. However, these cash balances are generally available without legal restriction to fund local business operations. In addition, a portion of the Company's cash balance is held in U.S. dollars by foreign subsidiaries whose functional currency is their local currency. Such U.S. dollar balances are reported on the foreign subsidiaries' books in their functional currency, and the impact on such balances from foreign currency exchange rate differences is recorded in Other (income) expense, net. As of June 30,2023,2022,2021 and 2020 , the Company had $1,$3,$5 and $8 of restricted cash, respectively, which was included in Prepaid expenses and other current assets and Other assets. Inventories The Company values its inventories using both the First-In, First-Out (FIFO) and the Last-In, First-Out (LIFO) methods. The FIFO inventory is stated at the lower of cost or net realizable value, which includes any costs to sell or dispose. In addition, appropriate consideration is given to obsolescence, excessive inventory levels, product deterioration and other factors in evaluating net realizable value. The LIFO inventory is stated at the lower of cost or market. See Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY The Clorox Company See Notes to Consolidated Financial Statements See Notes to Consolidated Financial Statements REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Stockholders and the Board of Directors of The Clorox Company Opinion on Internal Control Over Financial Reporting We have audited The Clorox Company's internal control over financial reporting as of June 30, 2023, based on criteria established in Internal Control Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (2013 framework) (the COSO criteria). In our opinion, The Clorox Company (the Company) maintained, in all material respects, effective internal control over financial reporting as of June 30,2023 , based on the COSO criteria. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the consolidated balance sheets of The Clorox Company as of June 30, 2023 and 2022, the related consolidated statements of earnings, comprehensive income, stockholders' equity and cash flows for each of the three years in the period ended June 30,2023, and the related notes (collectively referred to as the "consolidated financial statements") and our report dated August 10, 2023 expressed an unqualified opinion thereon. Basis for Opinion The Company's management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting included in the accompanying Management's Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the Company's internal control over financial reporting based on our audit. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, testing and evaluating the design and operating effectiveness of internal control based on the assessed risk, and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion. Definition and Limitations of Internal Control Over Financial Reporting A company's internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company's internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company's assets that could have a material effect on the financial statements. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. /s/ Ernst \& Young LLP San Francisco, CA See Notes to Consolidated Financial Statements CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Tho Clowor romnowv See Notes to Consolidated Financial Statements Valuation of Venture Agreement Terminal Obligation Description of the Matter As discussed in Note 9 of the consolidated financial statements, the Company has an agreement with The Proctor \& Gamble Company ( P&G ) for the Company's Glad bags and wraps business, for which the Company is required to purchase P&G 's 20% interest in the venture for cash at fair value of the global Glad business upon termination of the agreement. At June 30, 2023, the fair value of $495 million has been recognized as a venture agreement terminal obligation and represented 9% of total liabilities. How We Addressed the Matter in Our Audit Auditing the Company's Glad venture agreement terminal obligation is complex and highly judgmental and required the involvement of a valuation specialist due to the significant judgment in estimating the fair value of the global Glad business. In particular, the fair value estimate is sensitive to assumptions such as net sales growth rates, gross margins, discount rate and commodity prices. These assumptions are sensitive to and affected by expected future market or economic conditions, particularly those in emerging markets, and industry and company-specific qualitative factors. We obtained an understanding, evaluated the design and tested the operating effectiveness of controls over the venture agreement terminal obligation valuation review process. This included controls over the Company's budgetary and forecasting process used to develop the estimated fair value of the global Glad business. We also tested management's controls over the data used in their valuation models and review of the significant assumptions such as estimation of net sales, expense growth rates, terminal growth rates and commodity prices. To test the estimated fair v

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started