Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Income Tax Questions: 1-Your client asks you for some advice on ways to reduce their taxable income for the coming year, share three specific

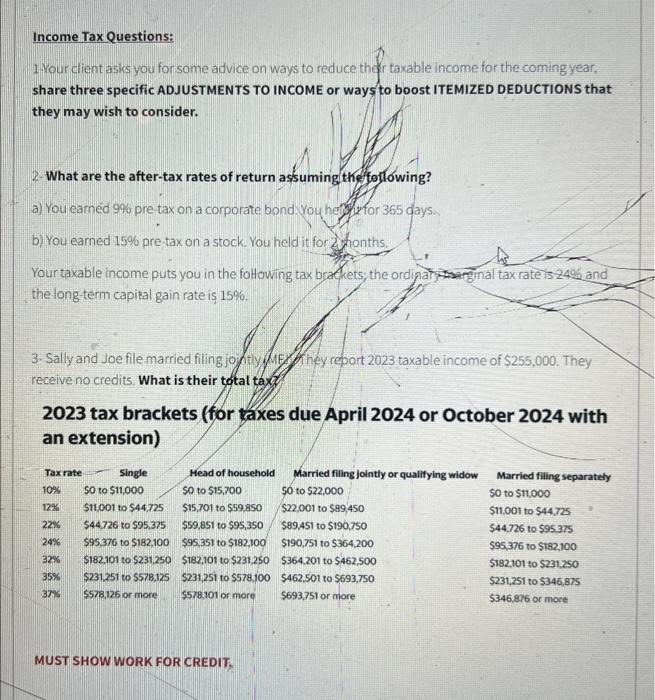

Income Tax Questions: 1-Your client asks you for some advice on ways to reduce their taxable income for the coming year, share three specific ADJUSTMENTS TO INCOME or ways to boost ITEMIZED DEDUCTIONS that they may wish to consider. 2- What are the after-tax rates of return assuming the following? a) You earned 99% pre-tax on a corporate bond. You hef for 365 days. b) You earned 15% pre-tax on a stock. You held it for 2 months. Your taxable income puts you in the following tax brackets; the ordinary marginal tax rate is 24% and the long term capital gain rate is 15%. 3- Sally and Joe file married filing jointly METhey report 2023 taxable income of $255,000. They receive no credits. What is their total tax 2023 tax brackets (for taxes due April 2024 or October 2024 with an extension) Tax rate 10% 12% 22% 24% 32% 35% 37% Single 50 to $11,000 $11,001 to $44,725 $44,726 to $95.375 $95,376 to $182,100 $182,101 to $231,250 $231,251 to $578,125 $578,126 or more Head of household $0 to $15,700 $15,701 to $59,850 $59,851 to $95,350 $95,351 to $182,100 $182,101 to $231,250 5231,251 to $578,100 $578,101 or more MUST SHOW WORK FOR CREDIT, Married filing jointly or qualifying widow 50 to $22,000 $22,001 to $89,450 $89,451 to $190,750 $190,751 to $364,200 $364,201 to $462,500 $462,501 to $693,750 $693,751 or more Married filing separately 50 to $11,000 $11,001 to $44,725 $44,726 to $95.375 $95,376 to $182,100 $182,101 to $231,250 $231,251 to $346,875 $346,876 or more

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Adjustments to Income or Itemized Deductions a Contribute to a 401k or IRA Your client ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started