Answered step by step

Verified Expert Solution

Question

1 Approved Answer

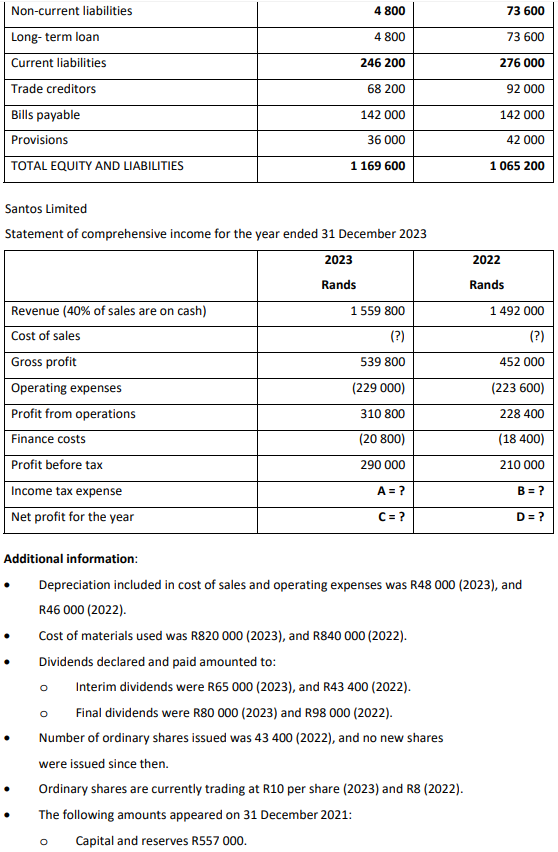

Income tax rate is 28% Q.3.1 Calculate the amounts A - D (Income tax expense and Net profit for the year). (4) You have been

Income tax rate is 28%

Q.3.1 Calculate the amounts A - D (Income tax expense and Net profit for the year). (4)

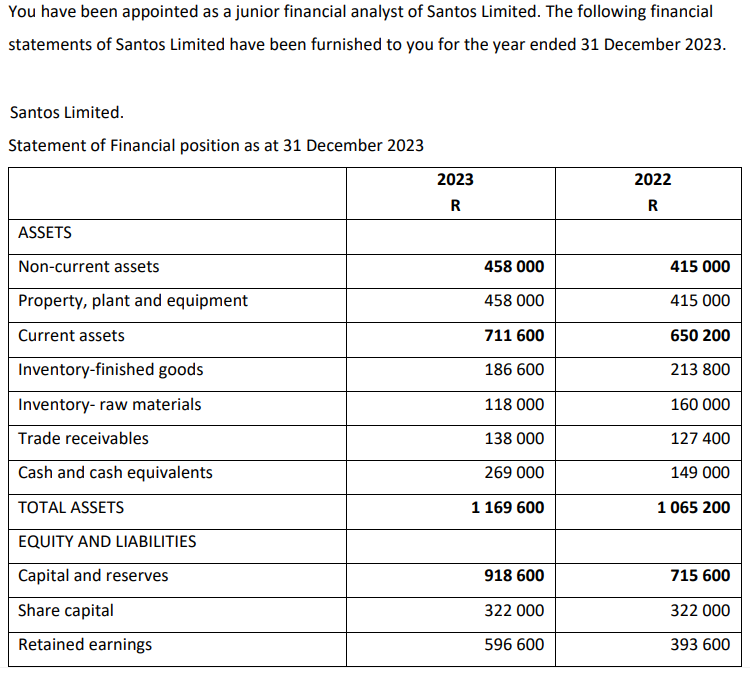

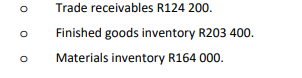

You have been appointed as a junior financial analyst of Santos Limited. The following financial statements of Santos Limited have been furnished to you for the year ended 31 December 2023. Santos Limited. Statement of Financial position as at 31 December 2023 Santos Limited Statement of comprehensive income for the year ended 31 December 2023 Additional information: - Depreciation included in cost of sales and operating expenses was R48 000 (2023), and R46 000 (2022). - Cost of materials used was R820 000 (2023), and R840 000 (2022). - Dividends declared and paid amounted to: - Interim dividends were R65 000 (2023), and R43 400 (2022). - Final dividends were R80 000 (2023) and R98 000 (2022). - Number of ordinary shares issued was 43400 (2022), and no new shares were issued since then. - Ordinary shares are currently trading at R10 per share (2023) and R8 (2022). - The following amounts appeared on 31 December 2021: - Capital and reserves R557000. You have been appointed as a junior financial analyst of Santos Limited. The following financial statements of Santos Limited have been furnished to you for the year ended 31 December 2023. Santos Limited. Statement of Financial position as at 31 December 2023 - Trade receivables R124 200. - Finished goods inventory R203 400 . Materials inventory R164000. Santos Limited Statement of comprehensive income for the year ended 31 December 2023 Additional information: - Depreciation included in cost of sales and operating expenses was R48 000 (2023), and R46 000 (2022). - Cost of materials used was R820 000 (2023), and R840 000 (2022). - Dividends declared and paid amounted to: - Interim dividends were R65 000 (2023), and R43 400 (2022). - Final dividends were R80 000 (2023) and R98 000 (2022). - Number of ordinary shares issued was 43400 (2022), and no new shares were issued since then. - Ordinary shares are currently trading at R10 per share (2023) and R8 (2022). - The following amounts appeared on 31 December 2021: - Capital and reserves R557000. - Trade receivables R124 200. - Finished goods inventory R203 400 . Materials inventory R164000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started