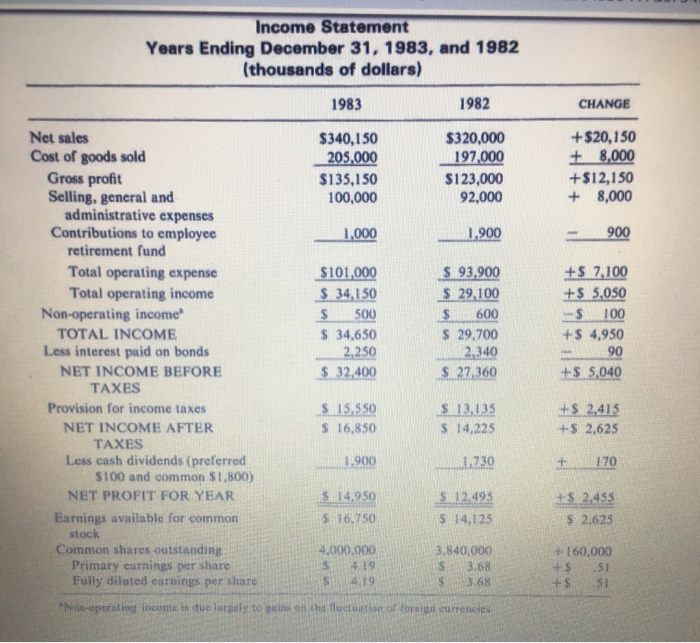

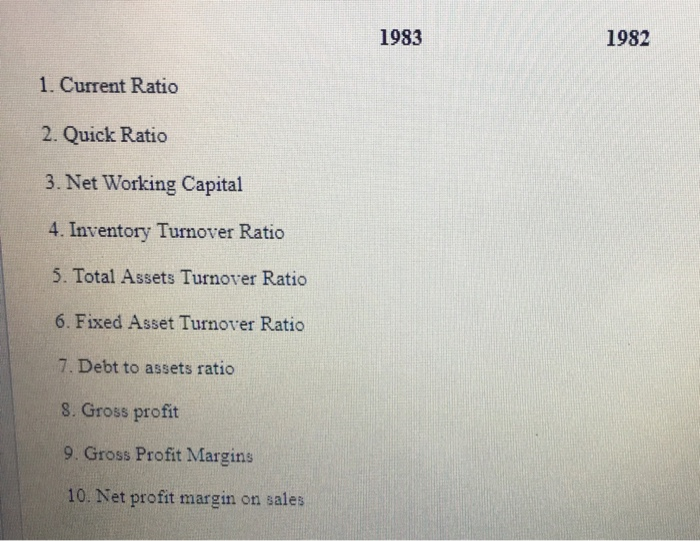

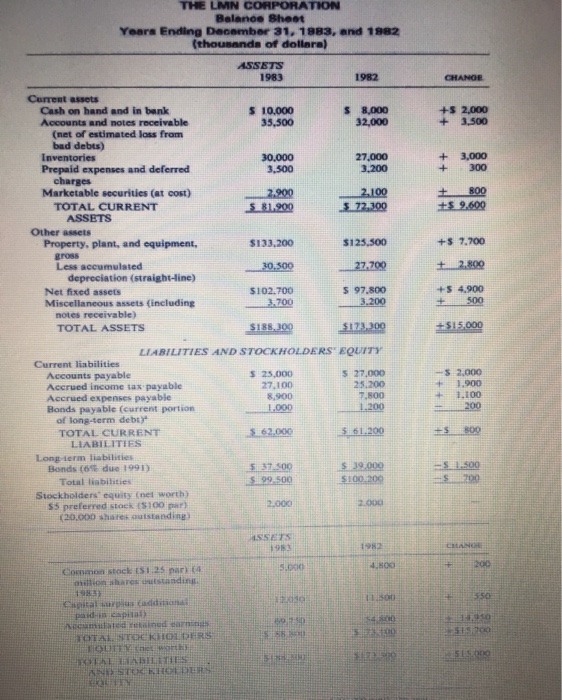

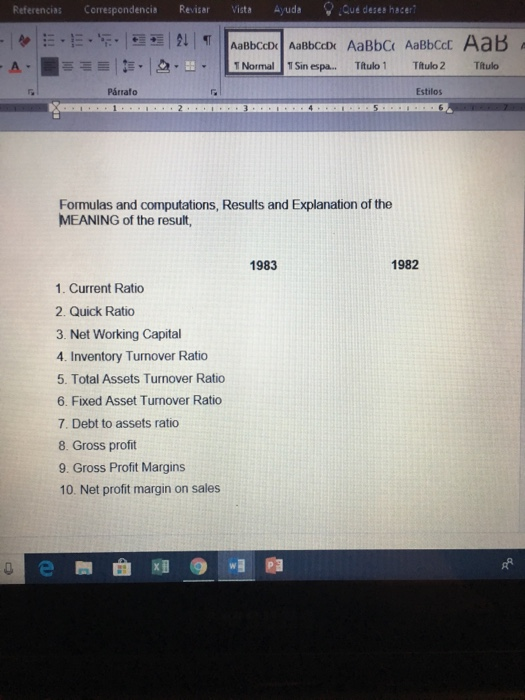

Income Statement Years Ending December 31, 1983, and 1982 (thousands of dollars) 1982 1983 CHANGE +$20,150 + 8,000 +$12,150 8,000 Net sales $320,000 197,000 $340,150 205,000 $135,150 100,000 Cost of goods sold Gross profit Selling, general and administrative expenses Contributions to employee $123,000 92,000 1,000 1,900 900 retirement fund $ 93,900 $ 29,100 +$ 7.100 +s 5,050 $ 100 Total operating expense $101,000 $ 34,150 Total operating income Non-operating income 600 s 29,700 2.340 S 27.360 500 $ $ 34,650 2,250 TOTAL INCOME +$ 4,950 90 Less interest paid on bonds NET INCOME BEFORE $ 32,400 +s 5,040 TAXES Provision for income taxes S 15,550 S 13,135 s 14,225 +S 2,415 S 16,850 NET INCOME AFTER TAXES +$ 2,625 Less cash dividends (preferred $100 and common $1,800) NET PROFIT FOR YEAR 1,900 1.730 170 S 12.495 +s 2,455 S 14,950 Earnings available for common s 2,625 $ 16.750 S 14,125 stock Common shares outstanding Primary earnings per share Fully diluted earnings per share 4.000,000 3.840,000 +160,000 S 419 s3.68 si +S S1 4.19 3.68 +$ .51 "Non-operating income is due largely to gains on the fluctuation of foreign currencies 1983 1982 1. Current Ratio 2. Quick Ratio 3. Net Working Capital 4. Inventory Turnover Ratio 5. Total Assets Turnover Ratio 6. Fixed Asset Turnover Ratio 7. Debt to assets ratio S. Gross profit 9. Gross Profit Margins 10. Net profit margin on sales THE LMN CORPORATION Balanoe Sheet Years Ending December 31, 1983, and 1882 (thousands of dollara) ASSETS 1982 1983 CHANGE Current assets Cash on hand and in bank Accounts and notes receivable (net of estimated loss from bad debts) Inventories Prepaid expenses and deferred charges Marketable securities (at cost) TOTAL CURRENT ASSETS s 8,000 32,000 S 10,000 35,500 +s 2,000 +3,500 30,000 3,500 27,000 3.200 3,000 300 800 2,900 2.100 $ 72.300 +S 9.600 S 81.900 Other assets $125,500 +S 7,700 Property, plant, and equipment, $133,200 gross Less accumulated depreciation (straight-line) 27,700 2.800 30.500 $ 97,800 3.200 +s 4,900 $102.700 3.700 Net fixed assets Miscellaneous assets (including 500 notes receivable) +S15,000 $173.300 $188,300 TOTAL ASSETS LIABILITIES AND STOCKHOLDERS EQUITY Current liabilities Accounts payable Accrued income tax payable Accrued expenses payable Bonds payable (current portion of long-term debt) TOTAL CURRENT LIABILITIES $ 25,000 27,100 8,900 1,000 s 27,000 25,200 7.800 1.200 -s 2,000 1,900 1.100 200 B00 s 62.000 +S S 61.200 Long-term liabilities Bonds (6% due 19913 S 37.500 s 39.000 -S1.500 700 s 99.500 S100.200 Total liabilities Stockholders equity (nes worth) S5 preferred stock (S100 par) (20,000 shares outstanding 2.000 2,000 ASSETS 1983 1982 CHANGE 200 4.8O0 5.oo0 Common stock IS1.25par) (4 adlion ahares outstanding 1983 550 Ciital sarpius Cadditiona paidia capat Nacumulated rekained earnings sa s00 970 580 S 00 SIS00 NOTAL STCE KHOLDERS eUTTY netiworth) SES000 EAE ABILITIES ANDESTOKEOLDE ++ 1++ Que desea hacer? Correspondencia Revisar Vista Ayuda Referencias E 4T AaBbCcD AaBbCcD AaBbC AaBbCct AaB 1 Sin espa.. Titulo 1 Titulo 2 T Normal Titulo Prrafo Estilos I 4 5 2. I Formulas and computations, Results and Explanation of the MEANING of the result, 1983 1982 1. Current Ratio 2. Quick Ratio 3. Net Working Capital 4. Inventory Turnover Ratio 5. Total Assets Turnover Ratio 6. Fixed Asset Turnover Ratio 7. Debt to assets ratio 8. Gross profit 9. Gross Profit Margins 10. Net profit margin on sales