Answered step by step

Verified Expert Solution

Question

1 Approved Answer

income tax question Juan should estimate his total vehicle expenses for the year, then WUULI UN UFU Juan could have leased a comparable vehicle for

income tax question

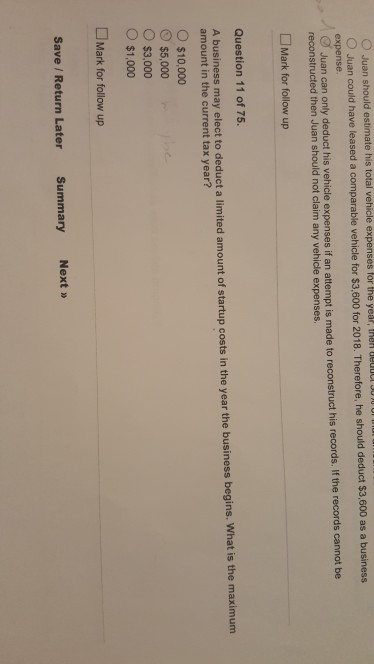

Juan should estimate his total vehicle expenses for the year, then WUULI UN UFU Juan could have leased a comparable vehicle for $3,600 for 2018. Therefore, he should deduct $3,600 as a business expense Juan can only deduct his vehicle expenses if an attempt is made to reconstruct his records. If the records reconstructed then Juan should not claim any vehicle expenses. Mark for follow up Question 11 of 75. A business may elect to deduct a limited amount of startup costs in the year the business begins. What is the maximum amount in the current tax year? O $10,000 $5,000 O $3,000 $1,000 Mark for follow up Save / Return Later Summary Next >>

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started