| | | | | | | | | |

| Income Statements: | | 2019 | 2019 Historical ratios | Forecasting basis | 2020 Input ratios | 2020 Preliminary forecast (doesn't include special dividend or LOC) | 2020 Final forecast (includes special dividend or LOC) |

| (December 31, in thousands of dollars) |

| | | |

| | | |

| Sales | | | $455,150 | | Growth | | | |

| Expenses (excluding depr. & amort.) | $386,878 | | % of sales | | | |

| Depreciation and Amortization | $14,565 | | % of fixed assets | | | |

| EBIT | | | $53,708 | | | | | |

| Interest expense on long-term debt | $11,880 | | Interest rate x average debt during year | | | |

| Interest expense on line of credit | $0 | | | | | |

| EBT | | | $41,828 | | | | | |

| Taxes (25%) | | | $10,457 | | | | | |

| Net Income | | $25,097 | | | | | |

| | | | | | | | | |

| Common dividends (regular dividends) | $12,554 | | Growth | | | |

| Special dividends | | | | Zero in preliminary forecast | | | |

| Addition to retained earnings | $12,543 | | | | |  |

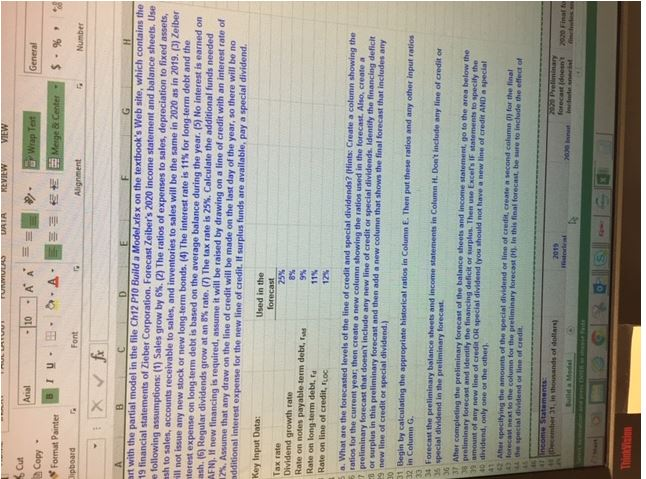

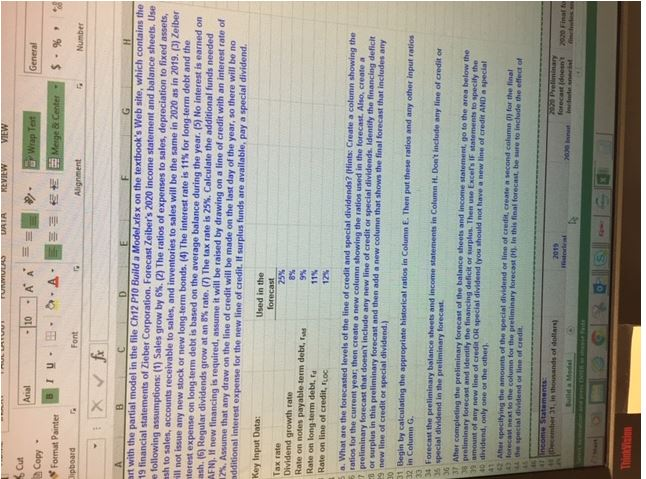

- Cut 2 Copy - IVE UNIVEA URTAKEVIEW VIEW Anal -10 AA == Wrap Tet BIU.E.O. A - z E Merge Center Font Alignment General $ . % Format Painter Jipboard Number art with the partial model in the file Ch12 P10 Build a Model.xlsx on the textbook's Website, which contains the 19 financial statements of Zieber Corporation. Forecast Zeiber's 2020 income statement and balance sheets, Use following assumptions: (1) Sales grow by 6%. (2) The ratios of expenses to sales, depreciation to fixed assets. sh to sales, accounts receivable to sales, and inventories to sales will be the same in 2020 as in 2019. (3) Zeiber ll not issue any new stock or new long term bonds. (4) The interest rate is 11% for long term debt and the verest expense on long term debt is based on the average balance during the year. (5) No interest is earned on ash. (9) Regular dividends grow at an 3% rate. (7) The tax rate is 25% Calculate the additional funds needed AFN), 1 new financing is required, assume it will be raised by drawing on a line of credit with an interest rate of 126. Aume that any draw on the line of credit will be made on the last day of the year, so there will be no additional Interest expense for the new line of credit. If surplus funds are available, pay a special dividend. Key Input Data: Used in the forecast 25% Tax rate Dividend growth rate Rate on notes payable term debt, Rate on long term debita Rate on line of credit, TOC 11% 12 a. What are the forecasted levels of the line of credit and special dividends? Hints: Create a column showing the 5 ratios for the current year, then create a new column showing the ratios used in the forecast. Also create a 7 preliminary forecast that doesn't include any new line of credit or special dividends. Identify the inancing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any 9 new line of credit or special dividend.) 31 Begin by calculating the appropriate historical ratios in Column E. Then put these ratios and any other input ratios 32 in Column G. 31 Forecast the preliminary balance sheets and income statements in Column H. Don't include any line of creditor 35 special dividend in the preliminary forecast 37 Ahor completing the preliminary forecast of the balance sheets and income statement, go to the area below the 23 preliminary forecast and identify the financing deficit or surplus. Then use Excel's IF statements to specify the amount of any new line of creat OR special dividend you should not have a new line of credit AND special 40 dividend, only one of the other 3) Ane specifying the amounts of the special dividend or line of credit create a second column for the final rec e to the column for the preliminary forecasts. In this final forecast, be sure to include the effect of the special dividend on line of credit anon Statement 2015 forecast den Thimizin - Cut 2 Copy - IVE UNIVEA URTAKEVIEW VIEW Anal -10 AA == Wrap Tet BIU.E.O. A - z E Merge Center Font Alignment General $ . % Format Painter Jipboard Number art with the partial model in the file Ch12 P10 Build a Model.xlsx on the textbook's Website, which contains the 19 financial statements of Zieber Corporation. Forecast Zeiber's 2020 income statement and balance sheets, Use following assumptions: (1) Sales grow by 6%. (2) The ratios of expenses to sales, depreciation to fixed assets. sh to sales, accounts receivable to sales, and inventories to sales will be the same in 2020 as in 2019. (3) Zeiber ll not issue any new stock or new long term bonds. (4) The interest rate is 11% for long term debt and the verest expense on long term debt is based on the average balance during the year. (5) No interest is earned on ash. (9) Regular dividends grow at an 3% rate. (7) The tax rate is 25% Calculate the additional funds needed AFN), 1 new financing is required, assume it will be raised by drawing on a line of credit with an interest rate of 126. Aume that any draw on the line of credit will be made on the last day of the year, so there will be no additional Interest expense for the new line of credit. If surplus funds are available, pay a special dividend. Key Input Data: Used in the forecast 25% Tax rate Dividend growth rate Rate on notes payable term debt, Rate on long term debita Rate on line of credit, TOC 11% 12 a. What are the forecasted levels of the line of credit and special dividends? Hints: Create a column showing the 5 ratios for the current year, then create a new column showing the ratios used in the forecast. Also create a 7 preliminary forecast that doesn't include any new line of credit or special dividends. Identify the inancing deficit or surplus in this preliminary forecast and then add a new column that shows the final forecast that includes any 9 new line of credit or special dividend.) 31 Begin by calculating the appropriate historical ratios in Column E. Then put these ratios and any other input ratios 32 in Column G. 31 Forecast the preliminary balance sheets and income statements in Column H. Don't include any line of creditor 35 special dividend in the preliminary forecast 37 Ahor completing the preliminary forecast of the balance sheets and income statement, go to the area below the 23 preliminary forecast and identify the financing deficit or surplus. Then use Excel's IF statements to specify the amount of any new line of creat OR special dividend you should not have a new line of credit AND special 40 dividend, only one of the other 3) Ane specifying the amounts of the special dividend or line of credit create a second column for the final rec e to the column for the preliminary forecasts. In this final forecast, be sure to include the effect of the special dividend on line of credit anon Statement 2015 forecast den Thimizin