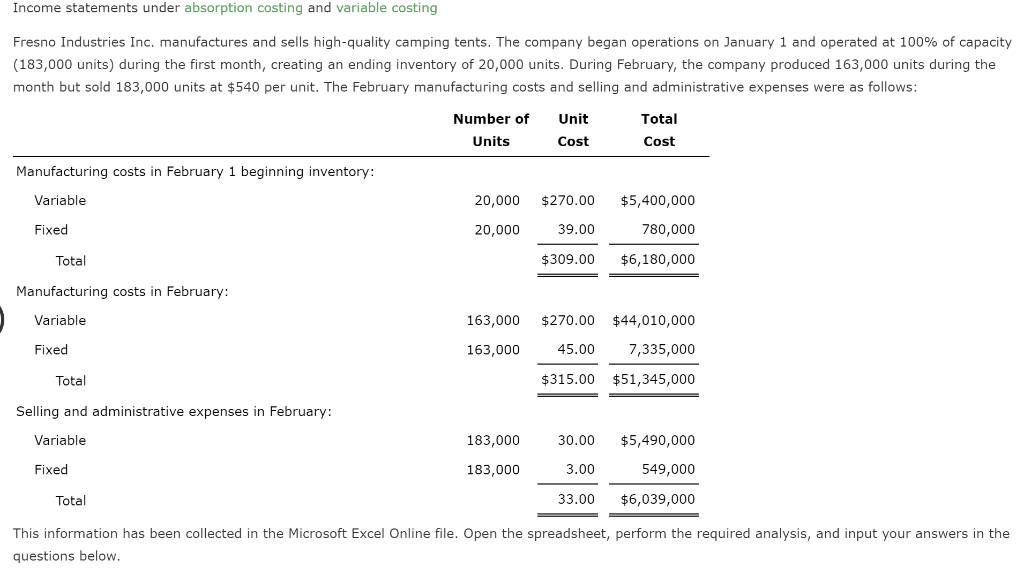

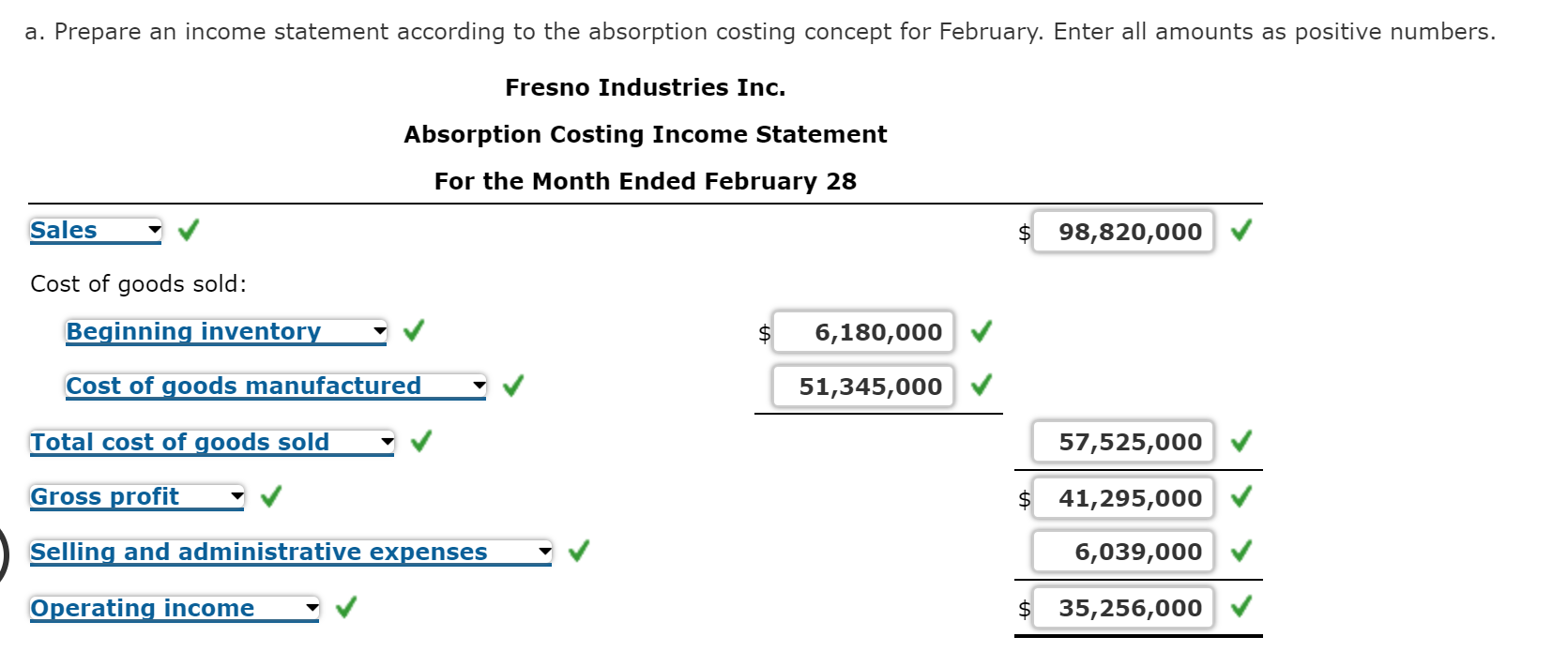

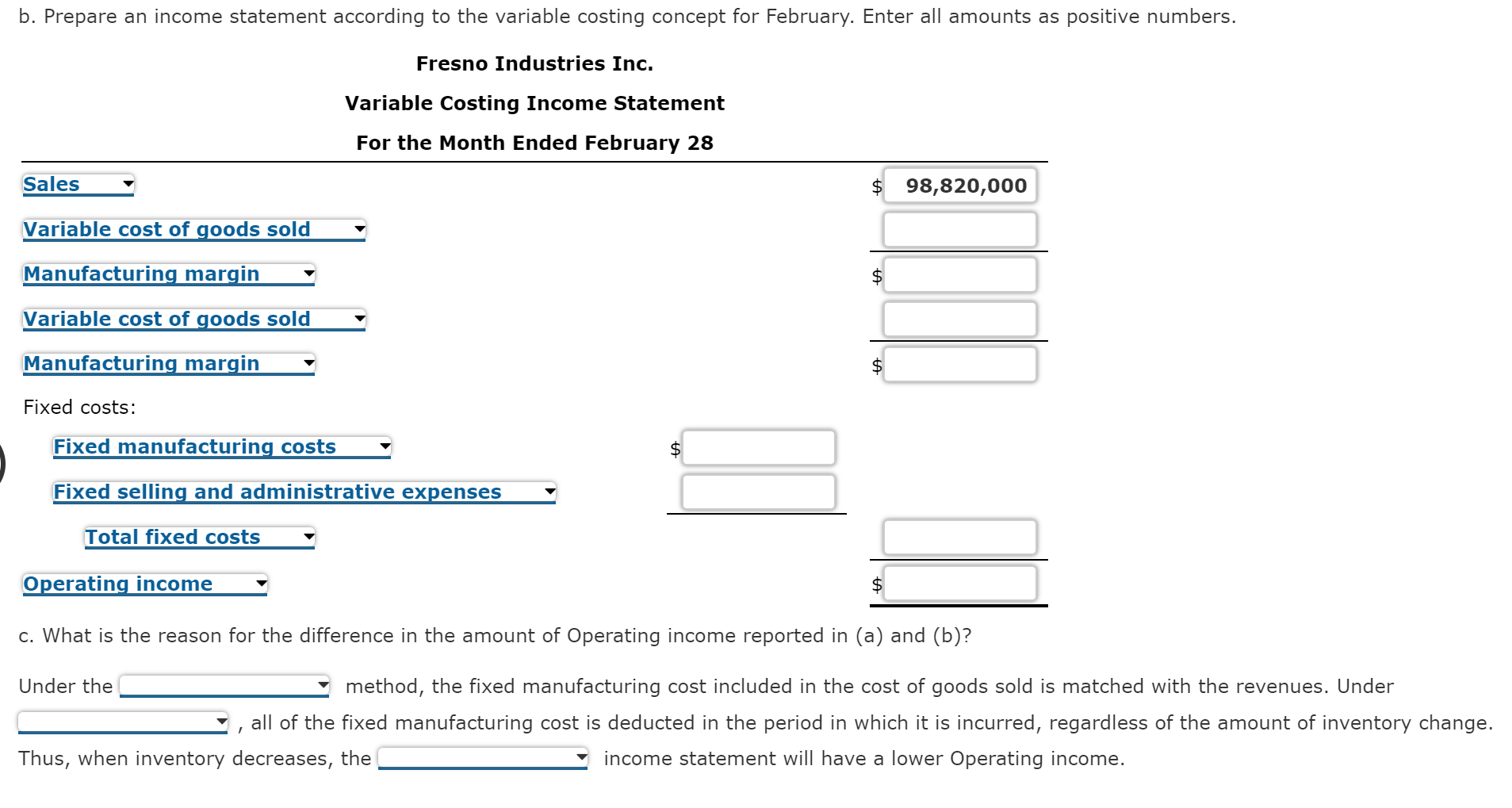

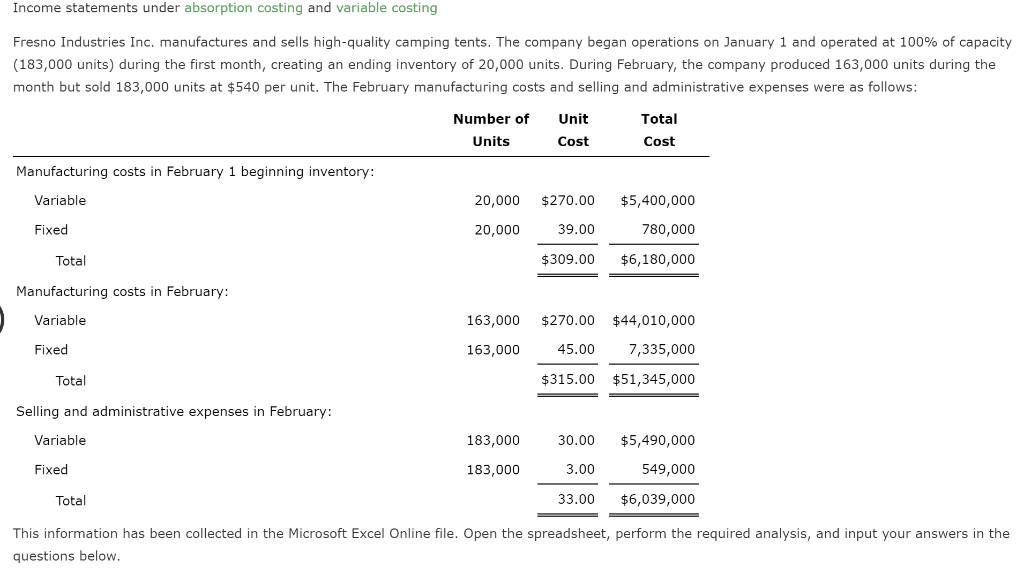

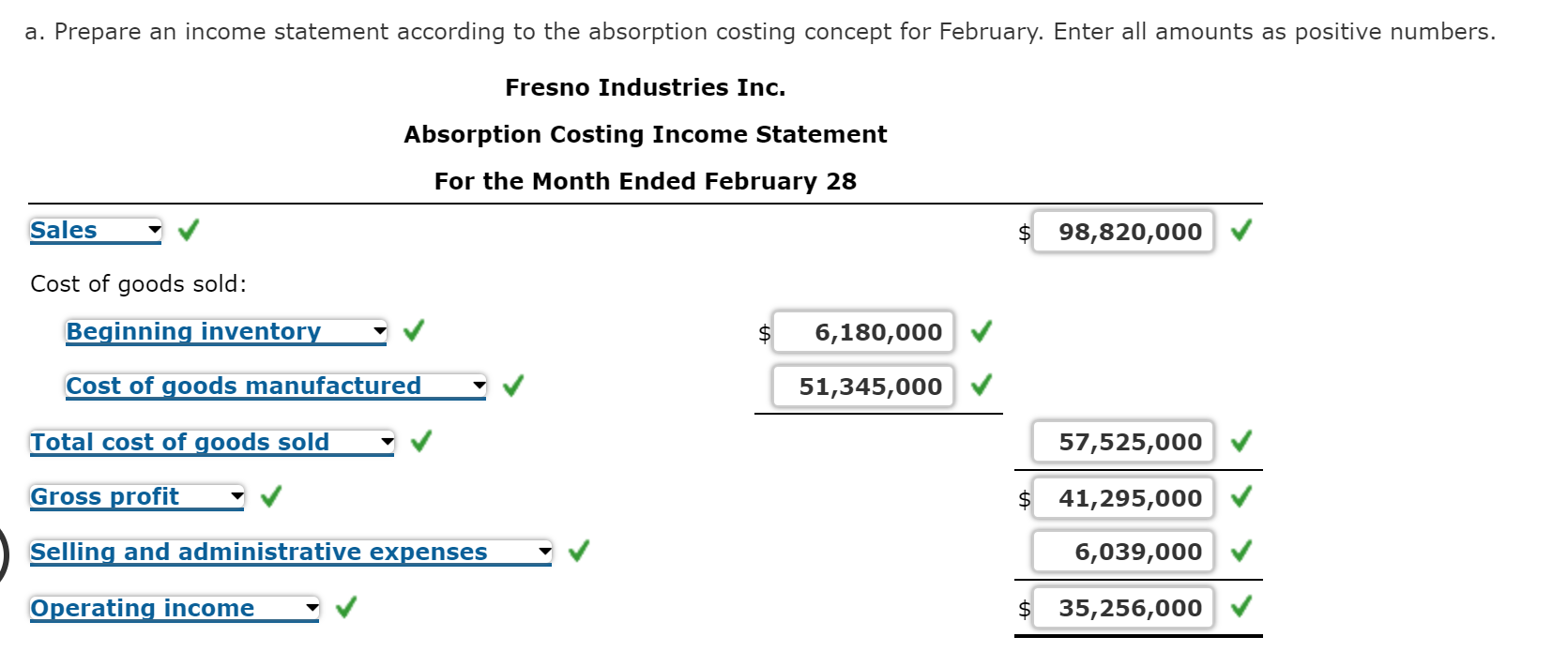

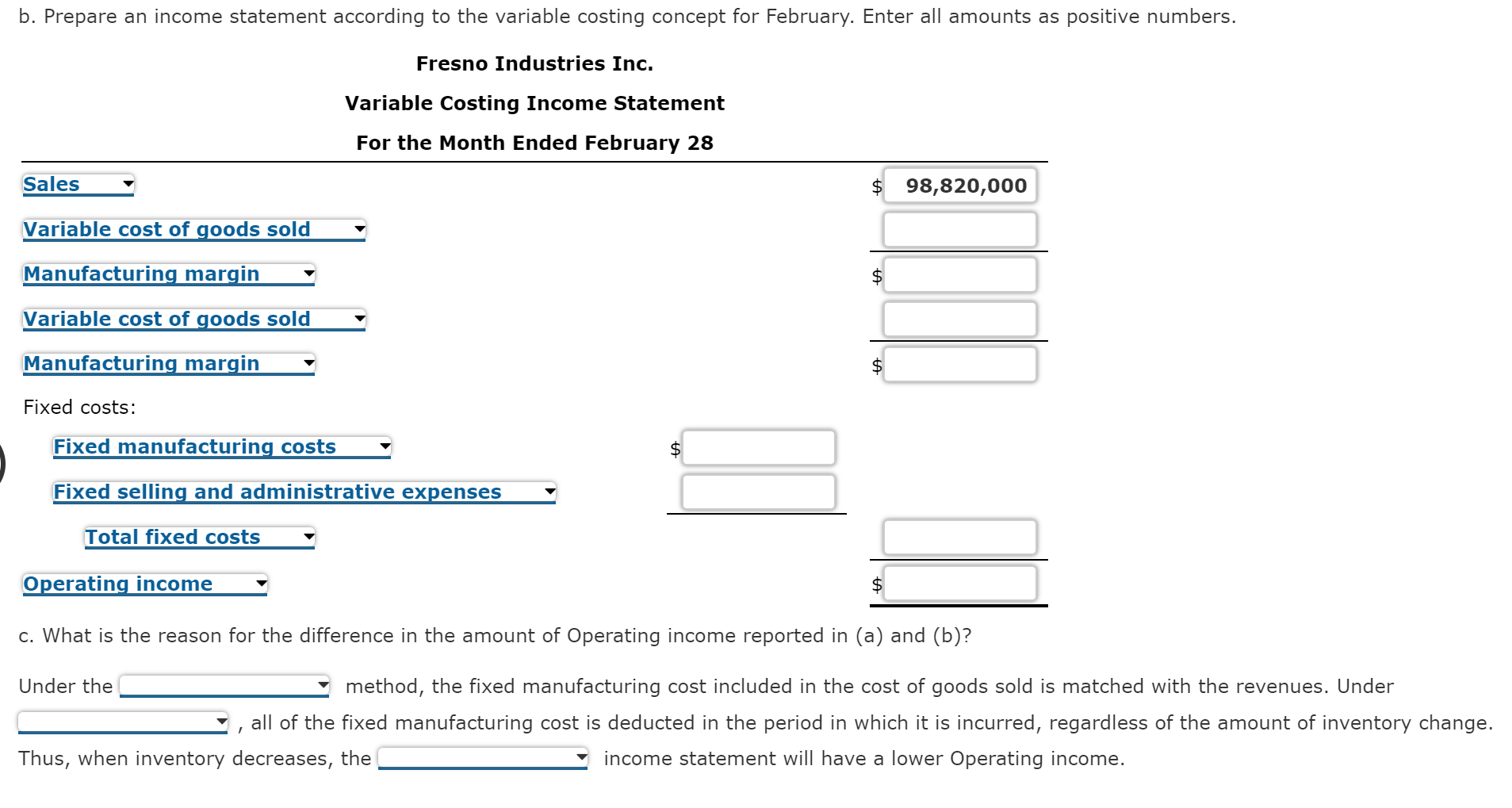

Income statements under absorption costing and variable costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (183,000 units) during the first month, creating an ending inventory of 20,000 units. During February, the company produced 163,000 units during the month but sold 183,000 units at $540 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Number of Units Unit Cost Total Cost Manufacturing costs in February 1 beginning inventory: Variable 20,000 $270.00 $5,400,000 Fixed 20,000 39.00 780,000 Total $309.00 $6,180,000 Manufacturing costs in February: Variable 163,000 $270.00 $44,010,000 Fixed 163,000 45.00 7,335,000 Total $315.00 $51,345,000 Selling and administrative expenses in February: Variable 183,000 30.00 $5,490,000 Fixed 183,000 3.00 549,000 Total 33.00 $6,039,000 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. a. Prepare an income statement according to the absorption costing concept for February. Enter all amounts as positive numbers. Fresno Industries Inc. Absorption Costing Income Statement For the Month Ended February 28 Sales $ 98,820,000 Cost of goods sold: Beginning inventory $ 6,180,000 Cost of goods manufactured 51,345,000 Total cost of goods sold 57,525,000 Gross profit $ 41,295,000 Selling and administrative expenses 6,039,000 Operating income $ 35,256,000 b. Prepare an income statement according to the variable costing concept for February. Enter all amounts as positive numbers. Fresno Industries Inc. Variable Costing Income Statement For the Month Ended February 28 Sales $ 98,820,000 Variable cost of goods sold Manufacturing margin Variable cost of goods sold $ Manufacturing margin $ Fixed costs: $ Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating income $ c. What is the reason for the difference in the amount of Operating income reported in (a) and (b)? Under the method, the fixed manufacturing cost included in the cost of goods sold is matched with the revenues. Under all of the fixed manufacturing cost is deducted in the period in which it is incurred, regardless of the amount of inventory change. Thus, when inventory decreases, the income statement will have a lower Operating income. 1